This article is machine translated

Show original

Let's discuss the interest rate hikes and cuts - focusing on rate hikes ~

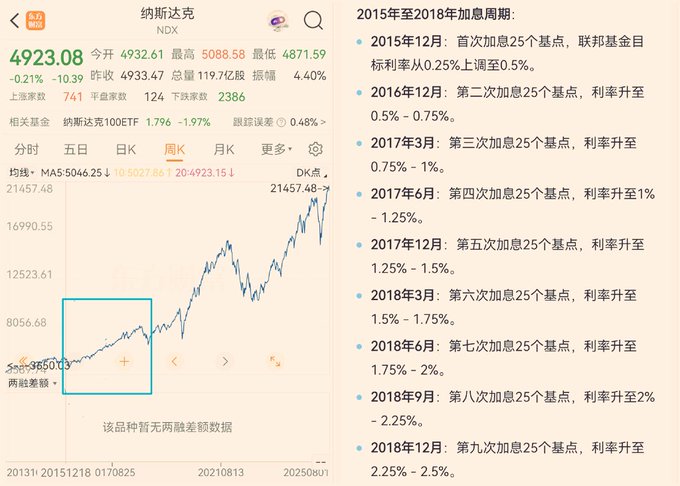

❶ You can observe the Nasdaq trend during the Federal Reserve's rate hike cycle from 2015-2018 (in the box)

The first rate hike in December 2015 caused market decline, followed by an overall upward trend, with a peak turning point before the rate hike in September 2018, and then a continuous decline until the rate hike in December 2018 (end of the rate hike cycle).

During the same period, the crypto experienced the 94 event in September 2017, Bitcoin peaked in December 2017, and hit bottom in December 2018.

TingHu♪

@TingHu888

07-26

①很久没有聊加息降息的问题了,这类问题你可以在抖音或知乎搜到大量的探讨文章。那么,加息降息对市场的核心影响是什么?或者说,什么情况下对金融市场的走势起到正相关影响?什么时候又没什么影响力?其实主要跟行情处于什么阶段有关。比如上上轮出现了所谓的“加息”牛,而上轮却是所谓的“降息”牛。 x.com/TingHu888/stat…

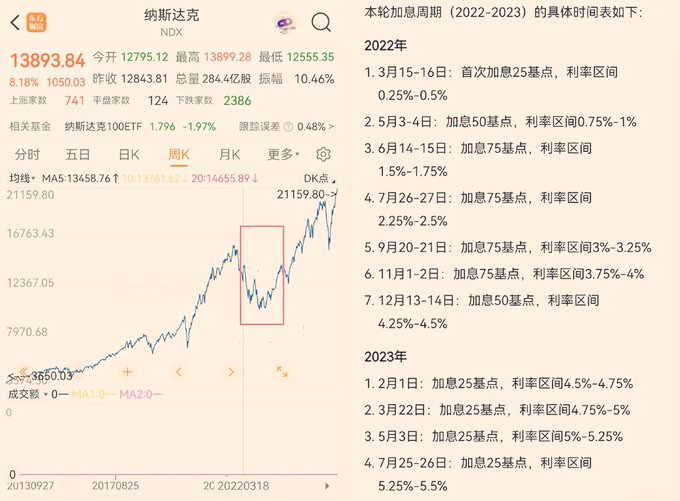

❷ The Nasdaq peaked in November 2021 (before the box) before the 2022-2023 rate hike cycle (a subsequent rate hike was confirmed in December), then fell in a wave-like manner to bottom out in November-December 2022, before resuming its upward trend. Over the same period, Bitcoin's trend from November 2021 to November-December 2022 was similar to that of the Nasdaq, peaking in November 2021 and bottoming out in November-December 2022. The subsequent trend was similar, with an initial upslope followed by a downslope (predicted in advance), and a continued upward trend after the downslope ended.

❸So, you can't invest solely based on the interest rate hike cycle. One reason is that the market will rise at the beginning of a rate hike and fall afterward, while the other is that it will fall at the beginning of a rate hike and rise afterward. This is why I always emphasize that you need to look at the market's state and trend, not just rate hikes or cuts. This is also the biggest reason why I valued interest rate hikes at the end of 2021, but felt it was unnecessary at the end of 2022. Focus on downward trends and ignore upward trends.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content