The continuous increase of Bitcoin Dominance (BTC.D) has sparked speculation about the potential for an altcoin season. While some analysts predict BTC.D will adjust, opening opportunities for altcoins to develop, a market expert has issued a warning.

He suggests that the current cycle may differ from previous patterns, with Bitcoin holders unlikely to sell their positions to move into altcoins.

Is Bitcoin's growth limiting altcoin development potential?

BeInCrypto reported last week that Bitcoin Dominance reached its All-Time-High in over four years. According to the latest data, BTC.D stands at 64.5%, increasing 11% since the beginning of the year.

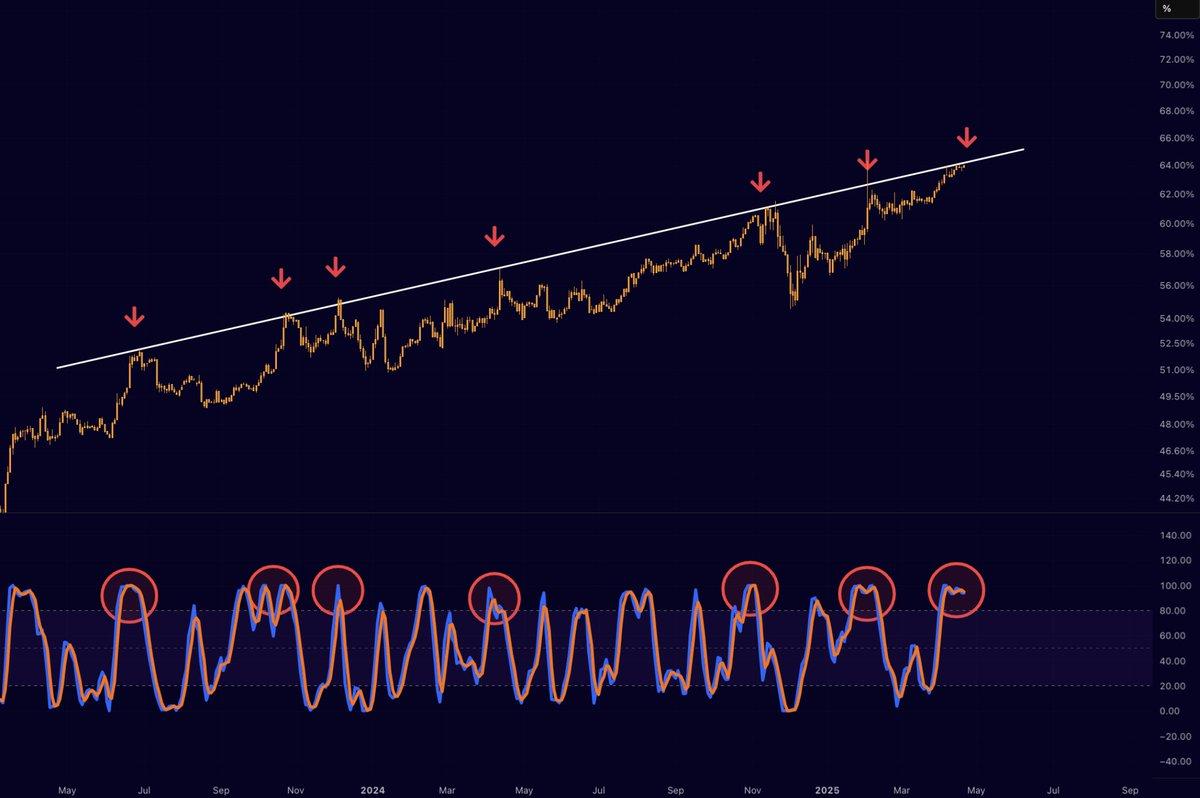

Bitcoin Dominance performance. Source: TradingView

Bitcoin Dominance performance. Source: TradingViewMany analysts are forecasting an upcoming adjustment in this index. Mister Crypto, for instance, noted that BTC.D appears to be preparing to be rejected at a key trend line. This resistance is crucial because historically, Bitcoin Dominance has struggled to surpass it.

"Bitcoin Dominance is about to be rejected here. As soon as this happens, altcoins will surge!" he wrote.

Historical BTC.D trend. Source: Mister Crypto

Historical BTC.D trend. Source: Mister CryptoAnother analyst shared an optimistic perspective, suggesting an imminent change.

"Bitcoin Dominance is collapsing. Altcoin season is coming this year. You just need to be patient," Merlijn The Trader posted.

BeInCrypto has also reported similar market predictions, emphasizing traders' expectations for an altcoin season. However, not everyone agrees. Experts remain divided about the exact timing of a potential altcoin season.

Meanwhile, Scott Melker, host of The Wolf Of All Streets Podcast, presented a more forceful perspective, arguing that the current cycle is fundamentally different.

In his latest X post, Melker explained that in previous market cycles, investors would rotate investments between Bitcoin and altcoins, which caused shifts in Bitcoin's dominance.

"This time, new money is flowing into Bitcoin from retail, institutional, and even government investors – and it's not flowing into altcoins. It can't go from an ETF into a meme," Melker commented.

Melker emphasized that altcoin decline relative to Bitcoin is primarily due to holders selling altcoins out of necessity rather than transferring capital into Bitcoin. According to him, this represents "surrender", where investors abandon their altcoins due to financial pressure more than market strategy.

However, the same does not occur with BTC. Unlike altcoin holders, Bitcoin investors are not selling their Bitcoin to buy altcoins. Therefore, Melker's analysis suggests that altcoins might require external capital inflow to recover instead of relying on traditional Bitcoin fund flows.

This market behavior change aligns with broader trends in the cryptocurrency space. Bitcoin is increasingly viewed as a value storage amid inflation concerns.

"This cycle might transform Bitcoin from a risky asset into an inflation hedge because there's nowhere else besides gold and BTC to park money," an analyst commented.

Moreover, BeInCrypto noted yesterday that the US Dollar Index (DXY) dropped to its lowest level in three years. This decline triggered a Bitcoin price surge.

It surpassed $87,000 yesterday, marking its All-Time-High on Liberation Day. Additionally, this price increase continues.

Bitcoin price performance. Source: TradingView

Bitcoin price performance. Source: TradingViewIn the past day, the largest cryptocurrency increased by 0.91%. At the time of writing, it is trading at $88,408.

Notably, the dollar's decline also benefited gold. The precious metal reached a new All-Time-High of $3,456 today.

"Gold price has now increased +47% in the past 12 months," The Kobeissi Letter revealed.

These contrasting developments have reinforced the narrative of Bitcoin as a reliable investment, placing it on par with gold. With increasing economic concerns, both assets are emerging as crucial safe havens.