"With the release of the latest judicial interpretations on the crimes of aiding and abetting, concealing, and money laundering, on the one hand, we should be aware of the risks in our work and daily lives to avoid being implicated in criminal offenses through virtual currency transactions; on the other hand, we must be aware of the evidence. In practice, when determining whether aiding and abetting, concealing, and money laundering constitute a crime and what the crime is, the most important issue is subjective knowledge..."

Background of Current Virtual Currency Money Laundering Cases

In recent years, due to the decentralized, anonymous, and cross-border transfer-friendly nature of virtual currencies, a growing number of cases involving various types of black and gray market criminals laundering money through virtual currencies have emerged. Money laundering methods are constantly evolving, becoming more covert and characterized by organized crime, chain operations, and industrialization. The "Interpretation of the Supreme People's Court and the Supreme People's Procuratorate on Several Issues Concerning the Application of Law in Handling Criminal Money Laundering Cases" (hereinafter referred to as the "2024 Money Laundering Interpretation"), which came into effect on August 20, 2024, explicitly lists virtual asset transactions as a method of money laundering.

Of course, "money laundering" is just an intuitive expression of ours. It does not mean that using "virtual currency to launder money" directly or only constitutes the crime of money laundering. According to the search, as of September 17, 2025, we have retrieved a total of 4,446 judgments with "virtual currency" and "criminal" as keywords, involving many crimes in the criminal law and several major provinces with the most similar cases. In judicial practice, there are mainly three crimes involved, namely, the crime of assisting information network criminal activities, the crime of concealing and concealing criminal proceeds, the crime of proceeds of criminal proceeds, and the crime of money laundering.

Recent real-world virtual currency money laundering cases

Case 1: The Trick Behind the 140 Million Yuan Reward (Legal Headlines)

Recently, the People's Procuratorate of Haidian District, Beijing, released the "White Paper on Anti-Commercial Corruption Procuratorial Work (2020-2024)". The case involved Feng, who was responsible for the entry approval, reward policy formulation and implementation of service providers at a short video platform company in Haidian District, Beijing. He colluded with internal and external parties to defraud 140 million yuan in rewards.

In the first step, in order to "safely" cash out and transfer these ill-gotten gains, Yang instructed his subordinates, including Wang, to register several "shell companies" in a short period of time. These companies had only one function: to receive "rewards" paid by the short video platform company.

In the second step, after obtaining the 140 million yuan in stolen money, Feng instructed Tang and Yang to use 8 different overseas virtual currency trading platforms to exchange the huge amount of defrauded funds into virtual currencies such as Bitcoin in batches.

Third, to completely sever the traceability of the funds, Feng's gang employed a more covert method called "coin mixing." This technical approach obfuscated the cryptocurrency transaction path to protect privacy. Through coin mixing, Feng further obfuscated the source, type, and circulation chain of the virtual currency.

In the fourth step, some of the laundered funds were converted back into RMB through covert channels and subsequently transferred to personal or corporate accounts controlled by core members like Feng, Tang, and Yang. This closed a high-tech, cross-border money laundering chain.

Li Tao, a prosecutor from the Science and Technology Crime Prosecution Team of the Haidian District People's Procuratorate, relied on the electronic data review room to quickly build an evidence system integrating information flow, data flow, and capital flow. This not only verified the authenticity and credibility of each other's evidence, but also fully presented the "criminal maze" constructed by Feng, and clearly restored the entire process of the 140 million yuan in funds being embezzled, transferred, laundered, and divided.

Ultimately, Feng's group was forced to surrender over 90 bitcoins they had hidden, allowing the company to recover some of its losses. Feng and seven others were also convicted of embezzlement and sentenced by the Haidian District People's Court to prison terms ranging from 14 years and six months to three years, with corresponding fines. The verdicts have now taken effect.

Case 2: Hunan police cracked a virtual currency money laundering case, arrested 15 people, and the amount involved was nearly 170 million yuan!

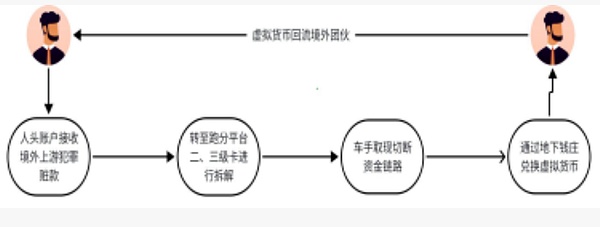

According to Hunan Public Security Bureau, the gang has been setting up a four-level money laundering channel under the cover of "blockchain OTC merchants" since July 2024.

At the first level, overseas financiers transfer the proceeds from online fraud and gambling to dummy accounts within the country.

The second level is to split and transfer funds to the secondary card through the "running point team";

The third level is for the "driver" to withdraw cash in the early morning and then hand it over to the fourth level "backpacker" on the spot;

The fourth level, through underground banks, is ultimately converted into USDT and repatriated to overseas criminal groups. In six months, this channel has laundered a total of 170 million yuan, with the gang illegally earning over 1 million yuan.

Case 3: On July 28, 2025, the Supreme People's Court and the Supreme People's Court issued the "Opinions on Handling Criminal Cases Such as Assisting Information Network Criminal Activities", a typical case of punishing assisting information network criminal activities and related crimes in accordance with the law. Case 4: The case of the defendant Wang Mou and others concealing and concealing the proceeds of crime - severely punishing the crime of transferring stolen money through virtual currency transactions in accordance with the law

[Basic Facts of the Case]

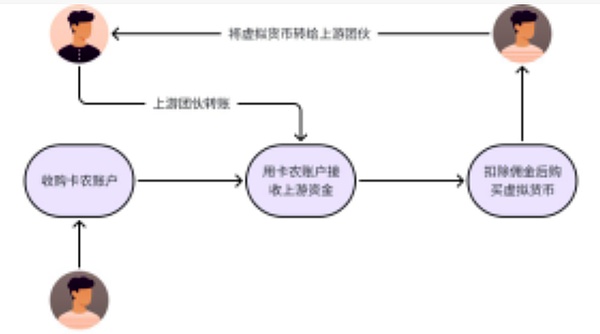

In mid-July 2022, the defendants Wang, Zhang, and Zhao conspired to transfer criminal funds for others through transfers, withdrawals, and virtual currency purchases to profit from the scheme. The three had a clear division of labor: Wang provided funds, which Zhao used to purchase virtual currency and provide to their upline as a security deposit. Wang and Zhang then purchased numerous bank cards from others and provided them to their upline to receive the criminal funds. Once the criminal funds were deposited into the bank cards provided by Wang and others, the upline notified Wang and others, who then arranged for others to withdraw cash from various banks in Daqing City, Heilongjiang Province. After taking a 10%-15% commission on the funds received, they used the remaining funds to purchase virtual currency and transfer it to their upline. An investigation revealed that between August 5 and 14, 2022, Wang and others defrauded 15 victims, including Lin, of over 400,000 yuan.

The above-mentioned "money laundering" circulation chain is also the most common way of "laundering money" using virtual currency.

Ultimately, the Harbin Acheng District People's Court, after a legal trial, sentenced Wang and Zhang to three years and six months in prison and a fine of RMB 30,000 for concealing and hiding the proceeds of crime. Zhao was sentenced to three years and three months in prison and a fine of RMB 25,000. Wang, Zhang, and Zhao appealed the verdicts, but the second instance upheld the original sentences.

Case 4: (2024) Yu 0223 Xingchu No. 171

In December 2020, defendant Li met Wang (already sentenced) through the "Bat" chat app and added them as WeChat friends. Wang then asked Li to provide his bank card, mobile phone, and SIM card to Zhengzhou to participate in money laundering by purchasing USDT (commonly known as "Tether"). Using the Huobi app, which he downloaded and registered , he used the stolen funds transferred to his bank card by upstream criminals (the crime had already been completed) to purchase the virtual currency USDT. He then transferred these virtual USDT coins to accounts designated by upstream criminals, including Shao, thereby facilitating the laundering of funds for upstream criminals. A total of 577,337 yuan was transferred, and it was verified that the victim had lost a total of 109,000 yuan.

Ultimately, the court found the defendant Li guilty of assisting in information network criminal activities and sentenced him to six months in prison and a fine of RMB 5,000.

Case 5: Fund-raising fraud and money laundering case involving Wang Moujian, Ma Mou, and others

In 2020, the defendants Wang Moujian and others designed a virtual currency called GUCS and the associated software "Wa11et Pro" app (GUCS wallet) by tampering with the code of other virtual currencies. They placed GUCS coins on an online platform for public trading by paying fees. After downloading apps like "Wa11et Pro," users registered as members on the platform, linked their bank cards, Alipay, and WeChat accounts, and exchanged RMB for the virtual currency "Tether." They then used Tether to purchase GUCS coins. Wang Moujian conspired with defendants Yang Moubin, Xie Moumao, and others to deliberately conceal the fact that they had locked up access to and the amount of GUCS coins they had obtained. They fabricated claims that the coin, like Bitcoin, could be continuously generated through computing power and linked to international finance. They also arranged for defendants Duan Moulei, Wang Mou, and others to manipulate the price of GUCS coins by buying and selling them among themselves, creating the illusion of strong demand and rising prices. Wang Moujian and others publicly promoted the GUCS coin project by distributing false promotional materials and holding seminars. They touted the coin's economic value and investment prospects, promising high interest returns and luring the public into investing. This resulted in losses totaling RMB 1.794 billion (the same currency used below) for over 29,000 participants. GUCS coin has been determined to have no technical application, no physical backing, and no real value.

In early October 2020, the defendant Wang Moujian transferred approximately 249 million yuan worth of Tether (USDT) obtained through the aforementioned means to the defendant Ma Mou. Ma Mou, through various means, altered the nature of the aforementioned virtual currency by investing on overseas foreign exchange platforms, transferring over 90 million yuan to Wang Moujian. The defendant Ma Mou was sentenced to eight years in prison and a fine of 500,000 yuan for money laundering. Following the verdict, the defendant Ma Mou appealed. On June 11, 2024, the Sichuan Provincial Higher People's Court issued Criminal Ruling (2024) Chuan Xing Zhong No. 77, dismissing the appeal and upholding the original verdict.

Case Study

In the previous section, we introduced the main crimes of "money laundering" using virtual currency through practical cases. In practice, there are four main models to determine what crime is constituted:

The first is that the perpetrator commits a crime and then launders the money through "virtual currency". In this case, the crime is generally determined based on the specific behavior. The act of laundering money through "virtual currency" alone does not constitute a separate crime. For example, in Case 1, the perpetrator committed the act of embezzlement and then used virtual currency to launder the embezzled funds. In this case, only the crime of embezzlement is constituted.

The second type is when the perpetrator is aware that the upstream gang is committing a certain crime and conspires with the upstream gang to launder the illegal proceeds through "virtual currency" in the criminal chain. In this case, the perpetrator is deemed to have committed a joint crime with the upstream criminal gang. For example, if the upstream gang is convicted of fraud, the perpetrator is also convicted of fraud. The act of "laundering money using virtual currency" is generally no longer considered a separate crime.

The third type is that if one has little knowledge of the upstream crime or recognizes that the proceeds or profits of the crime are obtained, and still provides assistance and uses "virtual currency to launder money", it is suspected of constituting the crime of assisting information network criminal activities and the crime of concealing and hiding the proceeds of crime or the proceeds of crime;

The fourth type is that if one is specifically aware that the stolen money is proceeds from seven types of upstream crimes, such as drug crimes, organized crimes of a gang nature, terrorist activities, smuggling crimes, corruption and bribery crimes, crimes that disrupt financial management order, and financial fraud crimes, as well as the source and nature of the proceeds generated by them, then it constitutes the crime of money laundering, and will not be considered to constitute the crime of concealing or hiding the proceeds of crime or the proceeds of crime.

▍Regulations on the three main crimes

[Crime of assisting information network criminal activities] If a person knowingly provides others with technical support such as Internet access, server hosting, network storage, communication transmission, or other technical support for their crimes through the information network, or provides advertising promotion, payment settlement, etc., and the circumstances are serious, he shall be sentenced to fixed-term imprisonment of not more than three years or criminal detention, and shall be fined or fined alone.

[Crime of concealing and hiding criminal proceeds and proceeds from criminal proceeds] Whoever knowingly harbors, transfers, purchases, sells on behalf of others, or conceals and hides criminal proceeds and proceeds by other means shall be sentenced to fixed-term imprisonment of not more than three years, criminal detention, or public surveillance, and shall be fined or fined alone; if the circumstances are serious, he shall be sentenced to fixed-term imprisonment of not less than three years and not more than seven years, and shall be fined.

[Money Laundering] Anyone who commits any of the following acts to conceal or hide the source and nature of proceeds from drug-related crimes, organized crime of a mafia nature, terrorist activities, smuggling, corruption and bribery, crimes that disrupt financial management order, or financial fraud, shall have the proceeds from the above crimes and the proceeds generated thereby confiscated and shall be sentenced to fixed-term imprisonment of not more than five years or criminal detention, and shall be fined or fined alone; if the circumstances are serious, he shall be sentenced to fixed-term imprisonment of not less than five years but not more than ten years, and shall be fined.

▍The differences between the three main charges

The main differences between the crime of aiding and abetting and the crimes of money laundering and concealment are: objectively, the essence of aiding and abetting is accessory to the crime, so aiding and abetting can only occur before the upstream crime is completed; the knowledge required for aiding and abetting is general knowledge, requiring the perpetrator to be aware that others are engaging in information network crime, but not subjectively requiring knowledge of the specific type of criminal conduct being facilitated. In contrast, the knowledge required for the crimes of money laundering and concealment requires the perpetrator to be aware that the criminal conduct and funds are proceeds or profits of crime, but does not require knowledge of the specific type of criminal proceeds (money laundering must be limited to the seven upstream crimes). Furthermore, the perpetrator must be aware that the upstream crime has already been completed.

The difference between money laundering and money concealment:

First, the types of upstream crimes are different. The upstream crimes of money laundering can only be seven types of crimes, namely drug crimes, organized crime of a mafia nature, terrorist crimes, smuggling crimes, corruption and bribery crimes, crimes that disrupt financial management order, and financial fraud crimes. However, the type of upstream crimes for concealment crimes is not required.

Second, the crime of money laundering requires the perpetrator to have subjective knowledge of the type of the upstream crime. This knowledge can be general knowledge, meaning an awareness of the type of upstream crime, without necessarily understanding its specific nature or charge. Concealment, on the other hand, requires only a general knowledge of the circumstances that constitute illegal proceeds.

Third, the crime of money laundering emphasizes the "whitewashing" of illicit funds, essentially disguising the illegal proceeds of the seven categories of upstream crimes as legal, thereby concealing and disguising the source and nature of the proceeds of crime and their proceeds. The crimes of concealing and disguising the proceeds of crime and their proceeds include not only concealing and disguising the source and nature of the proceeds of crime and their proceeds, but also other circumstances, such as concealing and disguising the physical location of the proceeds of crime and their proceeds.

Defense strategies for virtual currency money laundering cases

When handling money laundering cases involving "virtual currency", the main goal is to "turn felonies into misdemeanors, and misdemeanors into innocence", and to strive for the parties to withdraw the case, not to prosecute, probation, or turn felonies into misdemeanors; therefore, when handling such cases, when determining and selecting charges, priority should be given to whether the perpetrator has subjective criminal intent and whether the case has the possibility of innocence; then, based on the perpetrator's behavior, it is analyzed whether the specific charge of aiding and abetting, concealing, or money laundering should be applied.

1. Regarding the subjective knowledge of the crime of aiding and abetting, according to relevant judicial interpretations, the determination of subjective knowledge should be based on the time, method, number of times, tools used by the actor to provide assistance, whether the relevant behavior violates the prohibitions of the law, whether the actor evades supervision or circumvents investigation and whether he or she makes illegal profits, combined with the actor's cognitive ability, professional identity, past experience, relationship with the person being assisted, and his or her confession and defense.

Any of the following circumstances may be deemed as "other circumstances sufficient to prove that the actor was aware of the act", unless there is evidence to the contrary:

(1) Illegally providing equipment for inserting phone cards in batches, illegally providing equipment or software with functions such as changing caller numbers, virtual dialing, or illegally accessing public telecommunications networks for Internet phones, illegally providing batch accounts, automatic network address switching systems, or platforms for batch receiving SMS verification or voice verification;

(2) Those who continue to engage in related conduct after being subject to restrictions or service suspensions by financial institutions, telecommunications operators, or Internet service providers due to abnormal circumstances such as fraud;

(3) Prepare the language for responding to the investigation in advance.

Normally, if one knows less about the upstream crime, even if he is convicted, it is mainly a crime of aiding and abetting;

2. Regarding the subjective knowledge of concealment, according to relevant judicial interpretations, "knowledge" here includes knowing or should have known. This determination should be based on a comprehensive review and assessment of the information the perpetrator has accessed and received, the circumstances of their handling of the proceeds of crime and their proceeds, the types and amounts of the proceeds, the methods of transfer and conversion of the proceeds, any abnormalities in their transactions and financial accounts, as well as the perpetrator's professional experience, their relationship with upstream criminals, and their confessions and defenses.

3. Subjective knowledge is a very important defense point and is often the main focus of controversy in such cases. We need to combine the evidence of the entire case and conduct a detailed analysis, such as relevant chat records, bank statements, confessions of co-defendants, professional experience, profit situation, relationship with the persons involved in the case, etc., to prove that the existing evidence cannot prove the subjective knowledge of the party involved and does not constitute the crime of money laundering.

4. From the point of view of the time of participation, if it occurs before the upstream crime is completed and there is a lack of conspiracy in the upstream crime, it is appropriate to convict of the crime of aiding and abetting. If it occurs after the upstream crime is completed, the possibility of establishing the crime of money laundering or concealment should be considered.

5. Because the crime of money laundering is a serious crime compared with the sentencing of the crimes of aiding and concealing, and the crimes of money laundering and concealing are related to general laws and special laws, when choosing whether to apply the crime of money laundering or the crime of concealing, the elimination method can be used to first determine whether the crime of money laundering is established.

(1) Concealed or concealed stolen money does not fall under the seven specific categories of upstream crimes required for money laundering. In cases involving virtual currency money laundering, the amount of funds involved is large, and the sources of funds are complex and dispersed. They often undergo multiple layers and multiple flows of laundering, making it difficult for judicial authorities to prove that all the funds involved are proceeds of the seven categories of upstream crimes and their benefits. Therefore, when representing such cases, it is important to verify and review objective evidence such as audit reports and bank statements, and then combine them with the confessions of co-defendants to prove that the funds involved do not fall under the seven categories of upstream crimes and that the parties involved do not constitute money laundering.

(2) Subjectively not knowing that the proceeds of crime and the proceeds of gains are derived from one of the seven types of crimes of money laundering. The knowledge here includes "knowing or should have known" but does not include "possible knowledge". In addition to the confession of knowledge by the perpetrator, the judicial interpretation of money laundering has made provisions for the inference of knowledge, that is, when determining the subjective knowledge of the perpetrator, it should be based on the information the perpetrator has accessed and received, the circumstances of handling the proceeds of crime and the proceeds of others, the types and amounts of the proceeds of crime and the proceeds of gains, the transfer and conversion methods of the proceeds of crime and the proceeds of gains, abnormal circumstances such as transaction behaviors and fund accounts, and the perpetrator's professional experience, relationship with upstream criminals, his confession and defense, testimony of co-defendants and witness testimony, etc., for a comprehensive review and judgment.

6. Regarding the situation of seeking non-prosecution for the crime of aiding and abetting information network crimes, according to the Supreme People's Court's "Opinions on Handling Criminal Cases Concerning Assisting Information Network Criminal Activities" (Fa Fa [2025] No. 12) , those who commit crimes such as aiding and abetting information network criminal activities and meet any of the following circumstances may be given a lenient punishment in accordance with the law:

(1) Those who were deceived into committing a crime; (2) Those who participated for a short period of time and gained little profit; (3) Those who pleaded guilty and accepted punishment; (4) Those who actively cooperated with the investigating authorities in tracking down relevant information network crimes and played an important role. If the circumstances specified in the preceding paragraph are met and the crime is minor, prosecution may be waived or criminal punishment may be exempted in accordance with the law.

Therefore, if the perpetrator falls into any of the above four situations, we can actively strive for non-prosecution at the procuratorate stage; especially in the first and fourth situations, on the one hand, we must collect all kinds of evidence to prove that we were deceived into committing the crime, such as chat records, relevant witness testimonies, and explanations that can review common sense in response to the judicial authorities' questions; on the other hand, we must actively cooperate with the investigating authorities to investigate the relevant crimes as much as possible;

7. In cases where non-prosecution is sought for the crime of concealment, according to the Interpretation of the Supreme People's Court and the Supreme People's Procuratorate on Several Issues Concerning the Application of Law in Handling Criminal Cases of Concealing and Hiding Criminal Proceeds and Proceeds from Criminal Proceeds (Fa Shi [2025] No. 13), if the perpetrator conceals the proceeds of crime and their proceeds, pleads guilty and accepts punishment, actively cooperates in recovering the proceeds of crime and their proceeds, and has one of the following circumstances, and the circumstances are minor, prosecution may be waived or criminal punishment may be exempted: (1) There are statutory circumstances for lenient punishment; (2) The proceeds of crime and their proceeds are concealed for close relatives and are first-time or occasional offenders; (3) The perpetrator plays a major role in cooperating with judicial organs in investigating upstream crimes; (4) Other circumstances are minor and the harm is not great.

Therefore, in the specific defense process, we can combine this provision, comprehensively collect evidence, actively communicate with the case handler, and strive to obtain non-prosecution for the client as much as possible.

Inspirations for relevant practitioners

With the release of the latest judicial interpretations on the crimes of aiding and abetting, concealing and money laundering, on the one hand, we should have a sense of risk in our specific work and life to avoid being involved in criminal offenses due to transactions related to "virtual currency"; on the other hand, we should have a sense of evidence. In practice, when determining whether the three crimes of aiding and abetting, concealing and money laundering constitute a crime and what kind of crime they constitute, the most important thing is the issue of subjective knowledge; therefore, we must have a sense of evidence. When we find any abnormalities, we should promptly fix and retain evidence to prove that we were unaware or were deceived into doing so; we should retain evidence to strive for innocence, probation and other matters in the future, instead of "suffering in silence".