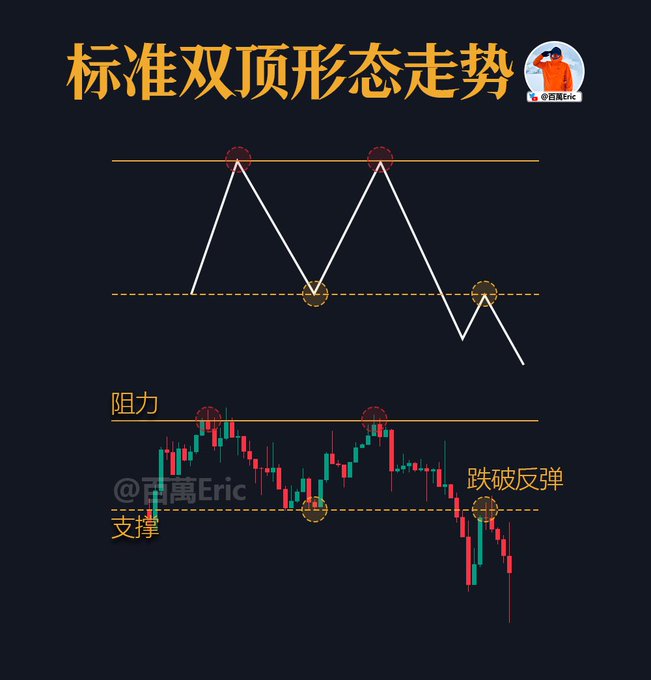

In a high-level market, the Double Top pattern is the most common peak signal: two similar high points, with a pullback in between, reflecting that the bulls’ two attempts to break through have failed and the bullish force is fading. But the real key to a Double Top is not whether the "shape looks similar", but whether the neckline is broken. Only when the price effectively breaks through the neckline and the rebound is unable to recover, does it mean that the bearish trend is truly established. Therefore, don't rush into the market when you see a Double Top. The most reasonable strategy is to wait for the neckline to be effectively broken, then look for a pullback to confirm. This not only conforms to the trend logic, but also keeps risk within a reasonable range. To put it more simply: the value of a Double Top does not lie in the two high points, but in "breaking through the neckline + retracement confirmation."

This article is machine translated

Show original

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content