The U.S. Bureau of Economic Analysis released economic data on the evening of September 25, showing that the final annualized quarterly growth rate of U.S. real GDP in the second quarter was 3.8%, higher than the expected 3.3% and the previous value of 3.3%; more importantly, the final annualized quarterly growth rate of the U.S. core personal consumption expenditures (PCE) price index in the second quarter was 2.6%, higher than the expected 2.5% and the previous value of 2.5%.

In addition, the number of initial jobless claims in the week ending September 20 was 218,000, lower than the expected 235,000.

Regarding the above data, market analysts pointed out that although the PCE data showed that inflation persisted in the second quarter of the United States, the GDP data showed that the US economy still experienced strong growth. The GDP growth rate in the second quarter was the fastest in nearly two years, and the economy remained resilient. However, it is worth noting that the labor market showed some signs of softening. The average unemployment period in August rose from 24.1 weeks to 24.5 weeks, the longest period since April 2022, and the unemployment rate also climbed to a nearly four-year high of 4.3%.

Bitcoin surges and dips, Ethereum hits $3,924

Following the release of the data, the cryptocurrency market experienced another period of significant volatility. Bitcoin briefly plummeted to $110,850 before recovering to $111,636 at time of writing. Ethereum also saw significant volatility, plummeting to a low of $3,924 before rebounding to $4,000 at time of writing, representing a 4% drop in the past 24 hours.

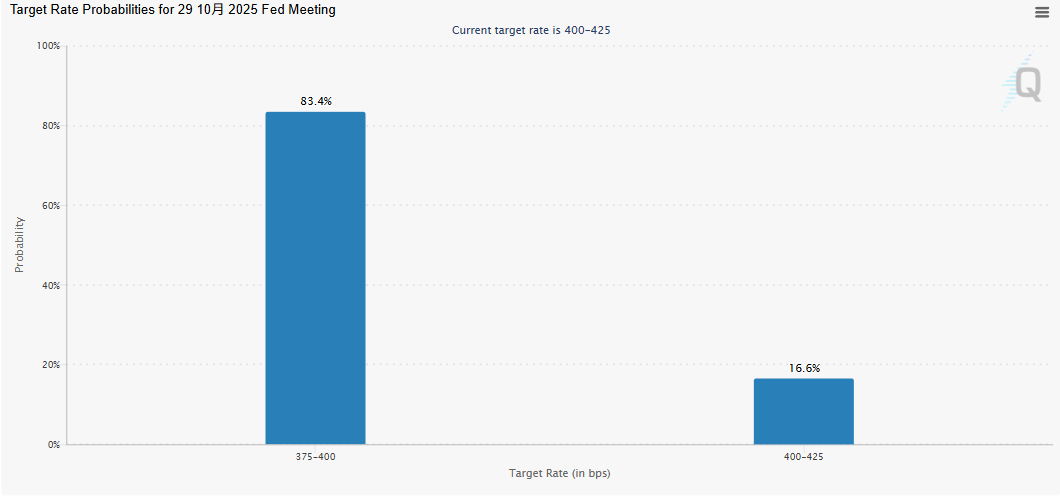

The market is still betting on the Fed to cut interest rates by 1 basis point in October

After the data was released, according to the CME FedWatch tool, the market is still betting that the US Federal Reserve (Fed) will continue to cut interest rates by 1 basis point in October, with a probability of 83.4%, but this is down from 91.9% the previous day.