This article is machine translated

Show original

🚨 COMPILATION OF IMPORTANT INDICATORS AHEAD OF THE MAY FOMC MEETING 🇺🇸

From now until the FOMC meeting on 5/8, a series of economic data will be successively released and could directly impact the Fed's decision: maintain, increase, or begin

🧭 Why does the Fed closely monitor economic data?

The US Federal Reserve (Fed) has two goals:

✅ Control inflation (keep prices stable)

✅ Maintain maximum employment (help the economy have enough jobs)

→ To know whether to keep or cut interest rates, the Fed

🗓️ Events that will “shape” the Fed’s decision

Here is a list of important data between now and the FOMC meeting that you need to pay attention to:

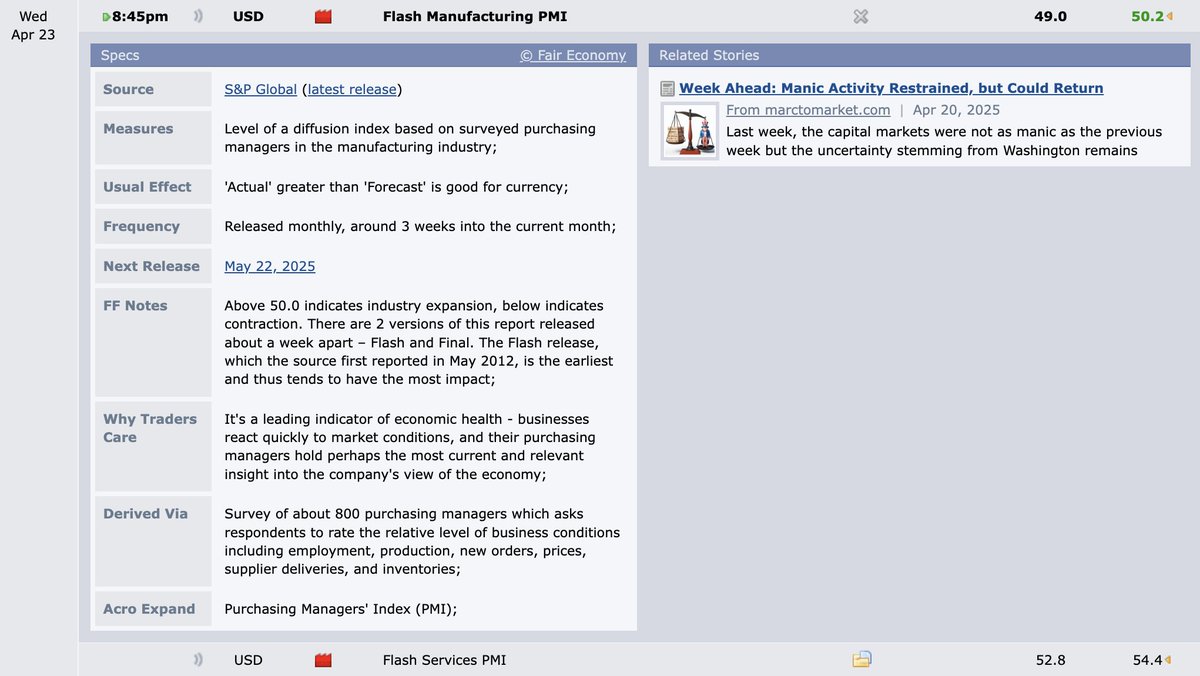

📅 4/23 – S&P Global PMIs & New Home Sales

🔴 PMI (Purchasing Managers' Index)

An indicator of the health of the economy

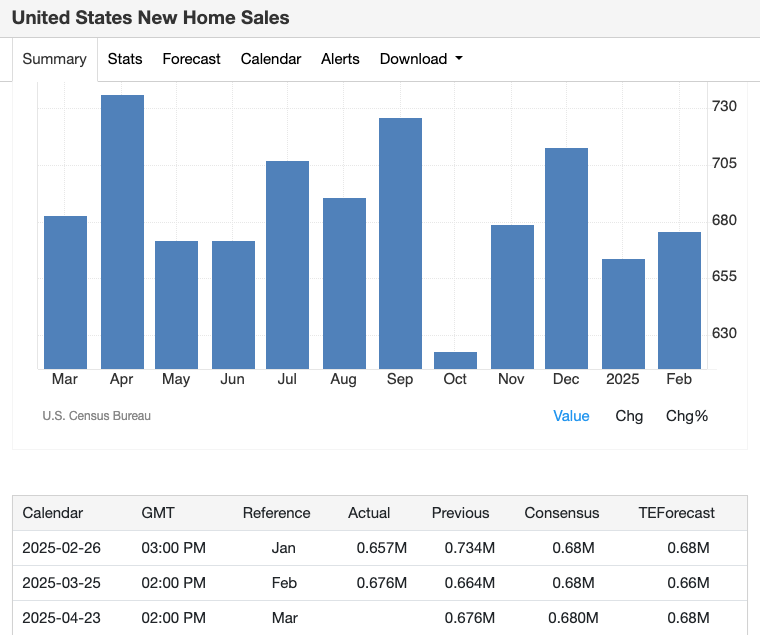

🔴 New Home Sales

This is the number of new homes sold in a month, and it shows the health of the housing market – an interest rate-sensitive sector.

Why does it matter to the Fed?

→ If home sales remain high despite interest rates

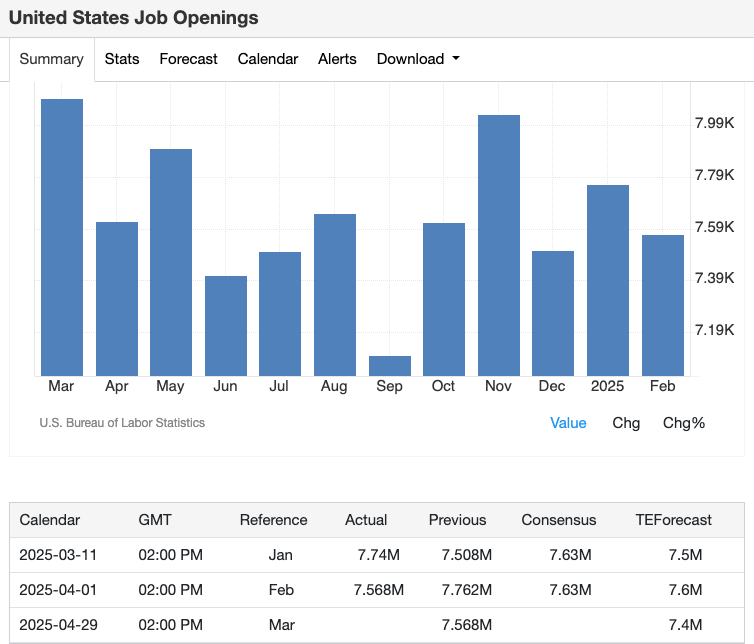

🗓 4/29 – JOLTs Job Openings

🔴 JOLTs Job Openings

Number of open positions but not filled yet → measures the heat of the labor market.

Why is it important to the Fed?

→ If there are still many jobs to fill → the labor market is still hot → can cause inflation

🗓 April 30 – The “Maker” Data Set

This is what the market calls a “super data day,” because it contains a slew of data that directly influence Fed policy:

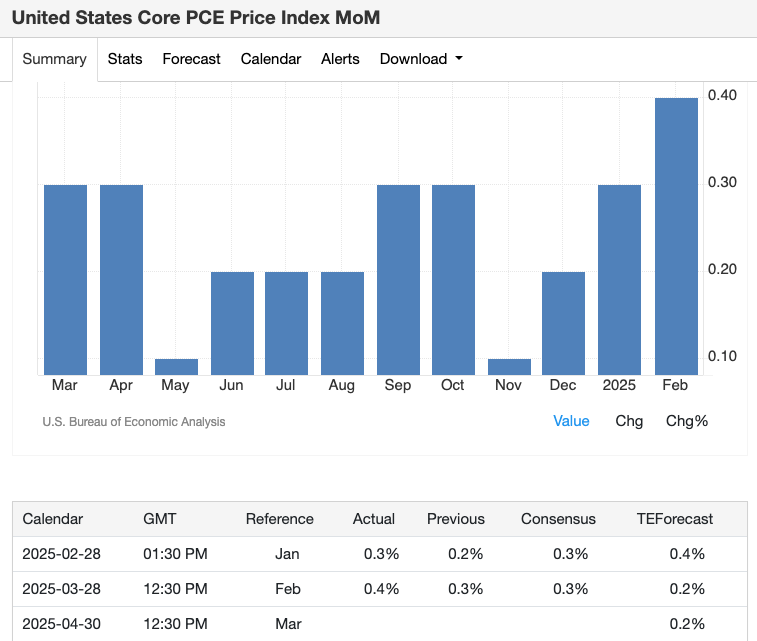

🔴 Core PCE Price Index

This is the Fed’s favorite measure of consumer prices

It ignores the price

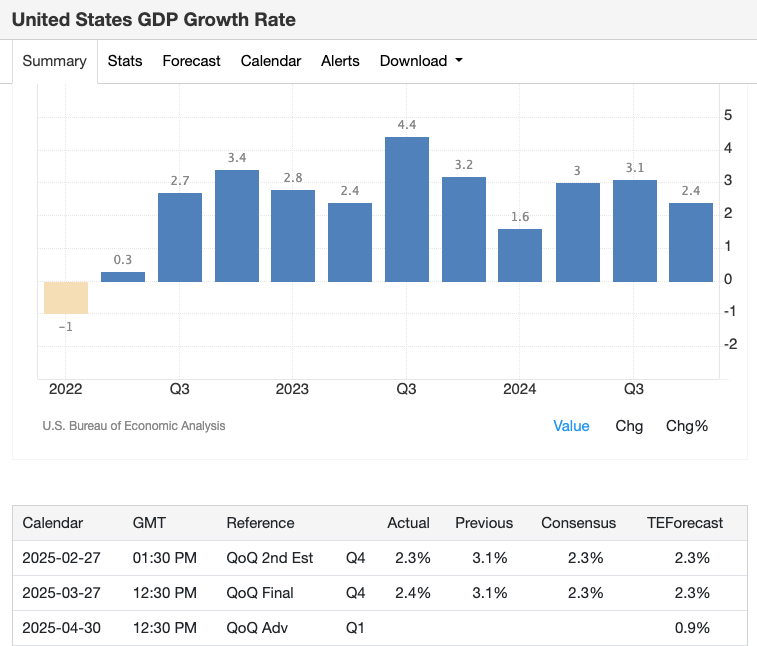

🔴 GDP Growth Rate – Q1

This is the total value of goods and services produced in the US in the first 3 months of 2025.

Why is it important?

→ If GDP increases strongly → the economy is still fine → the Fed does not need to act.

→ If GDP increases weakly (<1%) → growth slows down significantly →

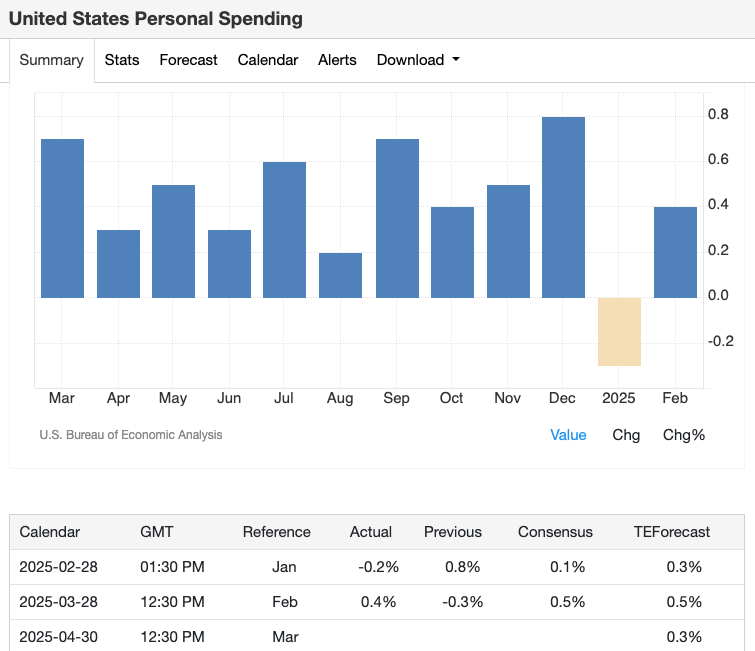

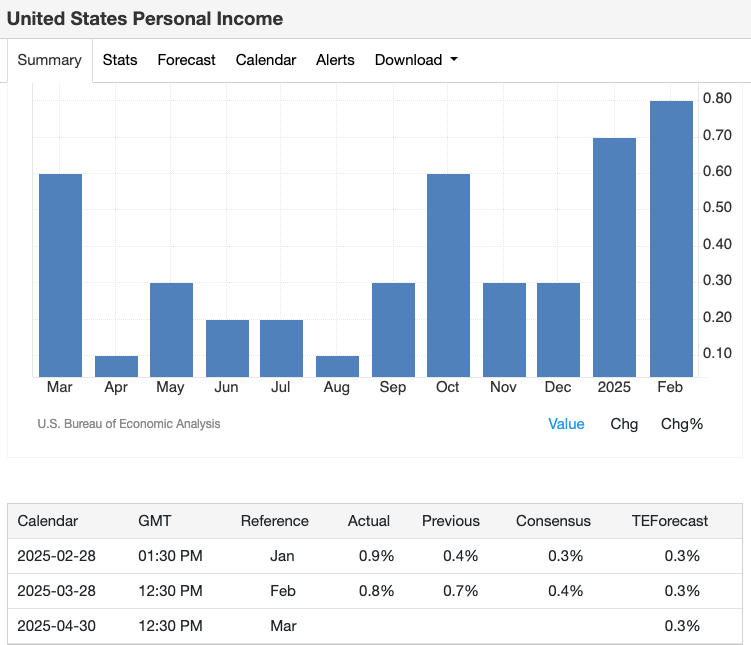

🔴 Personal Income & Spending

+ Income: how much Americans earn each month

+ Spending: how much they spend

Why is it important?

→ If income increases but spending decreases → people are worried → the economy slows down → support lower interest rates.

→ If both income

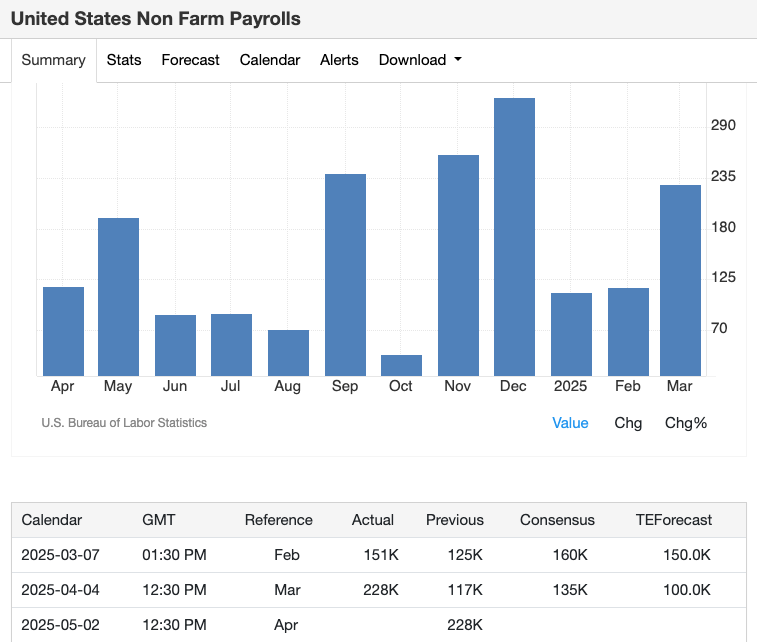

📅 02/5 – Non-Farm Payrolls & U6 Unemployment

🔴 Non-Farm Payrolls (NFP)

+ Is the number of new jobs created (excluding agriculture) in 1 month.

+ Is the most important US employment indicator, almost all financial markets are waiting.

Why is it important?

→ If

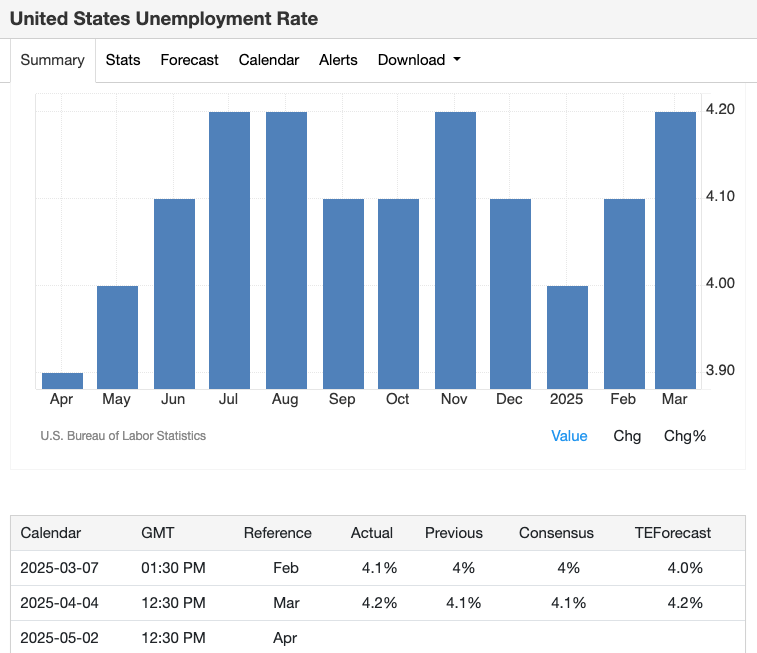

🔴 Unemployment Rate

The percentage of the total labor force that was unemployed and actively looking for work last month.

Why is it important?

→ If this rate increases → The Fed understands that workers are struggling → supports support policies.

If you find the article useful, don't forget to support the team with ❤️ and 🔁.

x.com/MarginATM/status/1914616...

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content