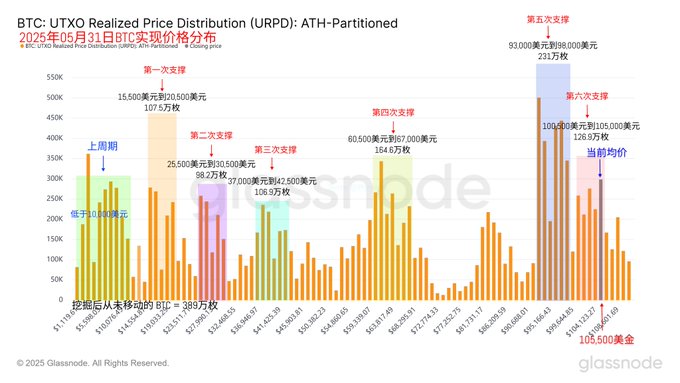

These past two days of work have indeed been difficult to write. The first three days were positive, with US stocks rising and $BTC falling. Today, positive and negative factors are intertwined. US stocks have shifted from declining to rising, but Bitcoin has not yet returned to $105,000. As recently discussed, the rise is not due to strong purchasing power, but because of low selling pressure. Once negative factors emerge, increased selling intensity occurs, and without improved purchasing power, the situation remains as it is. Today's positive news is that Trump's media group has officially signed a $2.32 billion agreement to establish a Bitcoin reserve. The company behind the US president announced that it has completed a private placement with 50 institutional investors. Additionally, the agreement was reached by selling over 55 million shares at an average price of $25.72 and issuing senior secured notes with a principal amount of $1 billion maturing in 2028. The negative factor is the escalating trade dispute between the US and China. The tariff issue was already troublesome, and now sanctions surrounding chips and tech companies are intensifying. The previously decent PCE data and the rare improvement in University of Michigan data have been impacted, and we hope nothing unexpected happens over the weekend. Looking at Bitcoin's data, today's turnover rate has significantly increased, mainly due to more obvious market battles between bulls and bears. Especially after $BTC's consecutive days of decline, some investors have become worried about the future. A clear sign of losses has led to many investors exiting. However, the support between $93,000 and $98,000 remains strong. Even with price fluctuations, investors in this range have not massively exited. As long as these investors do not panic, the problem is not significant. From the US stock perspective, the market has gradually shifted from declining to rising before closing. The market is slowly digesting the negative US-China information. The weekend will reveal if any new situations emerge, and then we'll wait for Monday's stock market opening to see if investor sentiment improves. This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

This article is machine translated

Show original

Phyrex

@Phyrex_Ni

05-30

最近两天的作业都很难写啊,明明利好不断,但是价格就是不涨,不但不涨,还有些下跌,而 $BTC 相反的是美股的走势还是不错的,本周工作后的三个工作日,Bitcoin 也连续跌了三天,美股涨了三天,昨天也聊过这个问题,之前 Bitcoin 已经很早回到了关税前的水平,但美股距离关税前还有一些空间。 x.com/Phyrex_Ni/stat…

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content