Written by: Squid | drift

Compiled by: Saoirse, Foresight News

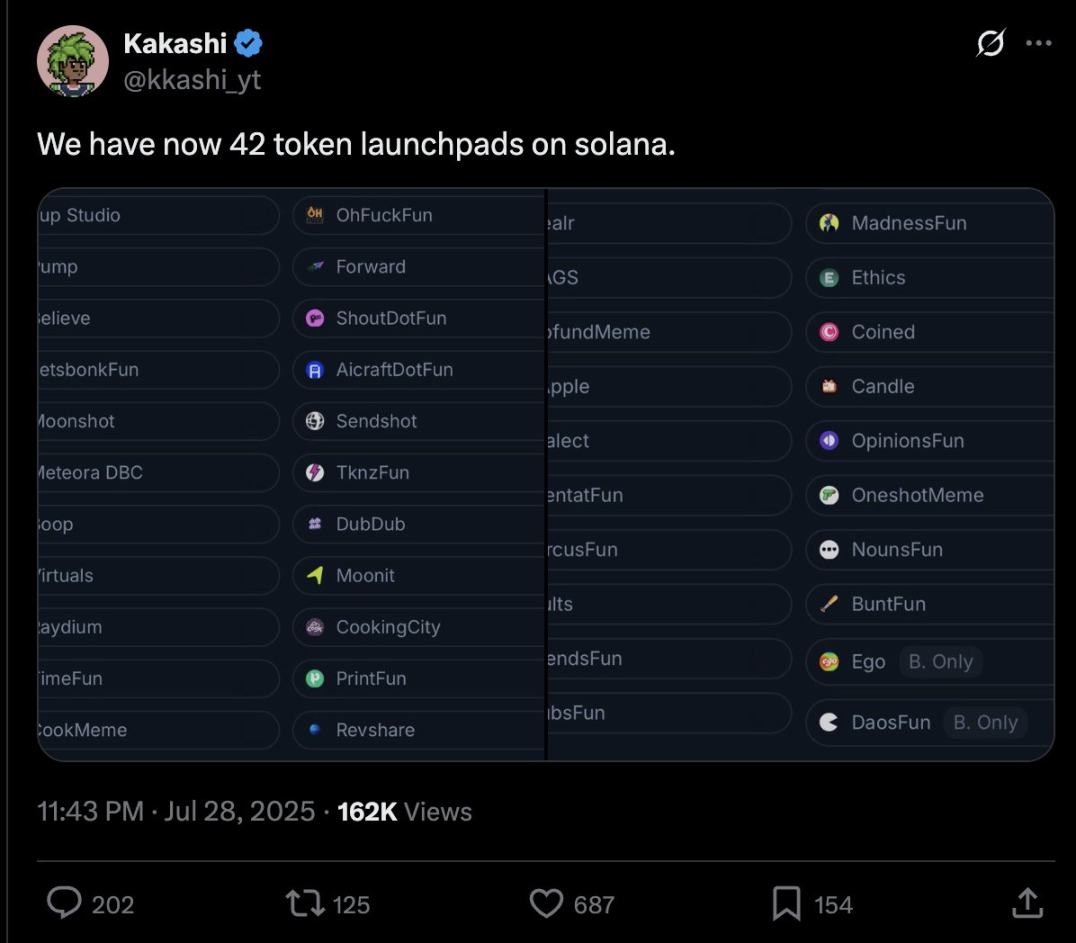

There are already dozens of homogeneous Launchpads on Solana, with more being added daily.

This article aims to provide a simple framework to help clarify industry chaos and provoke thought. We'll start from the core issue:

Why would users choose a new Launchpad instead of Pump.Fun (or now Bonk)?

Users can be divided into two categories: bidders and deployers. Although these two groups are highly interconnected, since capital is a scarce resource, bidders are the core group we first focus on.

To analyze why buyers choose a new platform over a top platform, the answer is simple: they believe the new platform offers more opportunities to make money. However, many factors are beyond the platform's control, so this article focuses on two major driving factors that platforms can control:

Assets: Can the platform create assets with significantly differentiated value?

Flows: Does the platform have a differentiated deployment process?

Let's dive deeper.

Assets

People buy tokens for two main reasons: speculation (believing the token will appreciate) and utility (the token has practical use).

Speculation level: Speculative drivers are diverse, mainly including meme (such as meme coins) and fundamentals (value brought by fund reserves, cash flow, etc.).

However, Launchpad cannot differentiate at the speculation level. Memes are spontaneous and market-dependent, while fundamental factors like returns are ultimately determined by the project or product.

Utility level: Utility is more flexible, essentially "Why do people buy tokens besides speculation?" (Of course, utility is closely related to speculation, as utility can drive speculation). Examples include token access permissions, fee discounts, governance rights, etc.

Launchpad can form an advantage in utility by providing differentiated supporting infrastructure and tools, allowing deployers to integrate from the first day of launch. These support forms are diverse, but competition may focus on more vertically focused platforms. It's important to note that supporting infrastructure must not only give tokens a unique utility but also create "valuable utility" - giving users a compelling reason to purchase.

[The translation continues in the same manner for the rest of the text, maintaining the specified translations for specific terms and preserving the original formatting.]Doppler: As the "Launchpad of Launchpad", with high industry recognition and good development prospects.

MetaDAO: Asset creation has differentiation, but needs to prove the value of its governance mechanism.

Vertigo: Assets lack differentiation (anti-sniping technology has been standardized), but still has the opportunity to attract deployers.

Believe: (Deployed on BNB Smart Chain) Core advantage is traffic, but currently deployers are leaving, and market sentiment is unclear. I still have expectations for this project and need to assess its health through newly launched projects.

heaven: (Deployed on BNB Smart Chain) Excellent design, core issue is how to attract high-quality deployers, and its investors may provide assistance.

The Metagame (Deployed on BNB Smart Chain), Trends: Details are unknown, but the team consists of experienced crypto-native players (which is crucial), and they are expected to break through in the social field.

Summary

Verticalization is an important opportunity, but must create actual value.

Early layout is more likely to yield returns than betting on "defensive" or market growth.

Novelty should be valued.