- Trump’s 100% tariff announcement reignited U.S.–China trade tensions, shaking global markets and raising fears of renewed supply chain and inflation risks.

- Bitcoin plunged over 7%, wiping out $200B in crypto market value as traders faced heavy liquidations amid surging volatility.

- The move underscores crypto’s deep link to macroeconomic policy shifts and its vulnerability to global trade and political instability.

Trump’s 100% tariff plan on China triggers global market turmoil, sending Bitcoin and major cryptocurrencies plunging as investors flee risk assets amid rising economic uncertainty.

TRUMP REIGNITES THE TRADE WAR

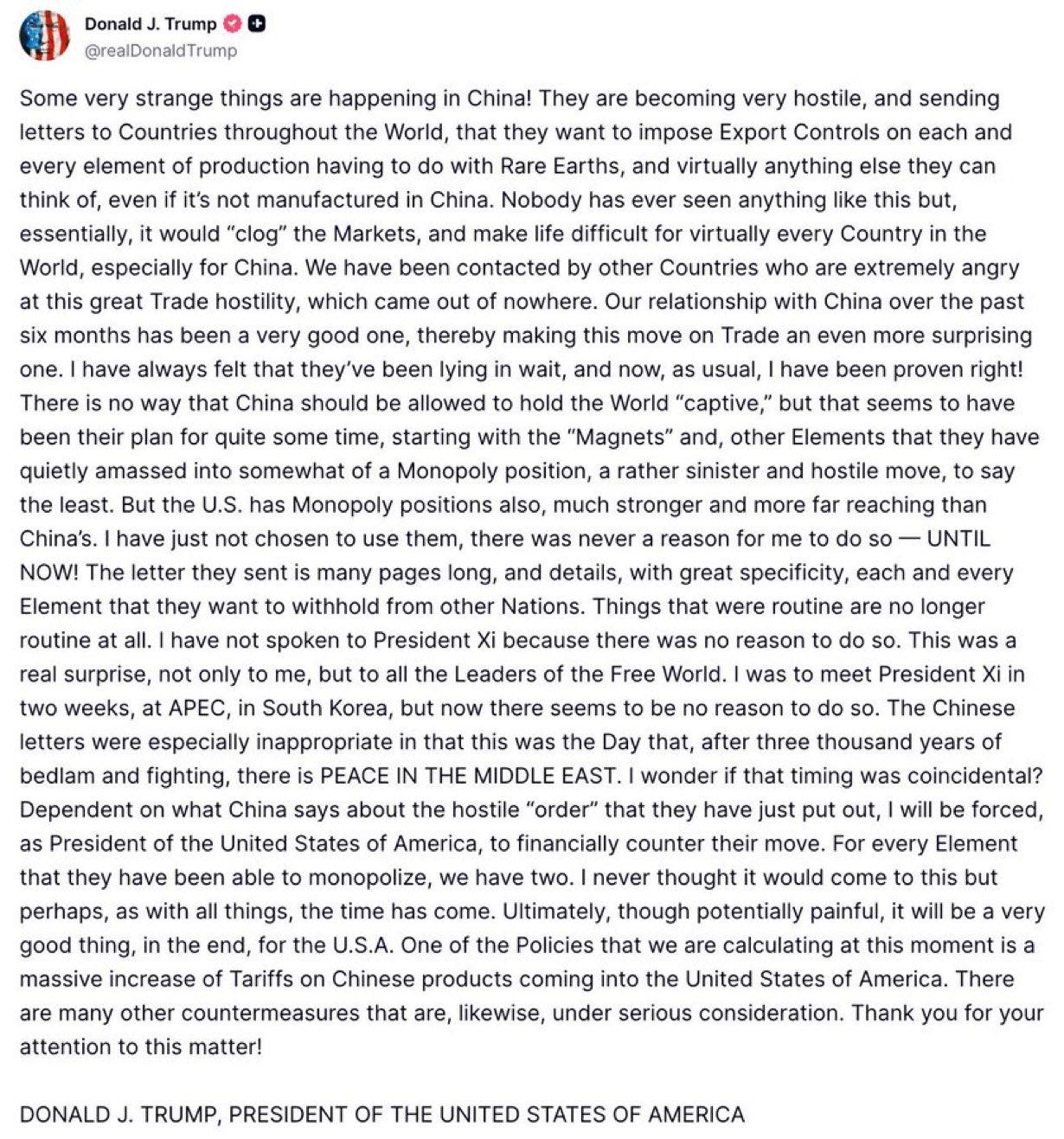

In a stunning move on October 10, 2025, former U.S. President Donald Trump announced a sweeping plan to impose an additional 100% tariff on all Chinese imports starting November 1. The decision marks the most aggressive escalation in U.S.–China trade tensions since 2018, signaling a return to economic nationalism and protectionist policies. Trump declared the measure on Truth Social, calling it a necessary response to Beijing’s “hostile” export restrictions on critical materials like rare earths — resources vital to global technology, energy, and defense industries.

Moreover, Trump revealed plans to introduce export controls on “critical software” sold to China, framing it as a countermeasure against Beijing’s tightening grip on global supply chains. The announcement shocked investors, reigniting fears of another prolonged trade war that could disrupt manufacturing, technology, and commodity markets worldwide.

MARKET FALLOUT BEGINS

The financial world reacted almost instantly. U.S. equities tumbled across the board — the Dow Jones Industrial Average fell nearly 878 points (1.9%), while the S&P 500 and Nasdaq Composite dropped 2.7% and over 3%, respectively. Investors rushed toward safe-haven assets such as gold and U.S. Treasuries, echoing the behavior seen during prior waves of geopolitical tension.

The crypto market, however, was hit even harder. Within hours of Trump’s announcement, Bitcoin plunged more than 7%, falling from around $113,000 to below $105,000. Ethereum, BNB, Solana, and other major altcoins lost between 8% and 10%. According to The Block and BeInCrypto, the total crypto market capitalization erased nearly $200 billion, while approximately $500 million in leveraged long positions were liquidated in a single day.

For a market already strained by macroeconomic uncertainty, Trump’s tariff threat acted like a spark in a tinderbox — forcing traders to unwind positions and triggering the largest one-day liquidation since early 2024.

WHY CRYPTO REACTED SO SHARPLY

At first glance, one might assume crypto, often viewed as a hedge against fiat instability, could benefit from geopolitical shocks. Yet in the early stages of crises, investors usually sell risk assets first — and crypto remains among the riskiest.

Tariffs threaten global growth, stoke inflation, and strengthen the U.S. dollar — a combination toxic to digital assets. As risk appetite declines, leveraged traders face cascading margin calls, while retail participants panic-sell. The result is a synchronized downturn that amplifies volatility across exchanges.

Additionally, potential disruptions to China’s export ecosystem add a structural layer of concern for blockchain infrastructure itself. Many mining operations, hardware manufacturers, and component suppliers are based in China. If supply chains fracture, production costs may rise and global crypto operations could slow.

In essence, while Trump’s move targets China, its ripple effects reach every corner of the financial system — including digital assets once thought insulated from traditional markets.

BROADER IMPLICATIONS AND NEXT STEPS

Analysts suggest this move goes beyond tariffs; it signals a deeper shift in global power dynamics. Trump hinted that he might cancel his planned meeting with Chinese President Xi Jinping during the upcoming APEC Summit, citing “hostile behavior” from Beijing. Such rhetoric only deepens investor anxiety.

For crypto investors, the environment ahead could be turbulent. If trade tensions escalate, liquidity could tighten further, dragging down risk assets. Yet paradoxically, if inflation accelerates due to tariffs, some may eventually rotate back into Bitcoin as a long-term hedge against monetary instability.

Thus, the relationship between macro shocks and crypto remains complex. The immediate reaction tends to be negative, but as markets adjust, digital assets sometimes regain appeal as alternative stores of value.

CONCLUSION

Trump’s 100% tariff announcement has reopened an old wound in global trade — and this time, crypto is caught squarely in the crossfire. The event underscores how deeply intertwined digital assets have become with the broader economy. While the sell-off reflects short-term fear, it also highlights crypto’s growing maturity as part of the global financial system.

As November approaches, the world will watch closely how Washington and Beijing respond. If tensions cool, markets may recover. But if hostilities deepen, another wave of volatility could test not only global finance but the resilience of the crypto industry itself.

〈Trump’s 100% Tariff Shock on China Sends Global Markets and Crypto Spiraling〉這篇文章最早發佈於《CoinRank》。