Written by: TechFlow

On September 17, Aster completed its TGE, and the $ASTER token’s first-day performance exceeded market expectations.

Data shows that within less than 24 hours of its launch, the token's total trading volume exceeded $310 million, with over 330,000 new unique wallet addresses added. The opening price was $0.03015, reaching an intraday high of $0.528, a single-day increase of approximately 1,650%. The platform's TVL also surged from $350 million to $1 billion.

Such a start is indeed remarkable.

The basic foundation of DEX after the airdrop is that the product is easy to use and has people using it. It also determines whether a project has the income to repurchase, thereby further increasing the value of the token.

A more fundamental question is worth discussing: When Hyperliquid has already occupied half of the perpetual DEX market with the "performance is justice" approach, and its monthly trading volume has exceeded US$330 billion, are there other paths for similar products in this field?

Some of Aster's product details are answering this question.

In June of this year, Binance founder CZ raised an intriguing question on social media: "If you want to buy $1 billion worth of tokens, you don't want others to see it before the order is completed." He bluntly stated that perpetual DEX needs a "dark pool" function.

Aster has chosen this "privacy-first" approach. As a perpetual DEX formed by the merger of Astherus and APX Finance, and backed by YZi Labs (formerly Binance Labs), Aster avoided competing with Hyperliquid in performance, focusing instead on solving a different pain point:

In the transparent world of blockchain, how can large traders no longer pay the price of being seen?

When the leader of a track is already so strong, should the latecomers catch up on the same path or open up a completely new path?

Aster’s choice may provide some inspiration.

Thanks for reading TechFlow TechFlow! Subscribe for free to receive new posts and support my work.

Aster's product secrets: Finding your niche in sustainable DEX

Understanding Aster's product design starts with its dual-mode architecture, which allows the platform to precisely serve two completely different user groups.

Simple Mode targets traders who seek speed and prefer degen strategies.

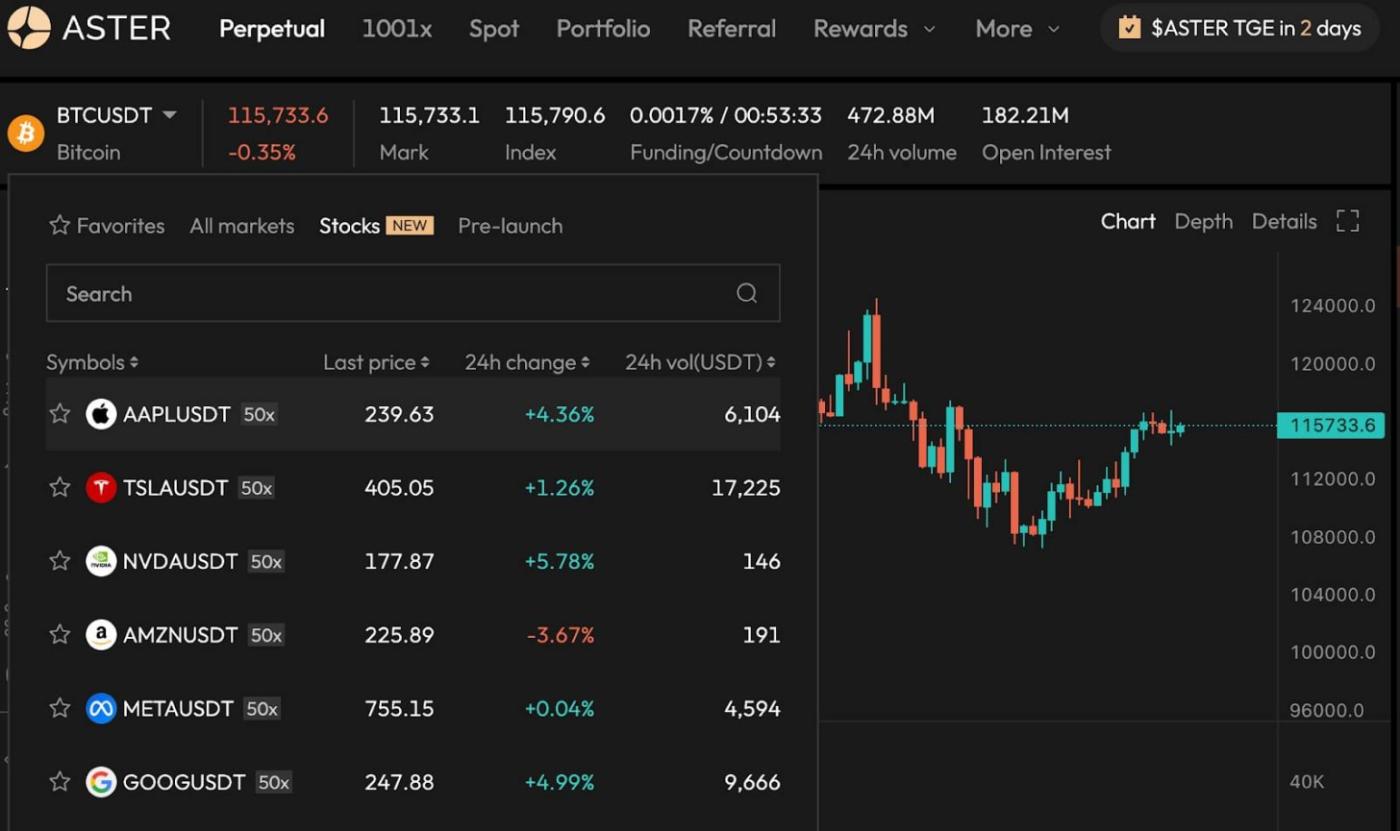

One-click order placement, automatic MEV protection, and that unmistakable 1001x leverage are all key features. While Hyperliquid offers 50x and most CEXs offer 100-125x leverage, Aster pushes the numbers straight into the four digits. While this may seem radical, it's clearly targeting a specific user base.

Pro Mode, on the other hand, is the domain of professional traders.

There is a full order book depth, professional charting tools, grid trading, and of course the Hidden Orders mentioned above. At the same time, the platform's fee structure is also quite competitive:

According to public information, Aster's Maker fee rate is 0.010% and its Taker fee rate is 0.035%, while Hyperliquid's is 0.015%/0.045%. While the differences may seem small, for high-frequency traders, these differences in basis points can lead to significant cost differences after a large number of transactions.

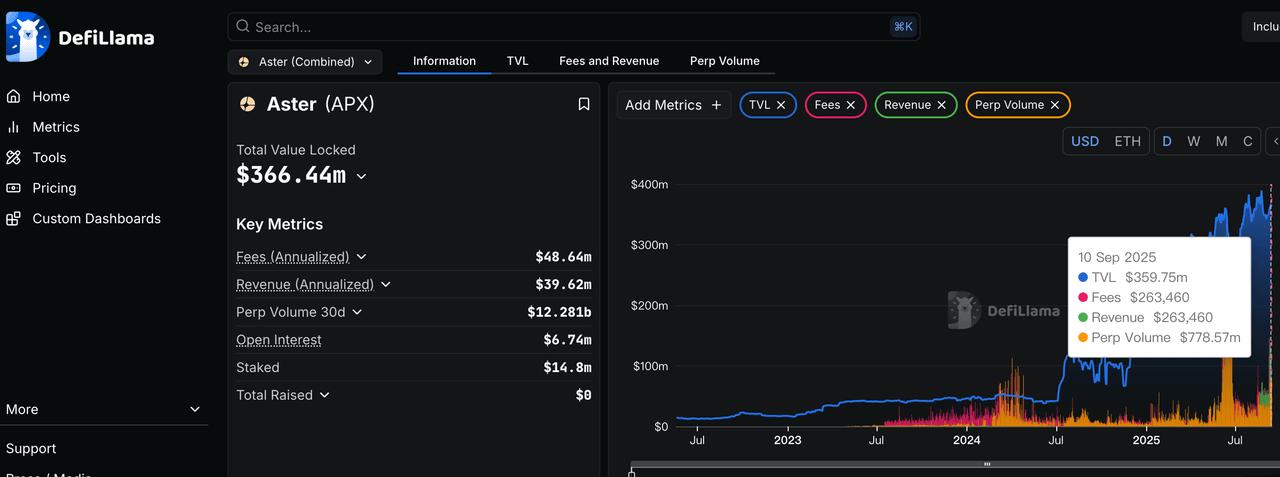

Another noteworthy feature is its cross-chain capabilities. Aster supports over seven chains, including BNB Chain, Ethereum, Solana, and Arbitrum, allowing users to switch between them without requiring a cross-chain bridge. As of September, the platform's TVL reached $360 million, demonstrating significant market recognition.

Particularly noteworthy is the US stock perpetual contract feature. Aster offers 24/7 trading on numerous US blue-chip stocks, including Apple, Microsoft, and Nvidia, all settled entirely in cryptocurrency.

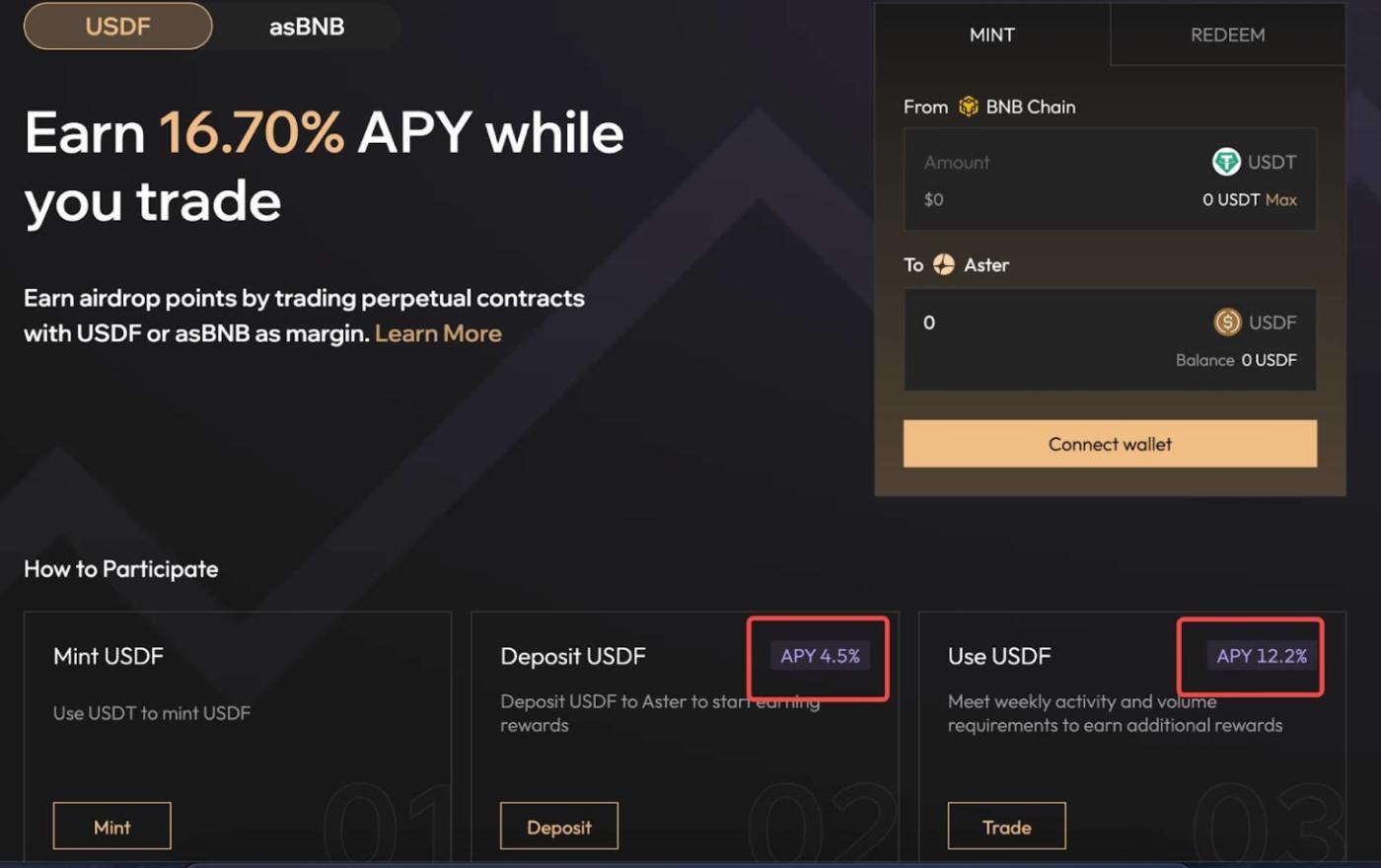

In addition to innovative trading features, Aster's capital efficiency innovations are equally noteworthy. In traditional perpetual swaps, USDT or USDC used as margin simply sits in the account, generating no returns. However, with Aster, users can choose to use USDF as margin.

What is USDF? Simply put, it is a Delta-neutral yield-earning stablecoin issued by Lista DAO that generates returns by investing underlying assets in low-risk DeFi protocols.

As an important part of the BNB Chain ecosystem, USDF not only provides users with stable returns, but also further strengthens the stability of the TVL on the chain.

According to the latest data from the platform, the current APY for depositing USDF has reached 4.5%, while the APY for using USDF has reached around 12.2%. This yield is quite considerable in the current market environment.

Notably, to encourage USDF usage, Aster offers USDF holders a 20x bonus on their airdrop points system. Furthermore, the Trade & Earn program allows each account to have up to 100,000 USDF participating in trading rewards, which both encourages adoption and prevents large holders from monopolizing the rewards pool.

After understanding Aster's overall product layout and capital efficiency innovation, let's look at its other differentiated feature, Hidden Orders.

Last November, James Wynn, a well-known foreign trader, established a long position worth more than US$100 million on the Hyperliquid platform. This huge position was fully exposed on the public order book.

Other traders quickly noticed this "big fish" and began to target his positions. By coordinating price manipulation, they successfully triggered a chain reaction of liquidations, ultimately costing Wynn over $20 million in paper profits.

For institutions and whale that need to execute large transactions, "being seen" often means additional costs.

Aster's Hidden Orders feature, based on zero-knowledge proof technology, offers a solution. When traders choose to hide their orders in Aster Pro mode, the order information is encrypted using a ZK circuit, allowing only the matching engine to verify the validity of the order without knowing the specific content. The order maintains price-time priority but remains completely invisible until it is executed.

This means they can execute large-volume trading strategies on DEX without worrying about being front-runners or maliciously targeted. This also provides a new option for traders who value privacy.

If 2024 is the year of the explosion of perpetual DEX, then 2025 is the critical moment when the pattern is initially determined.

According to dYdX's previously released annual report , DEX derivatives trading volume is expected to grow 132% in 2024, reaching $1.5 trillion, and is projected to reach $3.48 trillion in 2025. This growth rate far exceeds that of spot DEX, prompting CEXs to take this emerging force seriously.

In the rapidly growing market, different platforms have chosen different development paths.

But Hyperliquid is undoubtedly the brightest star. Aster chose a completely different path and solved another pain point: transaction privacy.

This choice is driven by clear market insights. Perpetual DEX users can be roughly divided into three categories: retail speculators focus on leverage and fees, professional traders prioritize execution quality and tools, and institutions and whale prioritize privacy and market depth. Hyperliquid serves the first two categories well, but the needs of the third category appear to be underserved.

According to DefiLlama data, Aster's trading volume in the past 30 days was approximately $16.7 billion, and more importantly, it is on a growth trend.

Aster achieved a record monthly trading volume of $34 billion in June 2025, bringing its cumulative trading volume to over $517 billion. This volume has firmly established Aster in the top tier of perpetual DEXs. Considering that it only completed its rebranding in March of this year, this growth rate is quite impressive.

From this perspective, Aster's privacy strategy isn't intended to replace Hyperliquid, but rather to carve out a new market segment. When the market is large enough, platforms with different positioning will find their niche based on their capabilities. Just like in today's CEX market, Binance, Coinbase, and OKX each have their own strengths and serve different user groups.

In the crypto world, “who invests in you” is often as important as “what you do”.

For Aster, the support of YZi Labs (formerly Binance Labs) is not only a sign of trust, but may also determine its future development trajectory.

In March of this year, when Astherus and APX Finance announced their merger to become Aster, YZi Labs' endorsement quickly led to market recognition of the "new" brand. After all, in the DeFi world rife with various "innovations," projects with a strong background are more likely to gain user trust.

The more practical value may lie in the potential sharing of ecological resources.

Although YZi Labs has become an independent operation, most of its team members are from Binance Labs, and their understanding of the Binance ecosystem and connections have not disappeared. This soft connection can be invaluable at critical moments, such as when seeking liquidity support or ecosystem collaboration.

If Hyperliquid chose the path of independent development, refusing VC investment and not expanding into other public chain ecosystems; then Aster has clearly taken the path of ecological collaboration.

According to public information, Aster has established cooperative relationships with core projects in the BNB Chain ecosystem, including PancakeSwap, Trust Wallet, and SafePal.

The collaboration with PancakeSwap is particularly noteworthy. As the largest DEX on the BNB Chain, PancakeSwap boasts billions of dollars in liquidity. While the specific liquidity sharing mechanism has not yet been disclosed, this collaboration at least represents a potential interconnectedness of user bases. For PancakeSwap users interested in perpetual trading, Aster is a natural choice.

The integration of Trust Wallet and SafePal solves another problem: user onboarding. These two wallets have tens of millions of users worldwide, and direct integration means these users can seamlessly access Aster from within their wallets. Compared to DEXs that require separate websites, this convenience is significant.

Perhaps the most interesting collaboration is with Four.meme, a memecoin launch platform on the BNB Chain. Aster is collaborating with Four.meme to capture the highly active community of memecoin traders. Considering that memecoin traders often favor high-leverage speculation, this user profile is a strong match.

From the above information, we can see that the logic behind Aster's alliance strategy is clear: in the DeFi world, liquidity is the most scarce resource. Rather than building from scratch, it's better to quickly gain initial liquidity and a user base through collaboration. While this means sharing some of the profits, it greatly reduces the difficulty of a cold start.

Another topic that may be overlooked is Aster's previous mergers.

Zero-knowledge proofs are great in theory, but their practical application, especially in high-frequency trading environments, requires strong engineering capabilities. This is why, despite years of discussion about ZK technology, there are still very few cases of large-scale application in DEXs.

Aster's technological expertise is largely derived from mergers. According to official data, Astherus and APX Finance processed over $258 billion in cumulative trading volume prior to the merger. This combined experience, coupled with the support of YZi Labs (formerly Binance Labs), provides Aster with a unique development advantage.

Overall, YZi Labs' support not only means funding, but also potential resources for the entire Binance ecosystem. Integrations with platforms like PancakeSwap and Trust Wallet have enabled Aster to quickly establish a liquidity network, which is precisely one of the biggest challenges faced by most new DEXs.

It is worth noting that this complete ecological synergy is not unique to Aster.

Other sustainable DEXs are also seeking support from their respective ecosystems. Jupiter has the Solana ecosystem, and Vertex, previously, has Arbitrum support. This ecosystem alignment may become a new dimension of sustainable DEX competition:

It is not just a competition of products and technologies, but also a competition of the ecological resources behind them.

Aster's opportunity lies in not trying to be "the next Hyperliquid," but rather becoming the first Aster. The on-chain DEX market is large enough to accommodate players with different positioning.

The key lies in the ability to execute within the next limited time window.

First, the Hidden Orders feature needs to be truly adopted by institutions. This requires not only technical improvements, but also market education and trust-building.

Secondly, synergy with the Binance ecosystem needs to be implemented. While $ASTER has only officially confirmed a listing on a "major exchange," the market generally anticipates its listing on Binance. Given YZi Labs' background, if this happens, whether through direct listing or a launchpool, it will be a significant boon.

First, the actual value of the Hidden Orders feature needs to be verified in real transactions. Currently, more and more institutional traders are beginning to pay attention to the potential of on-chain privacy protection. If Aster can provide stable and efficient hidden order execution, it will naturally attract these users.

Secondly, the value of ecological synergy needs to be truly released.

YZi Labs' portfolio synergy, liquidity sharing with PancakeSwap, and user portal integration with Trust Wallet - if these resources can be effectively activated, they will form a powerful network effect.

$ASTER’s confirmation to be listed on major exchanges is just the beginning. What is more important is how to convert these ecological advantages into actual user growth and trading volume increase.

Timing is also crucial. As the institutionalization of the crypto market accelerates, demand for professional trading tools is growing. If Aster can gain a foothold during this window and build its user base, it will have a chance to carve out a niche in the perpetual DEX market.

Ultimately, Aster’s success may lie in proving that the perpetual DEX market can accommodate multiple models.

The market will reveal the answer. Amidst the multiple trade-offs between transparency and privacy, performance and functionality, and centralization and decentralization, different options will appeal to different users. Hyperliquid has proven the feasibility of the performance approach, and now it's Aster's turn to validate its own path.

Regardless of the outcome, competition itself is victory. It drives innovation, gives users more choices, and enriches the entire ecosystem. This is perhaps the most fascinating aspect of DeFi:

There are always new possibilities, and there are always people trying different paths.

TechFlow is a community-driven in- TechFlow content platform dedicated to providing valuable information and thoughtful thinking.

Community:

Official Account: TechFlow

Subscribe to the channel: https://t.me/TechFlowDaily

Telegram: https://t.me/TechFlowPost

Twitter: @TechFlowPost

Join the WeChat group and add the assistant WeChat: blocktheworld

Donate to TechFlow to receive blessings and permanent records

ETH: 0x0E58bB9795a9D0F065e3a8Cc2aed2A63D6977d8A

BSC: 0x0E58bB9795a9D0F065e3a8Cc2aed2A63D6977d8A