BitGo, one of the most prominent digital asset custody providers, has taken a major step towards becoming a publicly traded company.

The Palo Alto-based company filed an S-1 registration statement with the U.S. Securities and Exchange Commission (SEC) on September 18, outlining its plans to list its Class A common stock on the New York Stock Exchange under the ticker symbol BTGO.

BitGo Seeks Listing on NYSE

According to the filing , the company will adopt a dual-class share structure. Class A shareholders will receive one vote per share, while Class B shareholders will receive 15 votes each.

Despite this, Mike Belshe, the company's founder, will still hold a controlling stake in the cryptocurrency custody provider.

“Michael Belshe will have the ability to control the outcome of matters submitted to our shareholders for approval, including the election of directors and approval of any change-of-control transactions. Furthermore, we will be a “controlling company” within the meaning of the NYSE corporate governance standards, and we will qualify for and be able to rely on exemptions from certain corporate governance requirements thereunder,” the filing states.

BitGo said the IPO will allow the company to raise Capital , increase its market presence and expand its financial flexibility.

The company added that the Capital raised will be used for working Capital , technology development and potential acquisitions, as well as to pay stock-based compensation taxes.

Meanwhile, BitGo’s filing has fueled a broader shift in the crypto Capital markets. Circle ’s public debut earlier this year sparked interest in digital asset IPOs, followed by filings by Gemini, Bullish, and Grayscale .

Industry leaders say these moves reveal the scale of crypto businesses. Bitwise CEO Hunter Horsley points out that nearly $100 billion in combined market Capital has emerged from this wave of new listings.

“People are discovering the sheer scale of businesses in this space… close to $100 billion in combined market Capital … Cryptocurrency is an industry,” he wrote on X.

IPO filing shows $4 billion jump in revenue

BitGo's decision to go public follows an impressive financial performance over the years.

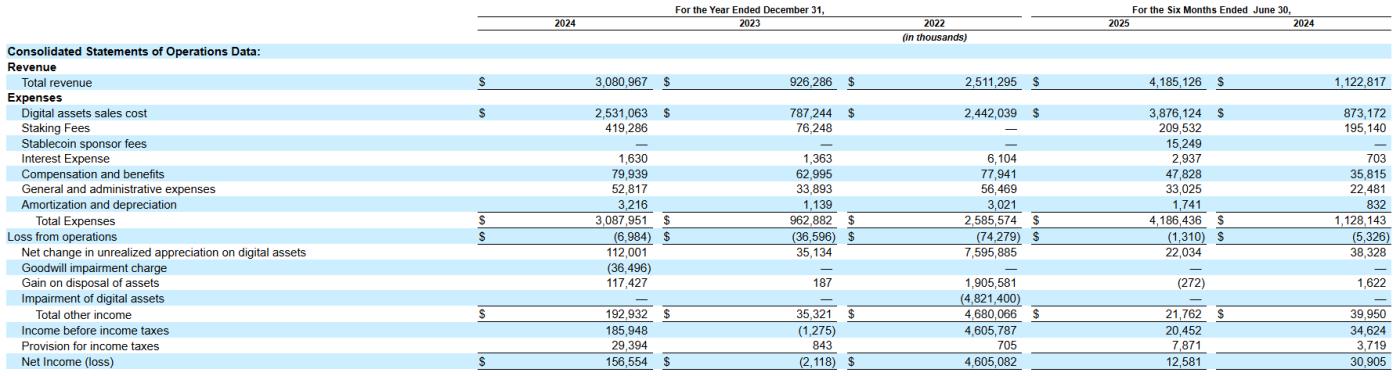

The company reported revenue of $4.19 billion in the first half of 2025, nearly four times the $1.12 billion it earned in the same period a year earlier.

BitGo's financial performance through 2022. Source: BitGo IPO filing

BitGo's financial performance through 2022. Source: BitGo IPO filingHowever, higher operating expenses reduced net income, falling to $12.6 million from $30.9 million in 2024. This contrast highlights the challenge of scaling infrastructure for institutional customers while balancing profitability.

“Only $12 million in profit on $4 billion in revenue – such a low profit number. Revenue increased by $3 billion, but profits dropped by more than half for no apparent reason. They can definitely do much better. It’s good that they’re going public. More public crypto companies are good for the industry and I’m curious how high their valuations will be,” said Bobby ONG, co-founder of CoinGecko.

Over the years, BitGo has positioned itself as a leading cryptocurrency custody service provider . The company has custody of over $100 billion in client assets and has obtained licenses in major regions such as the EU and Singapore, while pursuing a banking license in the US.

However, despite its ever-expanding portfolio of services, BitGo’s business remains focused on a few major Token . As of June 30, 2025, Bitcoin, Sui, Solana, XRP , and Ethereum accounted for over 80% of the assets held on its platform.

Staking activity is similarly concentrated, with Sui, Solana , and Ethereum accounting for the majority of customer participation.