The meme coin ecosystem is rapidly expanding, with new platforms like Raydium's LaunchLab and Bonk's LetsBonk competing with the established position of Pump.fun. As the number of launchpads increases, the volume of meme coins entering the market also rises.

In an already saturated industry with various projects, defining boundaries is becoming increasingly difficult. The explosion of meme coin projects also increases the potential for fraud. Representatives from CoinGecko, SPACE ID, and Neiro told BeInCrypto that this increase in meme coins comes with risks such as pump-and-dump plans and rug pulls, which are inherent to the speculative nature of the market.

The Rise of New Meme Coin Launch Platforms

If one meme coin launchpad wasn't enough, there are now many options to choose from. Pump.fun was the first platform in the meme coin industry to revolutionize token launches by democratizing access.

But now, it faces competition. Raydium has released LaunchLab, Bonk's LetsBonk has made Pump.fun worried, while Believe and CMC Launch are also creating waves. Since then, the original meme coin has lost its strong position in the industry.

More concerning than Pump.fun's decline is the continuous wave of new meme coins. This trend has significant impacts on an unregulated industry, causing most small investors to suffer large losses.

Does Accessibility Mean Sustainability?

When Pump.fun first launched, it introduced a concept never before seen in the cryptocurrency industry. The idea was simple: if you want to launch your own meme coin, you can do so almost for free and in just a few seconds.

"The accessibility of meme coin launchpads drives both innovation and speculation, with each factor reinforcing the other. Speculation drives market activity, attracting capital and participants, creating a competitive environment. This pressure forces creators to innovate, develop attractive narratives, community models, or unique token structures with cultural or social appeal," S, the head of Neiro's anonymous community, told BeInCrypto.

But as a meme coin sea turns into a tsunami, finding projects with real utility becomes an increasingly large challenge.

"Although it is generally accepted that meme coins do not need any utility as they are seen as projects people can identify with or 'vibe' with, the large number of meme coins being launched is draining liquidity from projects with products or use cases," said Shaun Lee, research analyst at CoinGecko.

This has begun to affect meme coins that have leveraged strong community support to survive through market downturns.

"Unfortunately, the wave of thousands of new meme coins entering the market has impacted established meme coins like Doge and SHIB. These coins have faced brand dilution and, with liquidity dispersed, cannot break their all-time highs from the 2021 price cycle," Lee added.

To make matters worse, this additional speculative layer in an already volatile industry significantly increases the risk of fraud.

The Alarming Scale of Fraud and Project Failures

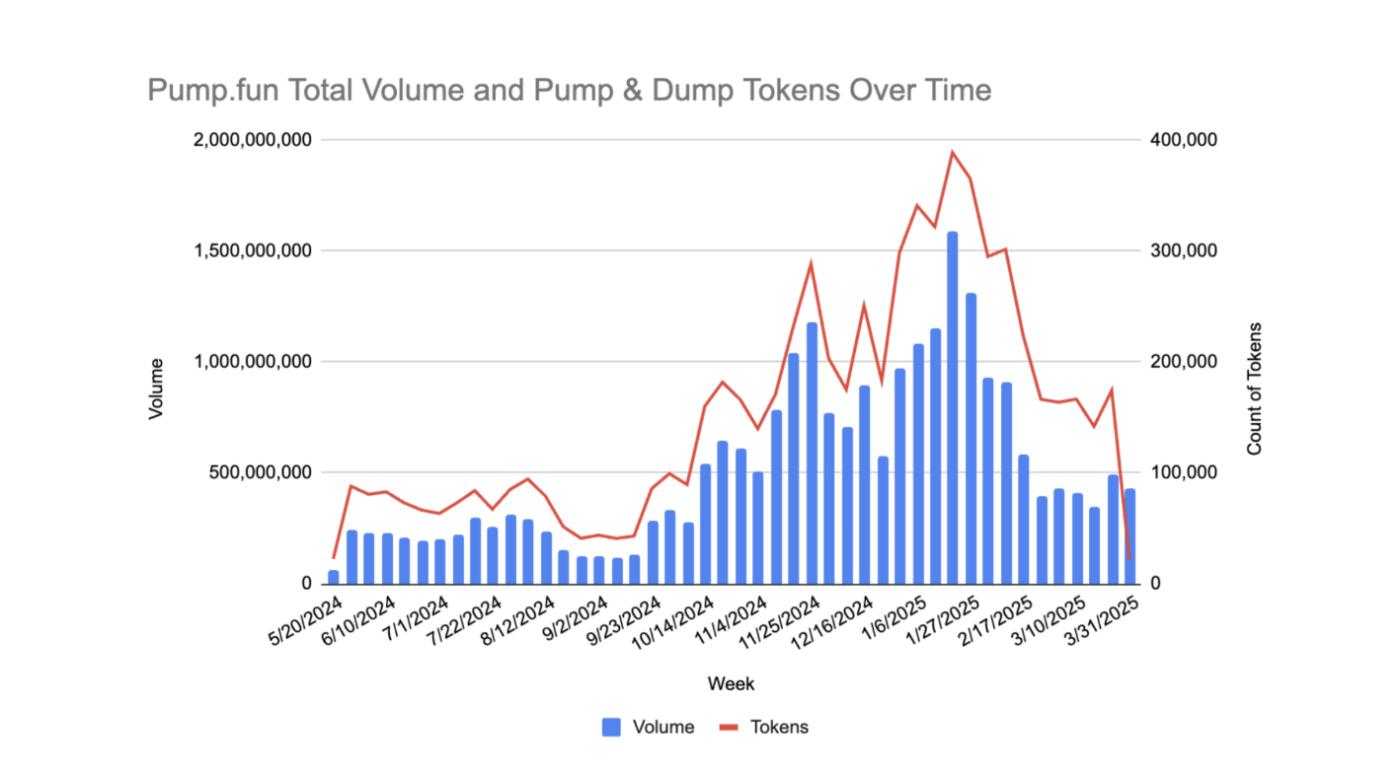

A recent report by Solidus Labs revealed the significant scale of fraudulent activities on Solana. According to the results, approximately 98.7% of tokens on Pump.fun and 93% of liquidity pools on Raydium showed characteristics of pump-and-dump or rug pull plans.

Approximately 98.7% of tokens on Pump.fun are pump-and-dump schemes. Source: Solidus Labs

Approximately 98.7% of tokens on Pump.fun are pump-and-dump schemes. Source: Solidus LabsKnowing this, many token launches are conducted solely to exploit the casino-like nature of the market.

"This is certainly very concerning. Meme coin platforms exploit human greed and FOMO, making them perfect places to launch pump-and-dump schemes, even if that was not their initial intention," Alice Shikova, Marketing Director at Space ID, told BeInCrypto.

As thousands of coins are launched daily, many of them become scams, with most of these projects typically ending up inactive. The data about this phenomenon is astonishing.

A recent CoinGecko report shows that out of approximately 7 million cryptocurrencies listed on GeckoTerminal since 2021, 3.7 million – or 53% – have become inactive.

Most of these collapses occurred in 2024 and 2025. Notably, over 1.82 million tokens stopped trading in 2025 alone, far exceeding the approximately 1.38 million failures recorded throughout 2024.

"The meme coin industry has always prioritized quantity over quality, reflecting the modern market dynamics where attention is fleeting. Many coins exploit short-term trends, sacrificing depth for immediacy. Launchpad platforms amplify this trend by simplifying token creation, leading to numerous projects, most of which lack sustainability," S explained.

With no federal regulations in place, only two options remain. Launchpad platforms must either take action or traders must make smarter investment decisions.

Legal Vacuum: Who is Responsible?

Currently, there is no specific and comprehensive legal framework for the meme coin industry, creating an environment where pump-and-dump schemes and rug pulls remain prevalent.

In February, the U.S. Securities and Exchange Commission (SEC) stated that typical meme coin trades are not considered securities. This classification means investors in these specific assets are often not protected by federal securities laws.

According to Shikova, launchpad platforms must bear responsibility in this regulatory context.

"Currently, it's not even clear which agency is responsible for meme coins, let alone what the rules should be. In reality, it will take a long time for government agencies to catch up and fully understand this field. Therefore, launchpad platforms need to self-regulate if they want meme coins to become a legitimate investment area. Otherwise, regulators will intervene and completely ban them," she warned.

Fortunately, existing methods can help mitigate increasingly prevalent scam risks.

The Way Forward: Audits, Asset Lockup, and Verification

In a field prioritizing quantity over quality, launchpad platforms have an opportunity to implement protective measures to prevent immediate project collapses.

"The only way to address this issue is through transparent audits and also implementing token lockup regulations for anyone launching a new token, so they cannot shut down the project and disappear with the money as soon as it appreciates. And the launchpad platforms themselves must be responsible for establishing these regulations – otherwise, regulators will do so, and when that happens, the regulations will certainly be much stricter," Shikova told BeInCrypto.

However, this is not a one-size-fits-all solution. Even with established regulations and protective measures, traders must ultimately be responsible for checking projects before investing.

"They can check the team's background (beyond what they say on LinkedIn), the project's tokenomics and roadmap (if it exists), and more importantly, its community. You can usually recognize whether the community is there just for short-term hype or truly believes in the project, and this often determines its sustainability, especially when talking about speculative assets like meme coins," Shikova added.

While expanding access and promoting innovation, the rise of meme coin launchpad platforms has undeniably increased challenges in this highly speculative market.

As these platforms continue to evolve, responsibility remains with both the launchpads to implement more stringent protective measures and individual investors who need to conduct thorough due diligence to navigate increasingly complex risks.