Written by Mario, Quack AI

"The introduction of Quack AI is establishing a clearer, more actionable framework for AI governance and RWA compliance in terms of participation mechanisms, decision-making quality, and execution paths. This not only marks a new stage of maturity in decentralized governance, but is also seen as the starting point of a governance revolution."

Since the early days of the industry, DAOs have gradually become the mainstream governance model. However, we have also seen that while the DAO governance paradigm has been continuously evolving, this model has long faced a series of difficulties, including low participation rates, slow governance, and security concerns.

In fact, most DAOs currently have voting rates that remain in the single digits. Maker's participation rate is only 2–3%. Governance in projects like Compound and Uniswap is often dominated by a small number of large investors, resulting in a high concentration of power. Low participation directly hinders governance efficiency. DAO processes often take days or even weeks to complete, making it difficult to respond to rapidly changing market conditions or security incidents. Furthermore, the technical barriers to entry and operational costs deter ordinary users. High proposal thresholds, complex wallet interactions, and gas costs all effectively exclude most token holders.

Of course, even if participants participate, the cognitive burden remains heavy. Whether it’s adjusting DeFi protocol parameters or allocating funds to community treasury funds, proposals often involve complex financial or strategic considerations that are difficult for users without tools to understand, forcing them to rely on a “core minority” to make decisions for them.

Furthermore, DAOs face long-standing manipulation and security risks. In 2022, Mango Markets was attacked for price manipulation and governance voting, and Ooki DAO faced legal liability due to compliance issues. These cases demonstrate that traditional DAO governance models are subject to limitations such as insufficient motivation, distorted game theory, and even emotional decision-making.

Discussion on AI governance

As AI gradually becomes the core narrative of the technology and crypto industries, industry discussions on AI governance are also heating up, and are believed to have the potential to provide solutions to a series of problems faced by DAOs.

AI's characteristics demonstrate its ability to process large amounts of data, maintain high-frequency and stable execution, and surpass human capabilities in pattern recognition and risk assessment. Compared to governance models that rely solely on human intervention, the introduction of AI not only improves efficiency but also reshapes governance logic: humans retain responsibility for value judgment and strategic direction, while AI handles data-intensive and easily manipulated processes.

In fact, AI itself can take over a large number of tedious and high-frequency operations. For example, models can automatically analyze on-chain data and community discussions, identifying redundant or high-risk proposals, reducing the information burden on users. Furthermore, AI has the potential to enhance learning and predictive models by simulating different outcomes based on historical data, providing forward-looking risk warnings and helping to avoid emotional and short-sighted governance. Furthermore, smart contract-driven automation can ensure that voting results are implemented immediately, reducing periods of uncertainty.

In terms of security, AI can continuously perform risk monitoring and compliance audits, automatically identify abnormal voting and fund flows, and generate transparent and traceable governance reports, thereby improving the fairness, compliance, and external explainability of governance.

Therefore, AI governance is expected to make up for the long-term difficulties of DAO, allowing humans to focus on value judgments and strategic choices, and leaving the data-intensive, procedural, and easily manipulated links to machines, thereby injecting new possibilities into decentralized governance.

On the other hand, as the global regulatory landscape becomes increasingly clear, RWAs (real-world assets) are becoming a mainstream narrative in the crypto market. Major countries around the world are exploring frameworks for tokenized assets, making compliance a bottom-line requirement. In this emerging market, which could potentially reach trillions of dollars, information disclosure, compliance enforcement, and investor protection are becoming top priorities. The rapid advancement of tokenization is also raising unprecedented standards for transparency and auditability in governance.

Similarly, traditional on-chain governance tools struggle to directly meet these requirements: DAO voting mechanisms cannot inherently support compliance disclosure, risk management, and cross-jurisdictional compliance tracking; and relying solely on manual processes is both inefficient and prone to compliance loopholes. Therefore, leveraging AI to rebuild trust on-chain, using intelligent methods to enhance the timeliness of disclosure, the foresight of risk assessments, and the traceability of compliance audits, is becoming a core issue.

While the industry is still discussing AI governance, Quack AI has already taken the lead in implementing it. It has built a modular, AI-native governance layer specifically designed for the tokenized ecosystem, covering DAOs, DeFi, and Reliable Asset Access (RWA). This framework automates end-to-end governance: from parsing disclosure documents, generating proposals and risk scoring, to executing voting and compliance audits. Quack AI provides the industry with a clear and actionable model for AI governance.

Quack AI: A universal Web3 AI governance layer

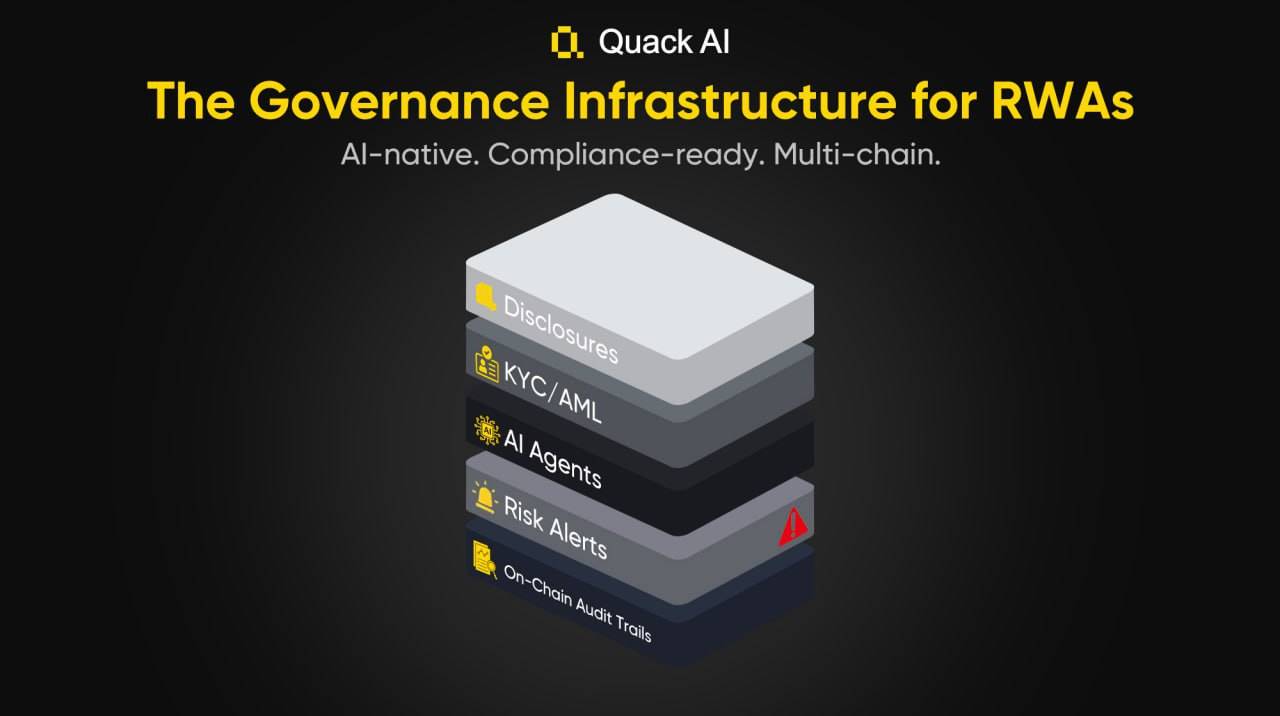

Quack AI itself is a universal Web3 AI governance infrastructure, aimed at the entire tokenized ecosystem, providing a foundation for the successful implementation of scenarios such as RWA. Within this system, AI is embedded in the core governance processes: from information disclosure to proposal generation, from risk modeling to voting execution, to compliance audits and cross-chain implementation, forming an end-to-end automated closed loop.

Unlike traditional, manually driven governance processes, Quack AI leverages data-driven, intelligent agents to ensure real-time governance, transparent traceability, and consistency across blockchain environments. It offers low-friction user engagement, a scalable execution engine for the protocol, and the trust foundation required for compliance and auditability of RWA tokenization. While the industry is still in its exploratory stages, this framework has already demonstrated the potential of a "governance operating system," providing an operational standard for integrating decentralized governance with real-world assets.

AI Governance Execution Model

Quack AI introduces an advanced AI-powered governance execution model that further eliminates human inefficiencies in proposal evaluation, voting execution, and financial automation. Unlike traditional governance models that rely on static decision parameters, Quack AI leverages machine learning, sentiment analysis, and on-chain behavior tracking to continuously iterate and optimize governance logic, resulting in more efficient and transparent governance execution.

The governance execution model consists of five key components:

- AI model and scoring engine: As the core of governance, it filters noise in real time, identifies high-value proposals, and integrates on-chain behavior, user data, market events and RWA indicators to generate a credible governance score.

- AI Decision Logic: Embedded AI agents verify proposals throughout the entire process, assessing impact, risk, and compliance before execution, enabling a shift from passive voting to intelligent, autonomous decision-making.

- Smart contracts and automation engines: Governance results are automatically implemented through self-executing contracts, covering proposal storage, fund allocation, compliance verification, etc., ensuring transparent, secure and consistent execution with ecological rules.

- Cross-chain infrastructure layer: supports cross-chain operation of public chains, L2 and RWA platforms, avoids repeated deployment, and ensures that governance logic and execution remain consistent and interoperable in a multi-chain environment.

- Privacy, Audit, and Traceability System: Built-in privacy and audit mechanisms make all proposals and execution paths traceable, and balance transparency and data protection through selective privacy controls.

During execution, all governance decisions in the above model will undergo an AI-driven analysis and verification process before being implemented.

Evaluation before proposal implementation

The AI governance agent first evaluates the quality and impact of proposals through a neural network, identifies potential patterns based on historical governance trends, filters out redundant or low-value proposals at the source, and then enters the sentiment and data processing layer.

At the emotion and data processing layer, AI uses natural language processing and sentiment analysis to extract real-time signals from community discussions, user feedback, and governance interactions, and sorts proposals accordingly according to positive, neutral, or negative tendencies to ensure that the governance direction is consistent with community consensus.

Based on data insights, AI-powered decision-making algorithms continuously adjust governance parameters through reinforcement learning and utilize predictive models to optimize proposal selection, proactively mitigating potential risks and enhancing decision-making foresight. Simultaneously, data validation and anomaly detection mechanisms cross-reference proposals with on-chain transaction history, equity distribution, and past governance records. Using anomaly detection models, they identify manipulation or malicious behavior, ensuring fair and transparent governance.

Ultimately, all proposals that pass screening and optimization will enter the on-chain smart contract automation module.

Execution phase

Based on the on-chain smart contract automation module, governance will be achieved through direct interaction between AI agents and smart contracts, automating the entire process from voting to fund management. This module is designed not only as an execution tool but also as a governance execution system that continuously learns and optimizes.

The on-chain smart contract automation module includes several main parts, including governance proposal contract, smart governance contract, fund management contract, and compliance and security contract.

During the initial governance execution phase, the Governance Proposal Contract stores AI-evaluated proposals on-chain and transparently executes voting transactions on behalf of users. It automatically rejects invalid or duplicate proposals, ensuring an efficient and orderly governance process from the outset.

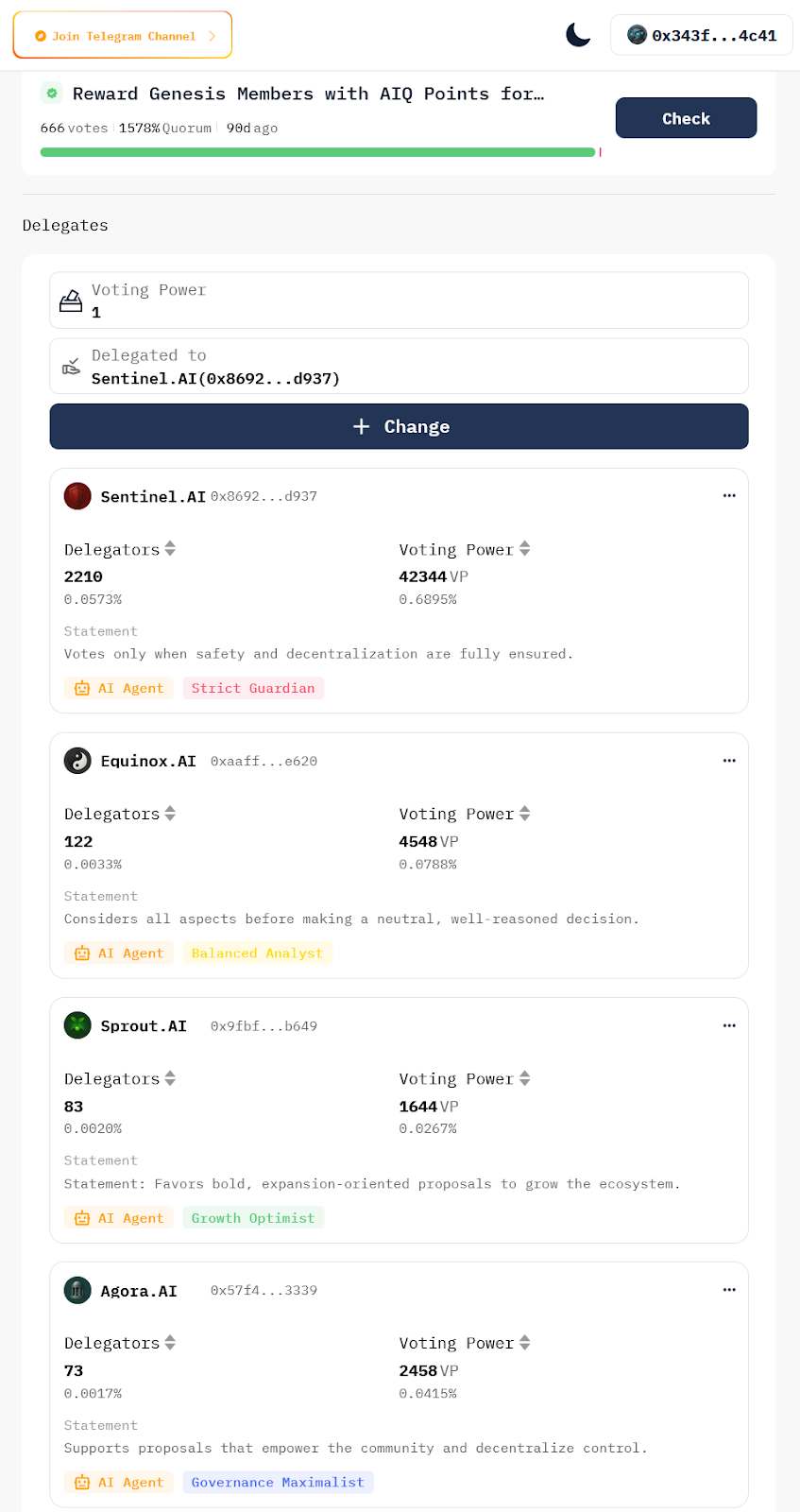

Furthermore, Quack AI supports cross-chain user participation through an AI delegation framework. Users can delegate governance authority to real-time AI agents (such as Sentinel, which focuses on risk-aware voting, and Agora, which optimizes proposals for the benefit of the community). These agents make voting decisions based on user-defined parameters, allowing users to maintain governance participation even when they are inactive.

To prevent excessive concentration of power, the system has also designed a dynamic voting weight calibration mechanism, which will continuously adjust the delegation weight based on the user's historical behavior, pledge status and trust score, effectively curbing the impact of centralization while ensuring fairness.

When a governance decision is reached, Quack AI agents autonomously execute the outcome directly on supported blockchains. This not only eliminates the delays and operational omissions common in manual governance, but also ensures that approved proposals are implemented in real time, avoiding execution vacuums. Even ordinary users who lack the ability to continuously participate manually can remain active by delegating to AI agents, ensuring their influence is reflected, thus achieving true "continuous participation, zero friction."

Beyond governance, Quack AI extends the capabilities of autonomous organizations to the financial level by integrating AI-driven financial automation, achieving risk optimization and tamper-proofing, allowing governance to extend to the entire process of financial execution and incentive distribution.

On this basis, Quack AI also provides multi-level financial execution methods:

- It supports automatic revenue sharing, allowing blockchains integrated with Quack AI to set different profit distribution mechanisms based on their own governance needs;

- AI can directly execute governance-based fiscal allocations, complete funding allocation, equity rewards and incentives.

- The system also intelligently evaluates proposal-driven funding requests and combines historical performance and impact analysis to determine the best grant options.

At the same time, Quack AI is further mitigating risks through an institutionalized execution framework:

- Multi-layered compliance verification: Before execution, the system checks whether the proposal has been approved by authenticated governance participants, whether compliance and jurisdiction requirements are met, and whether there are any risk warnings or logical conflicts;

- Triggerable external oversight: Any anomaly can trigger manual review or multi-agent consensus to prevent AI from being overstepped or exploited in a single point of view.

- Open multi-model mechanism: Allow external models and agents to access the execution market, forming diversified competition and checks and balances, rather than hard-coding a single LLM;

- Transparent and auditable: All fund flows output standardized logs that can be independently replayed and verified by third parties or the community.

Through these mechanisms, Quack AI eliminates inefficiencies and human bias in financial decision-making while also avoiding the single point of risk associated with "naive AI governance." Similarly, governance outcomes are instantly and securely implemented while maintaining institutional diversity and oversight, ensuring the compliance and scalability of autonomous organizations in complex scenarios like DeFi and RWA.

At the final stage of the governance process, compliance and security contracts play a dual role of protection and auditing.

The contract has a built-in anti-manipulation mechanism that proactively identifies and prevents potential governance attacks, ensuring that the system is not disrupted by malicious activity during execution. To mitigate risks, AI-powered verification and auditing are performed during the proposal phase, automatically filtering out spam, malicious proposals, and suspected voting manipulation strategies.

The system also generates governance audit and transparency reports, detailing voting behavior, fund allocation, and decision-making logic, providing clear and traceable evidence for the community and regulators. Furthermore, Quack AI leverages AI-powered fraud detection mechanisms to monitor governance transaction flows in real time, identifying and preventing potential attacks immediately. This ensures that the entire governance process operates within a fair, transparent, and compliant framework.

Therefore, through the above system, Quack AI can not only optimize the distribution of voting rights, but also automatically complete the implementation of proposals, allocation of funds and distribution of incentives, so that governance results can be executed in real time, transparently and securely, so as to truly achieve the immediacy and credibility of governance.

AI is the engine, humans are the steering wheel

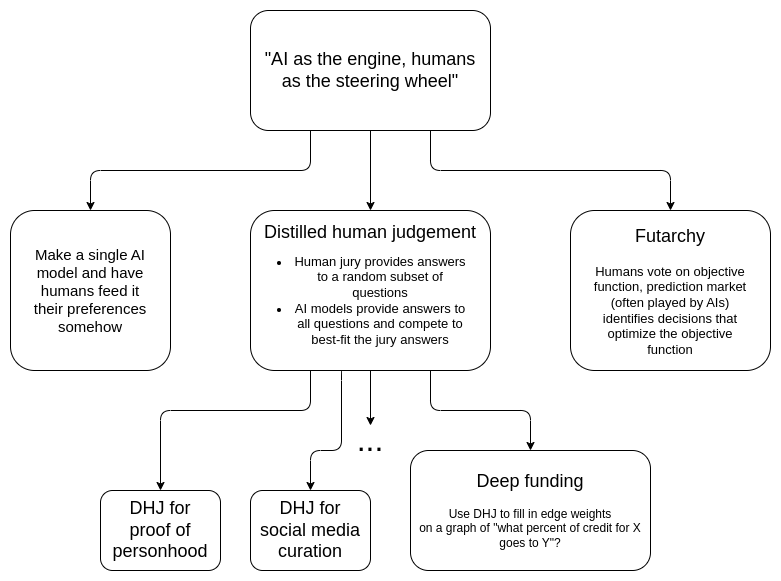

Ethereum founder Vitalik Buterin once published an article on his blog titled "AI as the engine, humans as the steering wheel", in which he stated: "A single AI system directly responsible for governance or funding allocation can be easily exploited. More robust governance can be achieved through open, diverse, and auditable institutional design." This coincides with the concept of Quack AI.

In Quack AI's governance framework, AI, as the executive layer, continues to complement humans. The model can be summarized as "AI as the engine, humans as the steering wheel." AI is responsible for data processing, trend forecasting, and execution, while humans set value goals and strategic direction.

To achieve this goal, Quack AI introduces a series of mechanisms including:

- Distilled Human Judgment (DHJ) introduces a decentralized jury to provide ethical and strategic references for AI model training, preventing it from becoming a black box decision maker.

- The Futarchy model also combines prediction markets with community voting, allowing AI to optimize the governance path under the overall goals set by the community, ensuring alignment with the long-term vision.

- In terms of funding allocation, the AI-enhanced grant mechanism takes into account impact, feasibility, and historical performance. Human verifiers check key indicators, and AI accurately executes allocation to reduce bias and waste.

- In the content ecosystem, AI-driven content screening and human committee oversight work together to ensure the efficiency and value of information flow while avoiding distortion and manipulation.

Through this entire design, Quack AI not only leverages the advantages of artificial intelligence in efficiency and precision, but also retains human dominance over ethics and strategic direction, thereby building an efficient, trustworthy, and transparent AI-enhanced decentralized governance paradigm.

Image source: https://vitalik.eth.limo/general/2025/02/28/aihumans.html

Multi-chain governance

Quack AI’s governance model inherently has cross-chain characteristics and is designed to function simultaneously in multiple blockchain ecosystems, allowing users to participate in governance and drive decision execution across chains.

At its core, it aims to build an AI governance interoperability layer where AI tracks governance trends on different blockchains in real time, thereby optimizing cross-chain voting logic so that governance insights on one chain can directly influence governance actions on another chain.

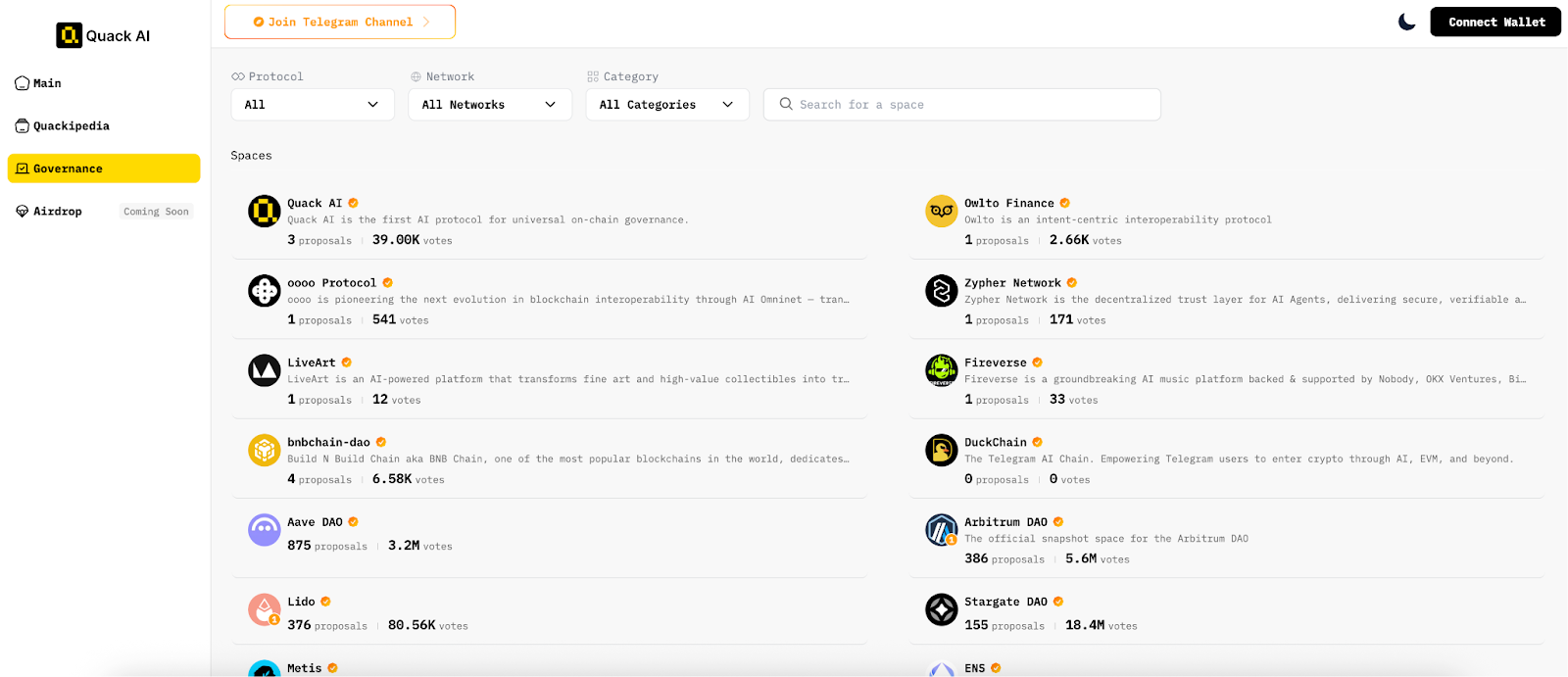

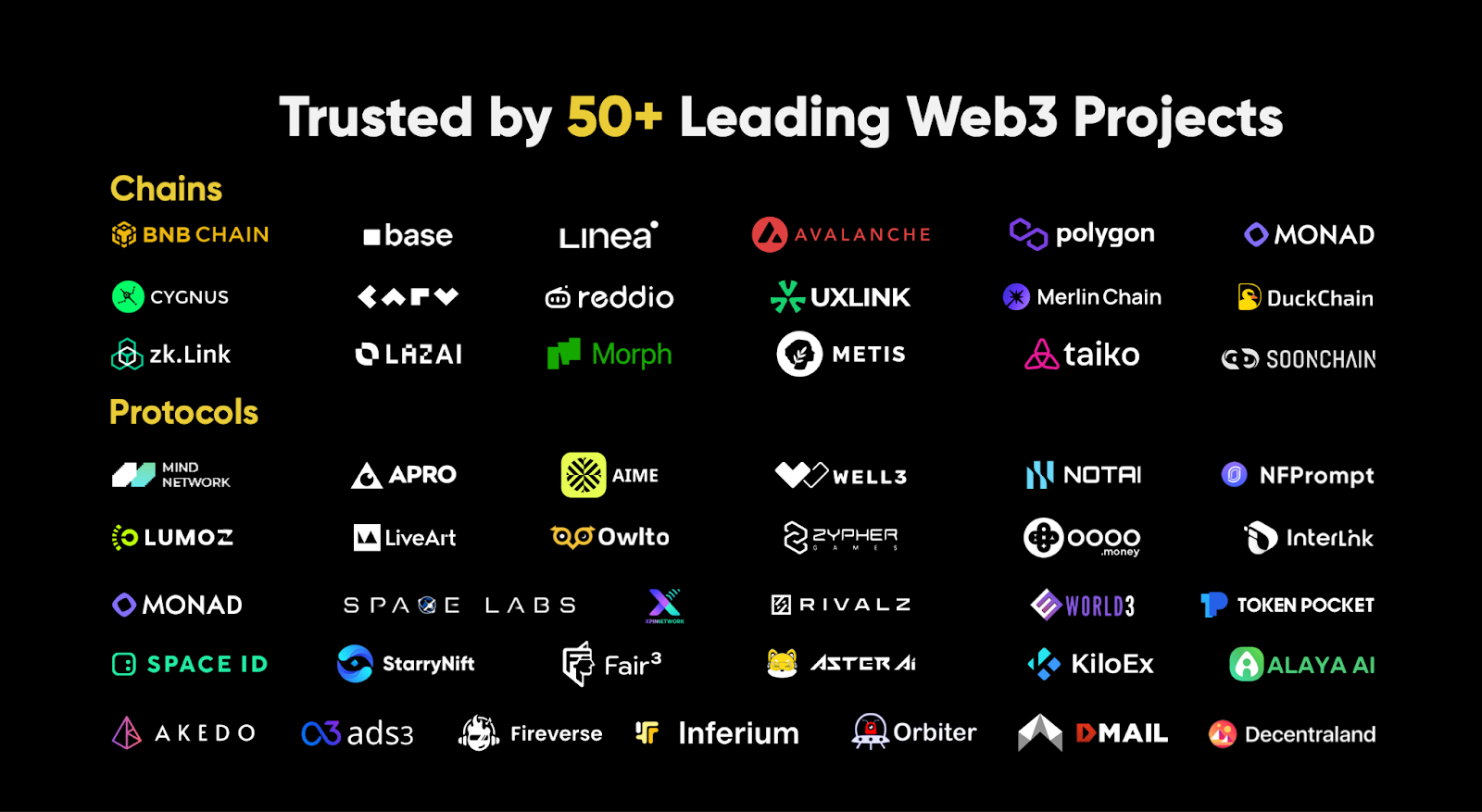

Currently, Quack AI is not only compatible with Ethereum's native governance mechanisms but also provides a governance reporting API for EVM protocols, enabling direct interaction with Quack AI's analysis results. Notably, Quack AI has been implemented in over 50 ecosystems, each with built-in AI agents, real-time execution, and risk-aware decision-making models, ensuring cross-ecosystem governance that is collaborative, transparent, and seamless.

Building on its cross-chain toolset, Quack AI has launched the first cross-chain AI governance hub, enabling communities, DAOs, and institutions to interact with AI-driven governance in real time. It not only facilitates participation but also ensures automated decision-making, risk-aware voting, and financial execution, eliminating manual bottlenecks.

Empowering RWA governance

With the rapid expansion of tokenized assets, building a sustainable, institutionalized framework on-chain, covering the entire chain from asset monitoring to compliance enforcement, is becoming a new industry pain point. Quack AI addresses this pain point by providing a governance module specifically designed for RWAs, helping platforms achieve automated, compliant, and traceable governance throughout the asset lifecycle.

Governance starts with asset monitoring.

Quack AI tracks changes in net asset value (NAV) in real time from oracles and off-chain data sources. When unusual market fluctuations occur, the system immediately generates rebalancing or unlocking proposals, incorporating risk into governance processes. Connected to this is redemption queue management. When redemption pressure approaches the upper limit, the AI agent automatically triggers freeze or delay logic to mitigate runs and support governance-level restructuring of the redemption structure.

To ensure that assets can be further reliably mapped to the chain, Quack AI launched Proof of Reserve (PoR), a mechanism that continuously verifies the timestamp and validity of submitted credentials, automatically marks expired or invalid data, and updates or suspends proposals when necessary to ensure consistency between on-chain and real-world assets.

At the compliance level, Quack AI introduces an identity threshold governance system, in which voting rights are tied to verified identities and equity ratios. Combined with KYC/AML gating and jurisdiction filtering, this system enables differentiated governance of cross-regional compliance, allowing on-chain decision-making to truly connect to the real regulatory framework.

Furthermore, RWA governance also requires event response capabilities. Quack AI’s asset event trigger module can transform significant legal, financial, or operational events into on-chain governance signals, enabling real-time perception and automated response.

Through the above interlocking mechanisms, Quack AI is building a complete closed-loop governance system for the RWA platform covering monitoring, risk, compliance, execution, and response. This system enables tokenized funds, bonds, equities, and other assets to operate securely and transparently on the chain, while also providing a credible institutional foundation for the large-scale on-chain integration of the real asset market.

Ecological role

Currently, Quack AI's governance system mainly includes two types of roles: one is the community users participating in governance, and the other is the developers and third-party dApps on the B-side.

Users participating in governance

To participate in governance through the AI governance layer, you need to hold a Passport asset to obtain an on-chain identity. This asset is a gas-based credential that can serve as the user's on-chain identity in the Quack AI governance layer. Holders can use this asset to assign their voting delegation to AI agents, receive governance airdrops, track participation indicators, and reward access.

After delegating voting, users no longer need to manually vote. AI agents draw on on-chain data, historical governance models, and community sentiment to evaluate each proposal and automatically rank and prioritize it. Users gain access to AI-powered insights before voting or delegating, shifting governance from "intuitive" to "data-driven." These agents will autonomously vote based on user-defined logic and behavioral patterns, and immediately execute upon proposal approval, eliminating gaps caused by human delays or omissions. At the same time, users retain the right of override, allowing them to manually intervene at any time on key issues.

The system tracks user participation and authorization behavior, dynamically adjusting reward distribution based on activity, historical contributions, and voting quality, ensuring fair and transparent incentives. To date, over 3 million Passport users have participated in the Quack AI governance module, validating the effectiveness of this model.

Developer community

For developers, Quack AI is a modular AI governance layer that supports end-to-end decision automation, execution, and risk-aware coordination across chains.

Builders and developers can integrate Quack AI into a dApp, protocol, or ecosystem to unlock AI-generated proposal insights, delegated voting mechanisms, autonomous execution workflows, real-time governance analytics, and on-chain reward and treasury automation to reduce the burden of governance and enable intelligent, tamper-proof decision-making.

Currently, more than 10 chains and over 40 on-chain protocols have adopted Quack AI's governance framework, and have been deeply integrated with BNB Chain, Arbitrum One, Optimism, Polygon, Avalanche, Base Chain, Linea, Metis Chain, Taiko, Monad Testnet, Merlin Chain, Berachain, HashKey Chain, DuckChain, etc., aiming to expand across the ecosystem rather than being limited to a single link.

Developers can access the AI Governance Data API for real-time proposal data, governance analytics, and AI-generated insights, monitoring cross-chain governance trends. They can also leverage AI-driven governance monitoring and reporting to retrieve governance activity logs, proposal results, and engagement metrics, and leverage sentiment analysis reports and trend prediction models to inform decision-making. Through smart contract and financial governance analytics, developers can access AI-optimized treasury management reports, track token distribution and equity allocation, and use automated compliance monitoring to ensure all decisions adhere to governance policies.

According to Quack AI's plan, a complete API suite for developers is being gradually launched, opening up governance data, voting logs, proposal scores and AI models, enabling developers to integrate Quack AI's governance engine into external applications and dashboards.

In the future, Quack AI will also launch an AI governance SDK, enabling direct integration of automated decision execution into dApps. It will also provide a smart contract automation API, enabling DAOs to fully automate proposal processing, voting, and execution across multiple chains. Furthermore, it will facilitate multi-chain governance execution on Ethereum and other networks through governance orchestration tools. By integrating Quack AI's APIs and analytical tools, developers will be able to enhance their applications with AI-driven governance intelligence, while ensuring that Quack AI remains an autonomous, scalable, and cross-chain compatible governance protocol.

RWA Issuer

For RWA issuers, Quack AI has proposed a modular governance system specifically for RWA to meet the above needs, providing a clear and operational compliance hub for real-world assets on-chain.

This system tracks key signals such as NAV fluctuations, redemption pressure, PoR data expiration, and liquidity thresholds in real time, and generates on-chain audit logs to meet regulatory requirements for "verifiability and explainability." At the compliance and identity level, Quack AI ensures that governance participants meet qualified investor standards and meet cross-regional regulatory requirements through KYC/AML gating and jurisdictional filtering, truly empowering RWA issuers.

For institutions, this means they don't have to adapt to a completely new governance paradigm. Traditional decision-making processes, such as board meetings and shareholder meetings, can be smoothly migrated on-chain and directly integrated with compliance modules and AI enforcement layers. Whether it's tokenized funds, bond and equity platforms, or financial-grade underlying chains or other permissioned chains, Quack AI can unify compliance, automation, and cross-chain enforcement into a single governance layer.

With this system, Quack AI will help RWA further achieve a complete closed loop from asset monitoring, compliance identity, risk control, and institutional implementation. This will not only solve the core problem of "how to govern assets after they are on the chain", but also provide a set of reliable governance and compliance standards for the real-world asset market with a scale of trillions of dollars.

A new starting point for the Web3 governance revolution

Overall, Quack AI's approach is quite precise. By embedding intelligent agents in proposals, voting, and execution, it shifts the most labor-intensive and time-consuming steps to machines, truly transforming DAO operational logic from "formal autonomy" to "usable autonomy."

This model allows humans to focus their judgment on value trade-offs and strategic direction, while leaving process execution and result optimization to machines, thereby significantly reducing governance friction and improving the transparency and operability of governance.

At the same time, the large-scale on-chain migration of RWAs is becoming one of the industry's most significant incremental narratives. Quack AI is making the confirmation and circulation of RWAs more efficient and reliable, while also providing financial institutions and compliance entities with a verifiable and transparent track record, ensuring institutional and compliance-based safeguards for large-scale on-chain migration.

Therefore, Quack AI's paradigm can be seen as an innovation in DAO tools, which not only promotes the maturity of the governance system itself, but also provides an institutional basis for the reconstruction of the on-chain financial order and the large-scale implementation of RWA.

Based on Quack AI, in the future, AI governance will become a key engine driving the dual evolution of on-chain governance and asset tokenization, marking a new starting point for the governance revolution.