Original | Odaily Planet Daily (@OdailyChina)

Author | Azuma (@azuma_eth)

Nearly half a year has passed since Sonic (formerly Fantom) mainnet officially launched (on December 18 last year), and recently the Sonic official team has repeatedly released information about the first season airdrop that is about to end and the upcoming second season airdrop. However, due to the fragmented information and relatively complex rules, some users still do not fully understand the detailed operational mechanism of Sonic's airdrop.

In the following article, Odaily will elaborate on Sonic's airdrop rules, hoping to help you deploy corresponding strategies more efficiently.

First Season Airdrop

First, regarding Sonic's overall airdrop plan, Sonic plans to distribute 190.5 million S tokens through airdrops, with the total airdrop amount for each season still undetermined.

According to the disclosure by Sonic team member assistant.sonic, the first season airdrop snapshot will be taken on June 18 (exactly half a year after mainnet launch), with distribution beginning in the following weeks.

As for airdrop claiming, there are different unlocking rules for ordinary users and Dapps.

Odaily Note: Sonic airdrop has three different channels for point acquisition. The first two channels are for ordinary users: one is passively earning points by statically holding whitelisted assets, and the second is earning active points by deploying whitelisted assets to designated ecosystem DApps. The last channel is for Dapps, where various Dapps will compete for "Gems" airdrop shares and can exchange these "Gems" for S tokens through the final airdrop, and Dapps can further redistribute these S tokens to users through custom point plans.

User Airdrop Claiming Rules

For ordinary users, 25% of the first season airdrop can be claimed immediately as S tokens without circulation restrictions, while the remaining 75% will be linearly released over 270 days in the form of tradable Non-Fungible Tokens. These Non-Fungible Tokens can be traded on the upcoming secondary order book market of Paintswap.

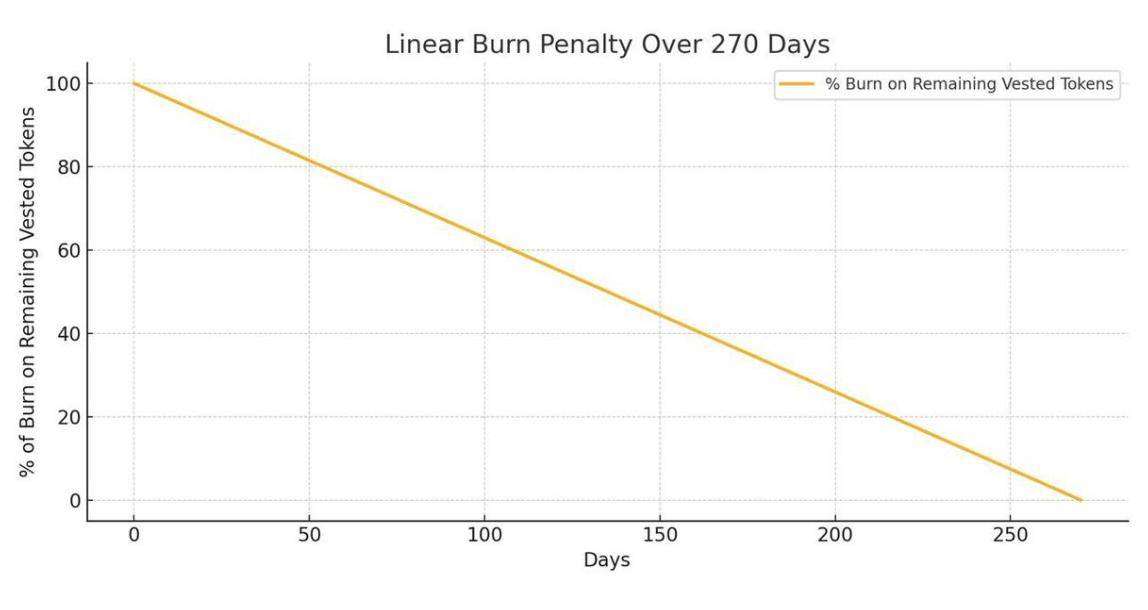

Users holding unvested Non-Fungible Tokens can choose to claim the remaining allocation at any time, but this will trigger a burn penalty based on the remaining amount.

For example, if a user receives a total of 100 S in airdrop, they can claim 25 S on the first day, with the remaining 75 S to be linearly released over 270 days. Early claiming will trigger a burn penalty. If the user forcibly "claims" the Non-Fungible Token portion of the airdrop midway through the release period (around 4.5 months, 135 days), they will receive 37.5 S while burning 37.5 S. This means the user's final total S token airdrop will be: 25 (first-day liquidity airdrop) + 37.5 (linearly released portion) = 62.5 (excluding burned portion).

The specific forced claiming and penalty function is shown in the table below, with the horizontal axis representing time and the vertical axis representing penalty intensity.

It is worth noting that users will have 6 months to claim their Non-Fungible Tokens, and unclaimed Non-Fungible Tokens and corresponding unclaimed S will be burned.

Dapps Airdrop Claiming Rules

For Dapps, those earning S airdrops through "Gems" can immediately claim 50% of S tokens without circulation restrictions, with the remaining 50% of S tokens to be linearly released through smart contract claiming frontend over 90 days.

It is worth mentioning that some Dapps have previously tokenized their "Gems" shares to incentivize users to deposit funds in a more liquid form. These tokenized "Gems" are already circulating in the secondary market and scattered among many users.

For Dapps that have tokenized their "Gems", Sonic will provide a frontend for users holding tokenized "Gems" to claim S tokens, with users having 3 months to claim airdrops using tokenized "Gems", after which unclaimed S will be burned.

Second Season Airdrop

Last night, Sonic officially published a detailed plan for the second season airdrop.

The second season will start on June 18, seamlessly connecting with the first season. Combining the experience from the first season airdrop, the second season airdrop has made certain modifications to both user and Dapps portions.

User Airdrop

Looking at the user side, the biggest change in the second season airdrop compared to the first season is the cancellation of passive points, meaning users will no longer earn points by statically holding whitelisted assets in their wallets. Instead, they must actively deploy assets in designated applications within the Sonic ecosystem to earn active points, including providing liquidity on DEX, participating in lending, or performing many other qualifying DeFi operations. Clearly, this is to further incentivize ecosystem activity and encourage users to actively explore Sonic ecosystem applications.

Additionally, to incentivize loyal users, Sonic will launch a loyalty incentive program where users' performance in the first season airdrop will determine the initial multiplier (1-2 times), and continued activity in the second season can increase or decrease this value, up to a maximum of 3 times and a minimum of returning to 1 time.

Furthermore, Sonic officially emphasized that the airdrop distribution method in the second season may differ from the first season's structure, but details are currently unclear. Sonic will announce the specific plan three months after the second season begins, to monitor the effects of the first season distribution model and make corresponding optimizations.

Dapps Airdrop

Compared to the first season airdrop, the biggest change in the second season airdrop regarding Dapps is the clear statement that Dapps are not allowed to tokenize "Gems", otherwise they will immediately lose their qualification for the entire season - which is understandable as a measure to prevent Dapps from circumventing the original unlocking restrictions of S tokens corresponding to "Gems".

To prevent Dapps from holding back, and to ensure more airdrop shares are further distributed to users, Sonic will measure how many tokens each Dapp actually distributed to users in the first season. For example, if a Dapp claims to distribute 100% of S tokens to users in the first season, it will receive a 1x "Gems" multiplier in the second season. If it only distributed 80%, the multiplier will be 0.8, and so on.

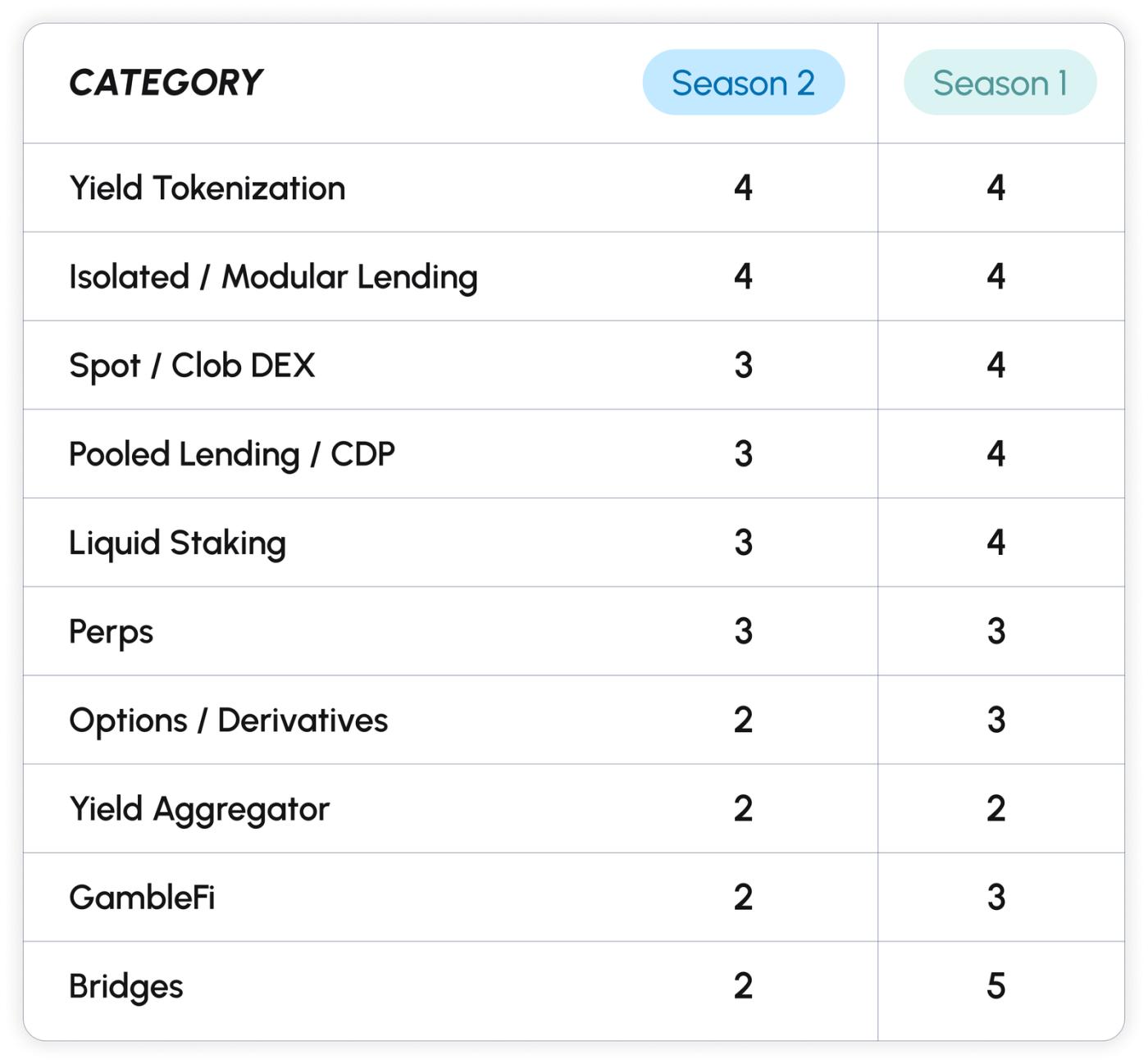

Additionally, Sonic emphasized that the "Gems" distribution mechanism in the second season will focus more on protocol revenue rather than TVL, to reward Dapps that drive truly sustainable usage.

For different types of Dapps, Sonic has established different weight multipliers to better reflect the sustainable impact of various protocols on the ecosystem, with specific weights as follows.

Corresponding Strategies

Combining the rule changes in the second season, the core strategy is quite clear - try to use addresses that participated in the first season to continue participating in the second season to obtain a higher loyalty multiplier; actively participate in ecosystem projects to earn active points and internal Dapp points (corresponding to "Gems" airdrop shares).

The Sonic ecosystem is currently quite comprehensive, and we have previously introduced some Sonic ecosystem scoring methods in multiple issues of the "Lazy Finance Strategy" column. Although the rules have changed somewhat, the overall strategy remains largely unchanged.

Considering different risk preferences, it is recommended that users with higher requirements for fund safety only participate in mainstream DeFi protocols such as Aave and Pendle. For users with higher efficiency requirements, exploring native protocols like Shadow or protocols with internal points programs such as Silo and Rings is suggested.

Moreover, given the special unlocking rules of the S airdrop, it is expected that after the airdrop is distributed, there might be potential arbitrage opportunities between the price of the unlocked Non-Fungible Token on secondary markets like Paintswap and future unlocked portions. We will continue to pay attention and will publish related strategies if necessary.