HODL is dead.

My biggest mistake this cycle was blindly holding ETH.

Even when my No 1. bullish case for $ETH failed to materialize - super high yields on ETH thanks to Restaking

I love crypto and trading due to its brutal honesty: if you're right = profit, wrong = loss.

But I got complacent with $ETH as narratives shift fast:

- "Ultrasound money" & ETH's ESG edge... Gone.

- Restaking superyields didn't materialize.

- ETH modular vs SOL's monolithic narrative: SOL proved stronger at least short run.

I ignored changing realities, sticking to HODL instead of adapting.

This cycle was more difficult than the last and crypto moves too quickly for passive holds (maybe except BTC).

Profits now come from more active trading, not hoping assets rebound "someday."

$ETH terrible under-performance was a wake up call.

Thankfully rotating to $HYPE saved me.

Still, $ETH has a place in everyone's portfolio and EF is not complacent anymore.

But emerging "Stablecoin & RWAs" L1s with gas abstraction is another growing risk for ETH.

Happy $HYPE ATH for those who celebrate.

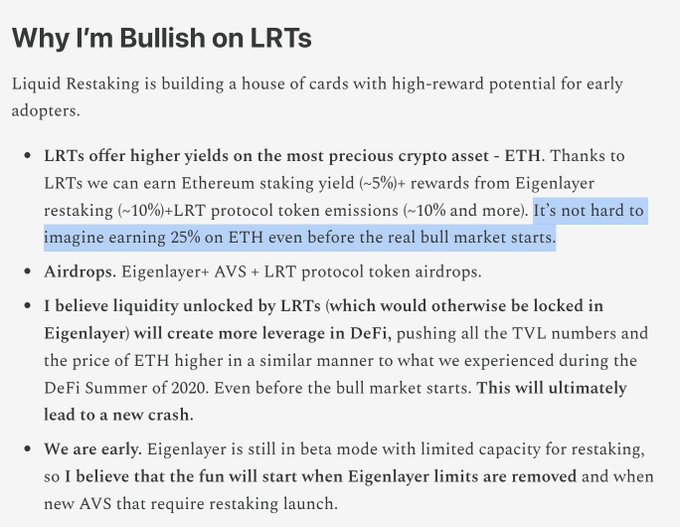

I expected 25% yield on ETH with restaking hahahahahah

This is what I wrote in my blog in Sept 2023.

Lol

And if you think BTC is the permanent HODL.... answer, what's the playbook for Bitcoin treasuries right now?

It feels like more struggling, publicly listed companies are rushing onto the BTC treasury bandwagon.

How will it play out? What will be the trigger to sell?

Do you think BTC will only go up as companies continue to stack BTC?

It's looking good for now but what goes up...

This post sounds super bearish for $ETH but perhaps the most bearish period for ETH is behind us.

But it was a different vibe a few months ago when HYPE looked prime to go up.

The catalysts are stacking for ETH

Ignas | DeFi

@DefiIgnas

06-10

That said I hope to jump back into ETH as well :)

I think the future looks bright for ETH.

But as I said, this is a trading market for me. Not HODL.

I can wait for catalysts to form instead of waiting for years.

Timing is everything

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content