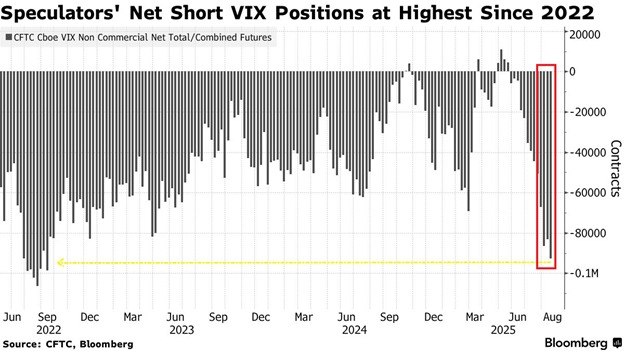

Hedge funds are betting against volatility: Hedge funds were net short futures tied to the Volatility Index, $VIX, by 92,786 contracts in the week ending August 19th, the most since September 2022. Net short positioning has more than DOUBLED over the last 5 weeks, according to CFTC data. This also marks a sharp reversal from the net long $VIX futures positioning seen in April. Meanwhile, the $VIX is trading below 15, one of the lowest levels this year and ~25% below its 12-month average. Wall Street sees more upside ahead.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content