The AVNT Token , owned by Avantis—a decentralized Futures Contract on the Base network—has continued to surge by double digits following an impressive launch.

Despite the strong performance, concerns have emerged about the integrity of the Token distribution. on-chain analytics platform Bubblemaps has revealed evidence of a sophisticated Sybil attack surrounding AVNT.

AVNT Volume Increases 280% After Listing on Major Exchange

BeInCrypto recently reported that AVNT’s arrival on the market is being supported by major exchanges. On Monday, the Token reached a major milestone with its listing on three of South Korea’s top exchanges, Upbit and Bithumb, as well as on Binance, the world’s largest cryptocurrency exchange .

The listing sparked a strong rally, pushing AVNT above $1 and hitting a new All-Time-High (ATH) of $1.54 yesterday. The rally has continued.

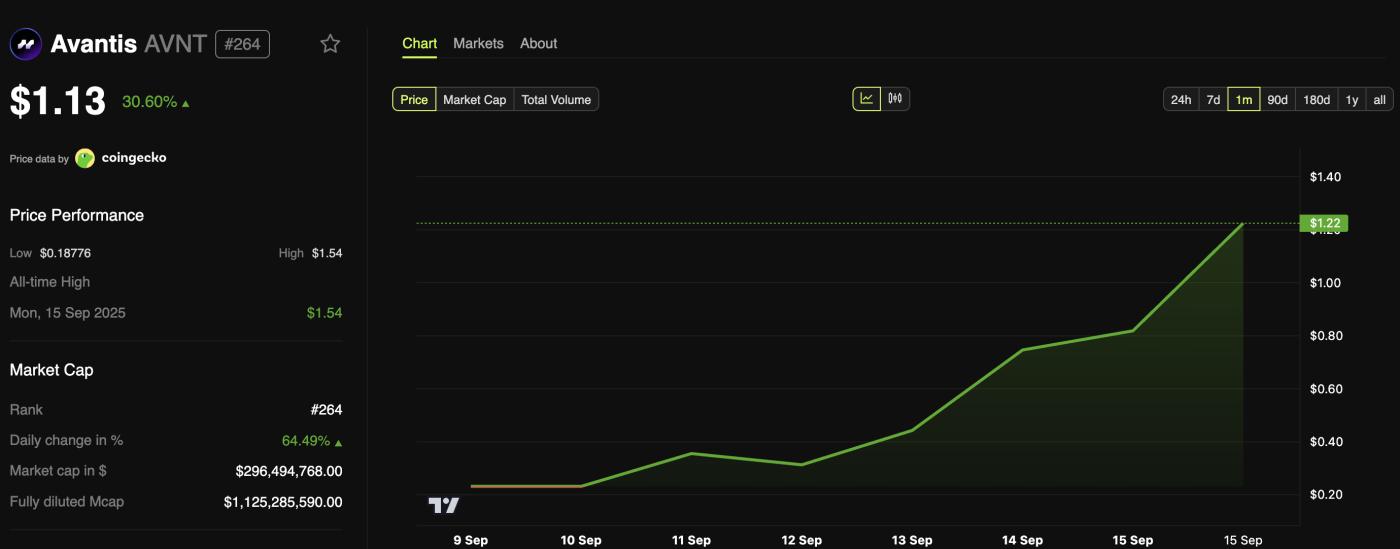

Data from BeInCrypto Markets shows that the Token has increased by 30.6% in the past 24 hours. At the time of writing, AVNT is trading at $1.13. Moreover, its market Capital has also increased from around $180 million to $296.5 million.

Avantis (AVNT) price performance. Source: BeInCrypto Markets

Avantis (AVNT) price performance. Source: BeInCrypto MarketsInvestors are also actively trading AVNT. Daily volume exceeded $2 billion, up 280.70% from the previous day. Korean traders account for the majority of liquidation, with about 29% of the volume on Upbit.

Avantis faces Sybil assault charges

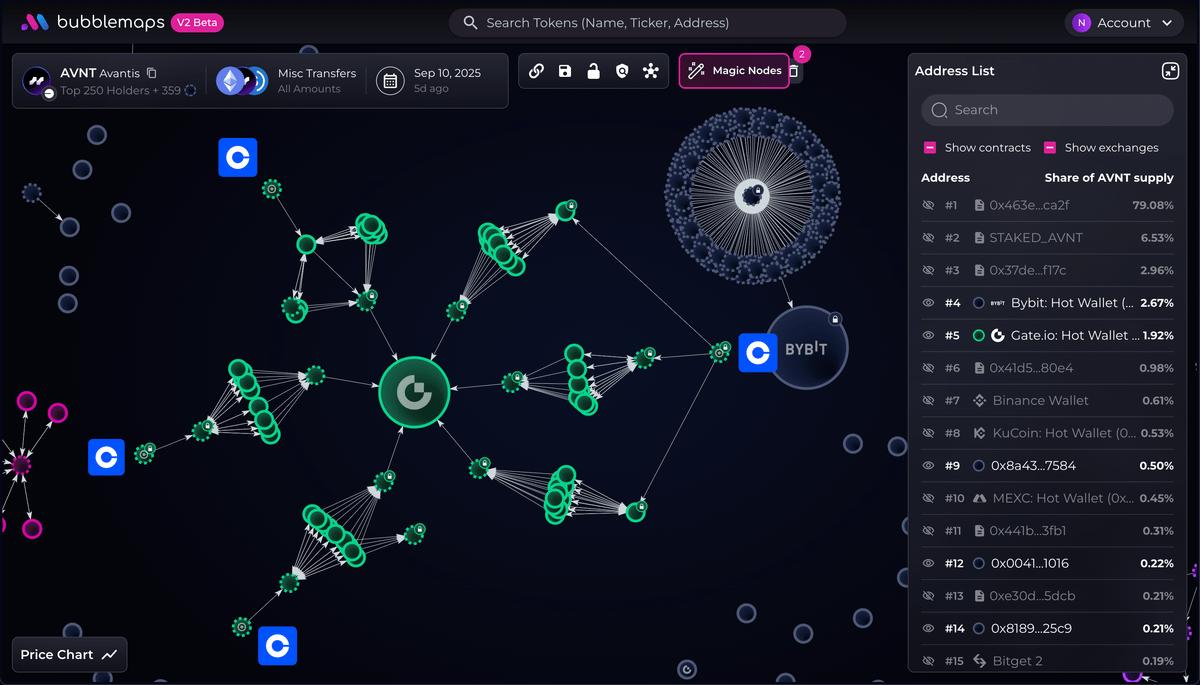

Despite the positive indicators, concerns have emerged about the integrity of the Airdrop. Bubblemaps’ investigation, detailed in a recent X chain , identified a coordinated Sybil attack involving more than 300 wallet addresses controlled by a single entity.

These addresses collected $4 million in AVNT Token , taking advantage of a distribution mechanism designed to incentivize genuine participation.

“AVNT made headlines last week after a 12.5% Airdrop . Some users received six figures – but one entity may have taken more,” Bubblemaps reported.

The article detailed several points of Sybil behavior among AVNT Airdrop recipients. The wallets involved were funded through Coinbase . Additionally, they received USDC transfers from a small cluster of sources.

These accounts then made transactions on Avantis and received AVNT Token through the Airdrop. The Token were then pooled into a few addresses.

Furthermore, addresses sent funds to centralized exchanges like Bybit and Gate in a synchronized move. This pattern strongly suggests that an organized group was driving this activity rather than actual individual users.

Avantis (AVNT) Transfer. Source: X/Bubblemaps

Avantis (AVNT) Transfer. Source: X/BubblemapsAccording to a blockchain analytics platform, these models are similar to the Airdrop of MYX Finance (MYX) . In MYX, inactive wallets are only activated to receive Token.

“The funding and Token receiving models match perfectly; this is clearly synergy,” Bubblemaps concluded.

Avantis has not issued an official response to these allegations as of press time. These claims are currently weighing the impressive growth of the Token against unresolved concerns about the fairness of its distribution. How Avantis handles these allegations could be Vai in shaping AVNT’s reputation and long-term direction.