Do you often feel like you haven't made any money yet, yet the market is already clamoring for a bearish turn, with all sorts of news headlines making you dizzy? Bitcoin's weekly MACD is facing a death cross, while Ethereum is struggling to hold up. Trend Research, which recently achieved impressive results by calling for a bullish ETH bottom and was once a firm bull on the Ethereum ecosystem, quietly liquidated its PENDLE and ENS positions at a loss this morning.

VX:TZ7971

At a moment like this, should we hold on or retreat?

The Ethereum and Bitcoin Game Stirred by Whale

For the past two weeks, the crypto market has been dominated by none other than an ancient whale. His massive sell-off of BTC for ETH is arguably the primary culprit behind Bitcoin's weakening performance. This individual has already dumped a total of 34,110 BTC, cashing out approximately $3.7 billion, and purchased 813,298.84 ETH, valued at approximately $3.66 billion. Currently, he holds 49,816 BTC in his two remaining wallets, valued at approximately $6 billion. The question is: Will he continue to sell? And how much? It hangs like a sword, unresolved, over Bitcoin's head. The sellers are simply too powerful.

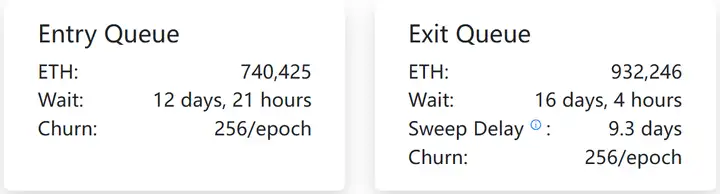

For Ethereum, the whale' rotation is clearly a positive development. This may be one of the key reasons for ETH's recent strength relative to BTC. However, Ethereum faces a tough two weeks ahead. Currently, 932,246 ETH is waiting to be unstaked, representing approximately $400 million in potential selling pressure that could impact the market.

Now it depends on the actions of the whale. If they can take over Ethereum, they will inevitably hit Bitcoin hard. A game of stock is still going on.

The collision of data and interest rate cuts

In the coming weeks, global markets will be focused almost exclusively on the Federal Reserve. According to today's CME "Fed Watch" data, the probability of a 25 basis point interest rate cut in September is 87.4%, with investors betting on the Fed's imminent launch of another round of easing.

This week is truly a "super week," with the release of the ADP small non-farm payrolls data, the ISM services PMI, and especially the core-of-the-core non-farm payrolls report. All of these data will influence the Federal Reserve's FOMC meeting on September 16-17. If the series of data, especially the non-farm payroll data, is weak, the market may bet on a faster and earlier Fed rate cut. If the overall performance is strong, market expectations of a rate cut will be weakened. Either way, this week is destined for significant market volatility.

While Powell's speech on the evening of August 22nd sent a dovish message, it didn't provide strong guidance on the duration or magnitude of rate cuts. Against the backdrop of higher tariffs and tightening immigration policies in the US, employment and inflation risks coexist. If inflation risks outweigh employment, the Fed may halt rate cuts. Even a 25 basis point rate cut in September wouldn't signal the start of a sustained easing cycle. If stagflationary pressures intensify, the Fed will face a dilemma, potentially exacerbating market volatility. The September meeting could be a turning point in market direction. Bitcoin remains a strong investment, but caution is advised in the short term.

If you want to see substantial fluctuations in Altcoin, you must rely on Bitcoin (an upward breakthrough) to drive the market, but Bitcoin's current performance has not met the expectations of bulls.

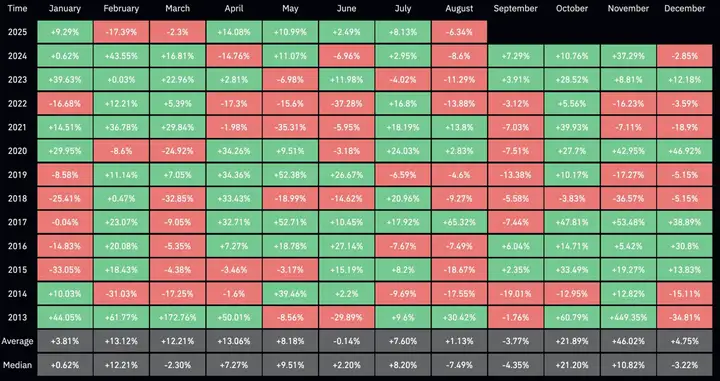

With US employment data due to be released this week, Bitcoin is at a critical technical juncture. Further price declines might surprise most traders, but this risk cannot be ignored. Historically, interest rate cuts are often viewed as bullish for the crypto market, but they often come with setbacks.

From a short-term valuation perspective, if Bitcoin fails to quickly reclaim $112,000, the downside support level will be around $100,000. The current BTC price is $107,420.

Today's panic index is 46, turning into a panic state.

Bitcoin has lost its bullish trend in the short term. However, the $100,000 to $105,000 area is a potential support level. This remains an ideal stage for continued accumulation.

Today is a US holiday, and the US stock market is closed, so it's rare for a purely crypto event to impact the market. The trends of other mainstream coins and market sentiment can serve as a barometer for the current crypto. We'll see if the market experiences another "TRUMP coin vampire effect," where Trump's coin drains liquidity, causing other coins to underperform. The market has recently begun to decline, especially BTC, which closed lower as usual in August. We hope that WLFI will have a positive impact on the market going forward.