Written by: Frank, PANews

Binance Alpha's points game is pushing "internal competition" to the extreme at an unprecedented speed. When the points threshold once broke through 200 points, and airdrop earnings suddenly dropped to around $25, the decline in user input-output ratio sparked widespread community discussion.

Beneath this seemingly winner-takes-all feast, one view suggests that its massive traffic is "spilling over" to ecosystems like Sui and Solana, injecting vitality into them. However, what is the real situation of this spillover effect? What profound impact will this "farming" carnival ignited by Binance Alpha ultimately bring to the industry?

The Virtual and Real of Traffic "Spillover": Observing Sui's Alpha Effect

The Binance Alpha points game mechanism has been detailed in previous articles, so it won't be repeated here. Generally, as more users participate, the result is that each airdrop's earnings have a clear upper limit, and the points threshold becomes increasingly high. In this situation, users must further compress costs to maintain profit margins.

Recently, Binance Alpha began listing Sui ecosystem tokens and subsequently announced multiple Sui ecosystem Alpha projects. The addition of the Sui ecosystem conveniently provides users who are trading volume farming with a new cost depression. On May 14th, KOLs like @lianyanshe proposed that Sui ecosystem projects such as NAVX have lower gas fees when farming trading volume, are not vulnerable to sandwich bot attacks, and have overall lower attrition, thus several Sui ecosystem projects will become the new "volume kings" of Binance Alpha.

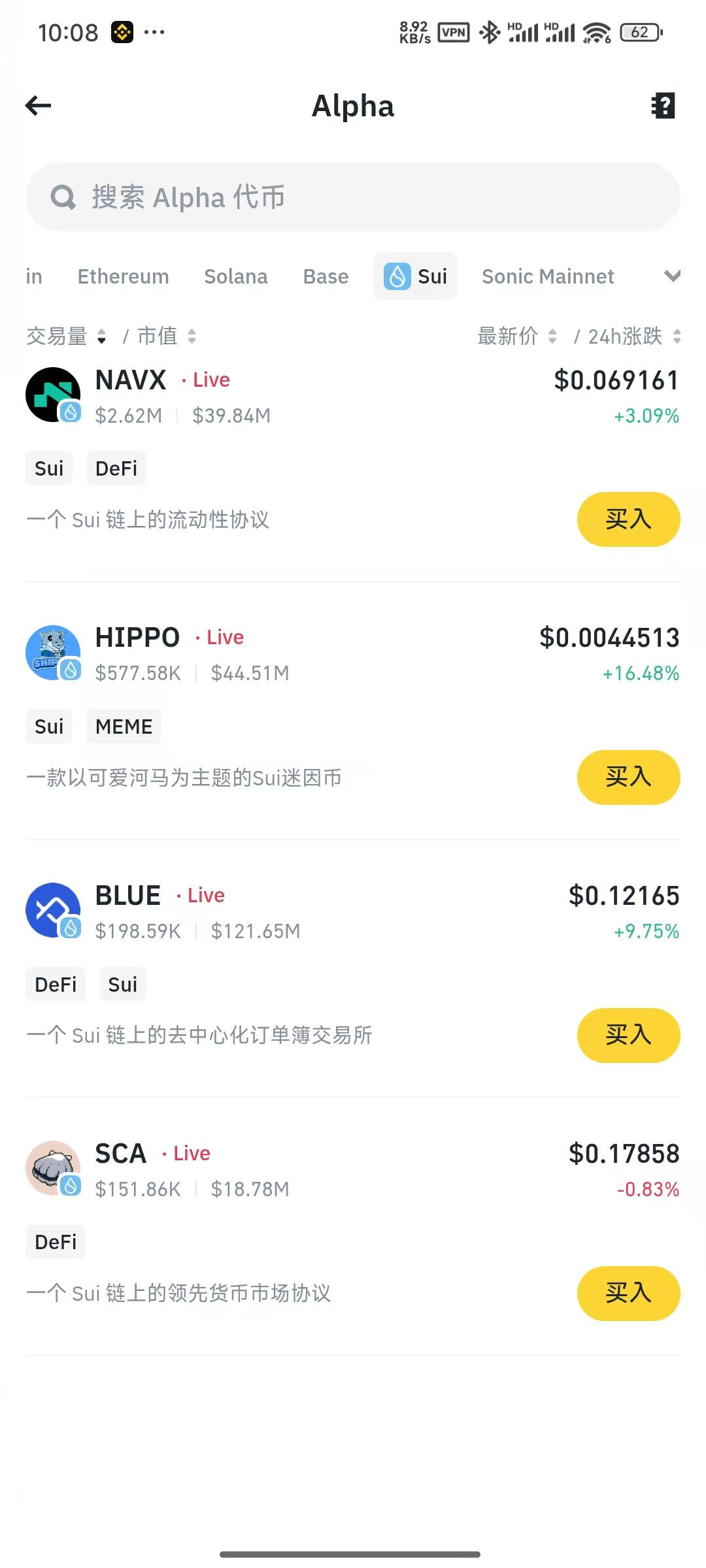

If most users choose this approach, it could indeed bring considerable trading volume and token heat to the Sui ecosystem. However, such an effect seems not to have materialized in reality. According to PANews's investigation, Sui ecosystem tokens' trading volume on Alpha is not high, with NAVX's highest 24-hour trading volume being only $3.34 million, while others like HIPPO, BLUE, and SCA have trading volumes between tens of thousands to hundreds of thousands of dollars. In comparison, several Solana chain projects have trading volumes basically above $10 million, and top BSC projects' trading volumes exceed $200 million. However, for NAVX, being listed on Binance Alpha did indeed boost its trading volume - on May 13th, NAVX's main pool trading volume reached $1.6 million, compared to just thousands of dollars the previous day.

In the actual trading process, it can be discovered that in Binance wallet's official cross-chain bridge, Sui ecosystem and BSC chain asset exchange is currently not connected. Users cannot directly exchange BNB and other assets for USDC on Sui, and if they want to save on attrition, they must bear the attrition of using other cross-chain bridges.

Solana's Top MEME Unexpectedly Receives Capital Inflow

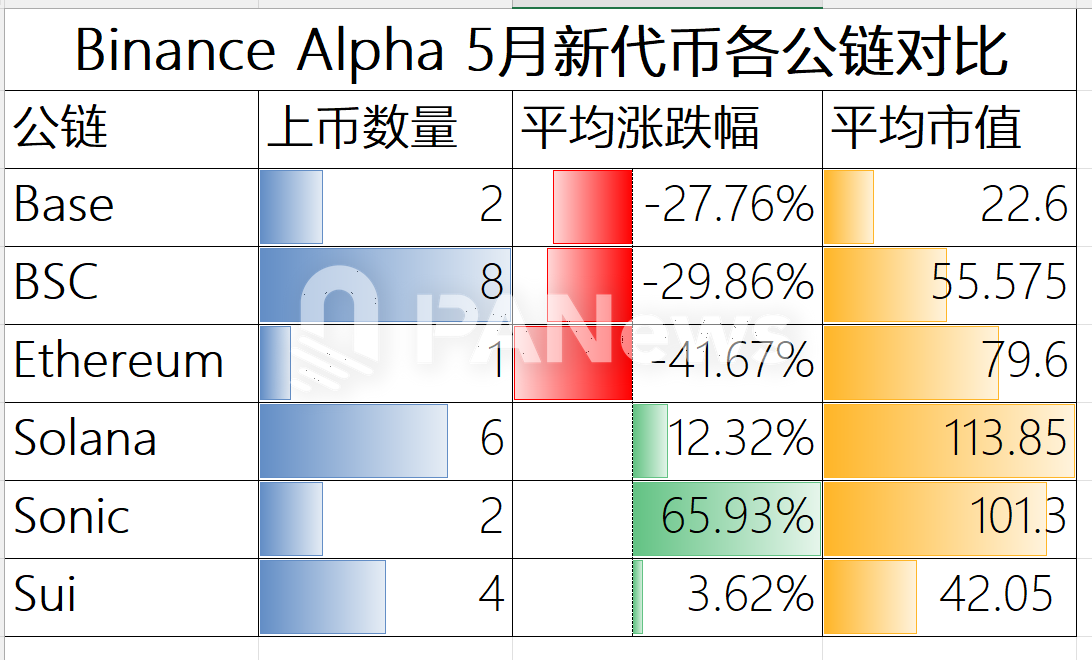

Solana is one of the ecosystems with the most projects listed on Binance Alpha besides BSC. From May, Solana's overall DEX trading volume has indeed shown a significant increase. On May 4th, Solana DEX trading volume was $2.2 billion, rising to $4.59 billion by May 15th, growing by over 100%. Several top tokens listed on Binance Alpha like MOODENG and jellyjelly indeed saw huge trading volume increases and notable price increases recently. MOODENG rose 140% from listing to May 14th, and the average increase of 6 tokens listed on Binance Alpha in the Solana ecosystem in May reached 12.32%, one of the few ecosystems with positive performance.

Besides Sui and Solana ecosystems, the Sonic ecosystem might be the most obvious beneficiary of this spillover effect. As Fantom's new brand, Sonic currently most needs breakthrough exposure and capital inflow. Although only 3 Sonic ecosystem projects are currently listed on Binance Alpha, the average price increase of two tokens listed in May reached 65.93% (data as of May 14th), ranking highest among all ecosystems. However, due to its limited number of listed tokens, this cannot prove that Sonic ecosystem tokens have higher potential.

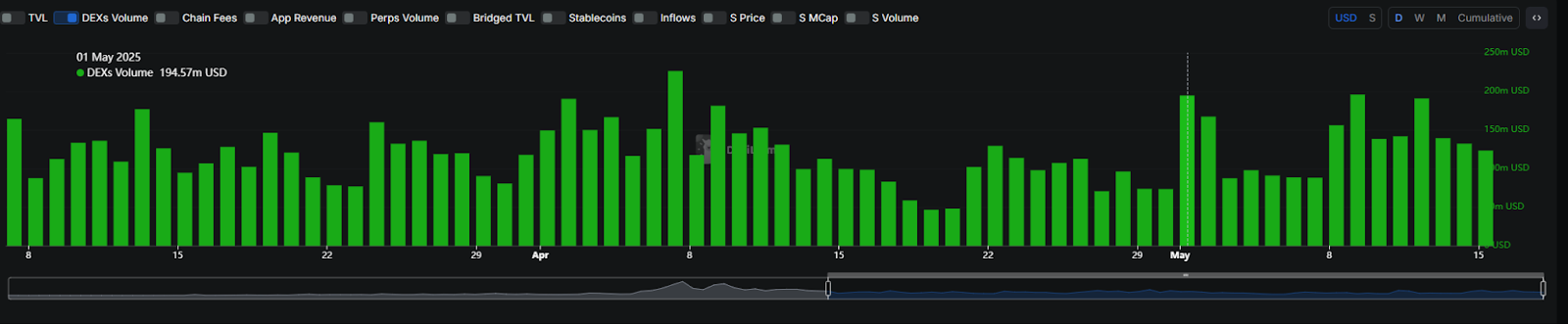

On May 1st, when Binance Alpha announced listing two Sonic ecosystem projects, the Sonic ecosystem's DEX trading volume indeed saw a significant increase, surging from over $73.4 million to $194 million.

Project Myth: Peak Upon Listing or Value Discovery?

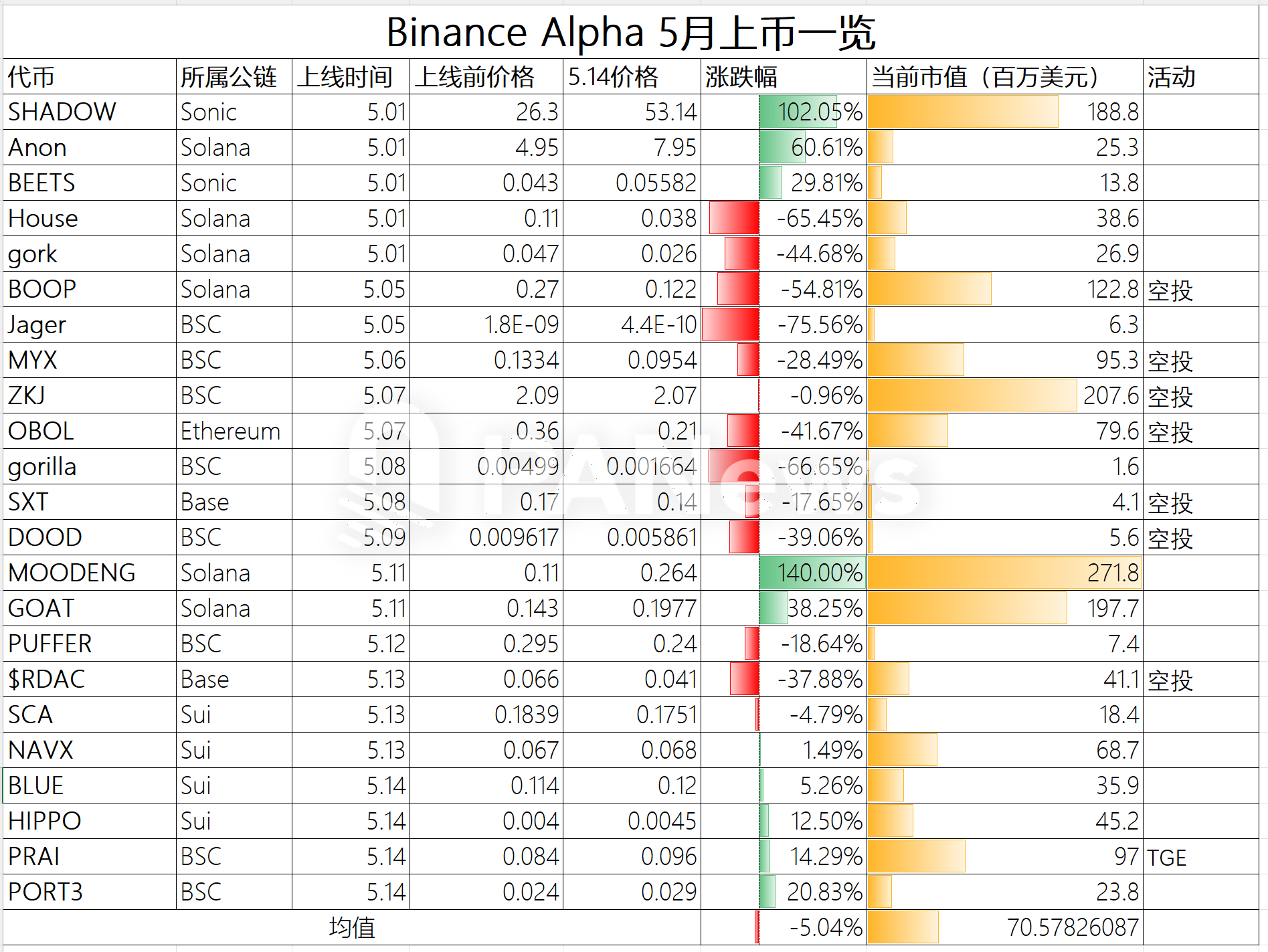

From a project perspective, will listing on Binance Alpha bring a chance of skyrocketing prices? From the data, 23 tokens listed in May had an average price change of -5.04%. The largest decline reached 75%. Although these projects experienced price surges in the short term after Binance Alpha listing, they generally experienced significant pullbacks after the heat subsided. Thus, Binance Alpha listing does not mean the birth of a large MC memecoin, but just adds another trading port.

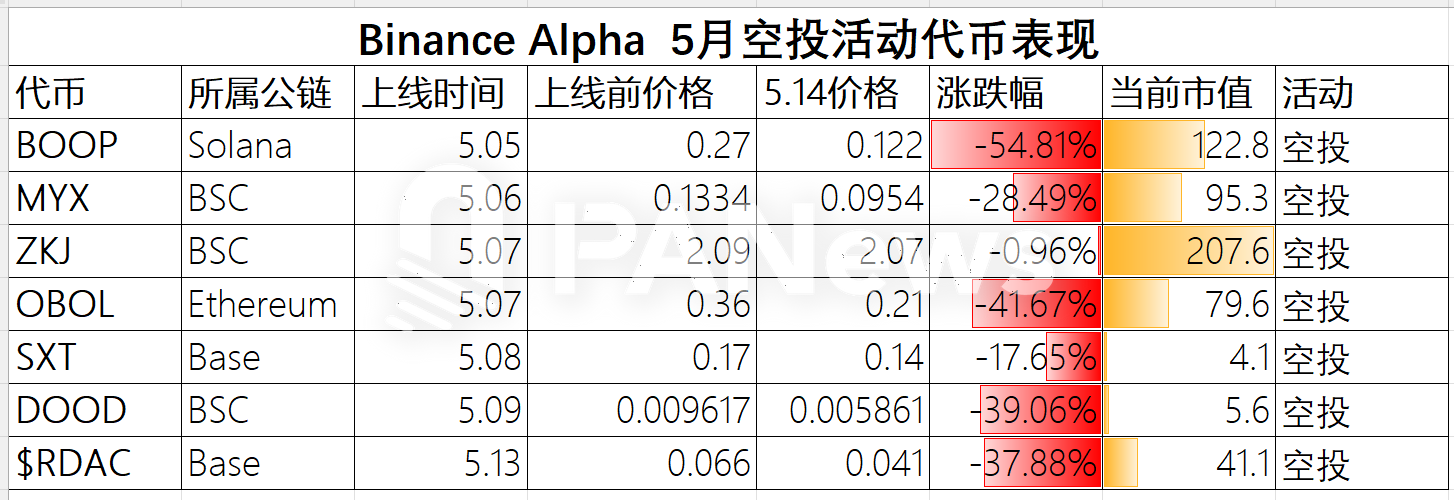

Moreover, for first-launch projects with airdrop activities, they seemingly did not gain market favor. The 7 tokens with airdrop activities listed in May had an average decline of 31.5%, all in a downward trend as of May 14th. From this perspective, for projects, airdrops and volume farming cannot drive price trends upward.

Overall, projects listed on Binance Alpha have an average market cap of $70 million, with the lowest token market cap around $1.6 million and the highest, MOODENG, reaching $271 million. Solana ecosystem's newly listed tokens have an average market cap exceeding $100 million, indicating higher requirements.

Internal Competition's Endgame: Professional Players' Arena and Ordinary Users' Exit

For ecosystems and projects, Binance Alpha means exposure and traffic gathering. For users, the current internal competition is eliminating ordinary users, becoming an arena for professional workshops and large investors. With the points threshold reaching 205 points, users need to complete at least 15 points daily to catch up. Based on a $1000 principal (earning 2 points), users additionally need to farm daily trading volume of $8000 to accumulate points. The daily slippage + gas fees for this trading volume might exceed $10. If unable to reach the next threshold or receive small airdrops, users face a double loss of money and effort. The latest RDAC token airdrop results basically yielded only $25 upon selling, hardly covering the 205-point cost.

It can be foreseen that the points threshold will continue to rise, and according to current rules, higher daily points require exponentially increasing trading volume. Either Binance Alpha will increase per-address airdrop amounts, or a large number of users will exit the internal competition, allowing the points threshold to fall to a reasonable range. Regardless, this internal competition game seems to be approaching its end. BSC chain's DEX trading volume has also begun to decline in recent days, dropping 16.4% from $3.16 billion on May 12th to $2.64 billion on May 15th.

In summary, the Binance Alpha's "traffic spillover" effect shows significant differences across ecosystems. The Sui ecosystem did not receive as many volume farming behaviors as expected, while the Solana ecosystem demonstrated stronger positive interaction and growth. For project parties, the short-term spotlight brought by Alpha often fails to convert into sustained value support, with price pullbacks after listing becoming the norm, and airdrop activities unable to become price saviors. Various projects offering airdrops become Binance's wallet product promotion "payers".

The core issue is that this frenzy driven by points is ruthlessly pushing ordinary users out of the game. The continuously rising point thresholds and exponentially growing transaction volume demands, coupled with increasingly diminishing airdrop returns, are gradually transforming Binance Alpha into a "zero-sum game" for professional studios and large investors. The recent decline in DEX trading volume on the BSC chain seems to also indicate that this model relying on high-intensity "involution" is approaching its sustainability critical point.