AVNT (Avantis) nearly doubled in a single day and was listed on Upbit, Bithumb and Binance exchanges.

By Nicky, Foresight News

On September 15, 2025, AVNT, the native token of Avantis, the Base ecosystem derivatives protocol, officially launched on South Korean exchanges Upbit, Bithumb, and Binance. Previously, the token was listed on platforms such as Binance Alpha, Coinbase, Bitget, and Bybit on September 10. AVNT's price nearly doubled within 24 hours, attracting market attention.

From 0 to Base: The Largest Derivatives Agreement: Avantis' Two-Year Accumulation

Avantis is a decentralized derivatives protocol based on the Base chain, focusing on perpetual contracts (Perpetuals) trading. It supports synthetic derivatives trading of assets such as cryptocurrencies, foreign exchange (FX), commodities (gold, crude oil, etc.) and US stock indices, with a maximum leverage of up to 500 times.

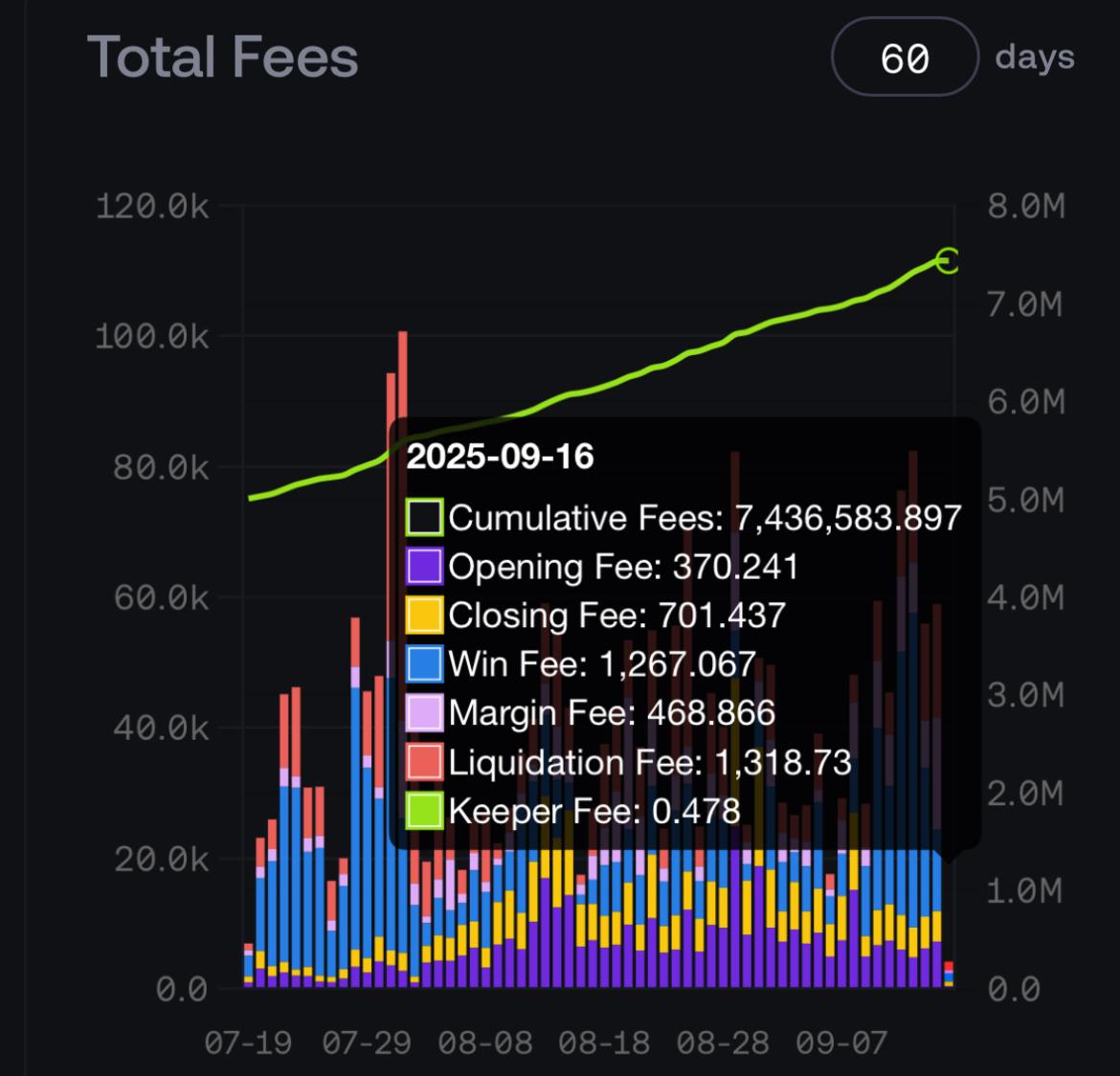

Since the mainnet was launched in February 2024, its cumulative trading volume has exceeded US$22 billion, its annualized trading volume has exceeded US$60 billion, it has served more than 41,000 traders, the number of liquidity providers (LPs) has exceeded 25,000, the open interest has reached US$25 million, and the accumulated transaction fees have exceeded US$7.4 million.

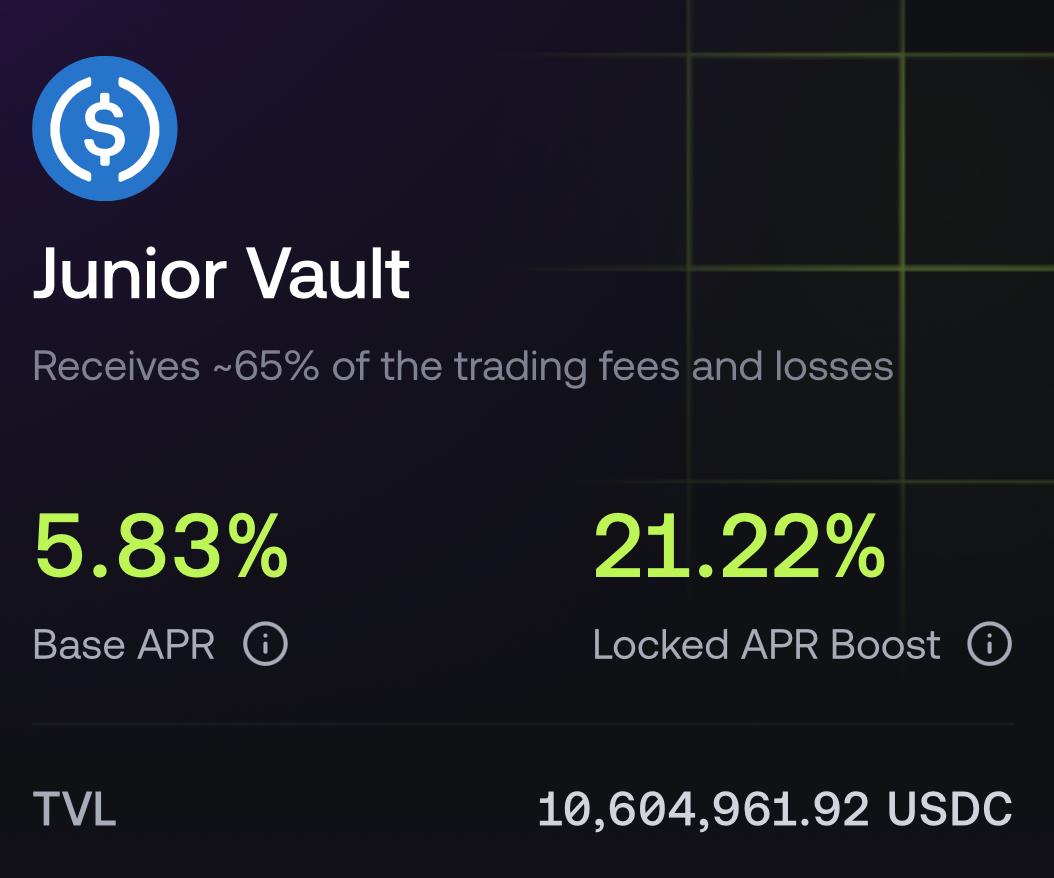

Currently, the platform's 24-hour trading volume has reached US$169 million, with a total locked value (TVL) of US$16.75 million, of which the TVL of the Junior Tranche (LP pool that bears 65% of the losses) and the Senior Tranche (LP pool that bears 35% of the losses) are US$10.6 million and US$6.14 million respectively.

Behind these figures lies Avantis's exploration of a "universal leverage layer." Through innovative features like "Zero-Fee Perpetual Swaps" and "Loss Rebates," the platform reduces the costs of high-frequency trading while providing loss protection for limited partners (by hedging public positions, the platform promises long-term positive returns for LPs).

The protocol uses a unique risk stratification model, allowing liquidity providers to choose pools with different risk levels. The primary pool assumes up to 65% of the risk of losses and shares 65% of the commission income; the advanced pool assumes up to 35% of the risk of losses and shares 35% of the commission income.

The current annualized yield for Junior and Senior Vaults is approximately 20% (locked for 180 days), and additional XP subsidies are provided to attract long-term participation.

Team and Financing

Avantis is developed and operated by Lumena Labs. Its core team comprises veterans in DeFi, finance, and technology. Co-founder and CEO Harsehaj Singh previously led consumer infrastructure and DeFi investments at Pantera Capital and is a graduate of the Haas School of Business at the University of California, Berkeley. Co-founder and CTO Brank D. has full-stack development experience building trading systems and has led technical architectures for hundreds of thousands of users and billions of dollars in assets under management.

Other team members come from institutions such as McKinsey, Lazard, and Barclays, focusing on on-chain consumer product innovation, and have accumulated rich experience in leveraged trading, risk infrastructure, and real-world assets (RWA).

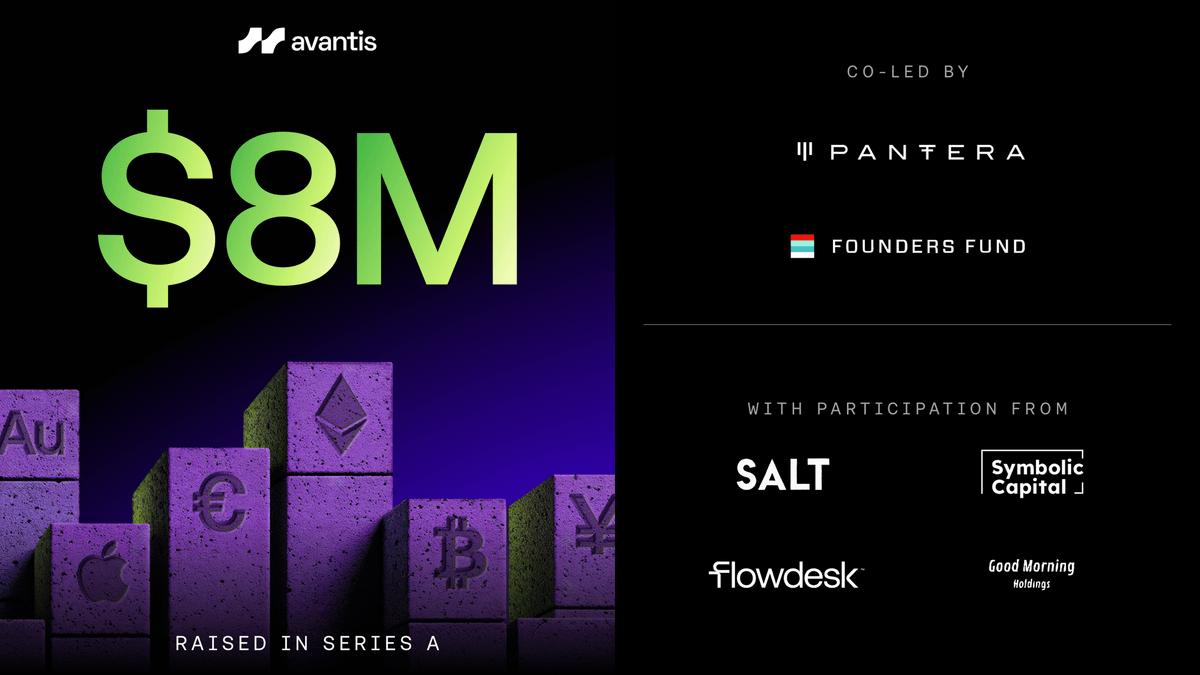

Avantis has enjoyed sustained institutional support for its growth. In September 2023, the project secured $4 million in seed funding, led by Pantera Capital, with participation from Founders Fund, Galaxy Digital, and Base Ecosystem Fund. In June 2025, it secured an additional $8 million in Series A funding, co-led by Pantera Capital and Peter Thiel's Founders Fund, with participation from Symbolic Capital and SALT Fund. The two rounds totaled $12 million, which will be primarily used for technology upgrades (such as expansion into asset classes like stocks and sports), the launch of a customized EVM-compatible chain to increase transaction speeds, and ecosystem development.

Token Economics and Distribution Mechanism

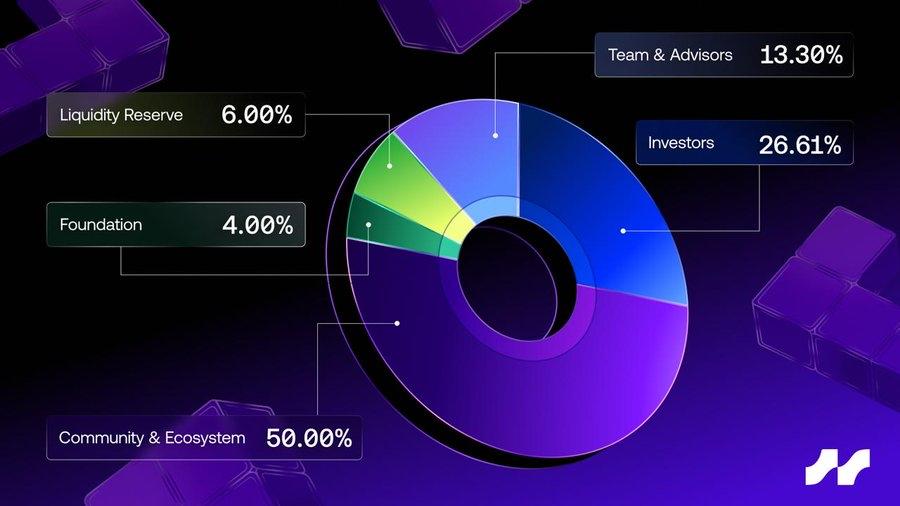

The total supply of AVNT tokens is 1 billion. The token economics design emphasizes community-first principles, with 50.1% of tokens allocated to the community and the remaining 49.9% to the team, investors, and the foundation.

Of the community allocation, 12.5% will be used for the first airdrop to reward users who have participated in protocol activities since February 2024; 28.6% will be used for on-chain incentives to reward liquidity providers, traders, and referrers through the XP season in the future; and 9% will be allocated to builders and ecosystem funding to support new front-ends and applications developed based on the Avantis SDK.

The team and advisors receive 13.3%, with a 12-month lockup period followed by a 30-month linear vesting cycle. Investors receive 26.61%, with the same long-term vesting schedule to ensure ecosystem stability. The foundation reserves 4% for strategic funding and 6% as a liquidity reserve for exchange marketing and market-making partnerships.

Market makers: Liquidity support from institutions such as Flowdesk

As a participant in the Series A funding round, Flowdesk is a key market maker partner within the Avantis ecosystem. Founded in 2020, the Paris-based digital asset trading firm is regulated by the French Financial Markets Authority (AMF). It provides liquidity services, over-the-counter trading, and fund management solutions. Its technology is deployed on Google Cloud for security and scalability, and its services cover CEXs, DEXs, and real-world asset liquidity. In March 2025, Flowdesk secured $102 million in funding (including $52 million in a hybrid equity/debt financing), led by HV Capital and others.

Ecosystem construction and technological development

While Avantis has achieved significant success on the Base Chain, it still faces technical optimization challenges. For example, due to the Base Chain's block production speed, the platform currently experiences delays in opening and closing positions, as well as occasional order failures. Zero-fee contracts have a profit cap (officially, this will be gradually eliminated as LP scale expands). The stop-loss and take-profit limit functions do not yet support ratio settings. Mobile app compatibility also needs improvement.

Avantis is building a developer ecosystem, providing an SDK toolkit to enable developers to access the deep liquidity on the Base chain. It has partnered with several projects, including Bankr (an AI agent that trades via tweets), Keyrock (an institutional market maker), Pyth (an oracle provider), and Nitrate (a Telegram trading bot).

The protocol plans a comprehensive technical upgrade, improving its automated market maker mechanism to support any type of price feed, including gold, crude oil, and sports odds. Furthermore, the project plans to launch a dedicated EVM-compatible blockchain, enabling fast and gas-free transactions.

These upgrades, which will be rolled out as Avantis v2 in the coming months, are expected to deliver a 10x improvement in capital efficiency, advanced trading capabilities, and cross-margin support for real-world asset markets.