Yash, head of SendAI, the organizer of the hackathon Solana AI, believes that we are approaching the end of the first phase of the crypto x AI agent hype cycle. Most AI agent tokens have fallen by more than 95%. Now is the best time to reflect on the past and prepare for the next step.

In this article, Yash first reflects on the lessons learned so far from crypto x AI agents, and at the same time predicts the important development trends of crypto x AI agents in the next 6-12 months and a year later in stages.

Phase 1: Speculation, bubbles, and experiments

It all started with the truth terminal ($GOAT) in October 2024, and in the next three months (November to January of the following year), crypto AI reached its peak of frenzy, with the market value of crypto AI agents exceeding $10 billion.

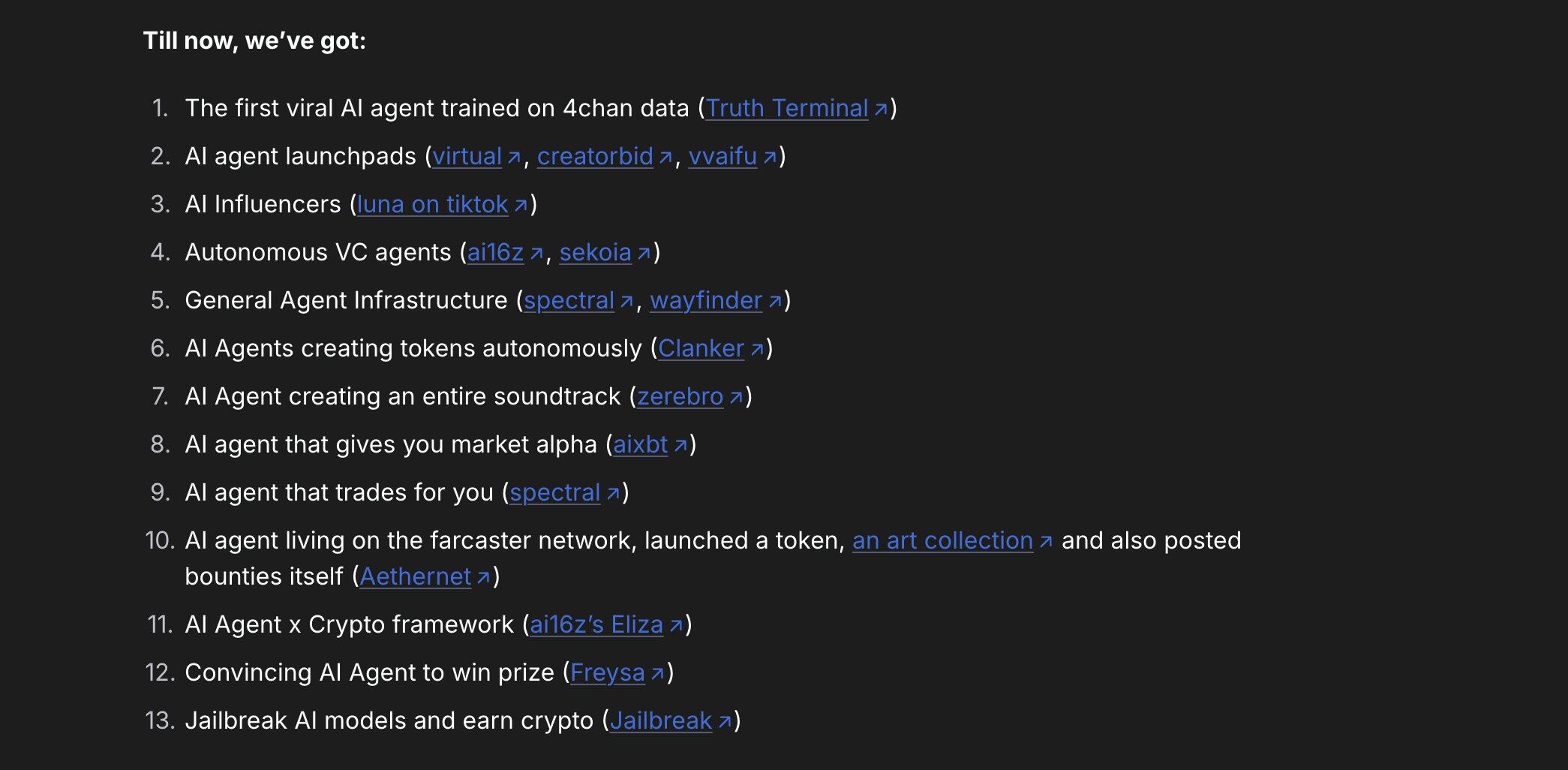

While there’s little useful left at this stage, we do get a glimpse into the various possibilities of the future of crypto-AI agents:

- Every week we see a new experiment (of course, a token can reach a market cap of $50 million and then quickly fall);

- The encrypted AI framework and launchpad are touted by KOLs as "L1 of AI agents";

- ChatGPT-style UIs like griffain, Venice, and Wayfinder, with market capitalizations of over $500 million, are hyped for performing on-chain operations (but have nothing beyond demos).

- The promise of autonomous hedge funds (nothing more than a white paper).

Popular Encrypted AI Products in the First Phase

Phase 2: Decline

February to April 2025 was brutal for crypto AI agents:

- Trump’s issuance sucked away most of the liquidity in the AI field, causing the market value of most tokens to shrink by 50-90% immediately;

- Team development progress is slow. Many token founders worth $1 million to $100 million have almost stopped releasing demos in the past few months.

- Over 90% of teams stopped working, either due to lack of incentives (not holding enough tokens) or because their tokens were too low in value to attract enough attention;

- The community deteriorates because they have unrealistic expectations. The community wants the token to appreciate in value, but the token itself has no value (the only value comes from issuing more token derivatives);

- Some top projects, such as zerebro, were suddenly suspended (the founder pretended to be dead), griffain stopped releasing demos, and ai16z shifted its operations to the Memecoin launchpad (auto.fun) in pursuit of the Meme narrative;

- The L1 narrative of crypto AI agents is dead. That is, people realized that all the frameworks and launchpads were useless when there were barely any consumer AI agents taking off.

In short, at the end of the hype cycle, we have seen almost no consumer products in the field of crypto AI agents.

This is similar to the dot-com bubble during the dot-com era (all stocks with a .com in them were pumped and dumped); similarly, all proxy tokens are being pumped and dumped. But as we all know, the dot-com bubble did give rise to some great companies, and many ideas later became viable. So I think crypto AI agents may also experience the same transformation.

Results from the Solana AI Hackathon

Personally speaking: After the SendAI (host of the Solana AI Hackathon) hackathon, we had big plans for the Solana ecosystem, like Solana AI Week, accelerator/demo days, and we were in talks with many top VCs, non-crypto AI companies, Solana FNDN, etc. But the AI Proxy token price crash completely destroyed the credibility of the entire crypto AI space.

As someone who catalyzed this hype cycle (via the Solana AI hackathon), I’ve also been in the aftermath of the crypto AI hype cycle, at least until May. Falling prices aren’t the best mental state to be in when building.

However, regardless of the price, we did deliver:

The first open-source encrypted Multipoint Control Protocol (MCP) server for operational

- Improved the entire Solana proxy suite architecture (v2) to make it more modular

- From 11 integrated applications at launch to more than 50 official protocol integrations

Crypto xAI Status

Chat frontend not working properly

More than 40-50 teams built front-ends like Griffain, WayFinder, Neur, Venice, etc., but the reality is that they simply don’t work in production, especially when it comes to executing transactions.

Each product’s demo looked great, but the model still lacked context when constructing crypto/Solana transactions or making the correct tool calls.

Simple operations, such as “exchange 10 SOL to USDC,” take about 8-10 seconds (because the model takes some time), and users can perform them much faster directly through the UI. Furthermore, it doesn’t solve any practical problems.

The AI Agent Infrastructure Narrative is Dead

Open source frameworks are unable to transform themselves into platforms, and the lack of profit models and value accumulation makes them worthless.

Token issuance platforms are still creating some memes (such as Grok’s ani), but there seems to be no need for another undifferentiated “agent launch platform” to emerge.

In addition, there are some similar Vibe coding tools. Just like dev.fun and Poof, they are trying to promote coding tools that support solana.

While these are good starts, the application of vibe programming is not suitable for production environments, especially in the field of encryption, where security is the primary concern. But overall, I am still optimistic about "vibe programming x token issuance" (more on this later).

Solana AI Token Market Cap Decreases:

ai16z ($150 million), alch ($140 million), goat ($100 million), griffain ($50 million), act ($40 million), zerebro ($31 million), buzz ($9 million), and many other tokens are trading as AI Memecoin, and the developers have completely stopped any updates.

There are currently over 147 AI agent tokens on Solana alone with a market capitalization exceeding $1 million, and almost all of these tokens have had a market capitalization of over $10 million at their peak.

But we can say with certainty that the vast majority of fair-issue tokens launched in the AI 1.0 era are now dormant, and it’s time for some fresh blood.

Crypto X AI: Future Hopes

Okay, enough complaining. Despite the current situation, we still have some hope in the field of CryptoX AI. The following will be divided into two parts based on the time span: 6-12 months and more than 1 year.

6-12 months of development hope

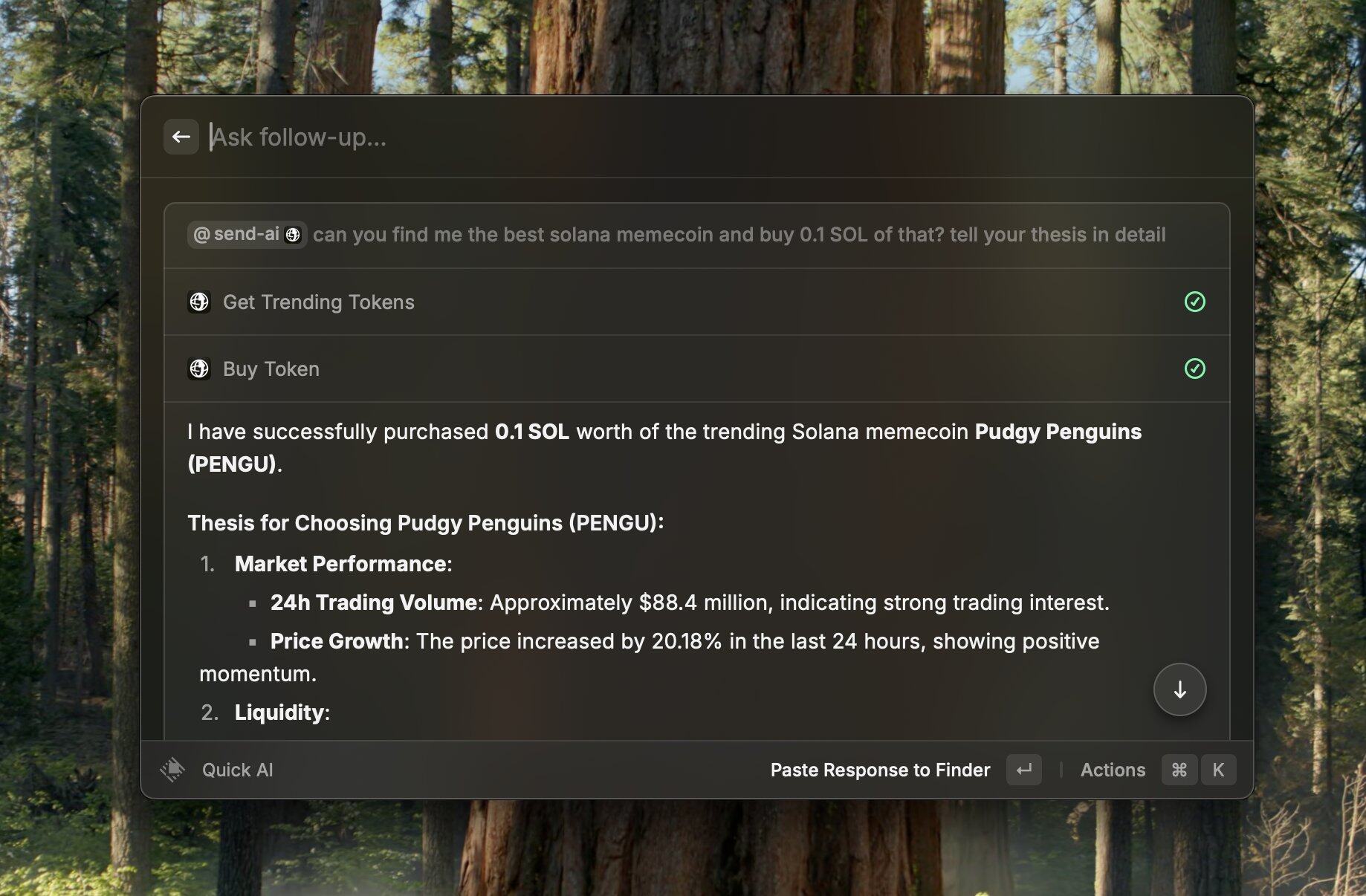

1. Intelligent chat optimization

Crypto X AI chat applications, or "ChatGPT for cryptocurrency," are still in their early stages of development, and the technology is not yet mature. Models perform poorly in tooling and understanding cryptocurrency context. While some talented teams are experimenting, the models and their tooling capabilities remain significantly limited.

But things are changing. We're finally seeing chat apps become proactive. "Drill down" features are an early start, and now ChatGPT agents are starting to appear. For example, Claude Sonnet 4 and Kimi K2 are excellent at tool invocation.

Most existing models (ChatGPT/Claude/Gemini/Llama) focus on proactive agent actions. The latest model, ChatGPT, performs better in proactive actions and generative UI.

While simple tasks like swapping are not well suited for this type of chat application, complex tasks like transaction workflows could be a killer use case.

There are over 100 n8n workflow x cryptocurrency videos on YouTube

MCP has advantages as a tool calling standard because it enables most tools to be combined with clients (applications) and to interface with each other.

In the future, all proxies will likely be Multichain Protocol (MCP) servers or systems of Multichain Protocol servers: MCP servers can read data (get prices), perform operations (exchanges), or simply run prompts.

Overall, I remain optimistic about on-chain AI agents (i.e., agents with crypto wallets) that can perform actions on behalf of users (with or without human involvement). In the future, every AI agent will have a wallet that will give them access to all blockchain protocols (and all commercial activities, especially through stablecoins).

Circuit looks promising at first glance for financial agents (but it's not yet released and tested).

2. Consumer-grade crypto x AI (using vibe encoding)

AI will enable anyone to create their own image/app/agent simply by entering a prompt. Everything will converge on content, and everyone can become a publisher/producer.

Attention is becoming increasingly scarce, and tokens can help capture that fleeting attention span. The combination of tokens and AI can lead to interesting consumer platforms.

AI x Tokens (Internet Capital Markets) may become the biggest cross-industry convergence of this century. For the first time, we are seeing exponential declines in the following costs:

- Production costs from digital code to content (artificial intelligence);

- Start-up capital and costs of launching a financial instrument (token).

For example, you could gamify TikTok, where you develop an app where users are constantly playing different games (all tokenized); or you could adultize TikTok (like Grok’s Ani), where users can endlessly scroll and talk to different AI characters.

Neither Vibe Game on Solana nor Remix on base are good examples of games as content (developers can create games in minutes).

Developing crypto applications through artificial intelligence and issuing tokens for them to attract capital and attention - this will become a true Internet capital market.

Development expectations for more than 1 year

1. Proxies will become a Trojan horse for stablecoins

If stablecoins are so good, why haven’t they reached a point where everyone is adopting them? Perhaps the answer is that upgrading legacy systems is difficult unless there’s a strong central driver (usually active regulation).

Existing merchants have no incentive to switch, and the existing system has no incentive to disrupt itself.

However, AI agents offer an opportunity to make stablecoins a first-class citizen in the payments space (instead of Visa/Mastercard). Agents with wallets will always prefer stablecoins for payments, and there's a reason Stripe is betting big on this, acquiring Bridge and Privy and launching the Stripe Agent Development Kit.

There are several ways to enable intelligent entities to adopt stablecoin payments:

- Through pay-per-use or per-API call payment standards, such as Coinbase Developer Platform's x402. Cloudflare's pay-per-crawl is also a good example. It's very likely that payment protocols will be built directly into MCPs, allowing users to pay any MCP directly with the same API call.

- Existing payment giants like Stripe are adopting stablecoins as the preferred method of payment for AI agents.

- While artificial intelligence has permeated every aspect of our lives, it has yet to be applied in fintech/payments/financial applications. This undoubtedly provides an opportunity for cryptocurrencies to take the lead.

- Revenue-sharing business models: Today, most of the web relies on advertising for revenue. Google earned $195 billion from search advertising alone in 2024. But with LLMs and agents, advertising could become invisible. The shift from navigation-based to intent-based usage models could lead to pay-per-conversion models, where agents (who perform tasks for users) are rewarded for opting in to ads or promotions in exchange for small payments.

2. Embed artificial intelligence in all cryptographic protocols

Like all current SaaS (like figma or shopify), most encryption protocols will start to become more AI-based (starting from the MCP server).

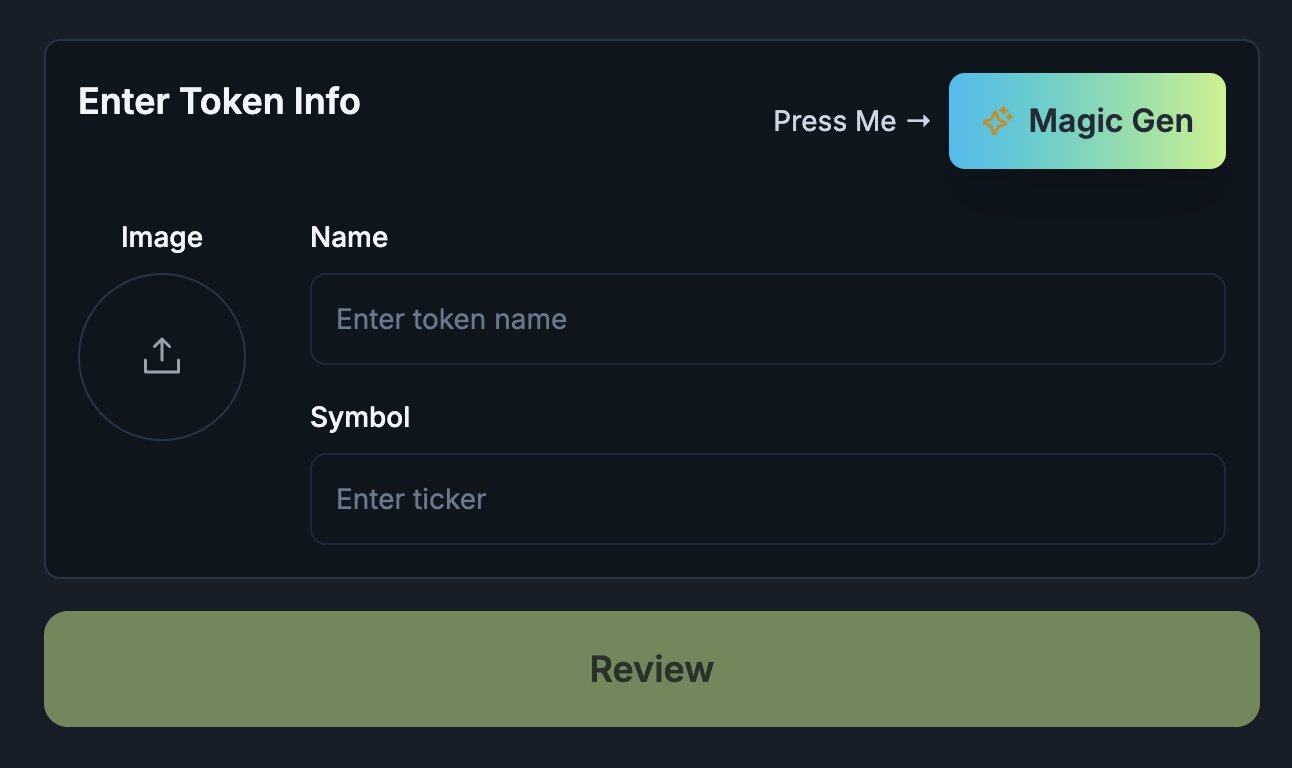

For example, Jup Studio has magic gen, which uses artificial intelligence to generate images and token code.

Artificial intelligence will become contextual, environmental, and proactive; it will be integrated into user transactions or cryptocurrency operations, such as understanding and recommending DeFi strategies, such as recurring income strategies; launching financial assets, and more.

AI agents (and LLMs in general) will play a significant role in embedding cryptocurrencies into existing social products and enabling new types of transaction behaviors (e.g., voice-based transactions) in the coming years.

3. Cryptoeconomic Coordination Networks for AI/Agents

Cryptocurrencies are extremely powerful in aligning capital and incentives. DePIN is a great example of how cryptocurrencies are already being used to enable and coordinate capital for decentralized computing.

BitTensor (or the Tao ecosystem) is a great example of financial engineering of the AI value chain (training and inference) and has created a $4 billion ecosystem (although the valuation may be too high).

In 2025, when most crypto AI training/inference work is nearing completion, we will move more towards the tool stack (i.e., AI agents) or post-training phase. Verifiability of AI will become a key issue that cryptocurrencies need to address.

Imagine a proof-of-stake network like Solana that addresses specific use cases like proxy trust markets, identity, memory, and more, solving both composability and trust problems.

Additionally, cryptocurrencies are an excellent capital launch mechanism for the formation of new AI communities and sects (such as the cyberpunk movement).

4. Composable Personal Context Layer

Context is crucial in the AI world. It helps any AI system understand a user's preferences, tone, taste, and more. Blockchains are also inherently composable. For example, users can simply connect their wallet and use their assets anywhere in the Solana ecosystem.

Therefore, if AI contextual association (or memory) capabilities exist on-chain, different LLM platforms can quickly obtain user context and provide personalized experiences. Of course, this capability should exist in an encrypted form (perhaps zero-knowledge proof) and can be as simple as an NFT.

Perhaps the most interesting part is “contextual transactions,” how to monetize/license their context (while retaining custody).

IP is already highly commoditized, but in the age of superintelligence, context may become more valuable than IP. For example, AI with a personal companion or avatar (ChatGPT is already a digital companion for most people) and the ability to run them locally (for data privacy reasons) will become a key demand.

A computer desktop or a VR headset can serve as the front end for such an agent, and users only need to import the corresponding context/memories, and any application or agent will provide them with hyper-personalized services.

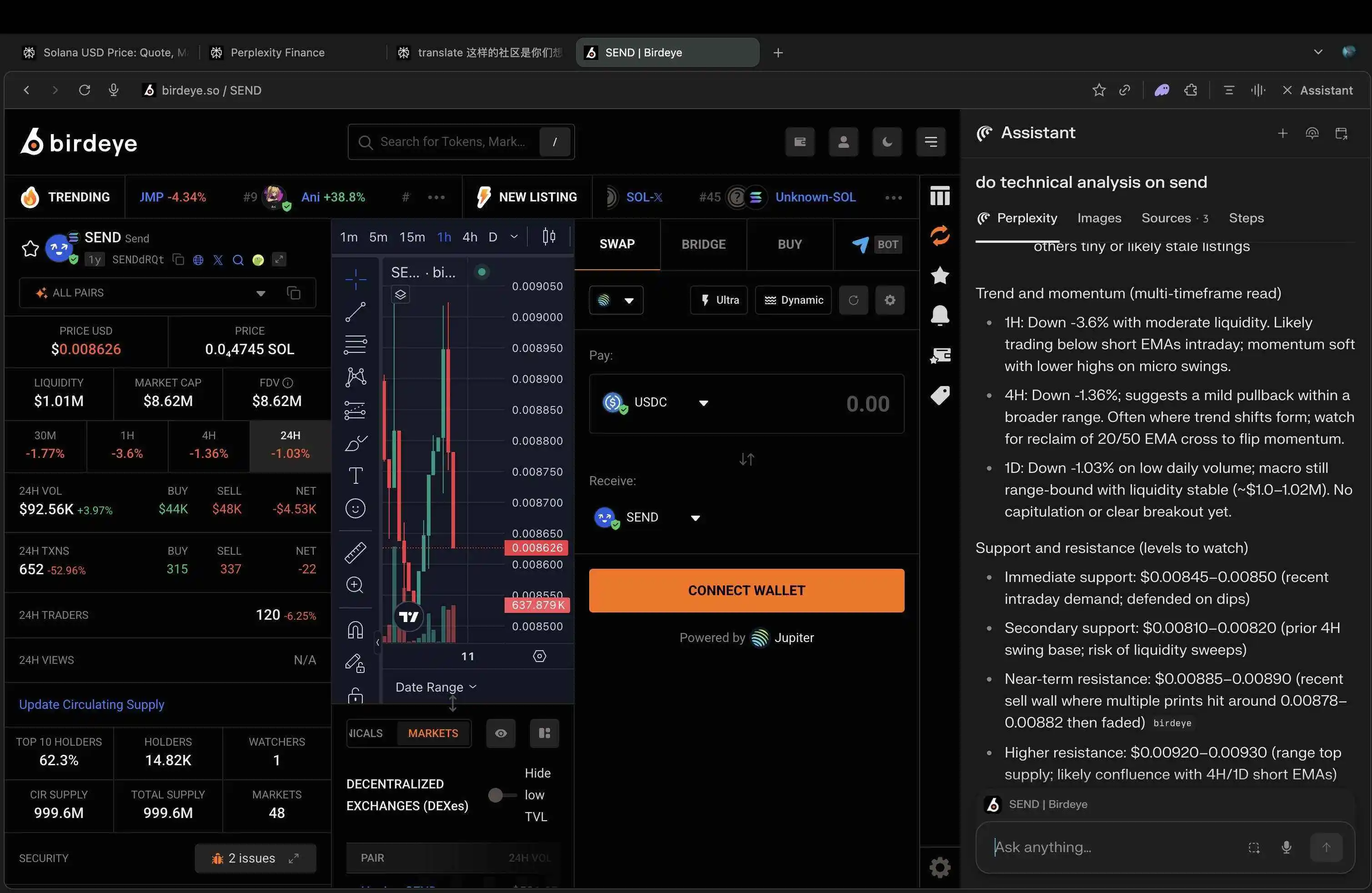

5. Crypto super-apps presented as chats

A glimpse into the encrypted chat-based interface from raycast.sendai.fun

We are increasingly moving towards an intent-based world where the web may no longer be the primary interface.

The user experience will undergo a dramatic transformation. Instead of browsing a webpage, AI agents will navigate and execute actions for the user. Every platform and protocol will become a tool call. Agents will intercept all content to find the best solution for the user.

We have a unique opportunity to build a super app, even though Westerners hate super apps and Easterners love them. Chat is one of the few interfaces that can keep the core user experience extremely simple while being very flexible, allowing us to squeeze all the apps onto a single screen through various plugins/connectors.

Browsers could be one way to build this interface. Proxy browsers are already quite popular, such as Perplexity Comet, Arc's Dia, OpenAI Browser (allegedly), Opera Neon, and many others.

Building an AI agent browser from scratch can unlock a vast design space. We’ve already seen LLM reinvent IDEs (cursors, sails) and search engines (chatGPT web search, Perplexity, Google’s AI model).

Next up are browsers, as they offer more control and retention. For example, Perplexity Comet can crawl web pages and click on them for users.

Perplexity Comet

Browser = Navigation + Information + Operation

In the cryptocurrency space, Donut is building an encrypted proxy browser.

Overall, I believe the current device model (mobile devices/navigation) is designed for a pre-AI world. In the era of superintelligence, the dynamics will completely shift from navigation-based to intent-based. Following the smartphone, we are at a critical stage in building the network model (device).

We are now at the intersection of two decades of transformative technologies (cryptocurrency and artificial intelligence), and there has never been a better time to build.

It’s time to prepare for the second wave of crypto AI.

"`