- OKX, Coinbase, and Hyperliquid stayed fully stable amid extreme volatility.

- Binance experienced brief quote and order latency under peak load.

- Lighter’s one-hour outage exposed DEX scalability limits during market stress.

Trump’s tariff shock sent Bitcoin plunging 8%. OKX and Coinbase stayed flawless; Binance faced short-lived delays, Bitget and Kraken had minor lags, while DEX Lighter went offline.

A NIGHT OF TURMOIL TESTS CRYPTO INFRASTRUCTURE

In the early hours of October 11 (UTC+8), the global crypto market was rocked by one of its sharpest crashes of 2025. Following Donald Trump’s confirmation of sweeping tariffs on Chinese imports, Bitcoin plummeted over 8%, briefly dipping to $105,000 before recovering near $111,000. Within minutes, trading volumes exploded, placing immense strain on centralized and decentralized exchanges alike.

What followed was a real-time stress test — not only for traders’ nerves but for the technical backbone of the crypto industry.

While some exchanges ran flawlessly, others faltered under the weight of record traffic, revealing critical differences in system stability and scalability.

TOP PERFORMERS: STABILITY UNDER EXTREME PRESSURE

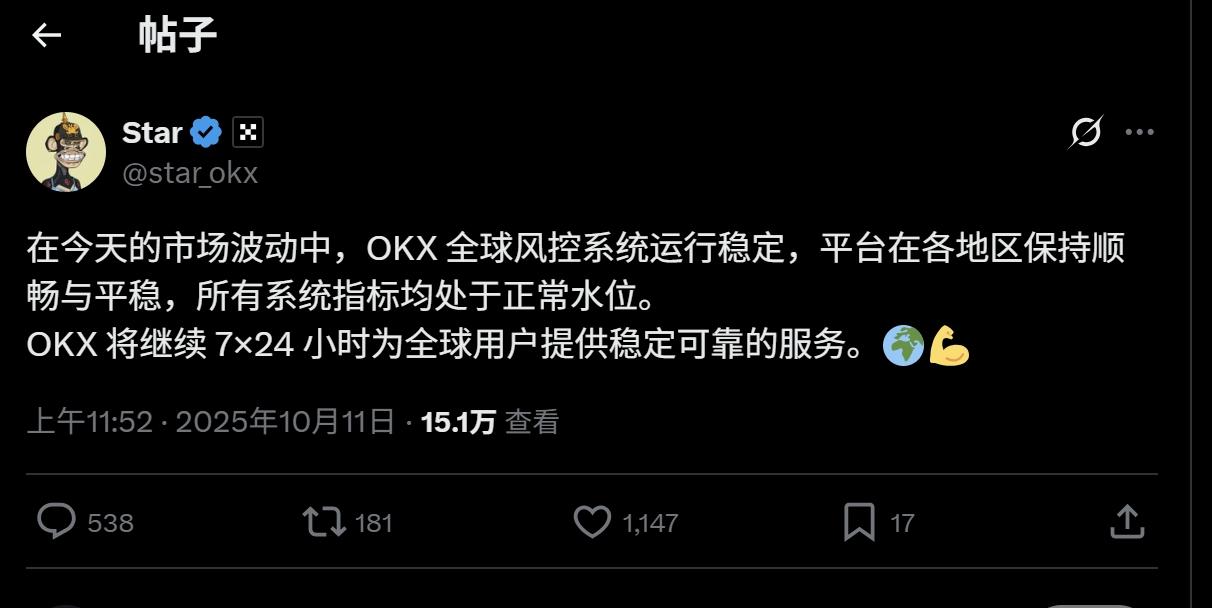

OKX once again proved its reliability. CEO Star (Xu Mingxing) announced on X that OKX’s global risk-control systems “remained fully stable,” with all operational metrics at normal levels. Despite record transaction volumes, OKX reported zero downtime, no API lag, and uninterrupted trading across all regions.

Coinbase, Bitfinex, and KuCoin also passed the test smoothly. Their official status dashboards showed no incidents throughout the crash period — spot, futures, and API services all remained operational.

Among decentralized platforms, Hyperliquid stood out. Despite record on-chain traffic, the exchange confirmed that its HyperBFT consensus layer and risk mechanisms handled the surge “without any downtime or delay.” The event effectively served as a live demonstration of Hyperliquid’s scalability and reliability in volatile market conditions.

BINANCE: HIGH LOAD, INTERMITTENT DELAYS, BUT NO OUTAGE

Binance, the largest exchange by trading volume, remained functional but not without strain. During the most volatile 30-minute window, multiple traders reported delayed order execution and API slowness, especially within the unified margin and futures modules. While Binance did not issue a formal outage notice, its system status briefly flagged “intermittent latency” affecting quote updates and order submission.

These delays were short-lived — generally lasting several minutes — and did not lead to a full suspension of trading. However, the event highlighted the recurring stress points in Binance’s infrastructure. As a reminder, its unified margin futures system experienced a similar 18-minute halt on August 29, showing that even top-tier centralized systems can reach their limits under sudden leverage spikes.

PARTIAL GLITCHES AND REGIONAL IMPACTS

Bitget maintained overall trading stability but acknowledged a notification system delay. CEO Gracy Chen explained that some users received outdated or repeated “abnormal market” alerts due to historical message queue lag. The issue lasted around 30 minutes and affected only price notifications — all trading, deposits, and withdrawals remained fully operational.

Kraken also experienced heavy load and transaction delay warnings on its status page. Some users encountered slow web and mobile responses, along with delayed ERC-20 USDT and USDC transfers. These were categorized as congestion-related rather than full service interruptions and were resolved within the same monitoring cycle.

Gate.io and Bybit reported no major disruptions, though traders noted short-lived latency during liquidation surges — a common symptom when matching engines are overwhelmed by rapid order cancellations and cascading liquidations.

THE STRUGGLERS: DEX OUTAGES UNDER PRESSURE

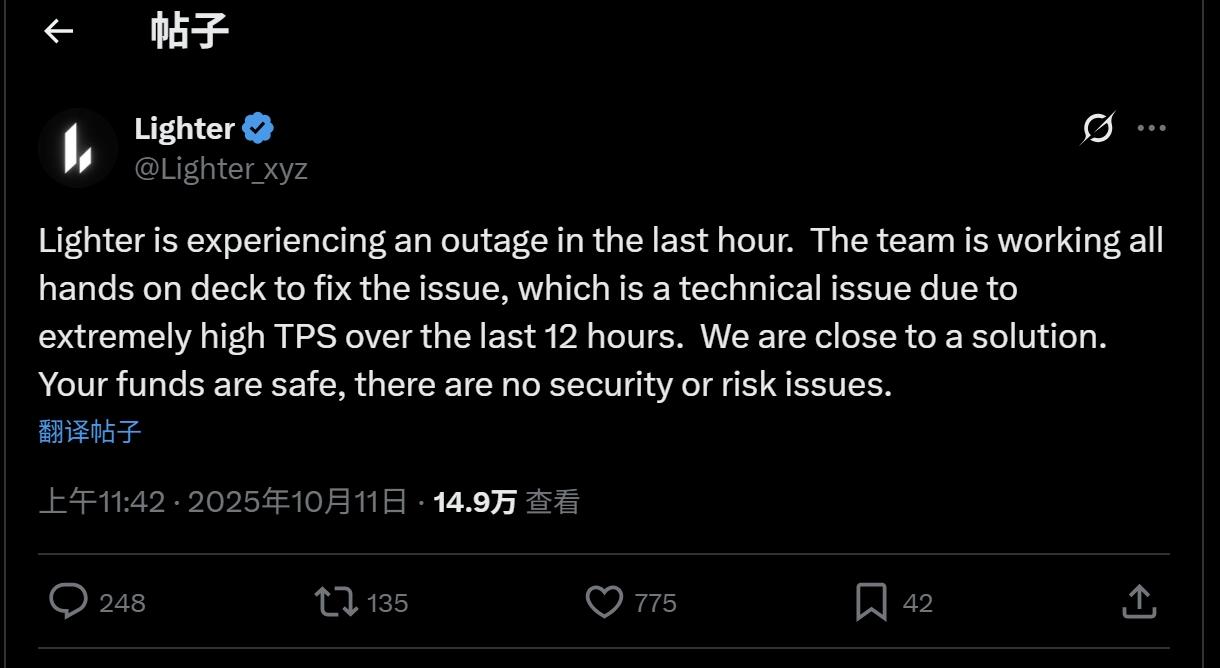

The decentralized perpetual exchange Lighter suffered the most serious breakdown. According to PANews, the platform experienced a one-hour outage after its transaction throughput reached sustained record highs over a 12-hour window. Users were unable to place or execute trades during that time. The team later confirmed that all funds were safe and no security incident occurred, but the downtime underscored DEX scalability limits when network TPS spikes uncontrollably.

In contrast, Hyperliquid’s smooth performance reinforced its architectural advantage — handling the same volatility with no downtime and proving the resilience of its all-on-chain design.

LESSONS FROM THE MARKET STRESS TEST

The October 11 sell-off was not just a market event — it was a global infrastructure audit.

- OKX, Coinbase, and Hyperliquid demonstrated exceptional robustness, managing record volume without noticeable disruption.

- Binance stayed online but displayed momentary quote and order latency, reminding users that even market leaders face performance ceilings under duress.

- Bitget and Kraken showed commendable resilience, though peripheral systems such as notifications and API connections briefly lagged.

- Lighter’s downtime revealed that while DEX innovation continues, performance scaling remains a critical challenge.

In an era where political shocks ripple instantly through digital markets, stability is more than a feature — it’s a competitive moat. This tariff-driven crash separated marketing from engineering, showing which exchanges are truly ready for the next wave of global volatility.

〈Crypto Exchanges Under Pressure: How Are OKX, Binance, and Others Performing?〉這篇文章最早發佈於《CoinRank》。