MYX Finance (MYX) has responded to fresh concerns from Bubblemaps, alleging that the platform may have carried out the 'largest Sybil Airdrop in history.'

The decentralized exchange released a statement emphasizing its commitment to fairness and transparency. It also addressed questions surrounding wallet operations and the participation model involved in the Token distribution.

MYX Finance Faces Criticism Over Alleged Airdrop Manipulation

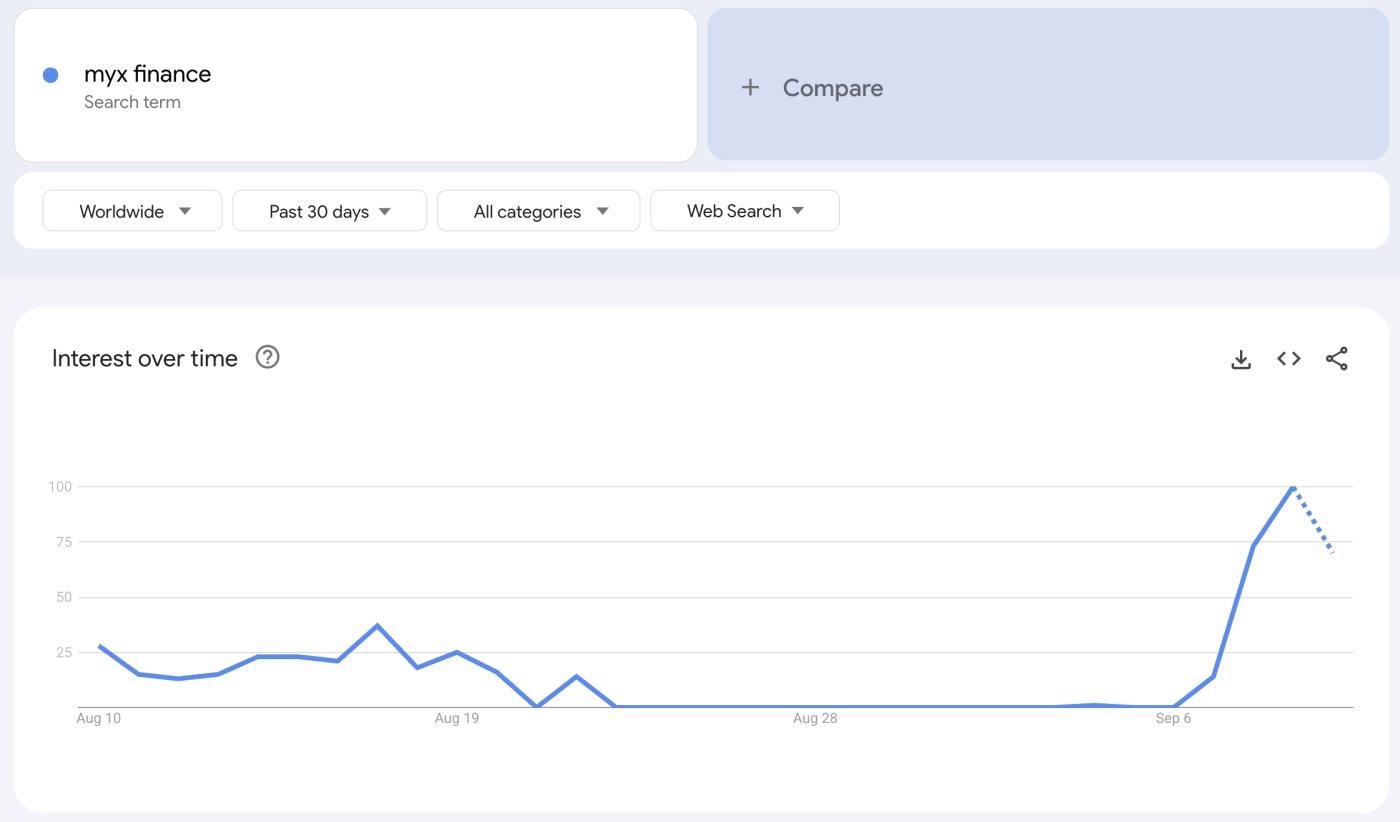

MYX Finance has been in the spotlight recently thanks to the MYX Token price surge . In fact, data from Google Trends shows that search interest for 'MYX Finance' spiked to a maximum score of 100 yesterday, signaling increased public attention. At the time of writing, that score has dropped to 70.

Retail investor interest in MYX Finance. Source: Google Trends

Retail investor interest in MYX Finance. Source: Google TrendsThis surge in interest has also been accompanied by growing criticism . Market observers have expressed concern about MYX’s rapid price rise . Some have accused the platform of manipulation, and others have predicted its collapse, similar to what happened with MANTRA (OM) .

Now, in a detailed chain on X (formerly Twitter), Bubblemaps, a blockchain analytics platform, has detected suspicious activity related to Token Airdrop .

“Everyone is talking about MYX hitting $17B FDV. 20x increase in less than 48 hours. But we noticed something unusual. Something no one is talking about,” the platform wrote .

To clarify, the MYX Token was launched in early May through Binance Wallet’s 15th Exclusive Token Generation Event (TGE). Bubblemaps revealed that nearly 100 wallets were funded through the OKX cryptocurrency exchange about a month before the Airdrop took place.

According to their report, each address received an equivalent amount of BNB during the same trading time frame on April 19, around 6:50 AM. These addresses then qualified for the Airdrop distribution . They received around 9.8 million MYX — around 1% of the total supply.

The platform added that most of these wallets made their requests around 5:30 a.m. on May 7. Given the lack of prior activity and the nearly identical funding and request patterns, Bubblemaps believes this concentration is unlikely to be coincidental.

“Is this the biggest sybil Airdrop ever?” Bubblemaps asked.

MYX Finance has responded to Bubblemaps’ allegations. The platform clarified that, aside from the ‘Cambrian’ campaign — which implemented anti-Sybil measures to curb bot activity — all other Airdrop rewards are distributed based on real user volume and LP (LP) contributions.

MYX acknowledged the pre-launch address change requests from high-volume participants. However, they stressed that their policy is not to restrict such actions in order to encourage user participation.

“Looking forward, in campaign designs that involve user growth incentives or may impact the interests of other users, we will place greater emphasis on preventing sybil attacks. However, in our trading and LP incentive programs, we will continue to maintain an open and inclusive approach, encouraging more users to actively engage with MYX,” the post reads .

Despite MYX’s defense, skepticism persists. Bubblemaps dismissed MYX Finance’s explanation as a “long, vague response from GPT.” The analytics platform argued that the response only added to the doubts surrounding the Airdrop rather than alleviating concerns.

“MYX founder did a sybil Airdrop with 100 wallets and made sure the allocation to each address was inflated. The total allocation is now worth $170 million but the sad thing is he can’t completely exit his position because he is definitely in a deal with the mms and vcs behind the MYX price surge,” another market observer added .

At this time, MYX has not provided further details to refute Bubblemaps’ findings. The situation is ongoing, with potential implications for MYX’s reputation and the broader DeFi sector. Stakeholders are awaiting further data or regulatory responses to clarify the extent of the alleged manipulation and its impact on the market.