This article is machine translated

Show original

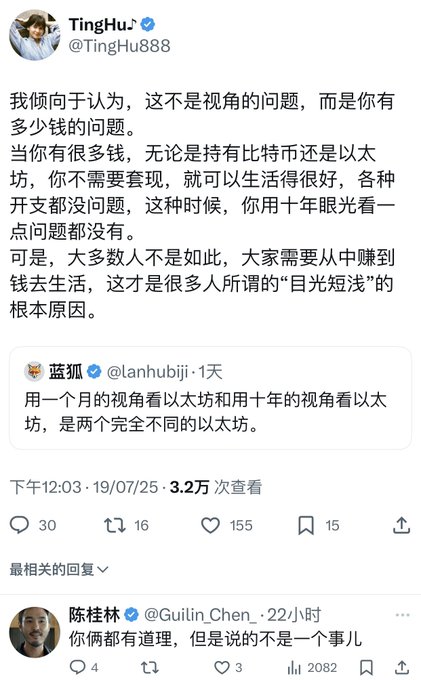

From the perspectives of assets, funds, and time dimensions, the following screenshot perfectly captures the views of three teachers. This is very similar to the view of @Guilin_Chen_ Guilin, and both @lanhubiji Blue Fox Teacher and @TingHu888 T-Daxue are speaking very reasonably, actually looking from different angles: the former from an asset perspective, the latter from a fund perspective.

What is the asset perspective? The core is to consider the fundamentals of this asset (stock or coin) target? How is its growth potential (the development state and growth rate of its business and ecosystem)? Can it guarantee continuous growth in three, five, or even ten years, and can it maintain a leading position in the industry ecosystem?

Here, we need to dynamically track: 1) The next one or two years may change in the future three to five years (from high-speed growth to stalling and becoming stable); 2) Or if it's not working in the next one or two years, but because its core capabilities are still strategically correct and rhythmically appropriate, it may recover after a year or two (turning around from difficulties).

What is the fund perspective? It's about the nature of funds and their cycle length?

For individual investors, is this investment fund for emergency use in the future, or not needed in the short term (within half a year to a year), or even if lost, it won't affect life? This determines our mindset, rhythm, and Longing-term perspective on asset targets.

Just like in institutions, hedge funds (such as Castle, Millennium) and ultra-long-term long only (such as Baillie Gifford) have completely different decision cycles, action rhythms, and perspectives: hedge funds report performance to investors monthly, and may face significant investor withdrawals if performance is poor for half a year to a year; long-term or ultra-long-term funds don't face this issue, so they can look further and better withstand fluctuations (premise being accurate asset judgment).

This extends to the third dimension: the time dimension. This is viewed from investment and trading behaviors themselves. The fund perspective discussed earlier is more external constraints, while the time dimension here is more of a personal choice, that is, what rhythm do we personally prefer? Some are obsessed with short-term trading, some like trend surfing, some prefer long-term holding. In the "Professional Speculation Guide" x.com/qinbafrank/status/183449...…, the book looks at different investment and trading behaviors based on time cycles: traders, speculators, investors, indeed with different cycles, all chosen by investment individuals based on their characteristics, fund nature, etc. There's no right or wrong or praise and criticism, I think what suits one's own rhythm is most important, just that different time dimensions require different requirements and abilities for investment or trading.

qinbafrank

@qinbafrank

02-28

投资是一个信心的游戏,信心来自于对所投标未来空间的高度确定性,而这个确定性来自于对赛道、所处身位、业务进展、团队甚至情绪溢价的深度研判。

交易则是一个纪律的游戏,纪律来自对人性的理解,在自己交易系统内信号发出就得进场,到了止盈止损位就得出场。违反了系统就容易乱了心性,积小胜为大胜

Teacher Frank's analysis is meticulous and detailed.

I find it very interesting that the three of us have completely different styles.

Blue Fox is a long-term idealist, not trading in waves, always long;

Guilin is a short-term speculative trader, fully leveraged 10x long the previous day, and starting to short the next day);

While I mainly focus on trend cycles.

Yes, all three are masters, but their different styles determine the differences in perspective.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content