Preface

In the cryptocurrency world, every action of whales can become a barometer of the market, triggering dramatic market trends.

James Wynn, the trader who emerged from the memecoin craze, turned about $6 million into a $43 million crypto legend in just one month with amazing operations. His battlefield is concentrated on the Hyperliquid platform, and his trading targets are surprisingly simple: only Bitcoin and three meme coins: Pepe, Trump and Fartcoin.

Every time James Wynn opens or closes a position, or updates his tweets on X, he influences market sentiment and injects volatility into the market like a tidal wave. His trading patterns were interpreted by many as hidden signals, attracting investors to follow his footsteps and triggering rapid fluctuations in the memecoin market. At the same time, some people think this is just a reckless gamble and question whether this way of acquiring wealth can stand the test of time in the long run. Whether he is seen as a hero or a villain, every move he makes undoubtedly becomes the focus of market discussion and is imitated by many.

An in-depth analysis of James Wynn's trading strategies, including his preference for different trading platforms and the dynamic changes in the markets he operates in. This article will reveal how he rode the memecoin craze and achieved his set goals. We will also explore how the rise of this new trader may cause short-term market volatility and whether this impact may persist and influence future long-term trends.

Who is James Wynn? The Memecoin God of War!

James Wynn 's rise in the crypto economy began with the trading of memecoins, which became a hot topic on social media in just a few days.

He was originally known for Memecoin:

First, from 2023/04/14 to 04/19, he bought 4,216,203,079 PEPE tokens at 3.64 ETH equivalent to 7,644 USD and earned 25 million USD.

Then on 2024/04/24 he posted on X (Twitter) that he thought there was a 1000x chance of trading and released relevant information about the ELON token. A few hours later, the ELON he bought through the two addresses was nearly 100 times more. But the good times did not last long. A few days later, the price of ELON plummeted by 70%. James Wynn announced the liquidation of his holdings and stated that there were problems with the project.

Finally, on March 13, 2025, we started trading on Hyperliquid and made a profit of $46 million using $6 million in just two months. From a memecoin celebrity to a derivatives tycoon, the rise of James Wynn has attracted both attention and become a hot topic among the public.

From spot to derivatives: a high-leverage gamble

James Wynn's early success came from trading memecoins in the spot market, but he really reached the pinnacle through derivatives operations on Hyperliquid. He uses a high leverage strategy of 5x to 40x, focusing on Bitcoin (BTC) and meme coins (PEPE, TRUMP and FARTCOIN).

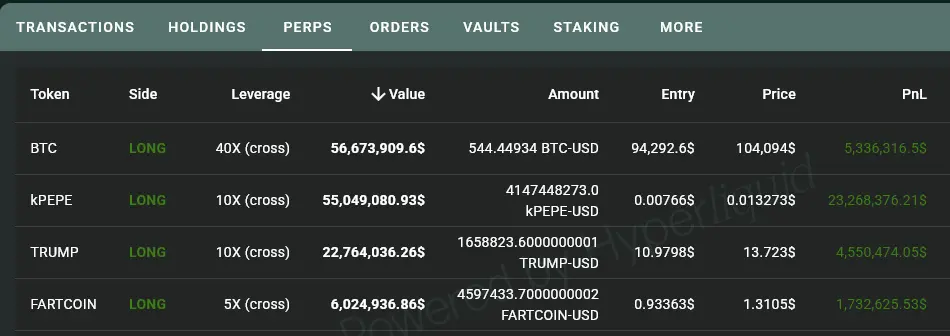

The above picture shows James Wynn's position in Hyperliquid (as of 2025/05/11)

On 2025/04/06, he long on Bitcoin at an average price of 94,292 with a high leverage of 40 times. Then, when the price rose from US$94,000 to US$100,000 in just two days, he had an unrealized profit of US$5,000,000. However, PEPE's 10x long order has unrealized profits of $23,000,000. Trump and Fartcoin made profits of $5,000,000 and $4,300,000 respectively. This increased its total assets from approximately US$6,000,000 to US$43,000,000.

In addition, according to the data from Hyperdash Terminal, James Wynn's BTC and PEPE long orders are the largest addresses on Hyperliquid, demonstrating the amazing potential of high risk and high return.

Why Hyperliquid? Transparency: Platform Choice and Controversy

James Wynn's preference for Hyperliquid stems from his dissatisfaction with the Bybit exchange. He publicly criticized platforms such as Bybit for manipulating token listings to the detriment of retail investors, and declared that even if he was paid $1,000,000 per month, he would not give up Hyperliquid's decentralized principles.

As a decentralized exchange, Hyperliquid provides high transparency and fairness, which is the core reason why James Wynn chose it. Additionally, Hyperliquid supports high leverage trading, providing an ideal environment for his strategy.

Stop loss turmoil: unexpected bonus of BTC pin

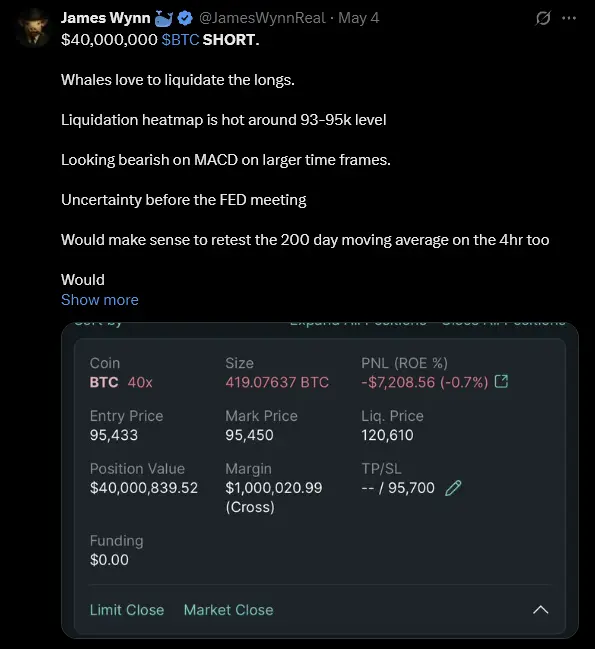

On 2025/05/04 James Wynn posted a tweet on X (Twitter) about opening a short position worth 40,000,000 with a stop loss set at 95,700.

Soon after the position was opened (yellow arrow), Hyperliquid suddenly spiked up to 96,573

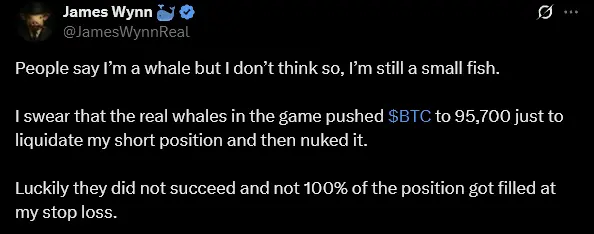

Later, he also posted a message pointing out that he set a stop loss when using the maximum position, which caused Hyperliquid to perform a spike in the Bitcoin price (price manipulation), but interestingly, the stop loss was not triggered, and a profit was made instead.

Wealth Miracle: The Bull Market Frenzy from 6 Million to 1 Billion

According to James Wynn:

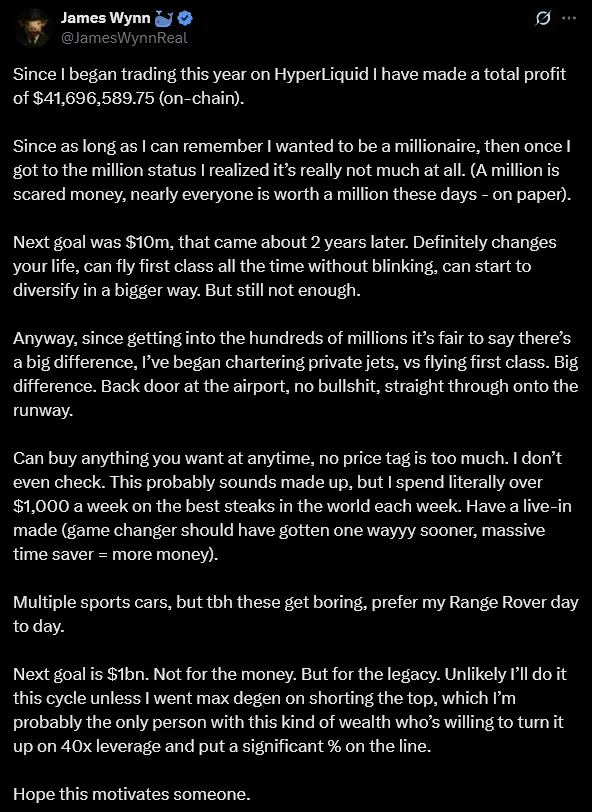

- HyperLiquid transaction cumulative profit: 41,696,589.75

- First Millionaire: After reaching the goal, I found that a million has become a common threshold

- Reach 10 million in two years: first-class travel at any time and expand diversified investments

- Assets exceeded hundreds of millions: upgraded from first class to renting a private jet and enjoying back door access to the airport

- Lifestyle change: Spending more than $1,000 a week on prime steaks; hiring a live-in maid to save time

- Luxury car collection: Owns several sports cars, but prefers Range Rover for daily use

- The ultimate goal is 1 billion: not for the money itself, but to create a legend, planning to use 40 times leverage to gain the top return

James Wynn's wealth growth is staggering. His trading on Hyperliquid has generated a cumulative profit of $43,000,000, an achievement made possible by a wave of gains in 2025/05 and his high leverage strategy. At that time, Bitcoin broke through $100,000 and Ethereum rose 20%, providing an excellent stage for it.

James Wynn's trading legend is not just about "from 6 million to 43 million", but also shows the process of investors constantly communicating with themselves in the market.

On the one hand, his obsession with Hyperliquid reflects his ideal pursuit of transparent and fair mechanisms, which is the epitome of DeFi's original vision; but on the other hand, his aggressive strategy of using up to 40× leverage also exposes the on-chain platform's weakness in preventing liquidity risks and market manipulation. Wynn’s remarks on X are no longer simply trading signals, but have indirectly affected the trend of the underlying asset, pushing up or down the price of memecoins through the herd effect.

For investors, if they want to follow this wave, they must first establish a "risk control awareness": do not be swayed by community popularity, and set strict profit/stop loss rules in advance; for platform designers, they need to find a more optimized balance between decentralized transparency and risk control mechanisms to avoid the next "88% liquidation" case from happening again.

Summarize

James Wynn's investment legend is a microcosm of the cryptocurrency market:

He started with an initial investment of about US$7,000, and achieved thousands of times returns in a short period of time many times by using aggressive strategies such as using up to 40× leverage on the HyperLiquid platform and publicly promoting meme coins (such as PEPE) and Bitcoin. As of May 2025, his cumulative profit on the platform is approximately $43,000,000.

However, high leverage brings not only amazing returns, but also huge controversies, from accusations of fraud to doubts that he liquidated ELON coins at a high point, causing the price to plummet. Short-term market fluctuations are often affected by his operations.

For investors, James Wynn’s story is both a symbol of opportunity—proof that high leverage and a public presence can magnify returns—and a warning of risk. In the pursuit of the next billion-dollar goal, any mistake could cause severe market fluctuations. In the future, can he continue to lead the trend? The market will give the final answer.