Gold and the S&P 500 both hit All-Time-High today, while crypto market Capital fell slightly. This decoupling could be a bearish signal for the market going forward.

These two assets are typically inversely correlated, so the rise of both indicates a combination of caution and excitement. If crypto gets left behind by both of these trends, it could be difficult to regain momentum.

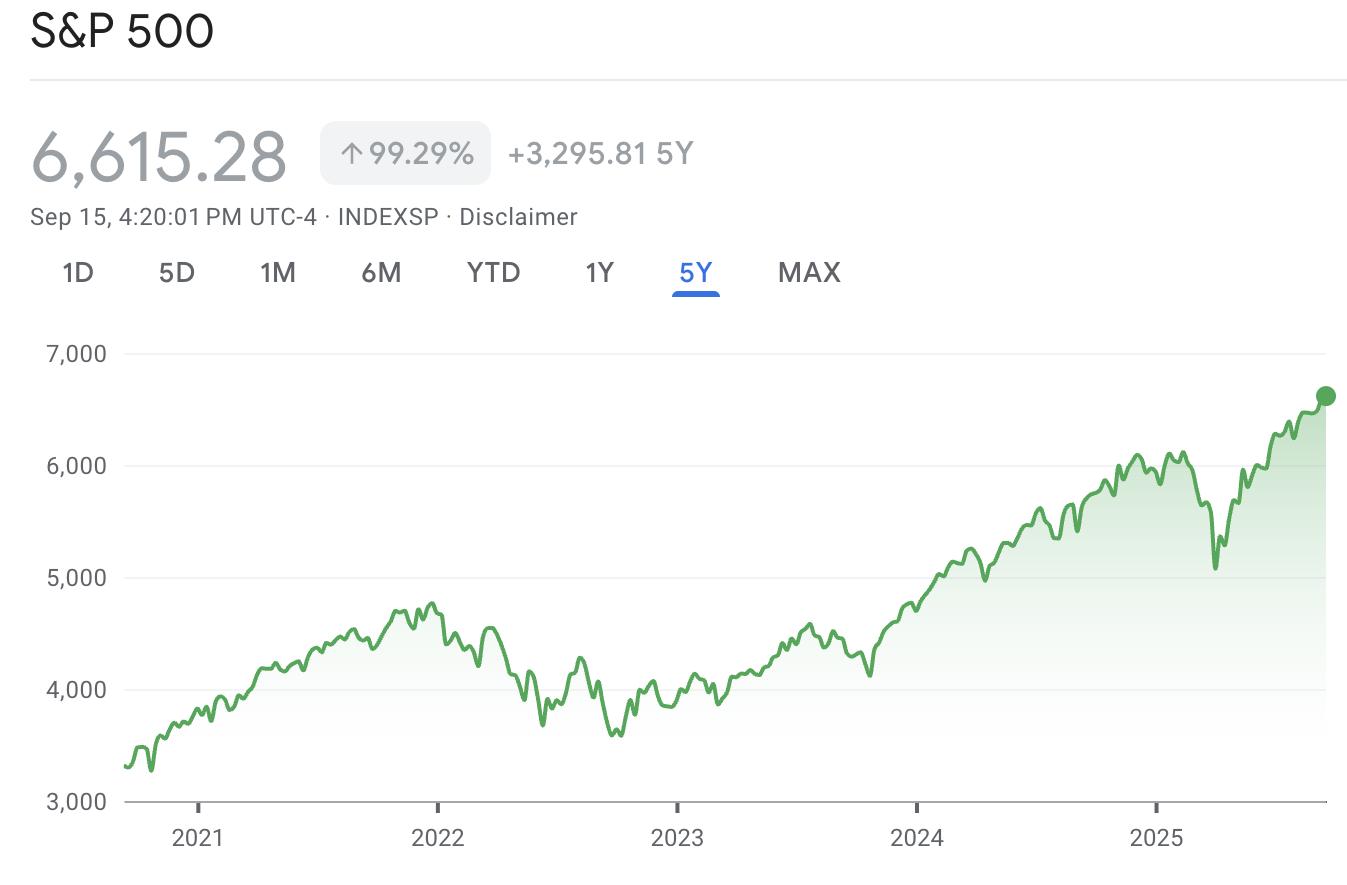

Gold and S&P 500 post big gains

Bitcoin is often referred to as “ digital gold ,” and these assets can intersect in interesting ways. Analysts have recently predicted that the current gold price rally could push crypto to new heights, and major companies are offering gold-crypto hybrid investment products .

However, the market today seems a bit worrying, as crypto is now decoupled from both the commodity and the traditional stock market. While gold and the S&P 500 have both hit All-Time-High, the market Capital of the crypto sector has actually declined.

S&P 500 price performance. Source: Google Finance

S&P 500 price performance. Source: Google FinanceSpecifically, gold and the S&P 500 are typically inversely correlated, so if both rise while crypto remains flat, it’s quite concerning. If both assets rise, it could signal a mix of optimism and concern in traditional financial markets.

What are the potential risks to cryptocurrencies?

There is one obvious reason for these conflicting emotions: the upcoming US interest rate cut . The next FOMC meeting is expected very soon, and the market is almost certain that a rate cut will happen. This could be a mixed blessing, bringing investment opportunities along with concerns about USD inflation.

This situation could therefore provide valuable insight into crypto market dynamics. Analysts have noted that the market may have priced in a rate cut . There has been ongoing speculation about whether crypto momentum will continue , but the movements in the S&P 500 and gold could suggest that we have reached a local top .

After all, why are gold and crypto decoupling if Bitcoin is a store of value ? Conversely, why is the Web3 market Capital stagnant while traditional finance is growing so much? Is the market exhausted by profit-taking? Are regulatory concerns the source of undervalued anxiety? It’s too early to tell.

Regardless, it is unusual for crypto to lag behind while gold and the S&P 500 are both rising. If this trend continues, it could signal a bearish turn for the industry.