Written by: FinTax

One of the core economic strategies of the Trump administration was a tough trade policy. During his first term, the China-US trade war centered on tariffs drew global attention. Now, with Trump's return to the White House, his trade protectionist stance has become even more hardline, and the imposition of tariffs has once again become a focal point, which will inevitably trigger global trade friction, lead to a series of economic chain reactions, and cause economic fluctuations or even regional hot conflicts. This uncertainty will also profoundly affect the crypto market. This article will review Trump's tariff measures during his term and explore their potential impact on the crypto market and possible response strategies.

1. Overview of Trump's Tariff Policies

1.1 Trump's Tariffs 1.0 in 2018

On March 23, 2018, Trump signed a trade memorandum against China, announcing tariffs on $60 billion worth of imported goods from China and restricting Chinese enterprises' investment and acquisition in the US, officially launching the China-US trade war. Subsequently, the US continuously expanded the tariff scope, covering high-end manufacturing, daily consumer goods, aerospace, industrial machinery and equipment, automotive parts, electronic products, clothing, home goods like luggage, furniture, and lighting. Tariffs on electronic products would threaten mining machine manufacturers. For instance, Bitmain, which once occupied 90% of the Bit mining machine market, was significantly impacted by Trump's tariffs in 2018 and moved some production lines to Southeast Asia. Besides China, the US also took tariff actions against multiple countries and regions, with the core goal of reducing trade deficits and protecting domestic industries, which triggered retaliatory tariff measures from other countries.

1.2 Trump's Tariffs 2.0 in 2025

On January 20, 2025, Trump signed the first US trade policy memorandum, emphasizing the importance of protecting the US economy and national security, including improving trade deficits, investigating unfair trade practices, strengthening economic and trade relations with China, assessing export control measures, and ensuring the interests of US workers and manufacturers.

Subsequently, the US implemented new tariff measures against multiple countries. First, a 10% tariff was imposed on all imported goods from China, then an additional 10% tariff was announced, which took effect on March 4. The cumulative tariff rate against China rose to 20%, and combined with the previous 25% tariff under Section 301, the comprehensive tariff rate for certain key technological equipment (such as servers, storage devices, semiconductors) could reach 45%-70%, significantly impacting the crypto industry. Tariffs of 25% were also imposed on Canadian and Mexican goods. The US Treasury Secretary Besson stated that specific reciprocal tariffs would be assigned to each trading partner. Besides targeting specific countries and regions, Trump also planned tariff measures on specific products like agricultural products, timber, steel, aluminum, automobiles, copper, semiconductors, and pharmaceuticals.

Trump previously stated in his campaign that he hoped Bit would be "mined, minted, and manufactured" in the US, and his tariff measures would inevitably involve the crypto industry. For example, in January, the US Department of Commerce's Bureau of Industry and Security (BIS) updated export controls on advanced computing semiconductors and listed some entities from China and Singapore on the entity list. These regulations target chips using "16nm/14nm node" process and below, and even strengthened due diligence on foundries, which will undoubtedly affect mining machine manufacturers.

2. Potential Impacts of Trump's Tariffs on the Crypto Market

2.1 Impact on the Entire Crypto Market

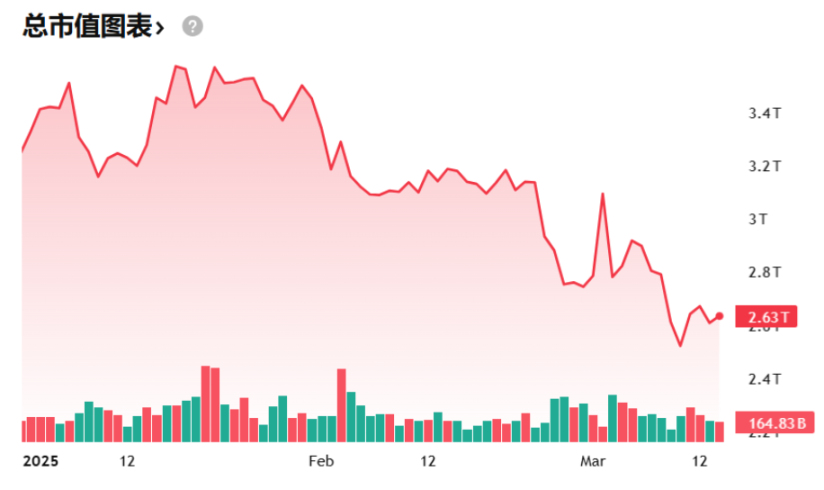

In the short term, Trump's tariff measures have already negatively impacted the crypto market. In January, Trump signed an executive order to establish a working group to develop clear rules for US crypto companies within six months and explore establishing a potential crypto currency reserve to support crypto development. After this news, the total crypto market value grew to $3.65 trillion by the end of January, with a cumulative increase of 9.14%. However, in February, the tariff policies announced by Trump immediately offset the positive effects of the previous executive order, triggering a series of negative chain reactions in the crypto market. Particularly on February 3rd, after Trump announced long-term import tariffs on Canada, Mexico, and China, the crypto market showed a synchronized decline with the stock market. Bit dropped 8% within 24 hours, Ethereum fell over 10%, with total liquidations exceeding $900 million and 310,000 investors forced to close positions. Behind this market volatility were investors' panic about escalating trade friction and concerns about the global economic outlook.

From a macroeconomic perspective, trade friction will cause global market volatility, and the US dollar's attractiveness as a safe-haven asset will further strengthen, with capital flowing back to the US, enhancing the dollar's strength and intensifying global capital market fluctuations. Investors' risk appetite for high-volatility assets will decrease, leading to massive sell-offs of crypto. Large funds and venture capital firms will also cause market volatility. If their equity positions decline, they might liquidate crypto holdings to manage risk. Moreover, tariff policies may trigger inflation, weaken consumer purchasing power, and further suppress economic growth. In this context, investors will generally shift towards safer asset classes, and crypto, being a high-volatility asset, will naturally be among the first to be sold, causing significant price drops and a decline in crypto market sentiment.

However, in the long term, Trump's tariff policies may still have positive impacts on the crypto market, specifically including the following aspects:

First, US tariff policies might increase market liquidity. While implementing tariff policies, the Trump administration will adopt expansionary fiscal policies domestically, such as large-scale tax cuts and infrastructure investments. These policies may boost the US economy in the short term but will also exacerbate fiscal deficits. To fill funding gaps, the government might increase market liquidity through bond issuance or monetary easing policies, which will provide a favorable environment for the crypto market. For example, in 2020, the Federal Reserve's balance sheet expanded by over $3 trillion, during which Bit rose by over 300%.

Secondly, tariffs will push up import goods prices, and potential US dollar depreciation might drive capital towards the crypto market. Eugene Epstein, Head of Trading and Structured Products at Moneycorp, stated that if the trade war leads to dollar weakening through inflation, Bit might actually benefit. In the long term, as the dollar depreciates, global investors might seek alternative assets to hedge against dollar depreciation risks, potentially turning to Bit and other fixed-supply, inflation-resistant assets. Additionally, some countries might choose currency depreciation to counter tariff impacts, at which point crypto could become a capital outflow channel.

Finally, trade conflicts might accelerate de-dollarization trends. Trade wars will deepen trust gaps between nations, prompting countries to reduce US dollar dependence. For instance, Russia and China have gradually reduced US dollar usage in international trade, and Middle Eastern countries have started exploring oil settlements in RMB or other currencies. In 2022, Iran used Bit mining to circumvent oil export sanctions. This de-dollarization trend will drive global capital demand for crypto further, bringing new development opportunities to the crypto market.

2.2 Impact on Investors

On one hand, investors must optimize their investment portfolios. Cryptocurrencies are still viewed as speculative or high-risk/high-volatility asset classes. Against the backdrop of trade friction escalation caused by tariff policies, investors may need to re-examine their portfolios, reduce exposure to volatile assets, lower the proportion of risky investments such as cryptocurrencies, and ensure an appropriate proportion of cash, government bonds, or other safe investment asset categories.

On the other hand, the frequent changes in Trump's tariff policies affect investors' stable expectations and investment confidence. During his presidential campaign, Trump claimed to be a "president supporting innovation and Bit" and announced a package of cryptocurrency support policies. Before his second presidential inauguration, he publicly issued a personal meme coin "Trump Coin ($Trump)". After taking office, he also signaled support for cryptocurrencies, including establishing working groups to study regulatory frameworks and crypto asset reserve plans. However, the macro risks caused by tariff policies offset market expectations of policy benefits. From February onwards, Trump implemented comprehensive tariff measures against China, Canada, and Mexico, with a near-crazy tariff offensive. The repeatedly changing policies brought chaos to the economic and financial markets, and this uncertainty challenged all parties trying to make decisions, triggering market concerns and potentially undermining investor confidence, forcing them to sell cryptocurrencies or reduce new investments.

2.3 Impact on Related Enterprises

Trump's tariff policies impact crypto enterprises, especially mining upstream and downstream companies, in multiple ways. First, tariffs will affect hardware imports, increasing component costs for mining machine manufacturers, raising production costs, and impacting profitability while hindering research and development. Second, mining machine supply may be short-term scarce, with prices rising, increasing equipment update costs for mining pool operators and mining enterprises, significantly increasing their operational pressure. Third, in the long term, tariff policies might cause mining machine and mining enterprises to migrate to regions less affected by trade wars, changing the global geographical distribution of crypto enterprises.

Secondly, tariffs will impact exchanges. First, tariffs might lead to global trade tension, stock market volatility, or increased economic uncertainty. In this context, some investors might view cryptocurrencies as hedging tools, increasing trading volume and attracting more short-term traders to the crypto market, potentially raising exchanges' trading volume and transaction fee income in the short term. Secondly, tariffs might trigger capital controls or foreign exchange restrictions, with cryptocurrencies potentially becoming an alternative channel for cross-border fund flows, driving increased deposit and withdrawal demands for exchanges. Finally, the Trump administration might adjust financial regulatory frameworks alongside tariff policies, intensifying cryptocurrency scrutiny, such as anti-money laundering and tax compliance, potentially increasing exchanges' operational costs and compliance pressures.

Lastly, tariffs will also impact the stablecoin market. To maintain profits, enterprises will inevitably seek alternative methods to bypass tariff barriers, with stablecoins potentially becoming one option. In regions with strict capital controls like Asia and Latin America, USDT is the primary tool for circumventing USD conversion restrictions. If tariffs cause emerging market currency depreciation (such as the RMB), local users might increase USDT holdings to hedge risks, thereby driving up USDT demand. However, if US sanctions involve USDT-using entities, this could threaten its liquidity. USDC, with high compliance, is more used for traditional institutional funding and compliant DeFi protocols. If US enterprises turn to cryptocurrency payments due to increased tariff costs, USDC might become the preferred settlement tool. If market risk aversion sentiment continues to rise, institutional investors might view USDC as a "safe stablecoin", potentially squeezing USDT's market share.