In a press conference following the Fed's decision to cut interest rates, Chairman Jerome Powell stressed that the move reflected a shift in the "balance of risks" as the central bank weighs its goals of price stability and maximum employment.

“Downside risks to employment have increased” seemed to be the main message today, as Mr. Powell pointed out that a significant part of the recent slowdown in job growth has come from both sides: a reduced supply of labor (due to limited immigration and lower labor participation rates) and a decline in hiring demand from businesses.

While the unemployment rate has only “increased slightly” over the past year and remains relatively low, Mr. Powell acknowledged that some members of the Committee, like Governor Christopher Waller, have warned of growing weaknesses beneath the overall numbers.

Inflation remains high, tariffs are potential risks

Mr. Powell also warned that inflation “remains quite elevated” compared to the 2% target. Goods prices have rebounded, while deflation in services continues.

"We've started to see commodity prices influencing inflation, and in fact, increases in commodity prices have accounted for much, or perhaps all, of the increase in inflation this year," Chairman Powell said.

On tariffs, Mr. Powell warned that while the impact is not yet large, the Fed expects the impact to grow and last even into next year.

He noted that the pass-through of tariff costs to consumer prices has been “slower and weaker” than expected. This may be because businesses are considering passing on higher import costs to consumers, but are still using inventory they bought before the tariffs were imposed. This could lead to gradual and potentially prolonged price increases.

Lower interest rates to control risks

The Fed chairman described today's rate cut as a shift to a "more neutral policy stance." He said a proposal for a sharp 50 basis point cut, as advocated by new Governor Stephen Miran, did not have broad support within the committee.

Mr. Powell also called this a “risk-management” cut — implying that this is not necessarily the start of a chain of consecutive cuts, but a move to prevent the risk of a weakening labor market.

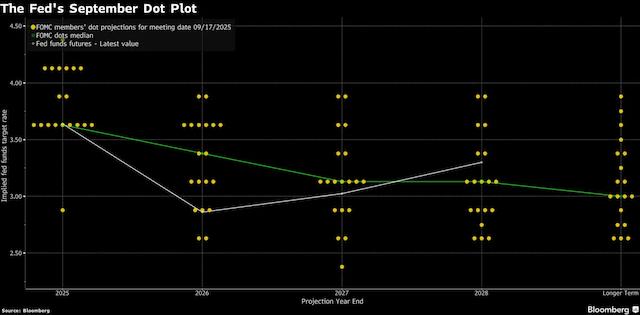

Regarding the SEP and the new DOT plot, Mr. Powell reiterated that this is just a set of 19 forecasts and not the Fed's actual action plan. Instead, actual policy decisions will be made based on "the actual incoming data" and the balance of risks.

September 2025 DOT-plot chart

September 2025 DOT-plot chart

The latest DOT plot shows that 10 Fed members forecast two more rate cuts this year, and nine others forecast fewer cuts. Mr. Powell said this divergence of views is “normal,” given the “very unusual” state of the economy.

“There is no path that is risk-free” for the Fed because there are risks to both inflation and the job market, Chairman Powell said.