Written by: Castle Labs

Translated by: Saoirse, Foresight News

Abstract

For many, the ability to enter the Real World Assets (RWA) field has become a benchmark for measuring whether cryptocurrency has achieved mainstream adoption: only when we can connect the on-chain world with traditional finance can cryptocurrency truly establish its position as an attractive mainstream asset.

Past visions are gradually becoming reality, with U.S. Treasuries, bonds, and even real estate being tokenized and put on-chain.

Driven by both regulatory clarity and technological maturity, RWA is gaining significant momentum.

This article focuses on the Arbitrum ecosystem, a Layer 2 solution that has successfully launched multiple RWA-focused projects, with the total locked value (TVL) of RWA assets currently exceeding $350 million.

The article will provide an overview of RWA on Arbitrum, the projects and initiatives driving its development, key assets and providers (including case studies), as well as related risk considerations and future prospects.

Overview of RWA on Arbitrum

The RWA market is thriving. Many early cryptocurrency adopters once fantasized about Wall Street elites using cryptocurrency. Today, this vision has been realized, and real-world assets have finally been successfully put on-chain and are beginning to be widely adopted.

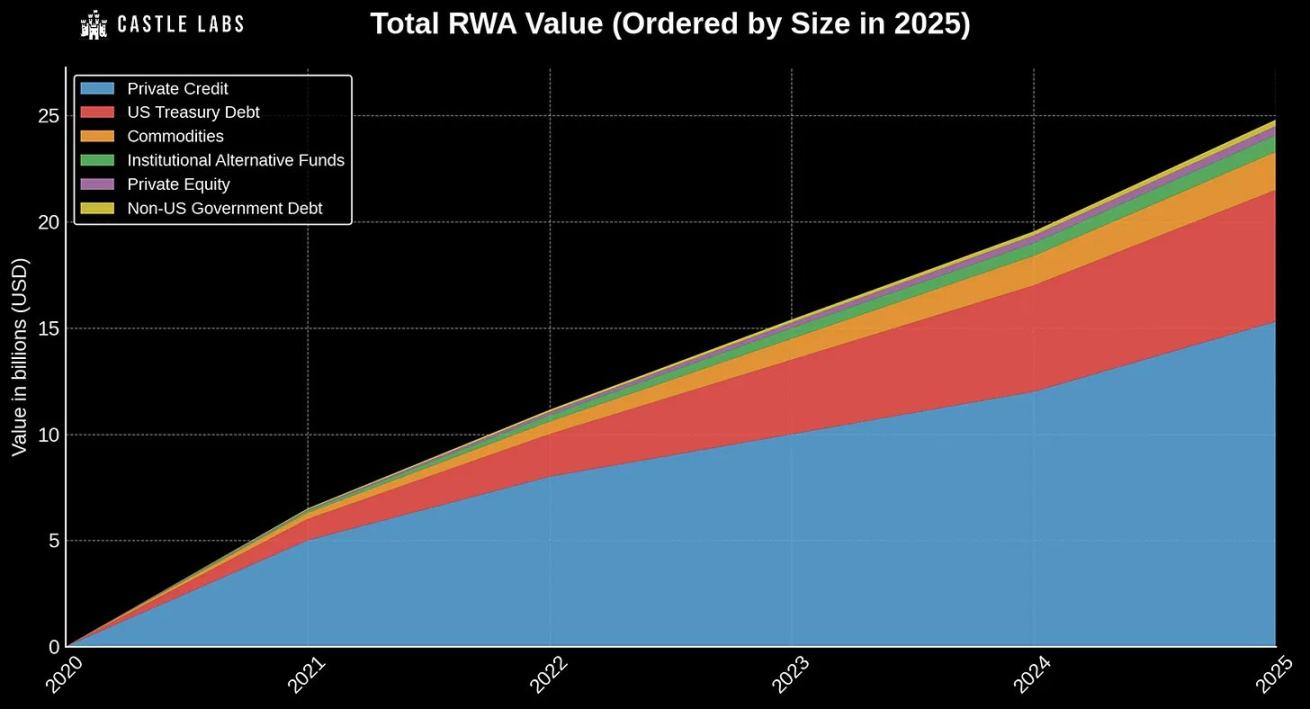

Source: rwa.xyz

Currently, the total value of RWA exceeds $25 billion, distributed as follows:

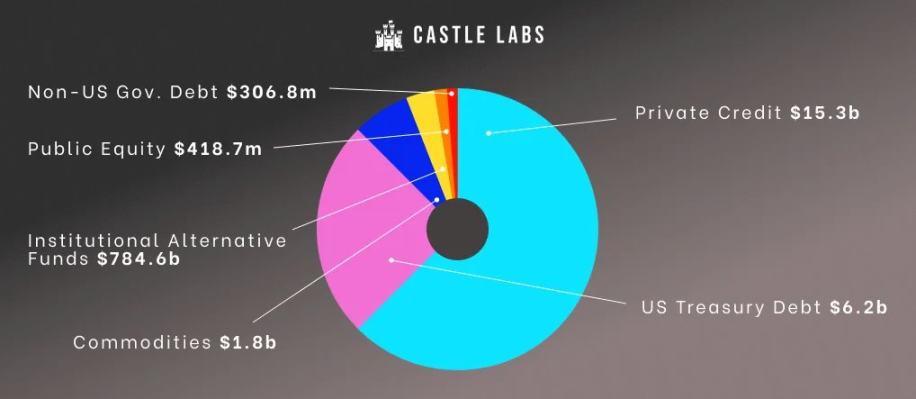

Source: rwa.xyz

Private Credit: $15.3 billion (60%)

U.S. Treasuries: $6.2 billion (26.9%)

Commodities: $1.8 billion (7.2%)

Institutional Alternative Funds: $784 million (3.26%)

Private Equity: $418.7 million (1.71%)

Non-U.S. Government Bonds: $306 million (approximately 1.2%)

The on-chain implementation of RWA is due to the combined action of multiple factors:

Digital asset regulatory framework is becoming increasingly mature

Technical infrastructure has reached production-level reliability

Institutional interest is rapidly warming up

Cryptocurrency is gradually being accepted and incorporated into the regulatory system, such as MiCA in Europe and the recently passed GENIUS Act in the United States, which means these assets are gradually becoming legalized in a broader financial environment.

Meanwhile, networks like Bitcoin and Ethereum have been running stably for over a decade, fully demonstrating their security, activity, and decentralized characteristics.

However, due to their inherent characteristics, RWA requires higher guarantees before being put on-chain. Therefore, L2 is extremely attractive to institutional investors, as it can dramatically reduce on-chain operational costs by several orders of magnitude compared to the Ethereum mainnet.

Among the many Layer 2 networks, Arbitrum is one of the fastest-growing Layer 2 solutions in the RWA field.

Why Choose Arbitrum?

Mature and reliable technology stack

Credible block space neutrality

One of the leading capital pools in the cryptocurrency field

[The rest of the translation continues in the same manner, maintaining the original structure and terminology.]

Explore how to invest DAO Treasury funds in RWA and how to launch on-chain tokenization on Arbitrum

More broadly integrate RWA assets and tools in existing ecosystem applications such as GMX, Aave, and Pendle

The plan ultimately funded 8 different projects:

RWA Research: Educate users about knowledge in this field

PYOR: RWA analysis dashboard

Mystic Finance: A lending market that allows users to borrow stablecoins with RWA assets as collateral

Jia: Convert small and medium enterprise accounts receivable into tokenized assets

Truflation: Provide real-time inflation data

Backed Finance: Create structured products tracking securities

Infinfty: Develop ERC-6651 RWA tokens to track the full lifecycle of product procurement, performance, ownership, and environmental impact

Treasury Management (December 2024)

By the end of 2024, a treasury management proposal emerged to complement the previous work of STEP. The proposal focuses on generating passive income through on-chain strategies using ARB tokens, rather than leaving tokens idle in the treasury.

Its goals include:

Asset Management: Manage 25 million ARB tokens to generate on-chain yield

Stablecoin Conversion: Simplify the process of converting ARB assets to stablecoins, minimizing slippage and market impact

Stablecoin Liquidity Deployment: Convert 15 million ARB to stablecoins and invest in low-risk yield-generating strategies to pay for DAO expenses or service provider fees

Diversification and Stability: Focus on risk-adjusted returns while ensuring fund safety

The strategy is divided into two directions:

Treasury: Reserve 10 million ARB for pure ARB strategies, convert 15 million ARB to stablecoins as the DAO's "current account"

Growth: Allocate 7,500 ETH to the decentralized finance (DeFi) sector

STEP 2 (January 2025)

Inspired by the initial success of STEP, the STEP 2 proposal was approved with an additional investment of 35 million ARB (approximately $15.7 million).

After carefully reviewing over 50 applications, the STEP committee decided to allocate assets in the following proportions:

WisdomTree WTGXX: 30%

Spiko USTBL: 35%

Franklin Templeton FOBXX (BENJI): 35%

The importance of this plan is also reflected in the DAO's endorsement.

STEP 2 was passed with an overwhelming majority, with nearly 89% of participants showing support, 11% abstaining, and only 0.01% opposing.

These projects and initiatives collectively drove the development of on-chain real-world assets on Arbitrum, growing its total locked value (TVL) from almost zero to over $70 million in less than a year.

Tokenized S&P 500 Index ETF Trust (SPY.d): An index composed of S&P 500 constituent companies, with a scale of approximately $141,000.

These assets highlight the potential of stocks and indices, but their proportion in Arbitrum remains relatively low.

OpenEden

OpenEden provides access services for tokenized products such as US securities. The platform is licensed by the Bermuda Monetary Authority, holds a digital asset operating license, and has received a Moody's "investment grade" rating.

Currently, the platform is the most important issuer of tokenized US Treasuries in Europe and Asia. OpenEden has specifically launched the TBILL fund pool, where users can invest in short-term US Treasuries.

At present, deposits in this fund pool have exceeded $5.8 million.

Ondo

Ondo provides investors with opportunities to access institutional financial products.

On Arbitrum, its USDY product has received a good initial response, with a total value currently reaching $5.7 million.

USDY is an interest-bearing stablecoin backed by US Treasuries, with an annualized yield of approximately 4.29%.

Although Arbitrum has a rich product and asset portfolio, the RWA ecosystem is still in its early stages.

Its future development will depend on:

Chain-level asset expansion to meet broader demands

Strategic focus on RWA as an advantage area for Arbitrum

Collaboration between Arbitrum Alliance entities (AAE)

Institutional drive at the business development level

Future Outlook

The initial providers established in STEP 1 were supplemented by a new batch of providers in STEP 2, enriching the assets and product types on Arbitrum.

Based on the growth rate of Arbitrum's current RWA total value, we can make the following predictions:

Forming a RWA ecosystem worth billions of dollars

Incorporating more asset classes (private credit, real estate, interest-bearing stablecoins, etc.)

Achieving deeper interoperability of these assets across networks

Despite the current progress, Arbitrum still has enormous growth potential to consolidate its position in this niche. In fact, in the network ranking of total RWA asset value, Arbitrum is only ranked seventh; based on current data, its RWA total locked value of $350 million represents merely 1.39% of the total on-chain RWA asset market value, which is negligible.

To compete with these networks, Arbitrum needs to explore more opportunities, expanding into areas such as private credit issuance products, bonds, precious metals like gold and silver, and stocks.

[The rest of the text continues in the same translated manner, maintaining the technical and professional tone of the original text.]