In recent years, the global bond market has experienced significant volatility, with the rise of Longing-term bond yields drawing widespread attention. However, this rise does not necessarily signify major shifts in inflation expectations, fiscal defdeficits, or government bond market liquidity as market rumors suggest. This article analyzes the bond markets of the United States, Canada, and Germany, explore using specific data to explore the phenomenon of rising Longing-term interest rates and stable short-term rates, revealing revealing the driving factors behind the steepening yield curve and its reflection on macroeconomic fundamentals.

<><>, lonbond yields in major global bond markets have significantly increased. Taking the United States as an example, the 10-year Treasury yield rose from March 27, 2025,, to to 23, 2025, from 4.38% to 4.59%-4.60%, an increase of approximately 21-22 basis points. While this change seems significant, its, magnitude is not extraordinarily intense. However, the market generally attributes this phenomenon to concerns about US fiscal deficits, inflation expectations expectations, bond market liqu. liqu, though common, lacks sufficient evidence. Historically, similar arguments have frequently emerged but rarely been substantby data. For instance, in December 2023 and 2024, the market similarly attributed the rise in -term-Treasury yields to deficits or inflation, but ultimately proving these concerns were exaggerated.

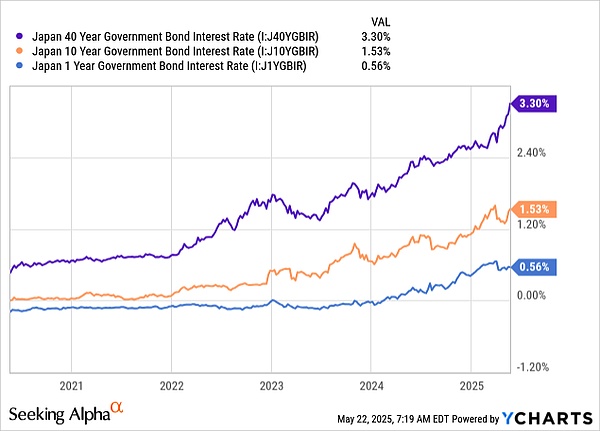

Short-term rates did not rise synchronously with Longing-term rates. The 2--Treasury yield during during the only slightly increased from 97% 4.00%, remaining almost stable. This divergence between Term rates is not limited to the US Treasury market but is equally evident in Canadian and German bond markets. Canada's 10-year bond yield reached its highest level since mid-January 2025, around around 3.65%, while the 2-year yield only slightly increased to 3%.'s 10-year government bonds (Bunds) recovered to 2.60%, while the 2-year yield (Schatz) remained remained below 2.00%. This global phenomenon of yield curve steepening (Bull steepening) indicates that rise in Longing-term rates is not a single market or country issue, dynamic faced by global bond markets.

The rest continues in the maintaining the formatting and structure and translating the content while key terms as specified.]The situation in December 2023 and 2024 is similar. The 10-year government bond yields rose to 4.70% and 4.50%, attributed to deficit concerns and the Federal Reserve's "higher for longer" policy. However, the stability of 2-year yields (around 4.8% in July 2023 and around 4.3% in November 2024) indicates that the market's judgment of economic fundamentals has not fundamentally changed. Currently, 2025 data further confirms this: the rise in long-term interest rates reflects more the uncertainty of central bank policies rather than a direct result of deficits or inflation.

IV. Bull Market Steepening and Market Strategies

In the context of Bull market steepening, 2-year bonds have become the market's investment focus due to their sensitivity to economic fundamentals and potential yield downside. In contrast, 10-year bonds have become an outlet for uncertainty, with their yield fluctuations more reflecting central bank policy hesitation. For example, from March to May 2025, the rise in 10-year government bond yields was accompanied by stock market volatility (S&P 500 index fell 2.5% in April), while the stability of 2-year yields indicates unchanged market expectations of economic slowdown.

In market strategy, investors are more inclined to hold 2-year bonds because, under expectations of economic weakness, short-term bonds have greater capital gain potential. Historical data shows that during Bull market steepening, 2-year government bond yields typically decline 2-3 times more than long-term bonds. For instance, during the 2008 financial crisis, 2-year government bond yields dropped from 4.5% in 2007 to 0.8% in 2009, while 10-year yields only fell from 4.0% to 3.2%.

V. Conclusion

The current dynamics of the global bond market indicate that the rise in long-term bond yields is not a direct result of deficit or inflation expectations, but a comprehensive effect of central bank policy uncertainty and Bull market steepening. The inflation bias of the Federal Reserve, Bank of Canada, and European Central Bank has led to blurred market expectations of the short-term rate path, driving up the uncertainty premium of long-term bond yields. Meanwhile, the stability of 2-year bond yields reflects the market's rational pricing of economic fundamentals, including weak labor markets and reduced consumer spending.

Investors should focus on 2-year bond dynamics, as they more accurately reflect macroeconomic and monetary fundamentals. While long-term bond yield fluctuations are eye-catching, they are more a result of central bank "hesitation" rather than fundamental economic changes. In the future, it will be crucial to closely monitor employment, retail sales, and inflation data to assess whether the economy will further slow down and whether central banks will adjust their policy direction accordingly.