Trump's long-awaited "Liberation Day" tariff announcement is set to be published, potentially including a comprehensive plan to impose a 20% tariff on all imported goods - a proposal first raised during the campaign and now seemingly becoming a serious discussion option.

Over the past period, this policy has gone through a tortuous and chaotic process, with multiple delays, changing timelines, and last-minute variables. Since this week, the official tone has also changed, from "all global countries, without exception" on Sunday to "relatively lenient" or even "very friendly" on Monday.

These inconsistent statements have made the market nervous, and the crypto market, being a 24/7 trading market, often becomes the first area to react to emotional fluctuations.

With market sentiment changing rapidly and Trump potentially changing the tone on Truth Social at any moment, the real status of the crypto market before the announcement becomes a critical issue.

1. Bitcoin Performs Best

In the market volatility, Bitcoin has remained relatively resilient. Over the past month, despite the overall market decline, $BTC has outperformed the S&P 500, Nasdaq index, and "Seven Giants" tech stocks, which is quite unusual, as Bitcoin historically tends to move similarly to tech stocks.

Bitcoin's resilience is backed by two major factors:

Market Structure: The crypto market's 24/7 trading allows faster reactions to news. Therefore, $BTC may have already reflected market concerns about tariff policies in January and February, while traditional markets lag behind.

Market Sentiment: Even with all eyes on the upcoming tariff news, Bitcoin remains stable. $BTC is currently in the middle of a support and resistance range, neither reaching extreme points nor lacking space to fluctuate based on news. Trading activity has slowed, panic selling has decreased, and long-term holders have begun quietly accumulating.

Demand Remains: MicroStrategy's Michael Saylor continues to accumulate Bitcoin, even raising the financing target from $500 million to $722.5 million, indicating strong market demand. The Bitcoin ETF fund outflow trend has slowed and briefly turned positive, showing improving market sentiment.

Overall, Bitcoin remains resilient while other markets weaken, with stable demand, low-volatility trading environment, and long-term buying suggesting fundamentals are more solid than market sentiment indicates.

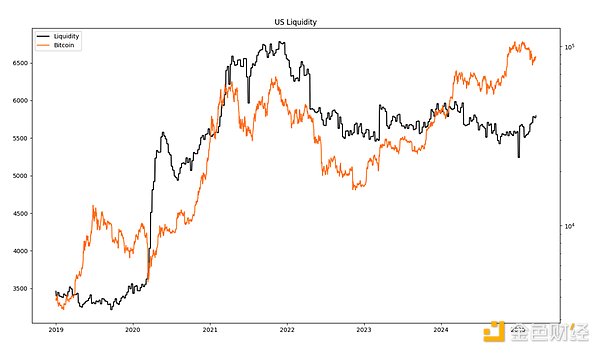

2. Federal Reserve Slows Tightening, Liquidity Rebounds

In recent years, the Federal Reserve has curbed economic overheating through interest rate hikes and balance sheet reduction, one method being not renewing maturing bonds, effectively withdrawing cash from the market. Such operations typically impact risk assets like crypto most severely.

The Federal Reserve is beginning to ease monetary policy. It will slow down the pace of balance sheet reduction. This is different from starting "quantitative easing" or "printing money again," but it does mean the Fed will not consume system funds as aggressively as before.

Market Environment Improvement: Historical data shows that after the Fed pauses tightening, risk assets usually get a breathing period, with market reactions often lagging 10-12 weeks, so Q2 might present a more favorable environment.

Liquidity indicators show US dollar fund flows beginning to warm up, with capital gradually returning to the market. While this won't immediately reverse market trends, it is an early signal of market rebound.

Conclusion: Tightening policies have not completely ended, but at least for the crypto market, macroeconomic resistance is beginning to weaken.

3. Bitfinex Whales Bet on Long

This week, a noteworthy signal has appeared again: Bitfinex exchange whales are massively establishing long positions. Bitfinex is closely related to Tether, and although not the most traded exchange, it often leads in price trends.

Analyst Cole Garner points out that large long positions on Bitfinex often signal an imminent market rise. This pattern has repeatedly occurred: significant long positions on Bitfinex, followed by Bitcoin price increases within 20-40 minutes, with Altcoins subsequently rising.

Key Factors:

• "Alpha Cartel" Effect: Bitfinex traders' leveraged long positions often trigger a chain reaction across the entire market.

• Signal Over Noise: Although Bitfinex is not the most active exchange, its leveraged trading data often provides clues about the next market move.

Currently, these signals are flashing bullish warnings, and in a market full of uncertainty, this might be the most worth watching.

4. Market Sentiment Completely Collapses

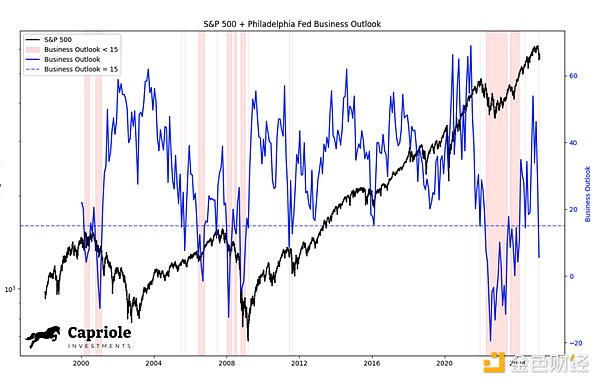

Despite some positive signals, it must be noted that businesses, consumers, and investors seem to be in a state of panic.

According to the latest Philadelphia Fed survey, business confidence has significantly dropped, approaching levels seen before the 2022 economic downturn. While this indicator is not perfect, similar sharp declines occurred before the 2000 dot-com bubble burst and the 2008 global financial crisis.

Meanwhile, investor sentiment has hit rock bottom. The American Association of Individual Investors (AAII) survey shows over 60% of retail investors are pessimistic, and Bank of America's latest fund manager survey indicates the lowest allocation to US stocks in history. Consumers are equally uneasy, with the March Conference Board report showing 44.5% of respondents expecting stock market declines (source: Blocmates).

• Panic Spreads: This comprehensive pessimism might not necessarily cause market collapse but indicates rapidly depleting market risk appetite.

• Crypto Market's Reverse Opportunity: With the overall market so defensively positioned and liquidity improving, if even a small positive surprise occurs, the crypto market could be the biggest beneficiary, and the current market is showing this possibility.

In short, the entire financial system is in a tense state, and this fear will either lead to deeper market declines or become a catalyst for the next upward trend.

Entering "Liberation Day", Where is the Market Heading?

The Federal Reserve is retreating, liquidity is quietly improving, Bitcoin remains stable in the middle, and some of the most astute traders in the field are going long. Meanwhile, business confidence is wavering, and investor sentiment has hit rock bottom. Ironically, these more pessimistic signals could actually pave the way for a sharp reversal - assuming we are not caught off guard.

And that's why tomorrow matters. A 20% comprehensive tariff could tighten the financial environment and impact risk markets, especially cryptocurrencies. But a more cautious push or another delay could immediately change market sentiment, especially when people are prepared for the worst.

Under Trump's policy style, everything could change with one announcement. But if he chooses a more moderate path, the crypto market might become the biggest beneficiary of a new wave of optimism.

In any case, the next 24 hours could determine the market tone for the coming weeks.