Author: Wall Street Insight

Key Points:

The Federal Reserve paused rate cuts for the third consecutive meeting, in line with market expectations.

The statement noted that economic uncertainty has "further" increased, with a new statement that "the risks of rising unemployment and inflation have increased".

The statement reiterated that recent indicators still show robust economic expansion, but pointed out that net export fluctuations have affected the data.

Continued balance sheet reduction.

This resolution was supported by all FOMC voting members, unlike the previous meeting where one member dissented.

"New Fed Communications": Fed officials are considering whether the focus should be on employment risks or inflation risks.

US President Trump was disappointed again. Despite his repeated calls for rate cuts, the Federal Reserve chose to wait and observe, did not cut rates, and even hinted at the risk of stagflation from Trump's policies.

On Wednesday, May 7th Eastern Time, the Federal Reserve announced after the FOMC meeting that the target range for the federal funds rate remains unchanged at 4.25% to 4.5%. This is the third consecutive monetary policy meeting where the Fed has paused actions. The Fed has cut rates for three consecutive meetings since September last year, with a total reduction of 100 basis points, and has been on hold since Trump took office in January.

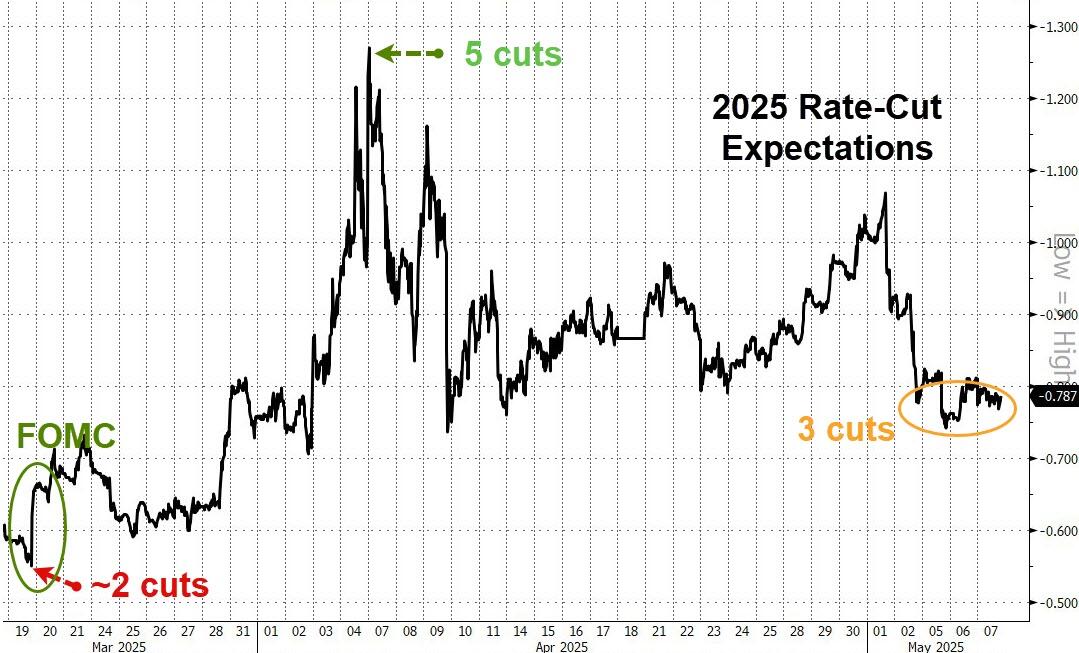

The Fed's pause in rate cuts was completely in line with market expectations. By the close on Tuesday, CME's tool showed that the futures market estimated over 95% probability of the Fed maintaining rates this week, over 68% probability of no rate cut in June, and about 77% probability of a rate cut in July. Before the Fed's announcement on Wednesday, derivatives market pricing showed traders reducing rate cut bets, expecting about three 25 basis point cuts this year starting from July.

Last Friday's April US non-farm employment data significantly exceeded expectations, reflecting the labor market's resilience and cooling investors' rate cut expectations. Nick Timiraos, known as the "New Fed Communications", commented that the non-farm data reduced the possibility of a June rate cut; facing the dilemma of economic recession and inflation pressure, the Fed is more likely to avoid uncontrolled inflation and thus may postpone rate cuts.

After the Fed's announcement on Wednesday, Timiraos commented that the Fed this time warned of increased risks of rising unemployment and inflation, and Fed officials are considering whether to focus on the risks of price increases or employment weakness. In other words, the Fed needs to consider whether to prioritize employment or fight inflation.

Economic Uncertainty "Further" Increased with Risks of Rising Unemployment and Inflation

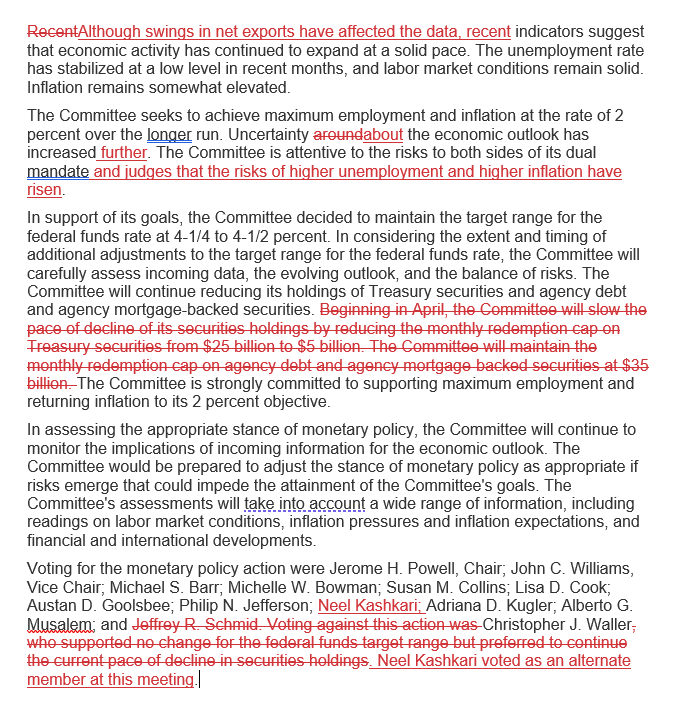

Compared to the last FOMC meeting statement in late March, this Fed resolution statement has three main changes. First, in assessing the economy.

The previous statement deleted the sentence "risks to achieving employment and inflation goals are broadly balanced" and added a sentence "uncertainty related to economic prospects has increased". This time, the statement adjusted this sentence again, changing it to "uncertainty related to economic prospects has further increased", adding the word "further" to emphasize the increase in "uncertainty".

Following this adjustment, the statement reaffirmed that the FOMC committee focuses on the two-sided risks in achieving its dual mandate of full employment and price stability, and then added a half-sentence:

"And determined that the risks of rising unemployment and inflation have increased."

Additionally, the statement slightly modified the first paragraph in assessing the economy. The previous statement's first sentence was that recent indicators show economic activity continues to expand robustly. This time, a half-sentence was added before this sentence, resulting in the statement beginning with "Although net export fluctuations have affected the data," recent indicators show economic activity continues to expand robustly.

Continuing Balance Sheet Reduction, Full FOMC Voting Support for Resolution

The previous resolution showed that the Fed decided to further slow down the pace of balance sheet reduction (QT) after June last year.

Specifically, starting from April, the monthly redemption cap for US Treasuries was reduced from $25 billion to $5 billion, while maintaining the $35 billion monthly redemption cap for agency debt and agency mortgage-backed securities (MBS).

This statement did not mention again the adjustment made to the US Treasury redemption cap from April, directly deleting the sentence about the adjustment, and reaffirming that the Fed will continue to reduce its holdings of US Treasuries, agency debt, and agency MBS.

This means that after slowing down balance sheet reduction in April, the Fed's guidance on balance sheet reduction has not been further modified.

Compared to the previous meeting statement, another major difference is that all FOMC voting members supported this resolution: neither adjusting rates nor changing balance sheet reduction.

In the previous meeting, one FOMC member opposed the resolution. Fed Governor Christopher Waller, who voted against, supported continuing to pause rate cuts but did not advocate slowing down balance sheet reduction, hoping to maintain the current pace of balance sheet reduction.

The following red text shows the deletions and additions to this resolution statement compared to the previous one.