Lin Zongliang, Global Vice President of ASUS Group

At the FinTechOn and AFA Summit, ASUS Group Global Vice President Lin Zongliang shared his company's observations on financial technology and the global supply chain. ASUS's revenue last year approached US$20 billion (approximately NT$600 billion). Its supply chain encompasses upstream chip giants and component suppliers such as NVIDIA, Intel, and AMD, as well as downstream distributors and resellers worldwide. The massive receivables and payables highlight the importance of financial technology.

First, supply chain challenges are becoming increasingly severe. ASUS is a top-five global PC supplier and a top-three player in the consumer market, and also plays a key role in AI servers. The COVID-19 pandemic has highlighted the importance of supply chains. In the post-pandemic era, coupled with US-China geopolitical tensions, tariff policies, exchange rate fluctuations, and the surge in demand for AI, supply chain management has become even more complex. This requires more transparent, efficient, and real-time data management.

Secondly, FinTech (financial technology) is an unavoidable issue. Given ASUS's massive revenue scale, with monthly cash turnover often exceeding tens of billions of NT dollars, the efficiency of accounts receivable and payable is crucial. Accelerating receivables and delaying payables through blockchain, digital payments, or stablecoins will directly impact operational performance. Furthermore, with ASUS operating in nearly 70 overseas locations and handling multiple currencies, leveraging FinTech to mitigate exchange rate risk and improve settlement efficiency is also a pressing issue.

Third, ESG and supply chain risk management are becoming global trends. Fintech can help analyze supplier financial status and credit risk, as well as track carbon footprints and sustainable finance data, meeting the ESG requirements of international investors. This not only enhances supply chain transparency but also strengthens corporate resilience.

ASUS is also considering integrating its AI and cloud capabilities with financial technology, initially internalizing them and then expanding them into a supply chain finance platform to serve upstream and downstream manufacturers, becoming a driver rather than a mere beneficiary. Leveraging resources such as Taichi Cloud and ASUS Cloud, new collaborative models may be established in the future.

In summary, fintech and supply chain issues are crucial to ASUS. Faced with a complex global environment, Vice President Lin Zongliang stated that ASUS will continue to monitor and actively participate, looking forward to collaborating with industry partners to promote innovation and build a more transparent, resilient, and sustainable supply chain finance ecosystem.

Zhang Zhiqing, Senior Vice President of Taipei Fubon Bank

Taipei Fubon Bank Senior Vice President Chang Chih-ching noted that recent financial technology innovations are reshaping business operations and service models. From supply chain management and blockchain applications to stablecoins and new payment methods, these are all fueling stronger innovation momentum amidst a complex environment characterized by tariffs, exchange rate fluctuations, technological mastery, talent development, and application-specific implementation. Fubon believes that financial services ultimately come down to the essence of the customer: understanding needs and optimizing the experience. Therefore, it advocates "361-degree service," meaning a comprehensive approach with an added degree of human warmth.

Regarding implementation, Fubon has launched its new mobile banking app, "Fubon+." Utilizing a cloud-based and microservices-based containerized architecture, it integrates a business and data middle platform, leveraging big data and AI to provide timely, personalized recommendations, achieving a "simple, intuitive, and understanding" experience. This platform also serves as the foundation for its distribution channels, offering a one-stop service connecting Taiwan and overseas, from deposits and remittances, investments, credit cards, and payments. It also extends to the enterprise-side "Fubon Business Network," enhancing financial transparency, cash management, and cross-border payment efficiency.

Regarding cutting-edge issues, Zhang mentioned that the US, Hong Kong, and Singapore have already initiated the process of stablecoin legislation, and Taiwan is also conducting research. Stablecoins are expected to improve the cross-border settlement experience. Fubon Group has also launched its "TWEX" virtual asset exchange, hoping to leverage the group's scale to provide better services.

Chang also shared that in the area of financial security, Fubon is promoting the use of AI to strengthen anti-money laundering and intelligent fraud prevention. They have also established the "Eagle Eye Anti-Fraud Alliance" with the Financial Supervisory Commission and other industry peers, emphasizing the importance of cross-institutional collaboration. In the face of the wave of generative AI, he advocates avoiding silos and instead advocates for sovereign AI/shared Large Language Model (LLM) resources, integrating the strengths of Taiwan and Asian partners to enhance joint R&D and service capabilities.

In summary, fintech and supply chain innovation require a customer-centric approach coupled with cross-domain collaboration. Fubon will continue to invest in data and cloud infrastructure, promote scenario-based applications, partner alliances, and regional collaboration to create a more secure, efficient, and people-centric financial services ecosystem.

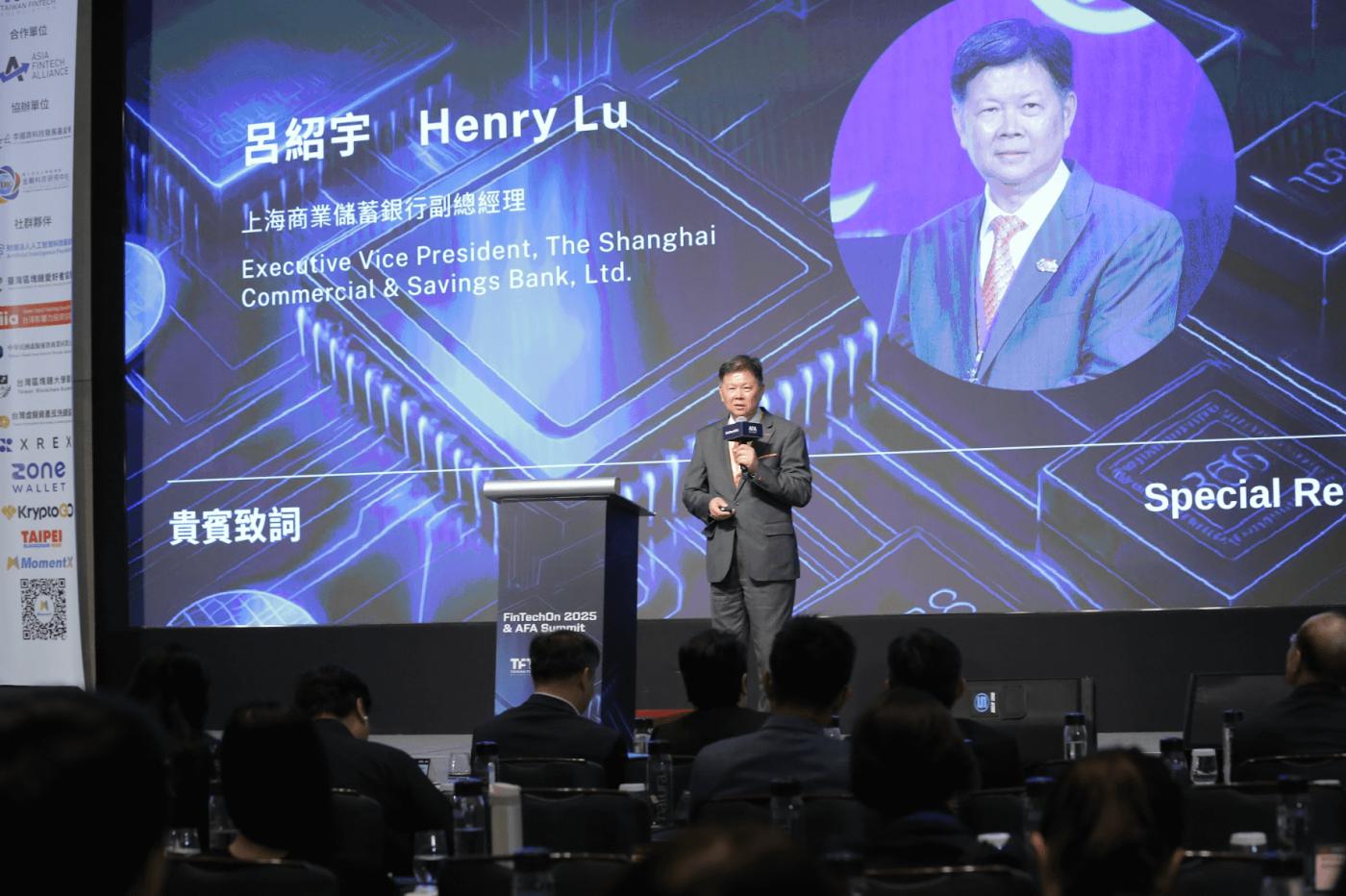

Lü Shaoyu, Deputy General Manager of Shanghai Commercial and Savings Bank

In his speech, Lü Shaoyu, Deputy General Manager of Shanghai Commercial and Savings Bank, noted that Asia is one of the world's largest markets, boasting a population of over three billion, abundant human resources, and enormous consumer potential. The recent rapid growth in cross-border trade between businesses and individual overseas travel has driven a surge in demand for payment systems, making cross-border payments a crucial issue.

Whether traveling or conducting business, individuals demand fast, secure, and low-cost payment methods. For businesses, ensuring funds transfer and transaction security during overseas transactions is equally crucial. These demands are driving collaboration between banks and fintech companies to create more convenient and efficient cross-border payment solutions.

Lu Shaoyu stated that advancements in financial technology have made logistics, financial flows, and information flows smoother, enhanced transaction security, and further driven the growth of the financial industry. However, future infrastructure must not only meet user needs but also address three major regulatory challenges:

1️⃣ Anti-money laundering

2️⃣ Privacy Protection

3️⃣ Consumer Protection

These challenges are crucial for the widespread adoption of cross-border payments. If the banking industry can collaborate with FinTech companies to address these challenges, they can simultaneously meet regulatory requirements and customer needs, achieving a win-win-win situation.

The speech also emphasized that the development of cross-border payments cannot rely on the power of a single bank, but rather requires the joint participation of fintech players, regulators, and industry experts. The forum will feature experts from various fields sharing their perspectives on the next-generation cross-border payment architecture. These topics are no longer a distant future, but rather are crucial issues that have a real impact on banks' daily operations.

In summary, cross-border payments hold enormous potential in the Asian market, and FinTech will be the core driving force behind its growth. Only through cross-sector collaboration can we ensure a satisfying user experience while also balancing compliance, security, and efficiency, ultimately fostering sustainable development for the overall financial ecosystem.

" FinTechOn Summit: Senior executives from ASUS, Fubon Bank, and Shanghai Commercial Bank discuss financial technology, innovations and challenges from supply chain to cross-border payments ." This article was first published in " NONE LAND Langlian ".