The spotlight's back on fundamental projects, but new industry leaders emerge.

AI grows, but DeFi holds strong in crypto.

Discover why Soul Protocol aims to lead in DeFi 🧵⬇️

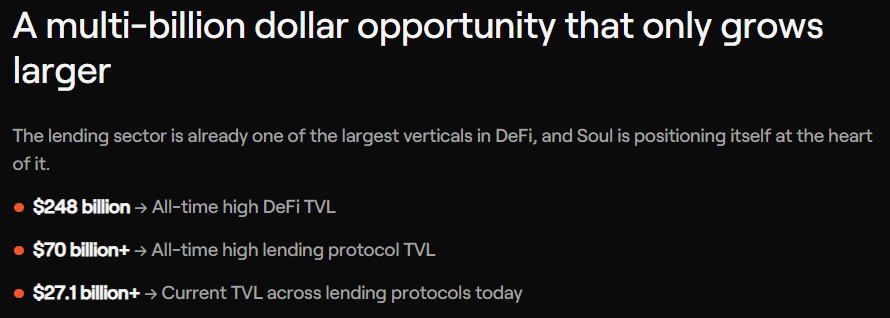

Most are still chasing memecoins or stuck in altbag limbo. But if you zoom out, it's clear: DeFi is still crypto’s real use case.

And one area that hasn’t been solved yet? Cross-chain lending.

That’s why I’m watching @0xSoulProtocol — launching this week with a rare fair token

So what is Soul?

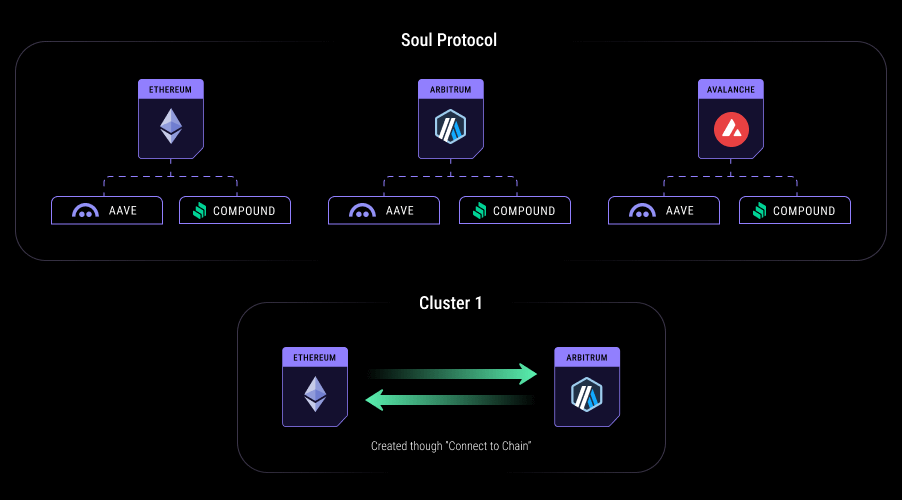

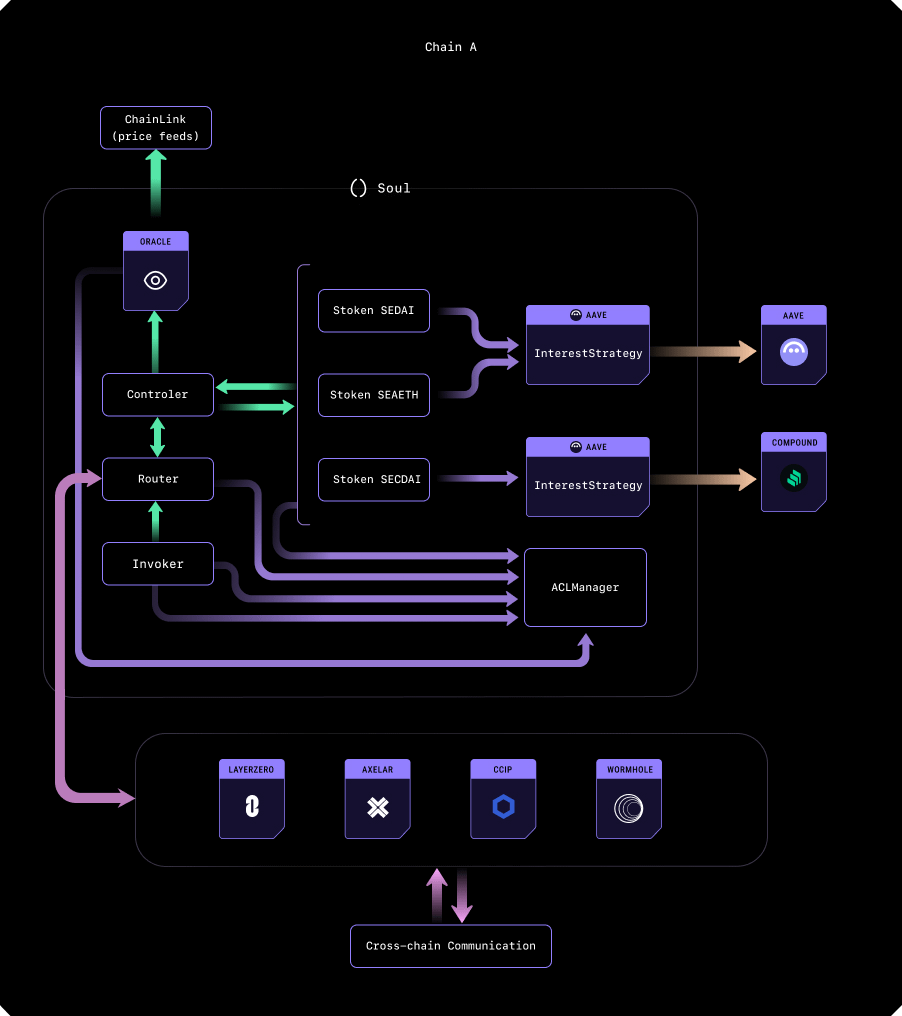

It’s a cross-chain, cross-protocol lending layer. You deposit on one chain, borrow on another. No bridging, no juggling dashboards, no liquidity fragmentation.

Think Aave x LayerZero — but unified and capital efficient from day one.

The token sale is not typical DeFi launch:

— No KOL discounts

— No insider deals

— Just a high float, low-FDV launch designed for real users

It’s what DeFi should’ve always been: fair, transparent, market-driven.

This isn’t some static whitelist mint either. SOUL’s token will be sold via a market-based price discovery mechanism via @xLaunchpadApp . Open to anyone. The price is set by the market — not by insiders.

The KYC going on right now.

x.com/xLaunchpadApp/status/191...

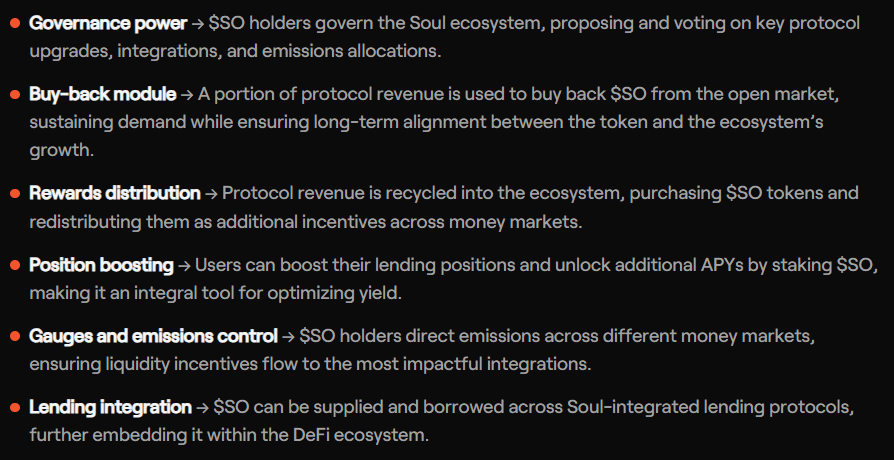

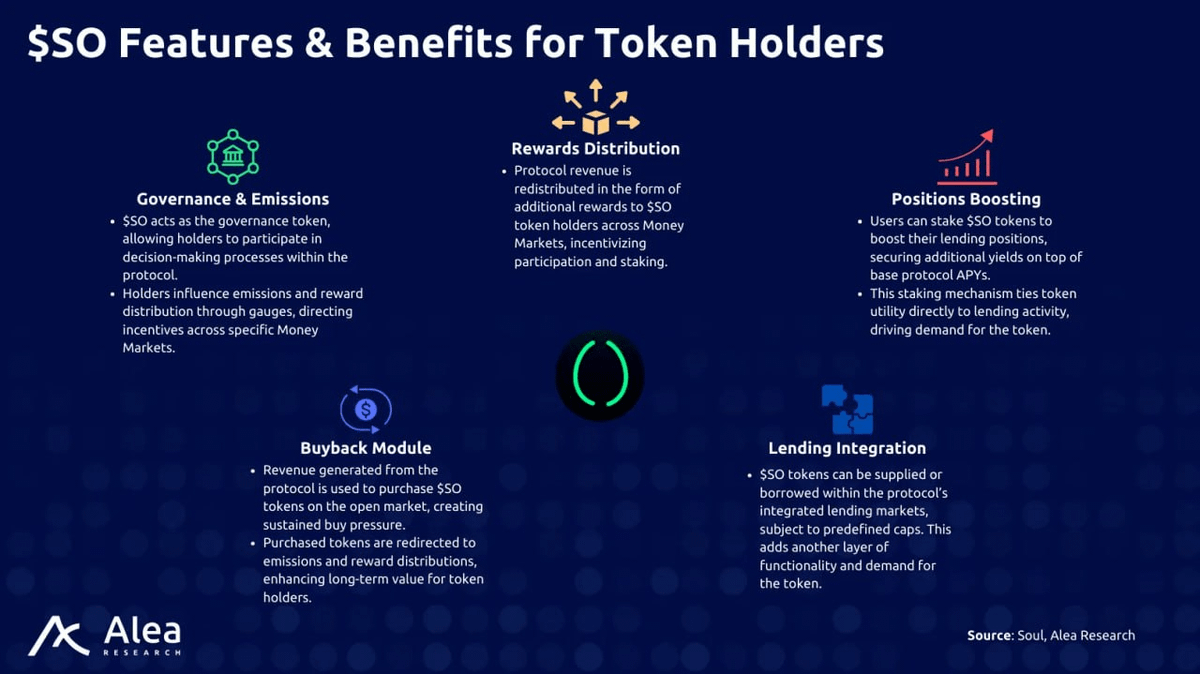

And it’s not just governance.

From day one, $SO will have actual utility:

— Fee switch: real protocol revenues to holders

— Emissions control: ve(3,3)-style gauges

— Governance: full protocol direction

It’s built to function, not just exist.

Let’s be real, most token launches today are just hype wrappers for vaporware. SOUL’s is different.

It’s infrastructure-first — and that infrastructure is already live and solving real problems across chains.

Owning $SO means owning a share of the next layer of DeFi. A coordination layer.

Built to unify fragmented liquidity, enable new strategies, and capture cross-chain volume that no legacy money market can.

Because it’s not just about lending. SOUL enables real capital movement:

— Deposit on Ethereum

— Borrow on Arbitrum

— Pay back from Avalanche

No more “bridge and pray” — just frictionless liquidity.

And the revenue model? Robust.

Cross-chain fees, protocol-level fees, liquidation incentives, flash loan income — it all flows back to $SO holders. That’s utility with clear cash flow.

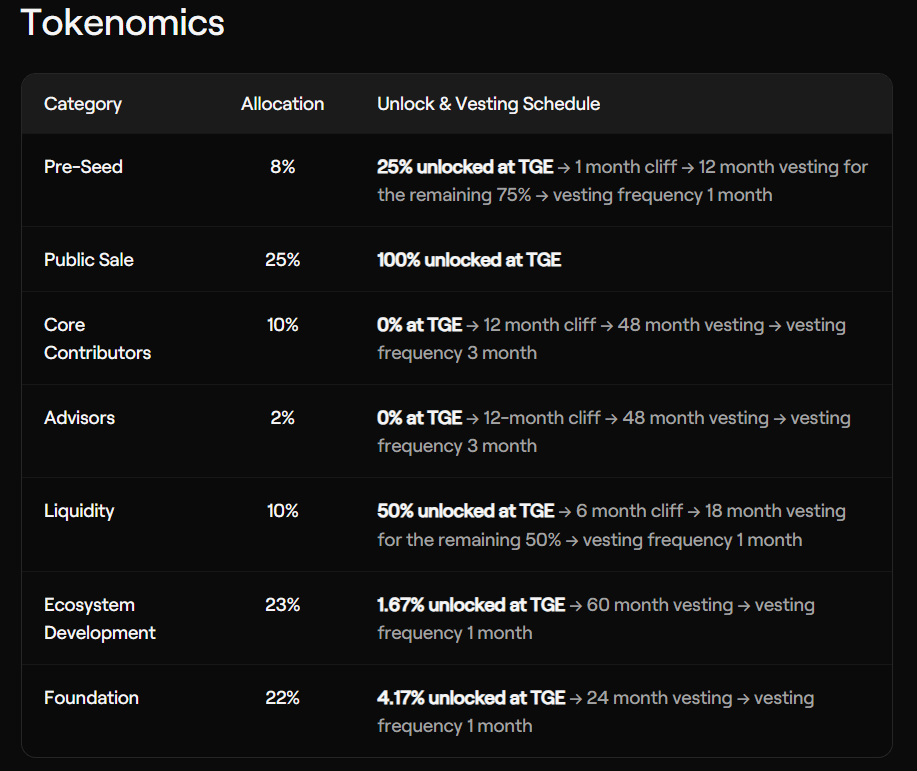

The token model avoids the usual pitfalls.

Instead of short-term liquidity mining games, SOUL ties demand for $SO directly to protocol usage.

To access boosted yields, users must stake $SO.

TVL grows → demand for SO grows → value accrual.

A clean, self-reinforcing flywheel.

It’s also a big narrative bet.

We’re moving from extractive, VC-heavy launches to fairer models. From meme-only seasons to real utility again.

SOUL is sitting right at that pivot — a bet on the next DeFi cycle, not the last one.

Public sale is this week.

High float, low FDV. Real demand will drive the price.

If you’ve been waiting for a reason to get back into early-stage DeFi, this is the one I’d seriously look at.

That's a wrap for today.

DeFi isn’t dead — it’s consolidating. The next winners won’t just be forks or ponzis. They’ll be infrastructure.

And @0xSoulProtocol looks like it’s shipping the architecture for the next lending meta. I'll be watching closely.

I'm going to provide even more alpha content about AI and Crypto.

To ensure you don't miss anything, join my Telegram and turn on notifications.

➜ http:/t.me/AW_TimeFundamental projects are back in the spotlight.

But new leaders from different industries are clearly already

I hope you've found this thread helpful.

Follow me @wacy_time1 for more.

Like/Repost the quote below if you can: twitter.com/141092729661417881...

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content