When the second week of August began, the total market capitalization of cryptocurrencies surpassed $4 trillion, officially establishing a new record high. With improved trading sentiment, price expectations further deepened the imbalance between buying and short-selling positions.

Therefore, some altcoins may face significant liquidations this week if prices move contrary to the expectations of traders using short-term leverage.

1. Ethereum (ETH)

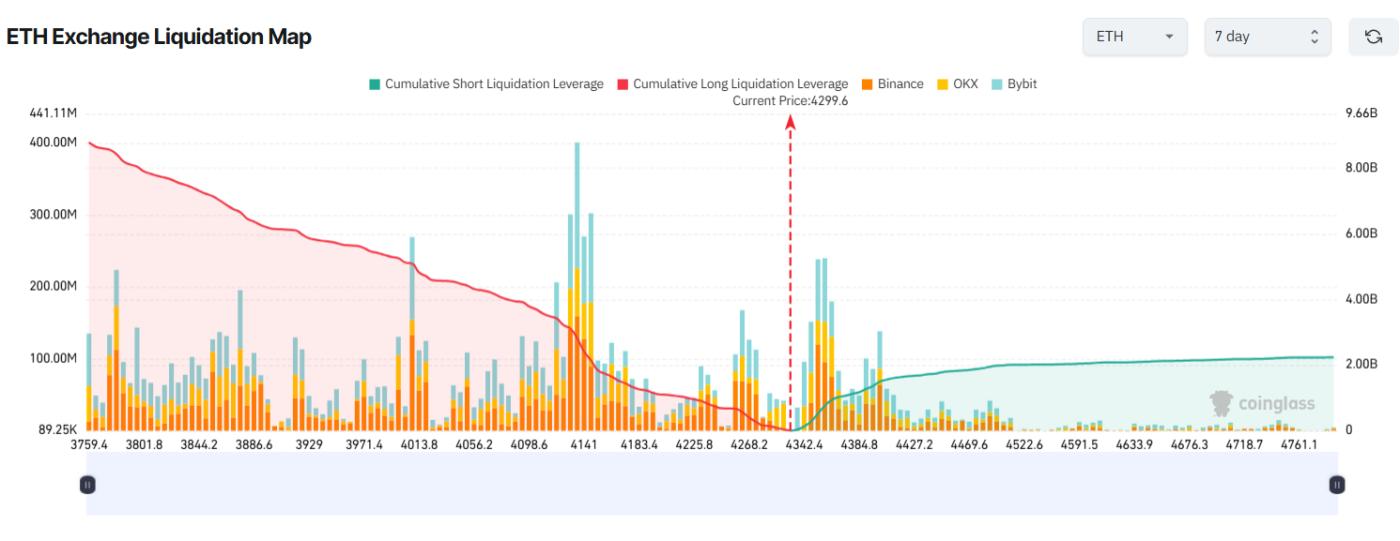

Ethereum's 7-day liquidation map shows a large imbalance between accumulated liquidation volumes on the buy and short-selling sides. Traders continue to allocate capital and leverage to bets that ETH will continue to rise after breaking through $4,300.

Data from Coinglass indicates that buy positions could lose over $5 billion if ETH drops 7% this week and falls below $4,000. Conversely, if it rises 7% to $4,600, it will trigger $2 billion in liquidations for short-selling positions.

ETH Exchange Liquidation Map. Source: Coinglass

ETH Exchange Liquidation Map. Source: CoinglassSome traders are concerned that liquidity is primarily flowing into ETH, while other altcoins are not seeing similar cash flows. They believe ETH's price surge may lack sustainability if buying pressure decreases, potentially leading to a sharp decline and liquidations up to $7 billion for buy positions.

"If Ethereum drops to $3,600, over $7 billion in buy positions will be liquidated — a very attractive liquidity pool for exchanges... Since liquidity has primarily flowed into ETH while other altcoins remain inactive, this suggests ETH may be positioning to balance the total cryptocurrency market capitalization in response to potential Bitcoin dominance movements," investor Marzell said.

2. Ethena (ENA)

Ethena (ENA) has become one of the most discussed altcoins in August. Thanks to the passage of the GENIUS Act on July 18, Ethena's stablecoin USDe reached a market capitalization of $10 billion, becoming the third-largest stablecoin after USDT and USDC.

Optimistic sentiment towards ENA has strongly increased, pushing its price from $0.50 to over $0.80 in August. A recent BeInCrypto report shows that whales are still accumulating ENA, and the liquidation map reflects traders' expectations of further short-term profits.

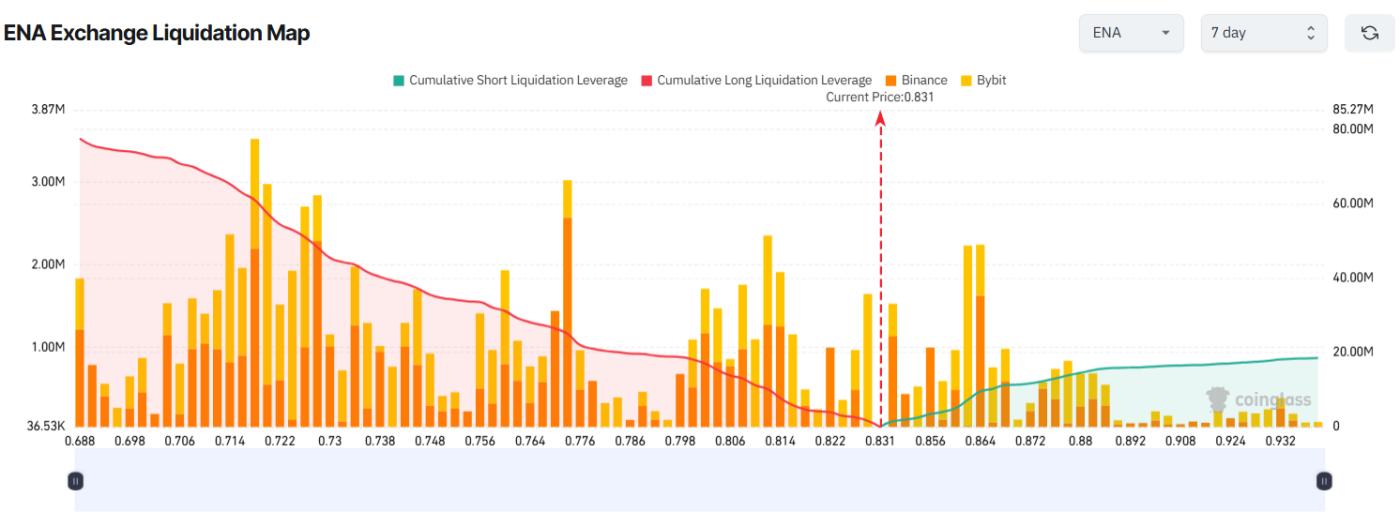

ENA's 7-day liquidation map shows the total accumulated liquidation volume of buy positions far exceeds short-selling positions.

ENA Exchange Liquidation Map. Source: Coinglass

ENA Exchange Liquidation Map. Source: CoinglassIf ENA drops to the psychological support level of $0.70 this week, buy positions could face losses of over $70 million. Conversely, if ENA rises to $0.90, short-selling positions would only lose $16.5 million.

Some traders believe ENA could continue to rise to $1.50. However, they warn that the token may face profit-taking pressure in the $0.80–$0.90 range.

3. XRP

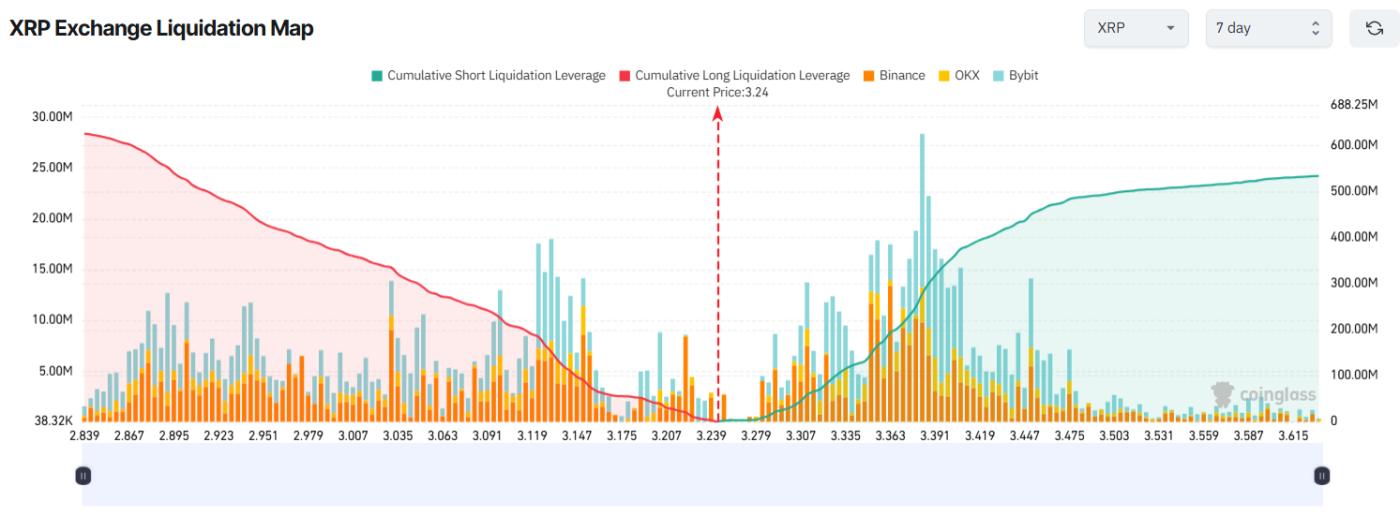

While many altcoins show an imbalance in their liquidation maps leaning towards price increase expectations from short-term traders, XRP presents a different picture.

A recent BeInCrypto report reveals that Ripple has unlocked 1 billion XRP, causing concerns about price pressure. Technical signals also suggest that sellers may soon take control.

Perhaps for these reasons, XRP's 7-day liquidation map shows that traders are placing more money on a price decline scenario.

XRP Exchange Liquidation Map. Source: Coinglass

XRP Exchange Liquidation Map. Source: CoinglassIf XRP moves contrary to these price decline predictions, short-sellers could suffer significant losses this week.

Specifically, if XRP rises 8% to $3.50, nearly $500 million from short-selling orders will be liquidated. Conversely, if XRP drops 8% to $3.00, buy orders will face around $370 million in liquidations.