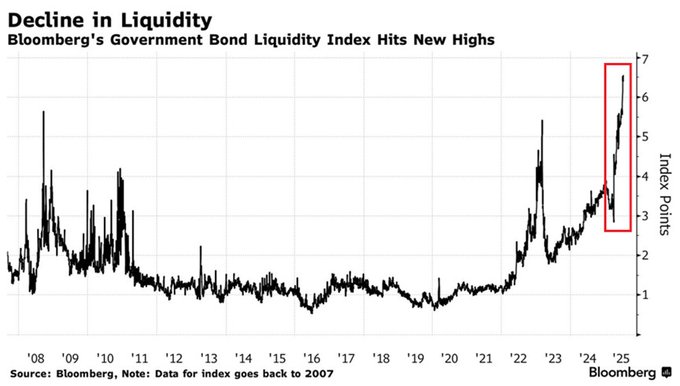

Government bond liquidity has never been worse: The Bloomberg Government Bond Liquidity Index hit a record 6.5 points on Monday. A higher reading in this index means LESS liquidity for global bond markets. The index has DOUBLED over the last several months, as government spending surged in the US and Japan. This means liquidity is now worse than during the 2008 Financial Crisis. As a result, long-term government bonds are selling off, with Japan’s 30Y bond yield hitting 3.15%, the second-highest level since its debut in 1999. At the same time, the 30Y Treasury yield is approaching 5.00% for the first time since May. Keep watching bonds.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content