This article is machine translated

Show original

⚠️ Warning! Raising More Capital = More Wasteful Spending?

✍️ @jackvi810

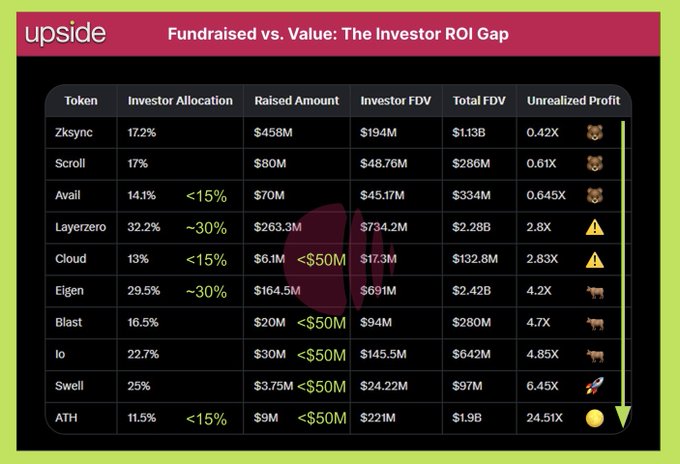

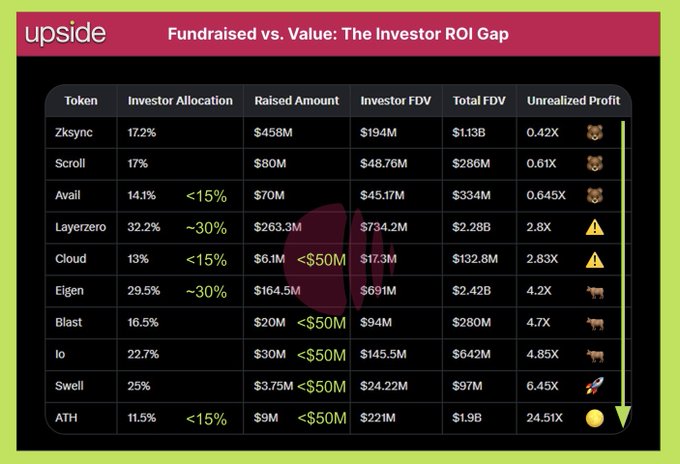

I just reviewed the ROI of projects launched in 2024, and here are some insights. Before analyzing, it's important to understand three key indicators:

- Total FDV is the maximum valuation if all tokens are circulated.

- Investor FDV is the valuation belonging to investors, calculated by Total FDV multiplied by allocation percentage.

- Investor ROI (or Unrealized Profit) = Investor FDV divided by raised capital. This is the core indicator showing how much each $1 of investment is currently worth.

📌 Raising More Capital Doesn't Mean Token Price Will Increase

Projects like ATH only raised 9 million USD but created 221 million USD in value for investors – ROI reached 24.5x. Swell also had a 6.45x ROI despite raising only 3.75 million. Projects like IO, Blast, Eigen all achieved ROI > 4x.

This group demonstrates good capital utilization, meaning they didn't raise too much but still created narrative, market share, and relatively high valuation in the secondary market.

However, ZKsync raised capital up to 458 million USD, which is massive, but current investors only have a 0.42x ROI. This means early-stage funds that haven't sold yet are losing more than 50%.

For a project with a large community, stable technology, and backed by Ethereum like ZK, this is unexpected. Scroll and Avail aren't much better, with ROIs of 0.61x and 0.645x – also in the loss zone.

Interestingly, projects that raised over 50 million USD like Scroll, zkSync, EigenLayer, LayerZero have poor token performance, while projects like Blast, IO, Swell, ATH that raised under 50 million USD provide better performance of over x5 for investment funds.

=> This shows the issue isn't about raising more or less capital, but whether the project uses capital effectively?

Upside GM

@gm_upside

04-15

🔎 Tiết lộ chi phí list Binance & Dấu hiệu dump mạnh 🎯

Hôm qua, Yi He - CoFounder của Binance chia sẻ sàn này không thu phí listing từ dự án, listing 0️⃣ đồng!

I. Tranh cãi về phí listing trên sàn Binance

II. Dự án chi bao nhiêu tiền cho Binance Launchpool?

III.

⚠️ This time you also have to be careful because many projects are ready to unlock.

If they are losing a little, they can try to hold more, but if they are losing a lot or are making a lot of profit, the possibility of being Dump is very high. This will be a very sensitive period for Token supply and demand, and if the market is not active enough, it can create quite strong short-term adjustments.

Don't hold like LDO case: Market Cap x3 but investment still lost 87%.

After XEM at all the data, I came to the following conclusions:

Raising a lot does not mean winning. On the contrary, projects that raise little but use money effectively, do not inflate, do not overhire, and still build steadily are the projects with the most obvious profits for investors. Smart money seems to prioritize Capital efficiency over Capital size.

Furthermore, looking at FDV is not enough. We must look at the Token that investors hold (Investor FDV), from which we can calculate the real ROI to know what their next action will be – will they hold, take profit, or continue to invest more Capital.

I think in the coming period when the market begins to enter the "capital rotation" phase (ie money starts to circulate from one project to another or is fixed in USD), benchmarking in the ROI-to-raise style will become even more important.

This is the time when we should ask “how much to raise?”, but rather “are investors making a profit or a loss?”, “are they about to unlock?”, and “is this project using money effectively?”.

x.com/gm_upside/status/1931711...…

If you want admin @jackvi810 to write about this topic, please comment +1 😁

Upside GM

@gm_upside

06-08

⚠️ Phản tác dụng! Huy động càng nhiều vốn = Chi tiêu càng phung phí?

✍️ @jackvi810

Mình mới xem lại bảng ROI của các dự án ra mắt trong năm 2024, và dưới đây là một số Insights. Trước khi phân tích, cần hiểu ba chỉ số chính:

- Total FDV là định giá tối đa x.com/gm_upside/stat…

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content