It's official:

For the first time in history, Moody's has downgraded the United States' credit rating.

Moody's cites concerns over soaring US debt levels with interest on US debt set to hit 30% of REVENUE by 2035.

What does it all mean? Let us explain.

(a thread)

This isn't the first time the US has seen a credit rating downgrade.

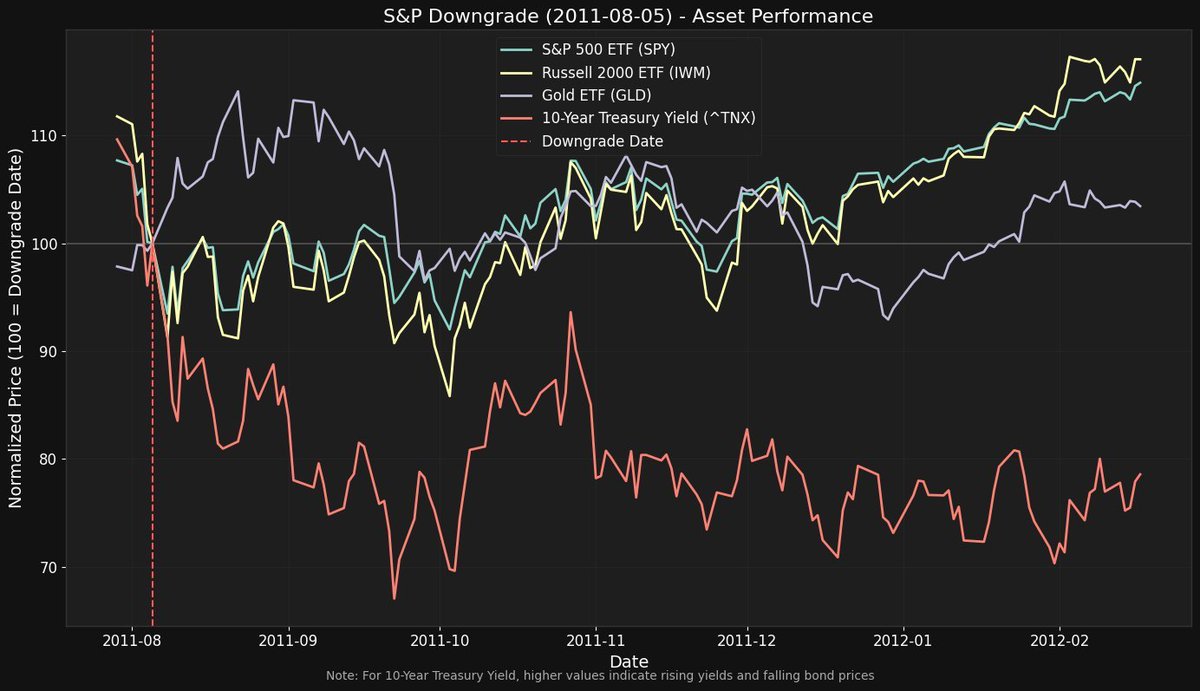

In 2011, S&P downgraded the US' credit rating from AAA to AA+.

As seen below, the downgrade came with an ~8% drop in the S&P 500 in 2 months.

The 10Y Yield fell as much as ~35% within the first 2 months.

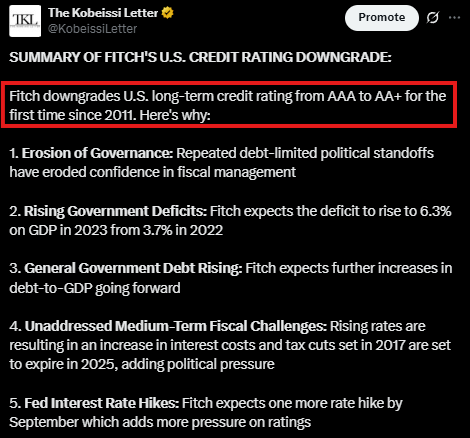

In 2023, Fitch downgraded the US' long-term credit rating from AAA to AA+.

They cited concerns over rising US debt levels, unaddressed fiscal challenges, and Fed rate hikes.

This seemed to pave the path for the historic Moody's downgrade that we just received.

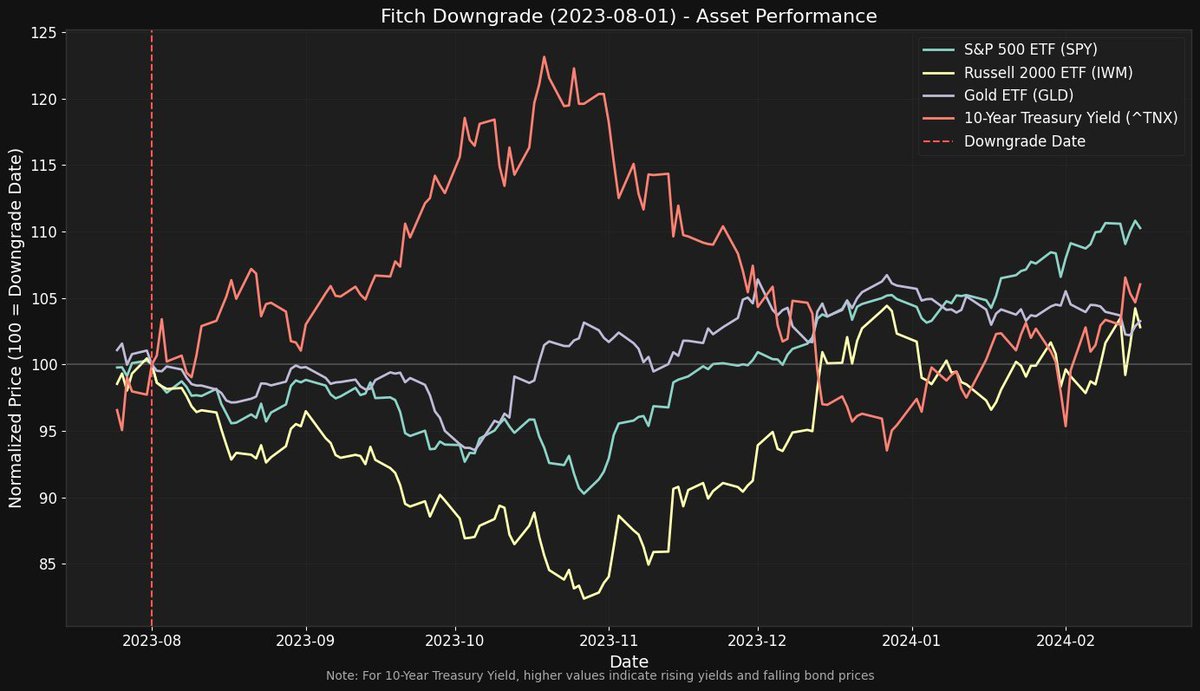

Following the Fitch downgrade of 2023, the S&P 500 fell -10% in 3 months.

The Russell 2000 fell -17% over the same time period, but yields surged as much as ~23% this time.

The move in stocks was more pronounced than 2011 while the move in yields was exactly opposite.

Why?

Largely because of the concerns that Fitch cited in 2023 being primarily focused around US debt.

This is exactly what Moody's noted in their downgrade.

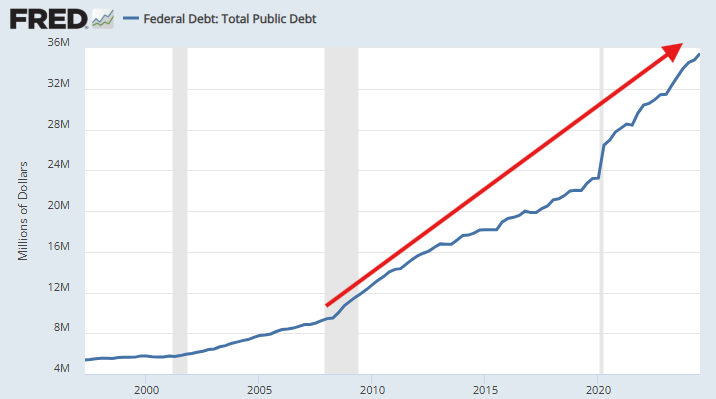

Moody's sees the US deficit hitting 9% of GDP by 2035 compared to 6.4% in 2024.

We are on an unsustainable fiscal path.

Moody's also said:

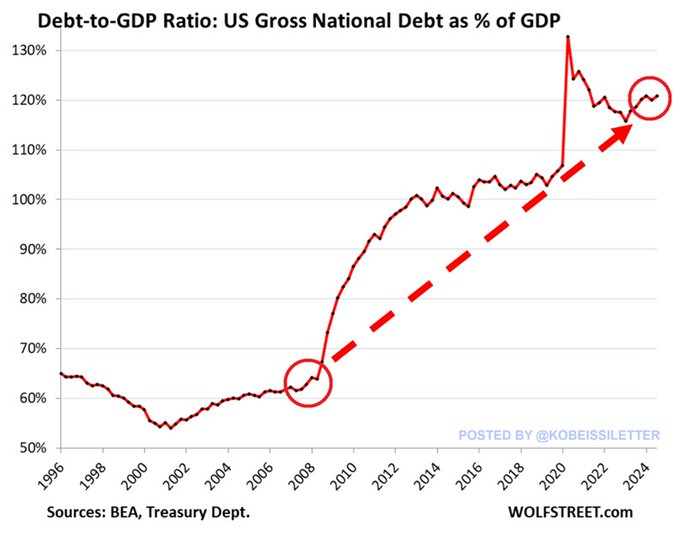

"We anticipate that the federal debt burden will rise to about 134% of GDP by 2035, compared to 98% in 2024."

Not even WW2 saw US Debt-to-GDP above 120%.

Interest payments would absorb ~30% of US revenue of debt levels rise this high, up from 18% now.

The timing of this downgrade was strange:

It came at 4:45 PM ET on a Friday after OpEx, minutes before the close for futures.

The initial reaction was similar to 2023, with yields rising and stocks falling.

Why was this not released on Monday or earlier in Friday's session?

US deficit spending has been propping yields up for 12+ months.

As seen below, the 10Y yield and the S&P 500 widened their performance gap heading into the trade war.

Between deficit spending and the basis trade unwinding, rates are ~90 bps higher than pre-"Fed pivot."

Many have called the downgrade unimportant.

The primary argument is that people will continue to borrow from the US, regardless of ratings.

While this is true now, it is not true over the long-run.

This mentality is why we are in a deficit spending crisis to begin with.

What's also interesting about the timing of this release is that is came hours after Trump's budget bill was struck down.

Some Republicans voted against the bill, asking for STEEPER spending cuts.

This budget is estimated to add more than $2.5 trillion to the US deficit.

Of course, there will always be the debate of whether events like this are political or not.

Regardless, we maintain our view that the deficit is out of control.

Furthermore, reducing the US deficit should NOT be a political issue, it should be bipartisan.

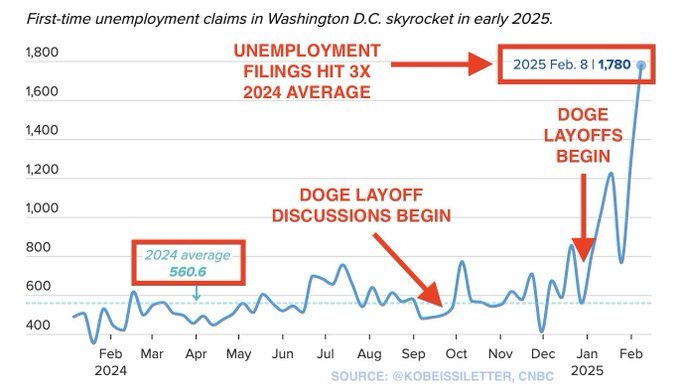

@DOGE is trying.

Between tariffs, interest rates, the Fed, and now this downgrade, volatility is here to stay.

As investors, we welcome this volatility.

Want to see how we are trading it?

Subscribe to our premium analysis and alerts at the link below:

http:/thekobeissiletter.com/su...

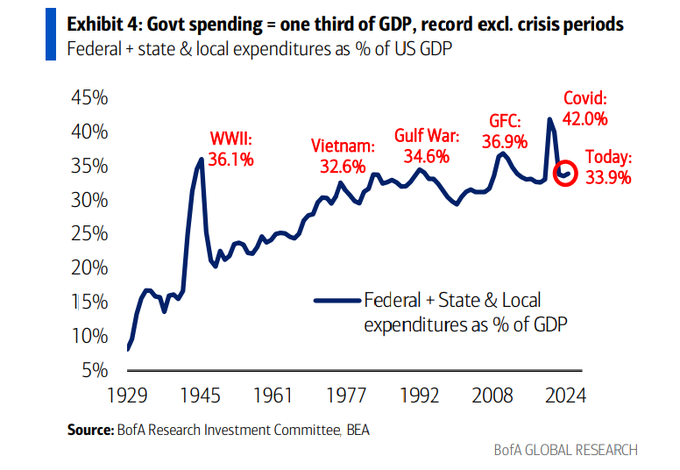

Lastly, this brings us back to the below chart which summarizes our current situation.

~34% of US GDP came from government spending in 2024; a record excluding period crisis.

Something must change.

Follow us @KobeissiLetter for real time analysis as this develops.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content