This article is machine translated

Show original

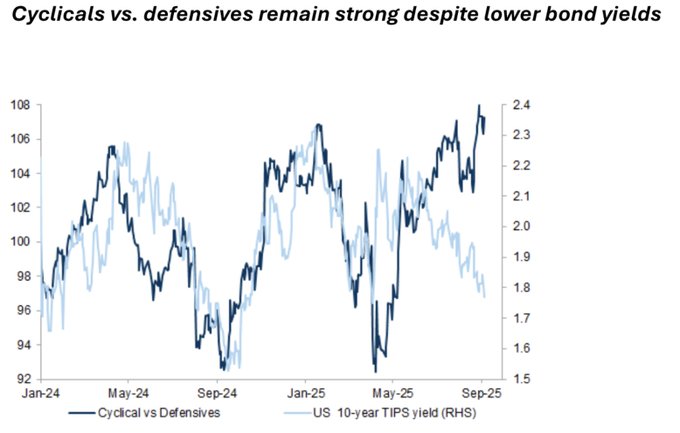

Reasons for the recent divergence between interest rate and stock market signals: Paradoxical phenomenon: The S&P 500 hit a record high, but interest rate markets are pricing in more Federal Reserve rate cuts, and the 10-year Treasury yield continues to decline.

Potential risks: If the rate cut is not accompanied by economic weakness, it may push up the term premium and steepen the yield curve; the residual tariff inflation may limit the room for rate cuts; if the 10-year yield falls below 4% driven by "rising recession risks", the stock market will come under pressure.

The market has lowered its US growth forecasts, shifting from "growth concerns" to "betting on a Fed shift." Weak data can still support risky assets (assuming it doesn't trigger recession fears).

Baseline scenario: "soft growth without a recession" for the next few quarters, which is positive for risky assets, but protection tools are needed for "rising recession fears."

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content