- Dogecoin holds around the 50-day EMA, but bearish-leaning technical indicators signal an extended decline.

- Dogecoin’s network activity suppressed with daily active addresses at 55,000 in contrast to over 500,000 in June.

- Dogecoin whales reduce their exposure, potentially contributing to selling pressure.

Dogecoin (DOGE) struggles to maintain support around $0.2400 on Tuesday, as risk-off sentiment holds steady in the broader cryptocurrency market. If market sentiment remains negative this week, the meme coin, which has declined 21% from last week’s peak of $0.3072, could extend its down leg.

Dogecoin’s downtrend persists as whales de-risk

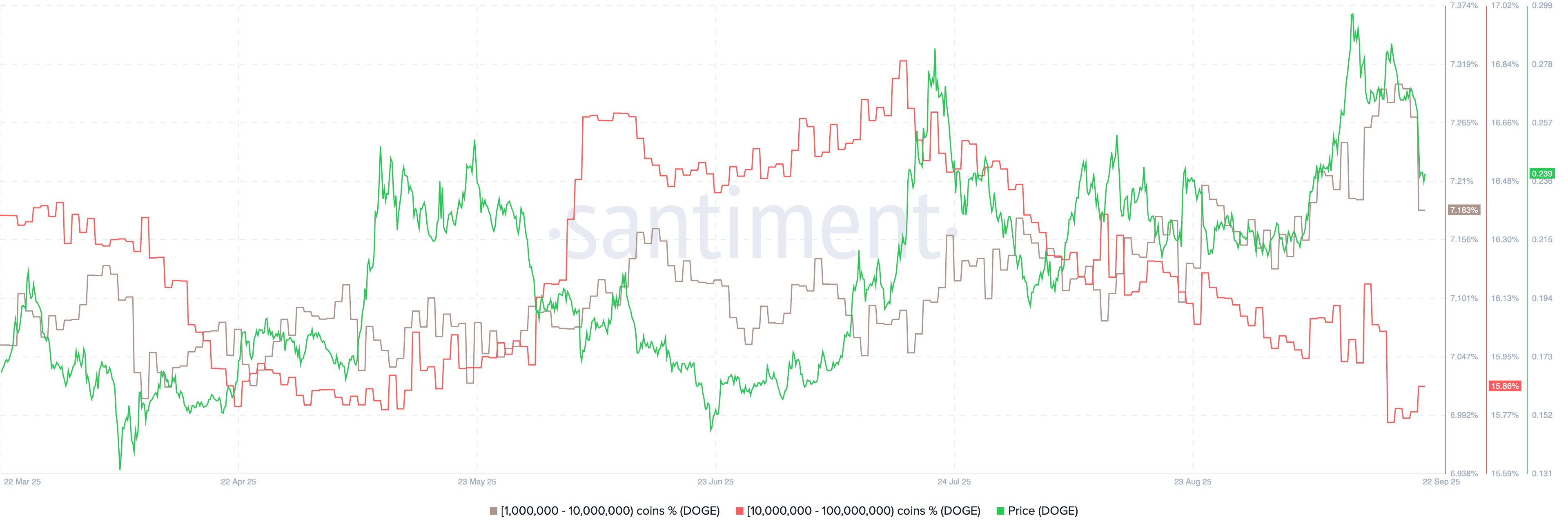

Large volume holders of Dogecoin have been selling aggressively over the last few months, as evidenced by Santiment’s on-chain data. Wallets with between 10 million and 100 million DOGE currently account for 15.86% of the total meme coin’s supply, down from 16.85% in July.

Despite the cohort holding between 1 million and 10 million DOGE increasing their exposure through July and August, the chart below highlights a local top of 7.3% of the total supply on September 8. These wallets now hold approximately 7.18% of Dogecoin’s supply, reflecting the surge in risk-off sentiment over the past few days.

If whales continue to de-risk, a short-term recovery in Dogecoin’s price could be a pipe dream. The Supply Distribution metric by Santiment is worth monitoring to gauge the level of interest in DOGE and whether a rebound toward last week’s peak of $0.3072 can be supported.

Dogecoin Supply Distribution | Source: Santiment

Additional on-chain data confirms the risk-off sentiment among whales, particularly with the number of active addresses averaging 55,000 as of September 22. This highlights significantly low network activity compared to approximately 517,000 daily active addresses in June. The increase in addresses transacting on the protocol in June preceded the steady rally in the price of DOGE to $0.2873 in July.

Suppressed network activity reflects a decline in adoption and demand for the meme coin. If this trend continues, it would be increasingly difficult for bulls to sustain an uptrend, leaving DOGE vulnerable to selling pressure.

Dogecoin Supply Distribution | Source: Santiment

Technical outlook: Dogecoin decline could persist

Dogecoin trades slightly above the 50-day Exponential Moving Average (EMA), marking a short-term support at $0.2387. The meme coin’s short-term path of least resistance appears downward based on key technical indicators.

The Moving Average Convergence Divergence (MACD) indicator continues to highlight a bearish outlook, maintaining a sell signal since Monday. Investors may continue to reduce their exposure if the blue MACD line remains below the red signal line, as the indicator generally declines.

Bearish momentum appears to be steady, as indicated by the position of the Relative Strength Index (RSI) at 45, which is falling. A further decline toward oversold territory would imply a significant reduction in buying pressure.

DOGE/USDT daily chart

Key levels for traders in upcoming sessions are the 50-day EMA, providing support at $0.2387; the 100-day EMA at $0.2259; and the 200-day EMA at $0.2192, all of which would serve as tentative support if declines accelerate.

Still, a daily close above the 50-day EMA cannot be ruled out. If traders aggressively buy the dip, Dogecoin could begin its recovery toward last week’s peak of $0.3072 as the tailwind steadies.

(This article was corrected on September 23 at 16:00 GMT to fix that Dogecoin’s symbol is DOGE, not BTC)