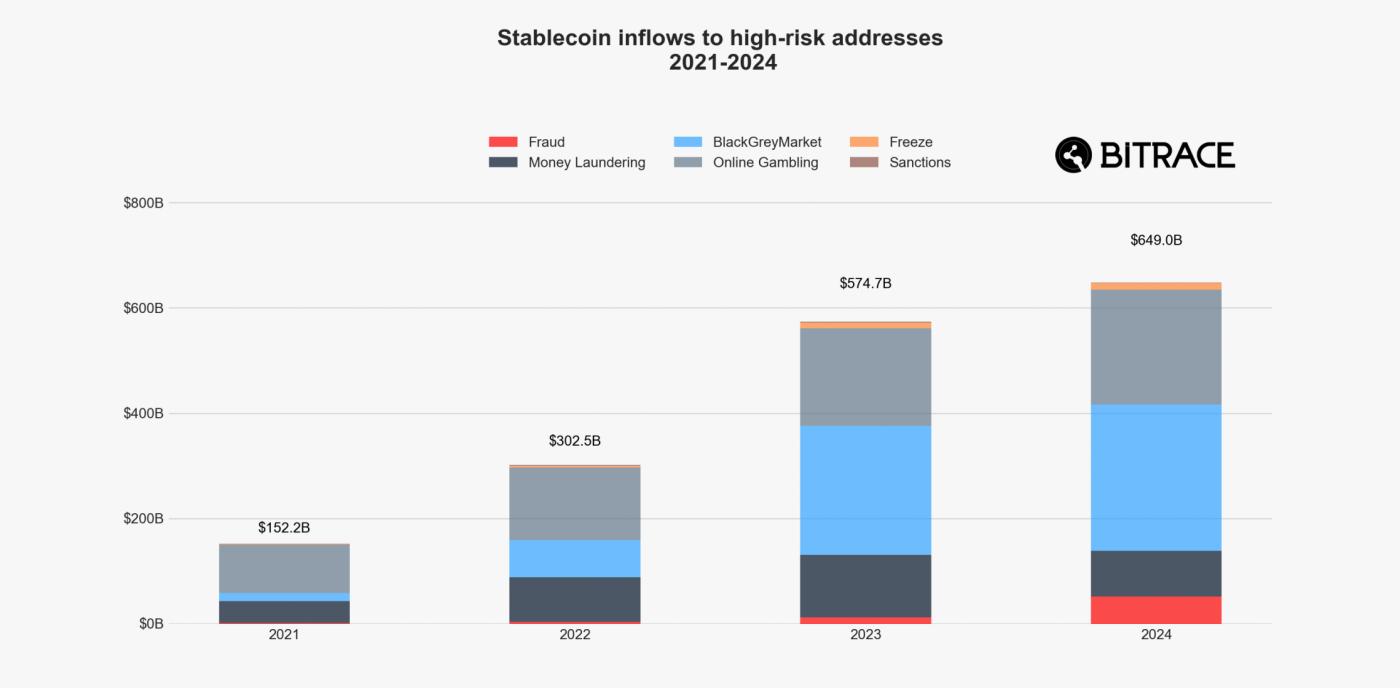

Bitrace's 2024 Crypto Crime Report shows that criminals have transferred $649 billion in stablecoins to high-risk addresses. The use of stablecoins in fraud and money laundering has increased, but the legal sector is growing faster.

The report also tracks other components such as gambling and darknet markets. It emphasizes the increasing enforcement actions against stablecoin money laundering, with Tether and Circle freezing over $1 billion in assets last year.

Stablecoins and Crypto Crime – A Worrying Trend?

Stablecoins are an important component of the international crypto ecosystem, but they also play a similar role in crime. For example, crypto investigator ZachXBT accused North Korean hackers of having a "pandemic" involvement in this field last month.

Bitrace's 2024 Crime Report details illegal activities across the industry, but specifically focuses on stablecoins.

Stablecoin Usage in Crime 2024. Source: Bitrace

Stablecoin Usage in Crime 2024. Source: BitraceThe report's data indicates that $649 billion in stablecoins were transferred to high-risk addresses last year, a significant increase from 2023. However, these transactions only account for 5.14% of the global stablecoin volume, down from 5.94% the previous year.

In other words, the stablecoin sector is growing faster than its use in crypto crime.

Naturally, Tether accounts for most of these transactions as it is the most popular stablecoin. TRON and Ethereum are the most common blockchains for USDT stablecoin, accounting for about 90% of the volume related to crime.

Ethereum's presence has increased compared to TRON, but the latter still accounts for over 75% of transactions.

Bitrace's Crypto Crime Report primarily focuses on the stablecoin industry but also mentions other areas.

For example, illegal trade on the darknet increased by over $30 billion as providers shifted to DeFi to avoid law enforcement. Crypto gambling is also increasing, rising 17.5% to $217.84 billion.

However, the industry is also implementing its own initiatives. Scams and fraud exploded last year, jumping from $12 billion in 2023 to $52 billion in 2024.

Escrow services like Huione play an important intermediary role, and Tether has been working to freeze its wallets. They have only disabled a small part of Huione's transactions, but it's a good start.

Tether and Circle have been actively freezing crypto wallets used by criminals because stablecoins are an important part of this ecosystem.

The total amount of frozen assets increased to nearly $1 billion in 2024, double the amount of the previous three years combined. This is still much lower than necessary, but there is hope that these activities can be scaled up.

In summary, stablecoins are a strongly developing component in the underground world of crypto crime, but enforcement is becoming more determined and sophisticated.

If the industry continues to focus on combating fraud and money laundering, it could make a real difference. The legal use of stablecoins far exceeds this sector, and the overall market share of crime is declining.