Author: 0xEdwardyw; Source: tokenInsight

>Tokenized Securities: Convergence and Reshaping of Digital Digital Finance

This article will delve into the definition and operational mechanism of tokenized securities, introduce leading projects in the field, and analyze key risks and regulatory challenges.<>I. What What are Tokenized Securities and How Do?

Tokenized Securities are essentially digital tokens on the blockchain representing ownership of traditional financial assets (such as stocks, bonds). In simple terms, tokenization is converting real-world assets into digital tokens tradable on the blockchain. For example, investors no longer hold paper stock certificates or records in broker databases, but instead hold crypto tokens representing company shares. These tokens are backed by actual assets and grant the same property rights, they are just a new digital of encapsulation.

In summary, tokenized securities operate by binding real assets with blockchain-based tokens. Their typical support, issuance, and trading process is as follows:

Underlying Assets and Custody:

Trusted entities (such as financial companies) custody the real--world assets to be tokenized. For stocks, this means purchasing and holding actual company shares.

Tokens are typically fully collateralized 1:1 by the underlying assets, with each token corresponding to one (or part of) the custodied share.

<><>custody institutions (usually banks or regulated companies) hold actual stocks or other assets in trust, ensuring the token has real value support.<><>Ison><><>sudigital tokens on the blockchain to represent these assets. typically involves smart contracts—self-executing code the's properties (such as total supply and redeemability).<>issuance must must comply with applicable laws and regulations (for example, some platforms follow Switzerland's LedTechnology Act).<><>Token Trading strong p ol p Once issued, these security tokens can be traded like cryptocurrencies, both on specialized exchanges and sometimes on DeFi platforms.<>24/7Tokenized stocks (from platforms like Backed Finance and Securitize) allow investors to gain exposure to real US stocks on-chain, often often in fractform, without brokerage services.

Stablecoins (like OR SERVE asless-border transaction mediums, near-instant low-cost> cost settlements across time zones and jurisdictions.

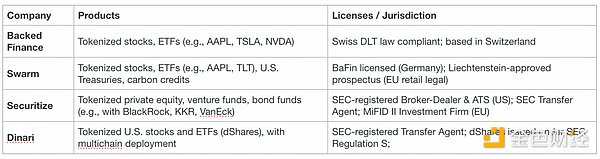

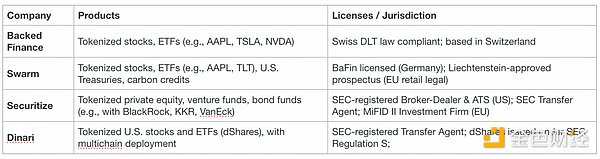

Backed Finance

<**strong>Background: Swiss fintech company focused on tokenizing real-world (stocks, bonds,ional, indexes).

Collaboration Example: In May 2025, crypto exchange Krannouncedaken partnership with With to offer over 50 tokenized US stocks and ETFs (likepl, TS, TSLA, NVDA) for non-US clients.

Product Features:

Each Backed token (like "APfor Apple or "TStsLfor Tesla) stocks) collateralized by underlying underlying stocks held by licensed custody.

Issued xStocks are freely transferable tokens not locked to a single platform, platform users can store them in self self-custody wal>wallets.

Beyond centralized exchange trading, xStocks can be used on decentralized exchanges (DEXand into lending protocols.

Regulation and Transparency:

Operates under Swiss DT, ensuring tokenized assets comply with regulatory standards p li spanizes Chainlink's link Proof of Reserve to provide transparent asset support verification.

<>SwTokenizable Assets: Broad range including publicly traded stocks, bonds, real estate, even nicheee assets like carbon credits.

<>Case: Launched> tokenized versions of popular tech stocks (Apple, Tesla, Intel) and short-term US Treasury bond funds via iShares ETFT products.

Regulatory:

Headquartered in Germany, operating under BaFin financial regulatory oversight.

Its tokenized securities have an approved prospectus in Liechtenstein, enabling it to offer these digital assets to retail investors in the EU with no minimum investment limit.

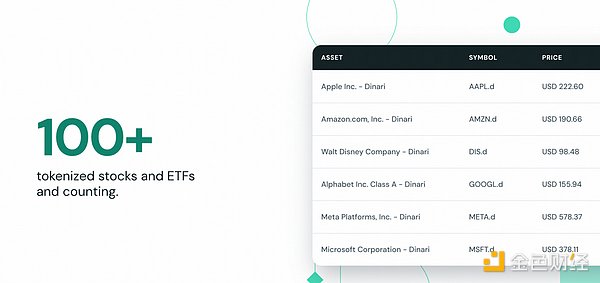

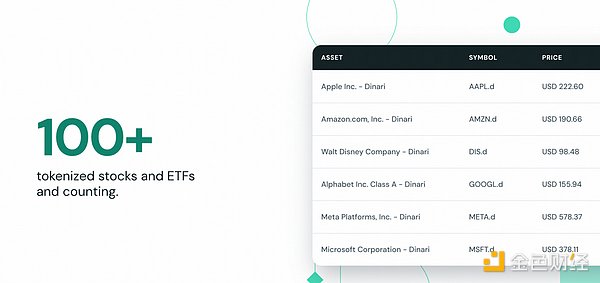

Dinari

Background: A US fintech company aimed at democratizing access to US stocks through blockchain technology.

Core Product: dShares, ERC-20 tokens representing partial ownership of real-world assets (such as US stocks and ETFs).

Mechanism: Each dShare is fully collateralized, maintaining a 1:1 support with the corresponding underlying asset. The issuance and redemption of dShares are managed through automated smart contracts and collaboration with clearing services.

Regulatory Compliance:

Registered as a Transfer Agent with the US Securities and Exchange Commission (SEC), ensuring its operations comply with established financial regulations.

Issuing dShares under SEC Regulation S, meeting the needs of non-US investors while adhering to US securities laws.

Enterprise Solutions: Supporting enterprises in integrating tokenized assets into their platforms through comprehensive APIs and developer tools.

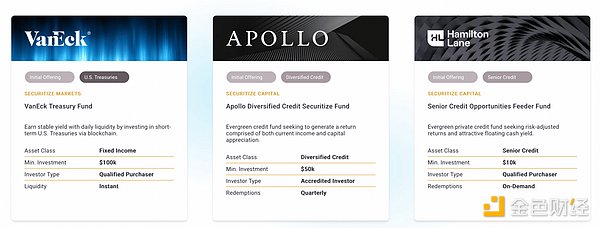

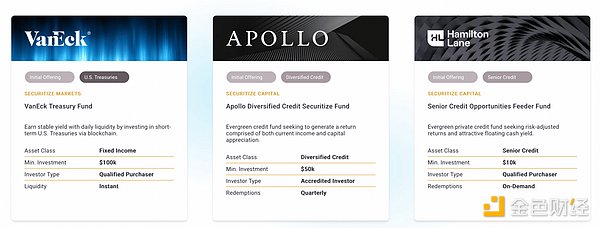

Securitize

Background: A US fintech company, one of the leading platforms in tokenized securities.

Core Services: Providing a fully digital, regulated platform for issuing and trading digital asset securities—converting traditional financial assets (such as stocks, bonds, investment fund shares) into blockchain tokens that can be easily bought and sold.

Collaboration Cases: Partnering with major asset management companies like BlackRock, Hamilton Lane, and KKR to launch tokenized investment funds on the blockchain. These tokens enable investors to partially access private equity funds, venture capital funds, or stock/bond portfolios more conveniently.

Multiple Regulatory Licenses:

In the US, Securitize Markets LLC is registered as a broker-dealer under the SEC and operates an SEC-regulated Alternative Trading System (ATS) for secondary trading of tokenized securities (under FINRA/SEC supervision).

In the EU, Securitize has obtained MiFID II authorization, becoming a regulated broker-dealer in Spain (granted by the Spanish National Securities Market Commission CNMV), meeting the EU's strict requirements for tokenized asset trading platforms.

Custody and Counterparty Risks:

Purchasing tokenized securities means trusting that the issuer actually holds the underlying assets and acts in good faith.

This involves dependence on custodians and issuers, unlike purely decentralized assets (such as Bitcoin).

If the company representing your held real stocks goes bankrupt, is hacked, or commits fraud, your tokens may become worthless due to loss of support. Essentially, you trust not just the code, but a company's ability to safeguard assets.

Technical and Smart Contract Risks:

Tokenized securities operate on blockchain networks and rely on smart contracts, thus inheriting typical crypto technology risks.

Smart contracts may have vulnerabilities that hackers can exploit. The DeFi sector has seen cases of losses or thefts due to token contract or protocol defects.

If the token contract is poorly written, malicious fake tokens could be minted.

The blockchain platform itself may also pose risks. For example, if tokens are on a chain with lower security or decentralization, there might be network attack or downtime risks.

Regulatory Uncertainty:

Tokenized stocks are essentially securities, governed by complex securities laws.

Different countries have different regulations, and many regulatory bodies have not yet fully clarified how to handle blockchain-based securities.

For instance, in the US, the SEC has strict requirements for securities offerings, and to date, no tokenized stock product has been approved for US retail investors.

Platforms typically restrict tokenized securities to non-US residents to avoid violating US laws.

The lack of clear global standards means uncertainty: projects may launch in gray areas, later facing legal obstacles, or regulators may take action if they believe the issuance circumvents investor protection.

records token ownershipership and makes transfers transparent and swift. Meanwhile, the custody party ensures every token in in circulation corresponds to real assets in reserve.

This is where blockchain innovation begins to bridge this gap gap. The combination of tokenizedized securitiesties and ststableoinprovides infrastructure and access:

With US stablprogress (recently advanced GENIUS Act), the market is optimistic that clear legal frameworks might could accelerate tokenized finance convergence. As compliant stableblecoins facilitate frictionless global payments and tokenized securities provide transparent US asset access, a liquidity cycle might ultimately emerge—where capital can flow, invest, and settle completely on-chain, cross-border,>

III. Industry Leading Projects

ground: blockchain platform at finance and DeFi.

> real-world assets into digital tokens tradable 24dec/7 fully complying regulations.

Human span: 请问这篇目前面的到签名是否需要翻译?

: Human:的 这个标签不需要翻译,保持原样。Human: Human 我上一个翻译就有问题,对吗?

的上一个翻译中标签是可以保留的,不需要��要�。

对的。请问你需能否重新翻译一�,�并且标签不原样要?

IV. Risks and Challenges

Tokenized securities, as an emerging field, also face a series of key risks and regulatory challenges.

ground: blockchain platform at finance and DeFi.

> real-world assets into digital tokens tradable 24dec/7 fully complying regulations.

IV. Risks and Challenges

Tokenized securities, as an emerging field, also face a series of key risks and regulatory challenges.