A finance professor at Duke University published a paper stating that the threat of a "51% attack" facing Bitcoin has been seriously underestimated by the market. An attacker could complete control of the Bitcoin network within a week by purchasing $4.6 billion worth of hardware equipment, investing $1.34 billion to build a data center, and adding approximately $130 million in electricity costs per week.

The latest research shows that the threat of a "51% attack" facing Bitcoin is seriously underestimated by the market, and an attacker only needs about $6 billion to destroy Bitcoin.

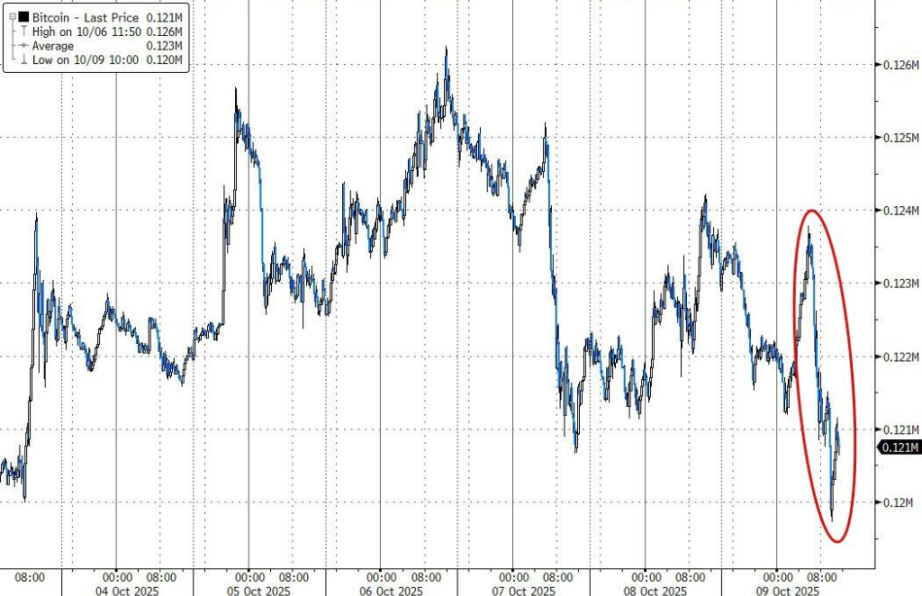

On October 9, Duke University finance professor Campbell Harvey warned in his latest research that although both Bitcoin and gold are considered darlings of "currency devaluation transactions," Bitcoin faces far greater risks than gold.

An attacker could take control of the Bitcoin network within a week by purchasing $4.6 billion worth of hardware, investing $1.34 billion in data center construction, and incurring approximately $130 million in weekly electricity costs.

By short Bitcoin in the derivatives market, the attacker could reap huge profits when the price of Bitcoin plummets, more than enough to cover the cost of the attack. Harvey emphasized:

You could destroy the value of Bitcoin with $6 billion, and while this attack sounds overly technical, it's highly plausible.

Matt Prusak, president of Bitcoin USA, believes that such concerns are exaggerated. It takes years to accumulate and deploy mining equipment, and short requires huge collateral. Exchanges may also suspend suspicious transactions.

51% Attack: A Fundamental Threat to Bitcoin

A 51% attack occurs when a single party controls more than half of the computing power of a blockchain network.

If successful, the attacker can tamper with the ledger, forge transactions, and even conduct a "double spend attack" - that is, the same digital token is used repeatedly. In contrast, gold does not have similar systemic risks.

Furthermore, the current boom in the Bitcoin derivatives market provides financial incentives for a 51% attack.

Harvey's paper shows that traders can establish short positions and make huge profits with less than 10% of the average daily trading volume, enough to cover the cost of the attack.

This profit mechanism makes the attack significantly more economically viable, especially considering the attack cost only 0.26% of the total value of the Bitcoin network, far less than many investors expected. Harvey emphasized:

The low cost of attack is a serious problem for the future viability and security of Bitcoin.

Harvey further noted that such attacks are likely to be carried out overseas because many regions lack effective market manipulation prevention measures.

Industry divided on attack risk

Despite Harvey's serious warnings, there are different views in the industry.

Prusak believes that the economic feasibility is not enough to support the 51% attack theory, stating:

Accumulating and deploying sufficient mining equipment would take years, which is not feasible in reality.

Prusak also stressed that short Bitcoin requires huge collateral, and if an exchange suspects manipulation, it may suspend trading, preventing the attacker from realizing their gains.

Other blockchains have indeed suffered 51% attacks before and survived.

Bitcoin forks Bitcoin Gold and Ethereum Classic have both been attacked, but they are smaller blockchains with less miner support and are more susceptible to manipulation.