Doge coin holders are withdrawing funds from the spot market in April, and the major meme coin is facing increasing selling pressure.

The lack of new capital inflow into Doge coin reflects a decrease in investor confidence and is putting downward pressure on altcoins.

DOGE, Outflows Exceed Inflows, Intensifying Sell-off

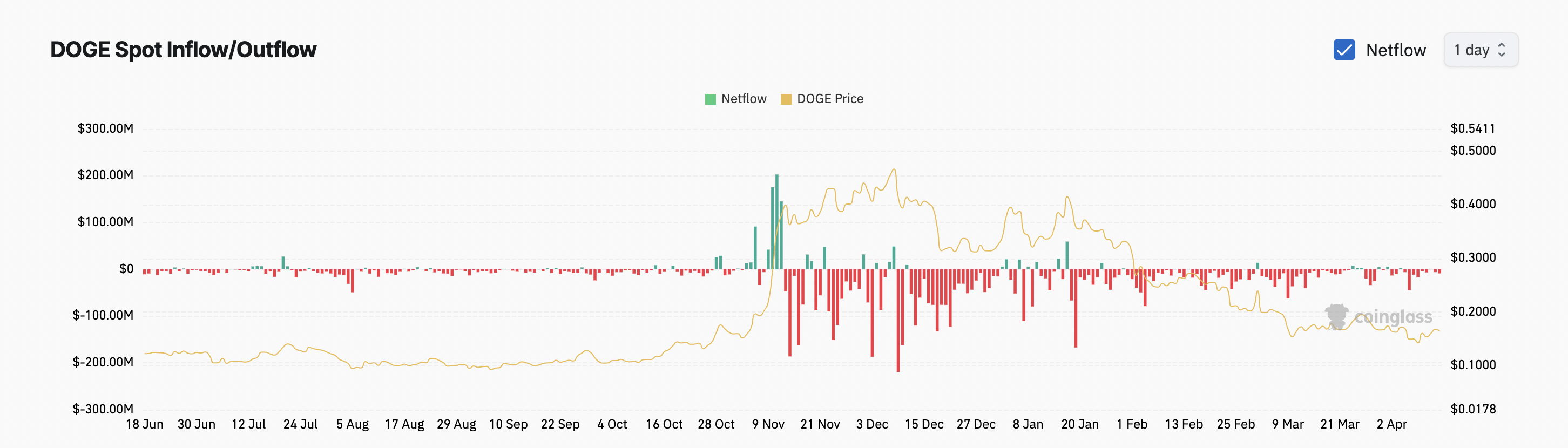

From early April, Doge coin has recorded continuous net outflows in the spot market, totaling over $120 million. During the same period, net inflows have been minimal, less than $5 million according to Coinglass.

When assets record spot outflows, more coins or tokens are being sold or withdrawn from the spot market.

This indicates that Doge coin investors are losing confidence and choosing to liquidate their holdings due to increasingly weak market conditions.

The continuous outflows of meme coins over the past two weeks reflect a lack of new demand for altcoins. If this trend continues, Doge coin's price may remain range-bound or face another downward cycle.

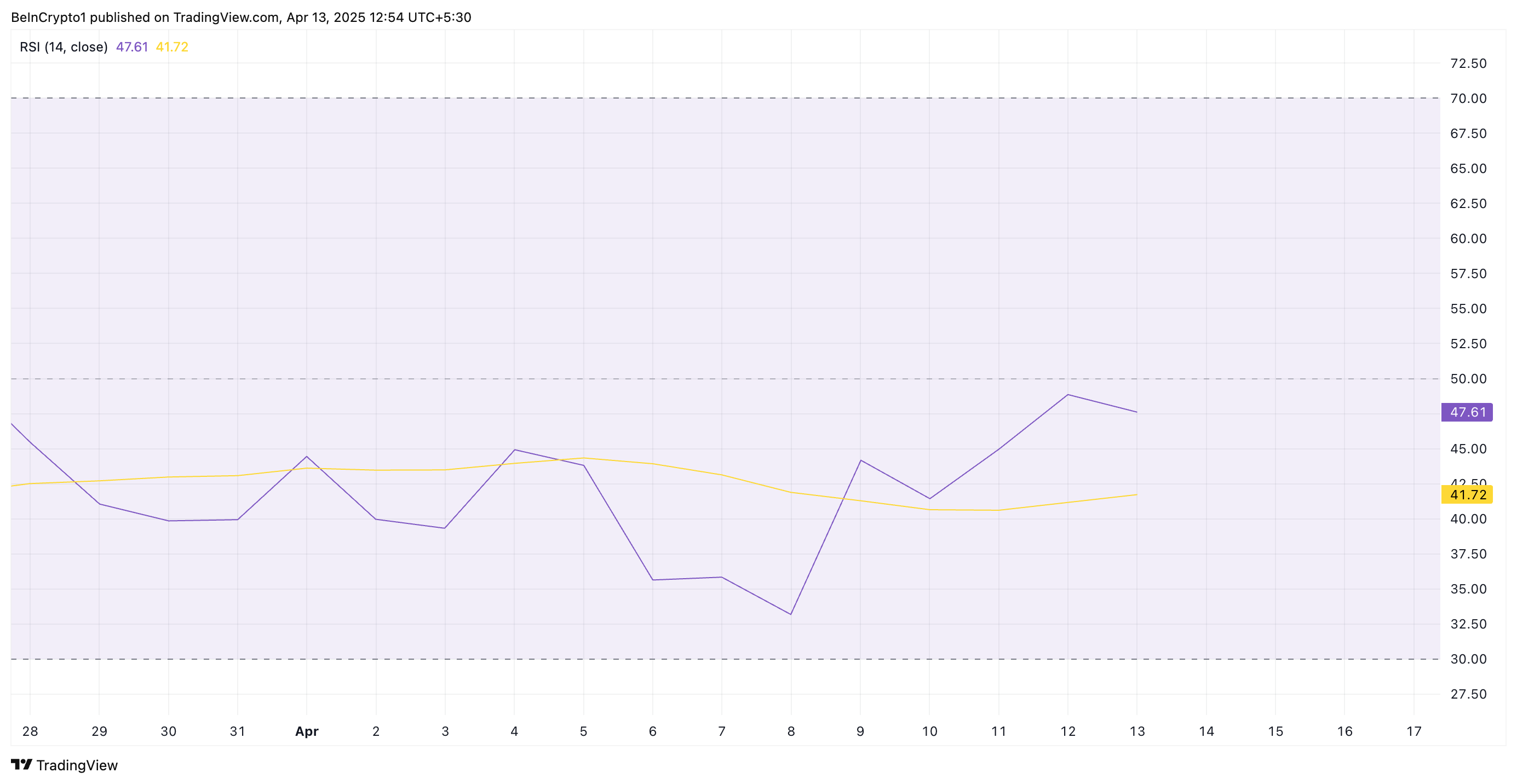

Technically, Doge coin's Relative Strength Index (RSI) continues to show a downward trend on the daily chart, further confirming a bearish outlook.

At the time of reporting, this key momentum indicator measures the asset's overbought and oversold market conditions, positioned at 47.61 below the 50 neutral line.

When an asset's RSI falls below the centerline, bearish momentum is strengthened. This suggests that selling pressure for Doge coin has begun to exceed buying interest, signaling a potential decline in asset price.

Doge Coin at Risk of Retesting Annual Low

With cryptocurrency market volatility heightened by Donald Trump's trade war and Doge coin struggling to attract new investments, the meme coin could test new lows in the short term. If selling pressure intensifies, Doge coin may revisit its year-to-date low of $0.12.

Conversely, a revival of new demand for meme coins would invalidate this bearish outlook. In that case, Doge coin's price could break through $0.17 and rise to $0.20.