On the morning of April 3rd, the three major U.S. stock indexes collectively plummeted, with the Dow Jones dropping 1,679.39 points, ultimately closing down 3.98%, the S&P 500 falling 4.84%, and the Nasdaq dropping 5.97%. Among them, the Dow Jones and S&P 500 recorded their largest single-day declines since June 2020, while the Nasdaq saw its largest single-day drop since March 2020.

Technology stocks also became a disaster area, with Apple's stock price falling over 9%, Amazon dropping over 9%, NVIDIA falling over 7%, and Tesla declining over 5%. The Nasdaq Golden Dragon China Index fell 1.9%, with individual stocks like 21Vianet dropping nearly 10%, GCL New Energy falling over 8%, and iQiyi dropping over 4%. Additionally, European stocks also experienced a significant decline, with the UK FTSE 100 falling over 1.5%, and both the French CAC 40 and German DAX indexes dropping over 3%.

U.S. Vice President Vance stated that he believes the market might "become worse to some extent" after the implementation of tariff measures.

Despite the U.S. stock market's sharp decline, Trump posted that the United States is like a "patient", and "reciprocal tariffs" are the "surgery", claiming that the "surgery is over, and the patient survived". Trump also said that despite the market impact of tariffs, the stock market will remain "prosperous".

Meanwhile, Bitcoin also followed U.S. stocks and briefly bottomed out at $81,200, with Ethereum dropping to a low of $1,750. By the time of writing, Bitcoin had recovered to $83,200.

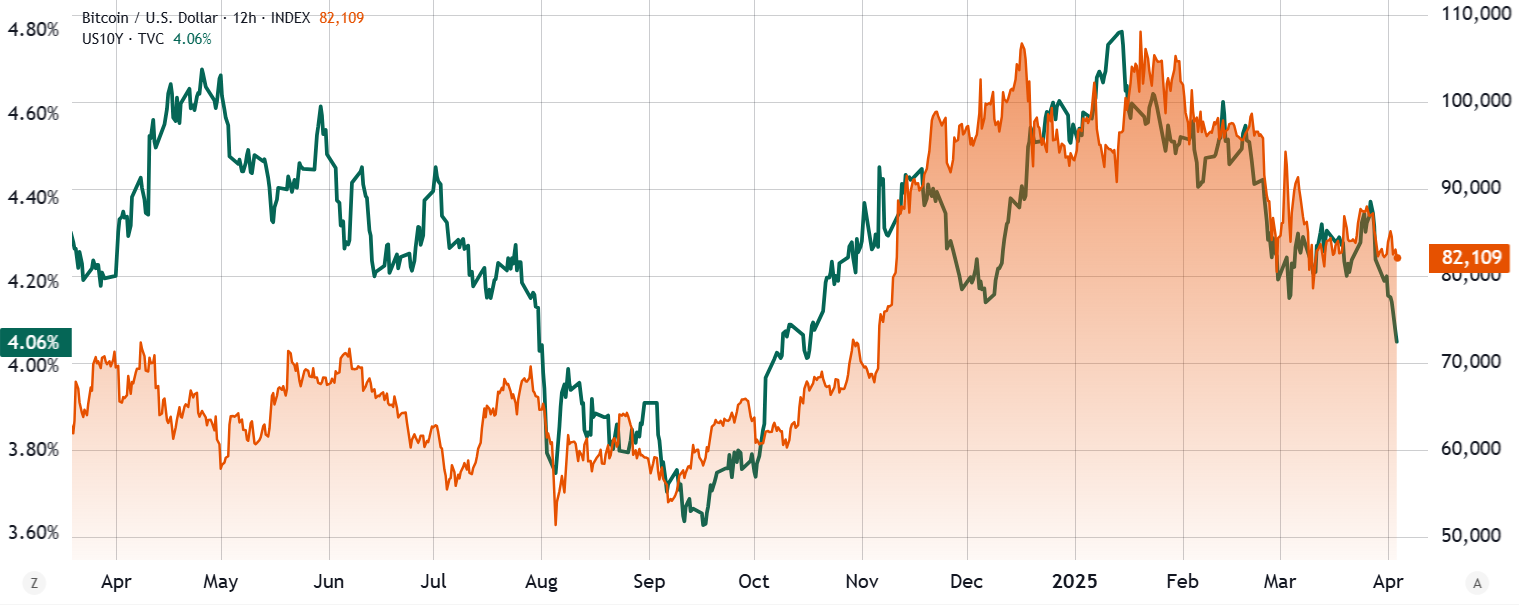

Simultaneously, the 10-year U.S. Treasury yield fell to 4% - does this mean it's a good time to buy Bitcoin when its price drops? Will the U.S. trade war become a catalyst for a short-term golden buying opportunity for Bitcoin, or will it continue to drag down its price?

The Relationship Between U.S. 10-Year Treasury Yield and Bitcoin Price

On April 3rd, due to escalating global trade tensions and the weakening U.S. dollar, the U.S. long-term Treasury yield dropped to its lowest point in six months. The 10-year U.S. Treasury yield briefly touched 4.0%, significantly down from 4.4% a week ago, indicating strong market demand for bonds.

At first glance, the risk of economic recession seems to put pressure on Bitcoin prices. However, the decline in fixed-income investment returns may prompt investors to seek alternative assets like cryptocurrencies. Over time, especially in the context of rising inflation, investors may gradually reduce their bond exposure. Therefore, Bitcoin is expected to reach new highs in 2025, particularly in a historically low-interest-rate environment.

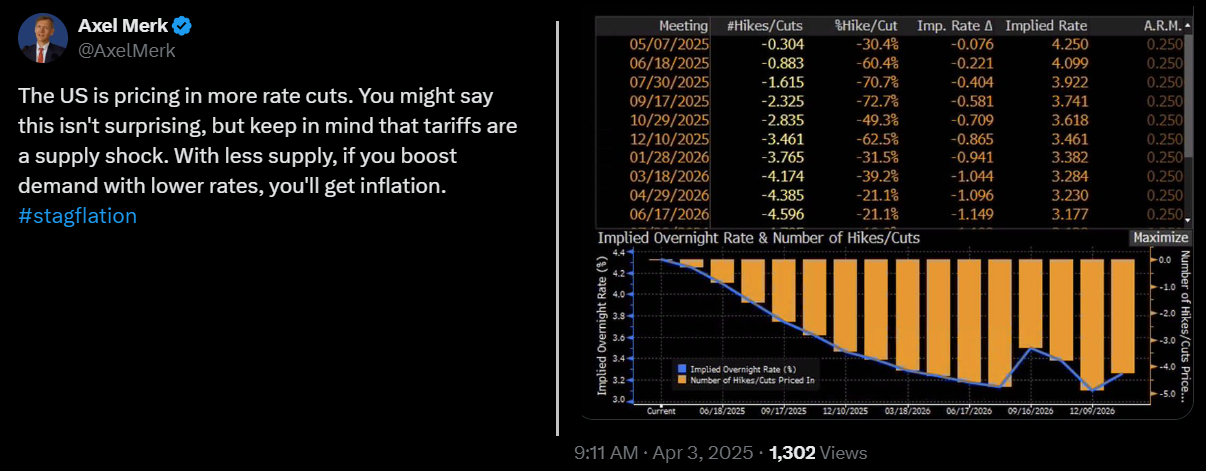

U.S. Tariffs Impact Supply Chain and Inflation, Stimulating Alternative Asset Demand

Recently, the U.S. government announced new tariffs on imported goods, negatively impacting corporate profitability, forcing some companies to deleverage, and ultimately reducing market liquidity. Such risk-avoidance measures often have short-term adverse effects on Bitcoin, especially considering Bitcoin's high correlation with the S&P 500 index.

AXEL Merk, Chief Investment Officer of Merk Investments, stated that tariff-induced "supply shock" phenomenon, where the supply of goods and services decreases, leads to market price increases and exacerbates supply-demand imbalance. As interest rates further decline, this impact may intensify, driving inflationary pressures.

Even if some argue that Bitcoin is not a traditional inflation hedge, the demand for Bitcoin and other alternative assets may increase as fixed-income investments become less attractive. With the massive global bond market, if just 5% of investors shift funds to high-return assets like stocks, commodities, real estate, gold, and Bitcoin, it could potentially bring in $7 trillion in fund inflows.

Weak U.S. Dollar, Gold Reaches Historic High, Benefiting Alternative Assets

The gold market continues to rise, with prices breaking through $3,167 per ounce, market value exceeding $21 trillion, and still possessing further growth potential. The gold price increase encourages previously unprofitable mining projects to attract reinvestment and stimulates more funds into exploration and extraction. Nevertheless, the supply increase may also become a limiting factor in the gold bull market in the future.

The U.S. dollar's weakness against a basket of currencies has also become a market focus. On April 3rd, the dollar index fell to 102, reaching a six-month low. The decline in dollar confidence might prompt other countries to explore alternative value storage methods, including Bitcoin.

U.S. Dollar Dominance Challenged, Bitcoin Welcomes Long-Term Growth Potential

Dollar Index (DXY)

This transformation won't happen overnight, but trade wars might gradually push the world away from dollar dependence, especially for countries significantly impacted by dollar dominance. While Bitcoin is unlikely to replace traditional currencies as a global reserve currency, any move away from the dollar will further enhance Bitcoin's long-term growth potential and solidify its position as an alternative asset.

From a global market perspective, Japan, China, Hong Kong, and Singapore collectively hold $2.63 trillion in U.S. Treasury bonds. If these regions choose to retaliate, bond yields might reverse, increasing the issuance costs of new U.S. government debt and weakening the dollar. This scenario could force investors to reduce stock exposure and turn to scarce assets like Bitcoin, further supporting Bitcoin's price increase.

Bitcoin's Market Resilience

Despite global economic uncertainty, Bitcoin bottomed out at $81,200 this morning and Ethereum found effective support at $1,750, demonstrating the cryptocurrency market's ability to rebound in challenging conditions. This phenomenon suggests that demand for crypto assets like Bitcoin may remain strong, and investors can still seize this golden buying opportunity.