Ethereum faces historic congestion, over 2.5 million ETH in unstake queue. Photo: CoinStats

Ethereum faces historic congestion, over 2.5 million ETH in unstake queue. Photo: CoinStats

Focus

2.5 million ETH awaiting withdrawal, pushing queue to record 46 days.

The source of the problem is Kiln "pulling the plug" after a series of security incidents, to take profits, restructure the portfolio and face security pressure.

Staking APR drops to 2.8%, driving Capital to move to Liquid Staking/ DeFi.

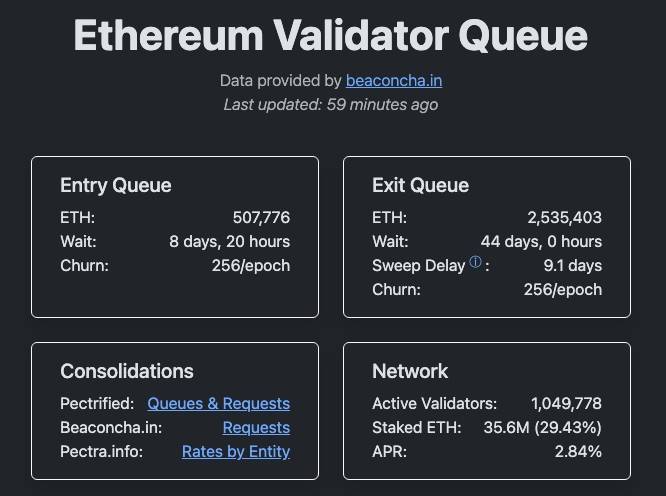

ETH withdrawal queue hits record high

- Ethereum is experiencing its largest congestion ever. As of mid-September, over 2.5 million ETH (~$11.3 billion) is waiting to exit validators .

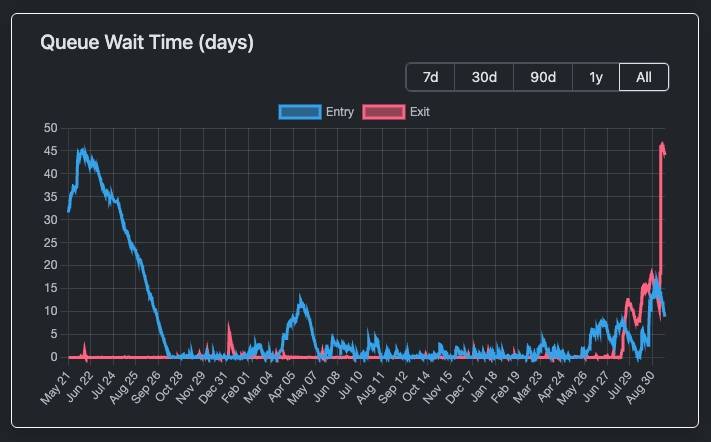

- This brings the unstake time to 44 days , the longest in Ethereum Staking history. For comparison, the peak in August only reached 18 days.

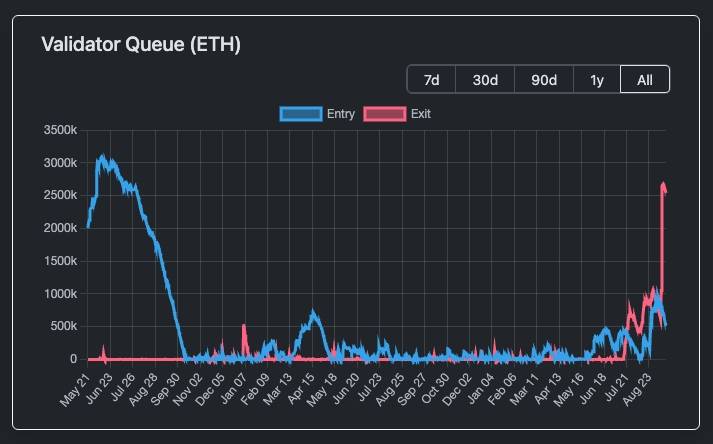

- The shock broke out on September 9, when Kiln - one of the major Staking infrastructure providers - decided to withdraw all validators. The cause came from a series of security incidents on the Ethereum ecosystem such as the NPM library attack and the SwissBorg hack .

- Kiln's action pushed about 1.6 million ETH into the queue at once. Although it did not directly affect Ethereum's Staking protocol, the move still caused some market turmoil.

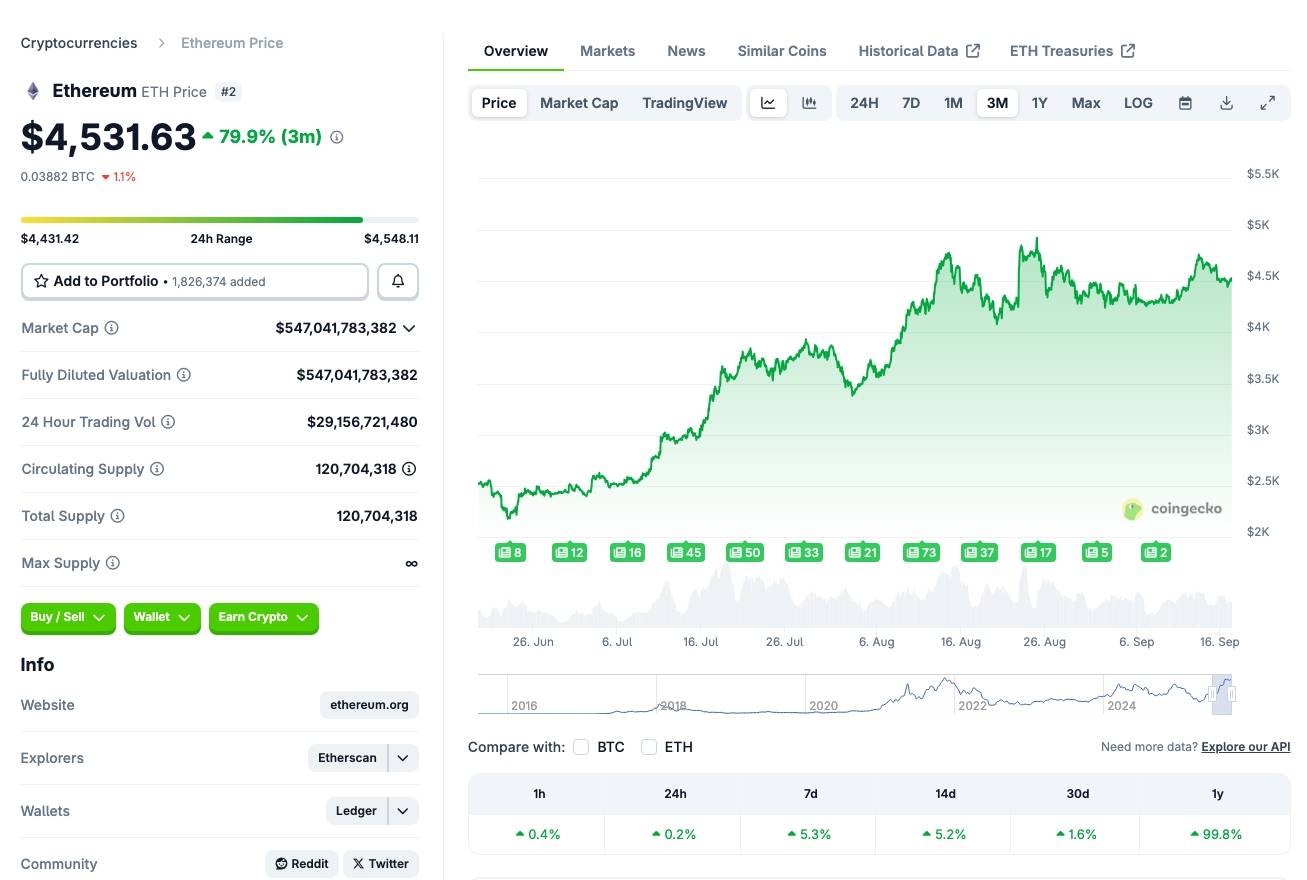

- According to analysis by Benjamin Thalman (Figment), this unstaking wave is not only due to security concerns, but also because ETH has increased by more than 160% since April, so profit-taking is inevitable. At the same time, large organizations have begun to restructure their portfolios, adjusting their exposure to ETH to balance risks and profits.

- The paradox is that while a huge amount of ETH is leaving the network, the number of new validators is still increasing steadily. The source may come from the SEC's statement in May that affirmed that Staking is not a security , creating more legal confidence; and the expectation of an Ethereum ETF that combines Staking also makes many funds ready to participate in a legal and regulated form.

Safety valve but causes blockage

- Ethereum has a technical mechanism called churn limit , which limits the number of validators that can enter/exit each epoch (~6.4 minutes). The current limit is 256 ETH/epoch, which helps the network stabilize against large fluctuations.

- However, this mechanism also causes the ETH withdrawal queue to be longer. With more than 2.6 million ETH in queue, stakers need to wait at least 44 days for the cooldown step. Not to mention the additional 9 days of "sweep delay" to actually withdraw ETH.

- Thalman warns that if 75% of the unstaken ETH (~2 million ETH) is re-deposited, this amount will flow to the new validator activation queue (entry queue), creating a double backlog - slow withdrawal, slow new Stake .

- In the current context, staking APR is only ~2.8%, the lowest level in history. Unattractive interest rates encourage many investors to move ETH to Liquid Staking or Staking ETH , where there is higher liquidation and rewards.

- Some Staking providers like P2P.org also launch pre-activated validator services, allowing investors to skip most of the entry queue waiting time.

Evidence

ETH queue growing. Source: validatorqueue.com

ETH queue growing. Source: validatorqueue.com

Staking and unstaking queue from May 2021 to present. Source: validatorqueue.com

Staking and unstaking queue from May 2021 to present. Source: validatorqueue.com

Time to withdraw ETH from validator system. Source: validatorqueue.com

Time to withdraw ETH from validator system. Source: validatorqueue.com

ETH price movement in the last 3 months, CoinGecko screenshot at 10:00 AM on 08/17/2025

ETH price movement in the last 3 months, CoinGecko screenshot at 10:00 AM on 08/17/2025

Coin68 synthesis