By Stacy Muur Source: X, @stacy_muur Translation: Shan Ouba, Jinse Finance

TL;DR

Catalyst: After the U.S. market closed, the Trump administration announced a 100% tariff increase on Chinese goods and introduced software export controls (effective November 1).

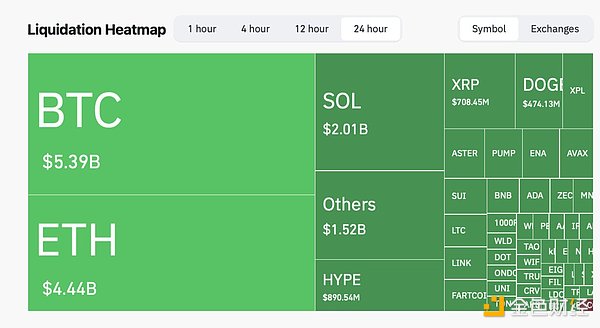

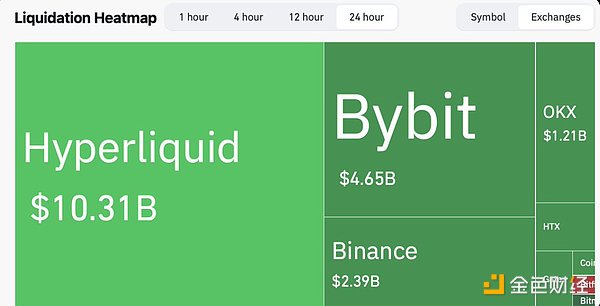

Crypto market losses: Liquidations reached $16-19 billion; Bitcoin (BTC) fell 12% and Ethereum (ETH) fell 16% on the day, while most Altcoin fell between 20% and 53%.

Traditional market performance: The S&P 500 fell 2.71%, the Nasdaq fell 3.56%, and the Dow Jones fell 1.90%.

Background factors: Record market leverage and high open interest, coupled with low liquidity over the weekend, amplified the decline.

Subsequent trend: It will first enter a stabilization phase, and then there will be a high probability of a gradual recovery rather than a V-shaped rebound.

1. Timeline of the plunge

Friday morning, October 10: Tariff threats resurfaced, sending Bitcoin under pressure around $117,000.

After the U.S. stock market closed: 100% tariff policy and software export control measures were officially announced, and Bitcoin plummeted by about $3,000 in a few minutes.

Asian trading session: Liquidations accelerated. As of noon Hong Kong time, long position liquidations had reached $16.7 billion.

In summary, the Trump administration's announcement of 100% tariffs on Chinese goods, coupled with the implementation of critical software export controls effective November 1st, triggered a safe-haven sell-off across all asset classes. The crypto market experienced its largest-ever dollar-denominated liquidation, and amidst thin weekend liquidity, the chain reaction of forced liquidations further amplified the decline.

2. Specific Market Impact

1. Bitcoin

Current price: $110,541; intraday low: $104,582; intraday high: $121,705; 24-hour drop: 12.4%.

Volume: approximately $153 billion, nearly double the recent average. The long lower shadow pattern suggests that selling pressure is nearing exhaustion.

Key price levels: support level at $104,000; resistance level at $118,000-120,000; next supply area at $125,000-127,000.

Important data: exchange fund flow

October 8: 38,020 BTC flowed into exchanges (fund distribution phase).

October 9: 7,320 BTC flowed out of the exchange (fund accumulation phase).

October 10: 6,180 BTC flowed out of exchanges (accumulated during panic).

Interpretation: Before the crash, funds were distributed at market highs; after the crash, funds began to accumulate on dips in panic.

2. Ethereum

Current price: $3,765; Intraday low: $3,460; Intraday high: $4,755; 24-hour drop: 16.1%.

Trading volume: approximately $97.7 billion, a new high. On October 7, the price encountered resistance at $4,755 and fell back, which is consistent with the characteristics of "distribution at high levels."

Key price levels: Support at $3,460; resistance at $4,100-4,350; next supply zone around $4,750.

Important data: exchange fund flow

October 8th: 686,750 ETH flowed into exchanges (large-scale distribution).

October 9th: 86,930 ETH flowed out of exchanges (strong accumulation).

October 10: 49,530 ETH flowed out of exchanges (continuous accumulation).

3. Altcoin

Common decline: Peak retracement ranges from 20% to 53%.

Individual performance:

XRP: fell to a low of $1.64 before rebounding to $2.36.

DOGE and ADA: Heavy selling pressure and the largest decliners.

SOL: Relatively resistant to declines, with a smaller drop than most Altcoin.

LINK, AAVE: showing “capitulation selling” characteristics.

Drivers of the decline: low liquidity, high concentration of leverage, capital transfer to Bitcoin and stablecoins, and insufficient order book depth during forced liquidation.

4. Traditional Market

The S&P 500 fell 2.71%, the Nasdaq fell 3.56%, and the Dow Jones fell 1.90%, with the technology sector leading the decline.

Trend characteristics: This decline is a market-wide risk-averse behavior and is not unique to the crypto market.

3. Liquidation Mechanism

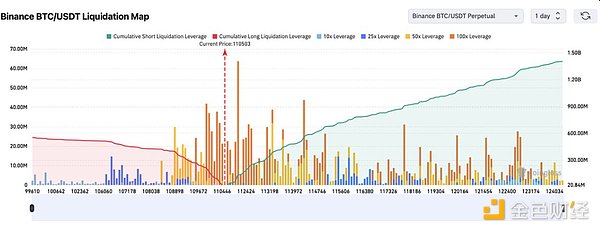

Total liquidation volume: US$16-19 billion, of which long liquidations accounted for approximately US$16.7 billion (87%) and short liquidations accounted for approximately US$2.4 billion (13%).

Scale comparison: In USD terms, the scale of this liquidation is an order of magnitude larger than the FTX crash or the March 2020 "black swan" event (although the overall market size is also larger).

Why is the scale of liquidation so large?

After Bitcoin approached its all-time high of $127,000, market leverage accumulated excessively.

Market makers' risk appetite declined over the weekend, and liquidity fell into a "vacuum".

The derivatives market is under pressure: negative funding rates, fluctuations in stablecoin basis, and forced deleveraging have triggered a chain reaction.

4. Macroeconomic drivers

Policy impact: 100% tariffs and software export controls directly trigger a repricing of corporate earnings expectations and supply chain risks, with growth stocks and the technology sector bearing the brunt. Furthermore, the policy will take effect on November 1, with a clear timeline, and short-term headline pressure will continue.

Market Position: High leverage and high open interest (OI) make the market extremely sensitive to negative news and have weak risk resistance.

Regulatory background: Uncertainty in U.S. crypto policy remains, and some institutions are reluctant to buy on dips.

5. Outlook for future trends

Please note: The following content does not constitute any financial advice. My ability is limited and it is for reference only.

1. Typical trend sequence after a crash

Phase 1: Continued decline and de-risking (completed).

Phase 2: Data and market maker behavior drive stabilization (in progress).

Phase 3: Basis repair and cross-platform arbitrage return to normal (in progress, this process may limit the initial rebound height).

Phase 4: Recovery of liquidity drives gradual recovery (most likely to occur within the next 1-2 weeks).

2. Scenario forecast for the next 1-2 weeks

Optimistic scenario (40% probability): The "investment low" of $104,000 for Bitcoin and $3,460 for Ethereum is maintained, and the price moves closer to the maximum pain point range of options ($118,000-120,000 for Bitcoin and $4,100-4,350 for Ethereum).

Pessimistic scenario (35% probability): If trade frictions escalate or liquidity remains tight, the market may retest or even slightly fall below the previous lows, with targets of $95,000-100,000 for Bitcoin and $3,000-3,200 for Ethereum.

Baseline (25% probability): Entering range-bound fluctuations, Bitcoin is between $105,000 and $120,000, and Ethereum is between $3,500 and $4,200.

3. Key price levels to watch

Bitcoin: $104,582 (key support); $110,000 (bull-bear watershed); $115,000 (first resistance); $118,000-120,000 (major resistance); $125,000-127,000 (supply zone).

Ethereum: $3,460 (key support); $3,750 (bull-bear watershed); $4,000 (psychological level); $4,100-4,350 (major resistance); $4,750 (supply zone).

4. ETF Fund Flow Background

Bitcoin ETFs: saw strong inflows (approximately $3.5 billion) from October 6-9, followed by a small outflow on October 10. Interpretation: Buyers are temporarily on the sidelines, not a large-scale withdrawal.

Ethereum ETF: Significant outflows (approximately $175 million) occurred on October 10. Interpretation: While this is a negative signal, the outflows are still relatively small relative to the total market capitalization.

VI. Operational Strategies for Different Risk Preferences

1. Conservative strategy

Wait for clear stabilization signals and use the "fixed investment" method to invest in Bitcoin and Ethereum.

No or only low leverage is used, and the stop-loss level is set below $104,000 for Bitcoin and $3,400 for Ethereum.

Avoid niche Altcoin with thin liquidity.

2. Aggressive Strategy

Try to long tactically around $110,000 for Bitcoin and $3,750 for Ethereum, with leverage controlled at 2-3 times.

Target: Bitcoin $118,000, Ethereum $4,100; set strict stop-loss (Bitcoin below $103,000, Ethereum below $3,400).

Gradually reduce your position when approaching the resistance level.

3. Long-term strategy

Maintain core position exposure and add to holdings on dips when the market corrects.

Focus on Bitcoin, Ethereum, and a few high-quality projects with sufficient liquidity.

VII. Structural Conclusions

Cryptocurrencies are still high-volatility risk assets, and macro shocks will be quickly transmitted to the market.

Leverage remains the core driving force that amplifies the decline, and excessive leverage has always been an important cause of market crashes.

The "surrender-style long lower shadow" under extreme trading volume often indicates a mid-term layout opportunity.

Trade policy uncertainty will keep market realized volatility high.

The essence of this plunge was a "clearing of high leverage amidst macroeconomic headwinds," rather than a breakdown in the core logic of the crypto industry. Capital flow data shows that the market was distributing at a high level before the plunge, and panicked accumulation of funds began during the plunge.

If there is no further policy deterioration in the future, the market is expected to enter a stabilization window first, and after completing the arbitrage repair, it will gradually recover to the range of US$118,000-120,000 for Bitcoin and US$4,100-4,350 for Ethereum.