After the Federal Reserve meeting, the probability of a market correction is extremely high, so it is recommended to lock in existing profits first.

Written by arndxt

Compiled by Saoirse, Foresight News

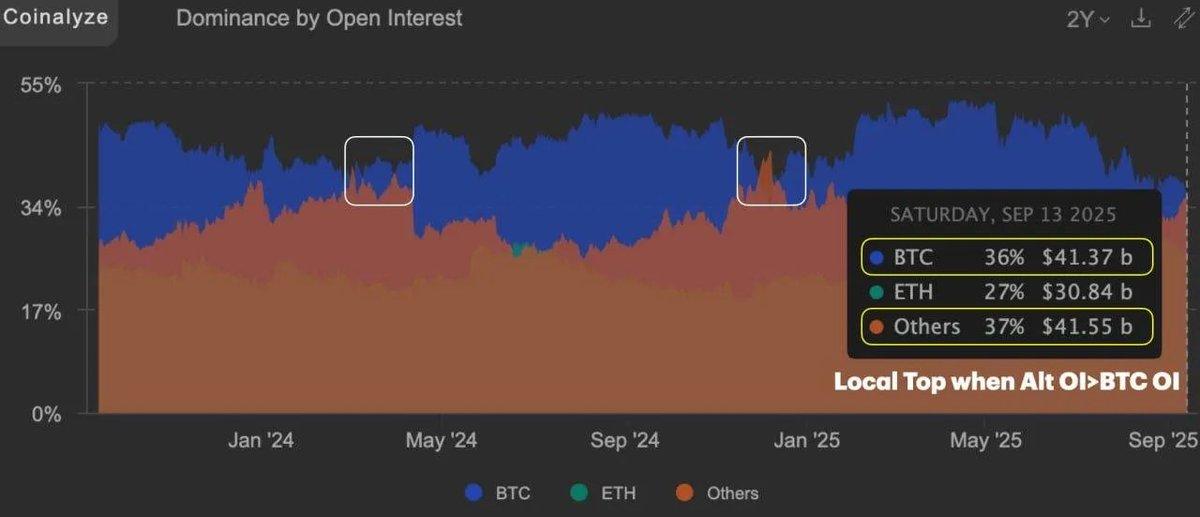

Editor's Note: The market is at a delicate turning point. The author argues that the uncanny balance of assets rising despite high interest rates is about to break. The author specifically points out that open interest in altcoins has surpassed Bitcoin for the first time. This trend has previously occurred at local tops, signaling a historical peak. Furthermore, there is an 88% probability of a correction following the Fed meeting, significantly skewing the risk-reward ratio. Based on this, the author recommends locking in gains at this time, perhaps the best strategy to avoid a correction. Investors should remain vigilant and adjust their investment strategies promptly.

The current trend is nearing its end.

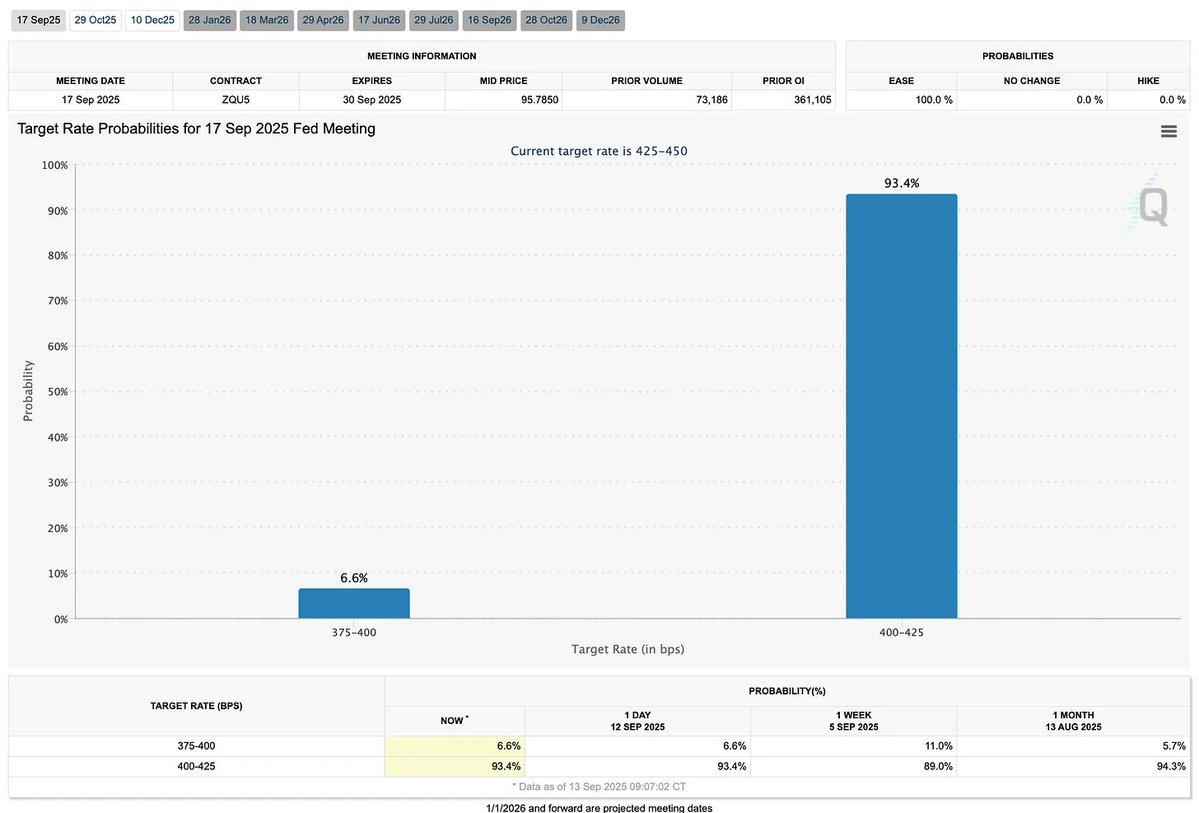

Our research models suggest the market is nearing a trend reversal. The risk-reward balance is clearly out of whack: the probability of a market correction following the Federal Open Market Committee (FOMC) meeting is extremely high.

It is recommended to lock in existing profits before the last wave of market arrives.

Image credit: @RamboJackson5

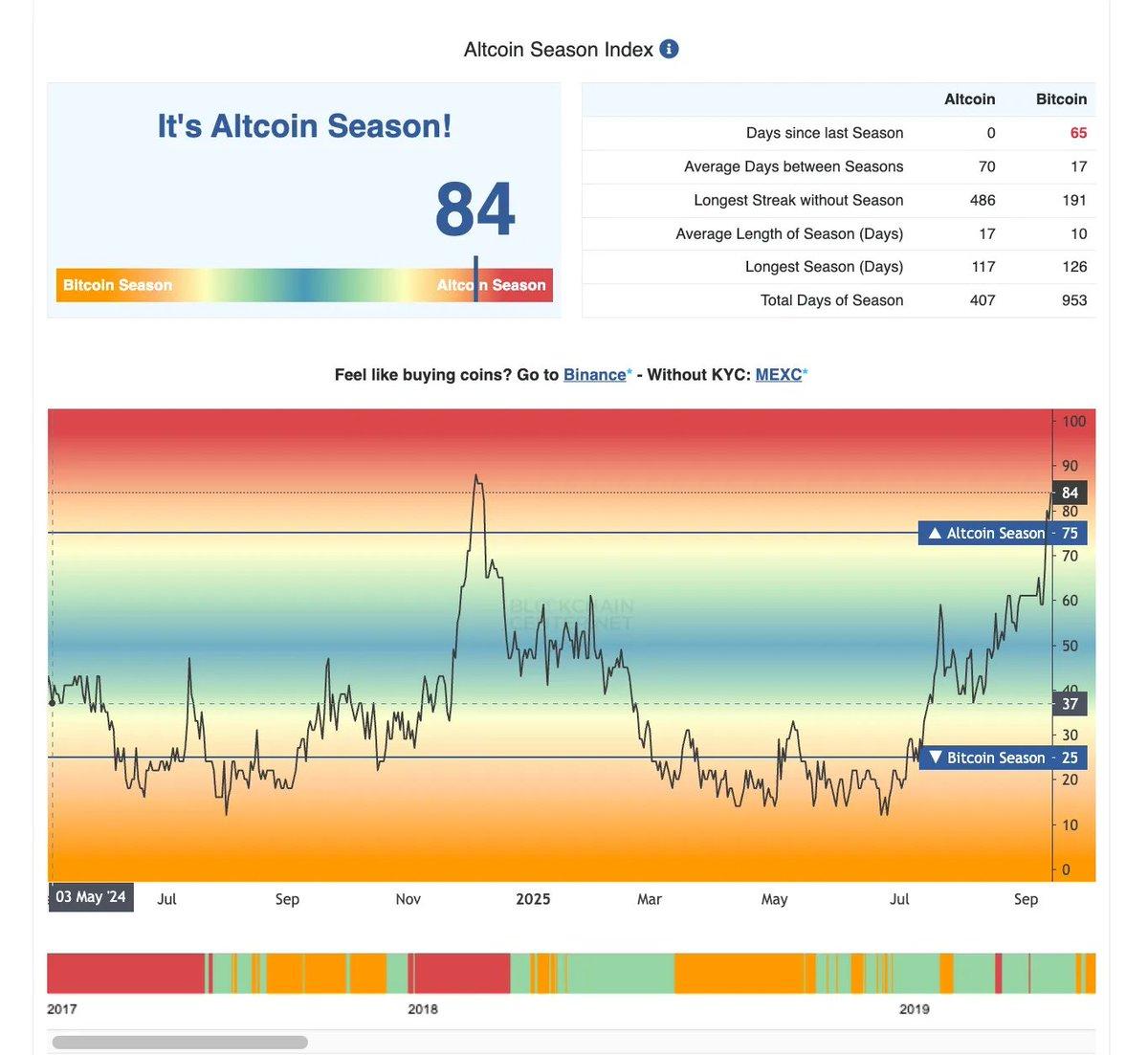

For the first time since December, open interest in alternative investments (cryptocurrencies other than Bitcoin) has surpassed Bitcoin; the last two times this occurred coincided with local market tops.

Today, perhaps only 1% of market participants can feel the true market frenzy. For everyone else, the real winners will be those investors who, during periods of liquidity tightening, position themselves around assets that continue to attract market attention.

The core characteristics of the current market are: selective concentration of liquidity, a generally bearish macroeconomic environment, and the continued depreciation of fiat currencies. Even in this unfavorable environment, asset prices continue to rise against the trend.

The biggest difference between this cycle and previous ones is that the 2021 market cycle was driven by liquidity - at that time, credit costs were low, liquidity was abundant, and risky assets benefited from the loose environment.

The market in 2025 is completely different: interest rates are currently high and liquidity is tight, but risky assets (Bitcoin, stocks, and even gold) are still gradually rising.

Why does this contradiction arise? The core driving force is the devaluation of fiat currencies - investors are hedging the risk of cash devaluation by allocating assets.

This trend has completely changed the market's rhythm: the previous risk-on market, characterized by widespread gains, is being replaced by a structural market characterized by a concentration of funds in high-quality, resilient assets. Market logic has shifted from a blind pursuit of all assets to one characterized by precise timing, patience, and discipline.

Ultimately, the devaluation of fiat currency itself is the key. Investors now allocate assets not only to pursue income growth, but also to avoid the risk of cash devaluation.

- 2021: Liquidity expansion drives growth → Risk assets outperform;

- 2025: Growth driven by devaluation of fiat currencies → Strong performance of hard assets (gold, commodities, etc.) and high-quality stocks.

This shift in market logic has significantly increased the difficulty of investing—you can no longer rely on an environment of "flooding capital and opportunities everywhere." However, for investors who can adapt to the new logic, it also means clearer structural opportunities.

Liquidity Reality Check

Despite numerous bullish market signals (Bitcoin's declining market share, open interest in alternative investments exceeding Bitcoin, and a rotation into CEX tokens), overall liquidity remains scarce. Over the past few years, the "leek-cutting" projects spawned by meme coins and celebrity-backed token launches have left many investors suffering from "investment post-traumatic stress disorder (PTSD)."

Image credit: @JukovCrypto

Affected by "investment PTSD", many traders are keen to chase "newly launched popular projects" in search of short-term excitement, but rarely provide sustained financial support for real project developers.

As a result, market liquidity is continuously concentrating on “assets with high market capitalization and loyal communities” - such assets can continue to attract market attention and capital inflows.

The Federal Reserve and the Bond Market

The bond market has already priced in the expectation of a "market downturn." According to FedWatch data, the market believes the probability of a 25 basis point rate cut by the Federal Reserve is approximately 88%, and the probability of a 50 basis point cut is only 12%. It is important to note that:

- According to historical data, the first 50 basis point interest rate cut is usually regarded as a signal of economic recession, which often leads to the market falling into a state of "slow bleeding";

- The "first interest rate cut of 25 basis points" is more interpreted as a signal of a "soft landing of the economy", which will support economic growth.

The market is currently at a critical turning point. Combined with seasonal indicators, the risk of rising market volatility following the Federal Open Market Committee meeting has gradually emerged.

Core Conclusion

"Sustained stability" is better than "short-term speculation";

Patience trumps FOMO (fear of missing out).

"Precise timing" is better than "pursuing Alpha (excess returns)".

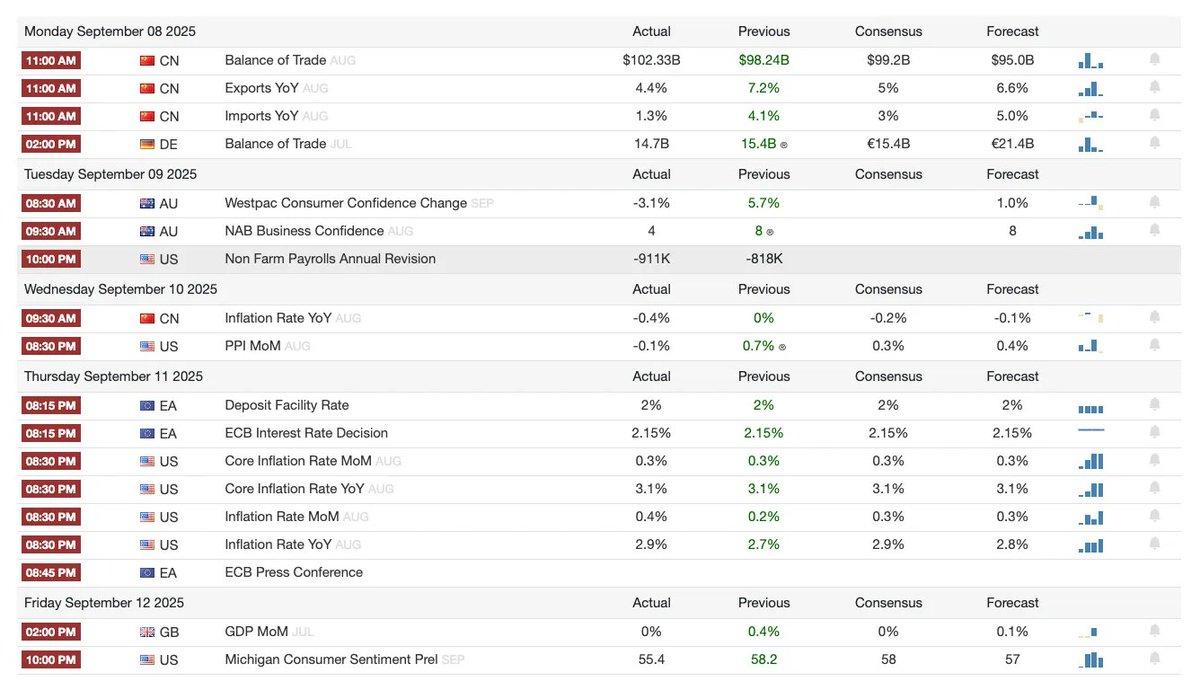

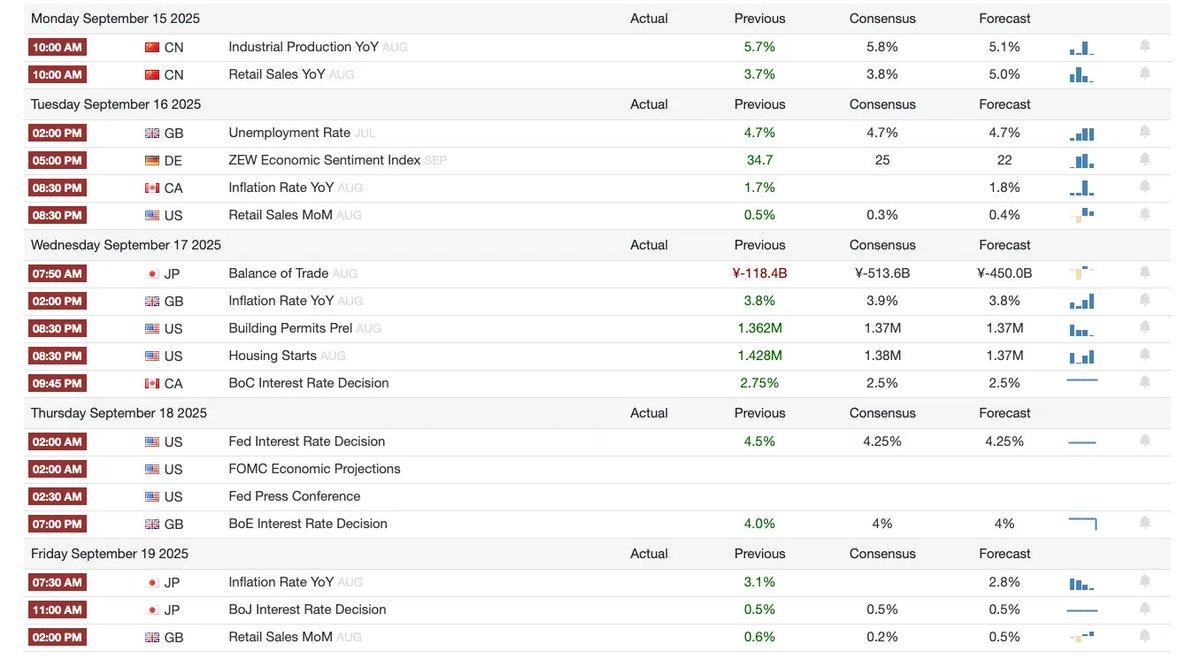

The following detailed analysis will be conducted from the perspectives of macro event outlook, Bitcoin heat index, market overview review, and interpretation of core economic data. The data is as of September 14, 2025.

Macroeconomic Event Outlook

Last Week Review

Next week's preview

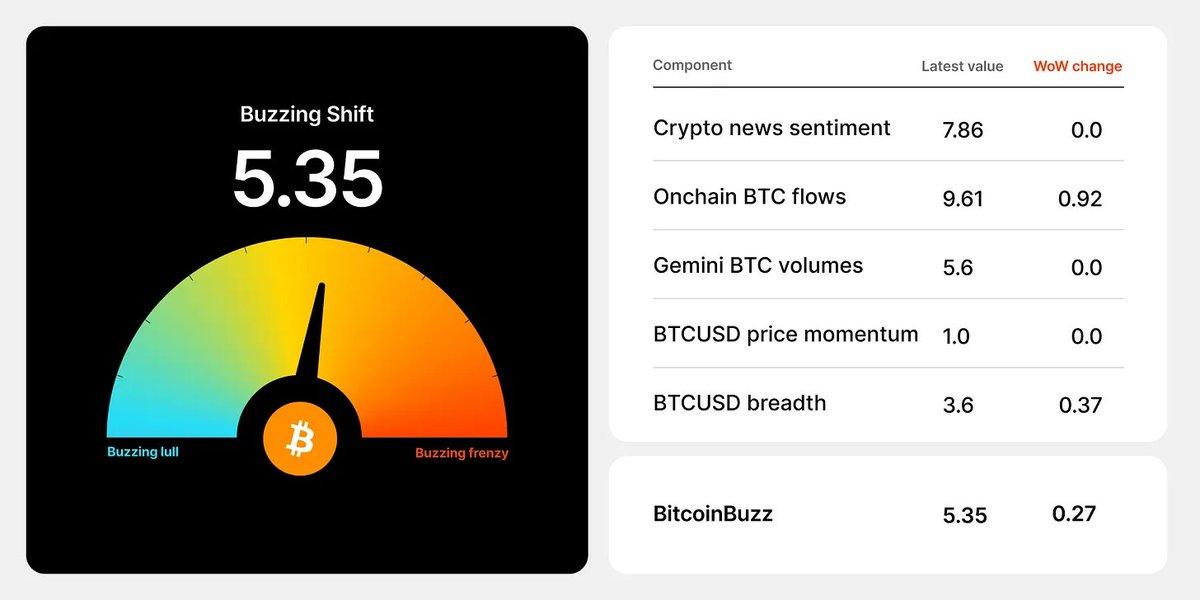

Bitcoin Heat Index

Market Panorama Review

- Dogecoin ETF Milestone: The DOJE ETF, jointly launched by REX Shares and Osprey Funds, became the first US fund to directly track the price of Dogecoin. This event marks a certain degree of recognition for the "meme coin" in traditional financial markets. However, due to the lack of practical application scenarios for Dogecoin, its demand is expected to remain primarily among retail investors.

- The Chicago Board Options Exchange (Cboe) Perpetual Futures Program: Proposed Bitcoin and Ethereum futures contracts with maturities up to 10 years, using a daily cash settlement mechanism, are expected to reduce investor rollover costs, enrich institutional investors' derivatives strategies, and enhance market liquidity.

- Ant Digital Asset Tokenization: Ant Digital has linked $8.4 billion in renewable energy assets to AntChain, enabling real-time production data tracking and automated revenue distribution. This institution-first model highlights the value of blockchain technology in large-scale infrastructure financing.

- Forward Industries' Solana Treasury: A $1.65 billion private equity investment (PIPE) led by Galaxy and Jump Crypto establishes Forward Industries as a core institutional investor in the Solana ecosystem. This marks the first large-scale institutional investment in crypto assets beyond Bitcoin and Ethereum, and is expected to reshape Solana's capital market narrative.

Interpretation of core economic data

Core revelation for ordinary users

- The job market is tightening: employment opportunities in traditional industries are decreasing. It is recommended to shift to areas with stronger risk resistance such as medical care and services through skill improvement.

- Purchasing power will improve in the short term, but risks remain: Current wage purchasing power has increased, but tariff-driven inflation may quickly erode this benefit, so it is recommended to be cautious when making large purchases.

- Debt relief opportunities are approaching: If interest rates fall, debt pressure may be alleviated, but current household financial pressures are continuing to rise. It is recommended to maintain a conservative budget and prepare for debt refinancing.

- Increased investment volatility: Interest rate cuts may boost the market in the short term, but inflation risks may lead to a rapid loss of returns, so we need to be wary of volatility risks.

Labor market dynamics

- The number of newly created jobs continues to decline → competition for jobs is intensifying, especially for low-skilled jobs;

- There is a significant differentiation among industries: demand remains strong in the healthcare (+46,800 jobs) and hotel services (+28,000 jobs); however, hiring activity in the manufacturing, construction, and business services sectors has slowed significantly.

- Employment growth slows significantly: new jobs fall from 868,000 in the fourth quarter of 2024 to 491,000 in the first quarter of 2025 and 107,000 in the second quarter; only 22,000 new jobs are added in August 2025, nearly stagnating.

- Reasons behind industry differentiation: Tariff pressure, investment uncertainty, and immigration policy restrictions on labor supply have led to the contraction of cyclical industries (manufacturing, construction, etc.).

Wage and labor force participation trends

- Wages grew by 3.7% year-on-year: While slower than previously, this growth rate was still above the inflation rate, indicating a slight increase in real purchasing power – a rare positive sign in the current economic environment.

- Be wary of tariff inflation risks: If tariffs lead to higher commodity prices, the increased purchasing power brought about by wage growth may quickly disappear;

- Revenue growth: 3.7% year-on-year, the lowest level since mid-2021. While this has eased the pressure of the "wage-inflation spiral," it is still higher than inflation, which is a net positive for consumer purchasing power.

- Labor market structure: The labor force participation rate has risen slowly, but the unemployment rate has risen to 4.3% (the highest since 2021). Employment pressure is mainly concentrated in the low-skilled labor force, while employment of high-skilled and highly educated groups remains stable.

Macroeconomic impact

- The window for interest rate cuts is approaching: If the Federal Reserve cuts interest rates as expected, financing costs for mortgages, consumer loans, credit cards, etc. are expected to fall;

- Household debt pressure is rising: Default rates for credit cards, auto loans, and student loans continue to climb. If you are facing debt pressure, it is recommended to plan ahead – the refinancing environment may improve later this year.

- Bond market dynamics: The 10-year US Treasury yield fell to 4.1% (the lowest in 10 months), reflecting that the market has already priced in the expectation of "economic slowdown + Fed rate cuts";

- Federal Reserve Policy Outlook: Futures markets indicate a 90% probability of a September rate cut, with two to three rate cuts expected before the end of the year. Despite persistent inflation, the market is betting on an aggressive easing policy from the Fed.

- Financial pressures are diverging: the household sector faces the dual pressures of rising credit defaults and the resumption of student loan repayments, while the financing environment for the corporate sector remains loose.

Strategic Implications

- The economy is showing a "divided pattern": institutions (enterprises and financial markets) enjoy a loose financing environment, while households face increasing financial pressure;

- The policy is caught in a dilemma: if the Fed cuts interest rates, it could exacerbate inflation; but if it doesn't, the pressure of slowing employment and rising debt defaults will intensify.

- Investment layout suggestions:

- Risk-resistant sectors: healthcare and hotel services – benefiting from demographics and experiential consumption needs;

- High-risk areas: Trade-sensitive industries (manufacturing, construction) – significantly affected by tariffs and labor supply bottlenecks;

- Summary of the macro environment: Expectations of interest rate cuts and a slowing labor market may drive a rebound in asset prices, but inflation risks will lead to "asymmetric fluctuations" in assets such as stocks, credit, and commodities.

Eurozone Policy Outlook

- Inflation: Although it has fallen significantly from its 2022 peak, it remains above target and is showing signs of a plateau, limiting the European Central Bank's (ECB) room for easing.

- Policy divergence risk: The Federal Reserve leans toward easing due to "slowing employment," while the European Central Bank remains cautious due to "sticky inflation" - this divergence could exacerbate volatility in the euro against the US dollar;

- Investor perspective:

- Interest rates: The ECB has limited room to cut interest rates, and eurozone bond yields are likely to remain relatively high;

- Equities: Declining service sector inflation is positive for corporate earnings, but cost shocks from global tariffs could squeeze profit margins.

- Macroeconomic risks: Economic growth momentum is weak, but the ECB is unlikely to ease, potentially leading to a period of "mild stagflation";

- ECB stance: Current inflation remains above the 2% target, the probability of a September rate cut is low, and uncertainty remains about whether a rate cut will take place in December.

- Market expectations: Futures markets indicate a roughly 50% probability of a rate cut before the end of the year. While the market is leaning toward easing expectations, the ECB remains cautious in its signals.

- Christine Lagarde (President of the European Central Bank) stated that she would adopt a "wait-and-see strategy" and tend to maintain the current interest rate and avoid premature easing.

Global linkage impact

- Tariff spillover risk: US tariff increases could push up input costs through global supply chains, which ECB officials (Eric Schnabel) have identified as an "upside risk" to eurozone inflation.

- Transmission mechanism: Even if domestic demand in the euro area is weak, "imported inflation (high-cost imports)" may still limit the ECB's policy flexibility.

China Market Focus

China is currently adopting a "dual-track strategy": at the political level, it responds to external shocks by strengthening cooperation with India; at the economic level, it alleviates economic vulnerabilities by injecting liquidity and guiding market expectations.

- Core Logic: Hoping to make up for the shortcomings of economic growth through leading position in technology;

- Potential risks: If the real economy continues to stagnate and the market is maintained at a high level solely by liquidity support, it may lead to structural fragility beneath the surface prosperity.

Tariff impact

- Data from China International Capital Corporation (CICC) shows that Chinese exporters only bear 9% of US tariff costs, far lower than the proportion borne by European and Southeast Asian companies.

- The underlying implication: US importers are currently absorbing the tariff costs themselves, squeezing their own profit margins. This model is unsustainable – ultimately, US consumers will face rising prices, further exacerbating inflation risks.

- China's export pressure: China's exports to the United States continue to decline, and factory idleness rates are rising, which may create potential pressure on domestic stability. This vulnerability, although not obvious, has a critical impact.

Reshaping the geopolitical landscape

- The US's "China containment" strategy suffered a setback: the US imposed a 50% tariff on India for importing Russian oil, weakening the "China containment" alliance it had built;

- China's strategic response: quickly seized on this rift and facilitated the first trilateral talks between India and Russia in many years in Beijing;

- Key Insight: If China and India deepen their cooperation, the US-led Quadrilateral Security Dialogue (Quad, which includes the US, Japan, Australia, and India) may face the risk of strategic hollowing out.

The “safety valve” role of the capital market

- The divergence between the market and the economy: Despite weak economic fundamentals in China, the stock market hit a 10-year high – this rise was not driven by corporate profits, but by "liquidity injection" and "the transfer of $22 trillion in household savings from deposits (yielding about 1%) to the stock market";

- Attractiveness: The 10-year Treasury bond yield is only 1.7%, making stocks structurally attractive in terms of "relative returns." Meanwhile, global investors are also chasing China's technological strengths.

- Core insight: The current market optimism is a bet on "loose liquidity + technical narrative" rather than confidence in the recovery of the real economy.

Macro risk warning

- Bubble risk: If the real economy fails to achieve a genuine recovery, the current stock market rally could turn into another round of "liquidity-driven bubble";

- Increased policy dependence: If exports continue to decline and consumer demand weakens, China may need to further increase monetary easing and use more capital market regulatory measures to maintain market stability.