ADL is one of the clearest examples of how DeFi protocols improve, in code, the protections that derivatives law requires intermediaries to build. In regulated derivatives markets, clearinghouses must maintain a default risk waterfall: first, trader margin; then, the clearing fund; and finally, if losses exceed both, a loss-allocation mechanism that mutualizes what’s left across counterparties. That last layer (what CFTC regs call “procedures to allocate losses beyond the default fund”) conceptually mirrors ADL — but through regulated intermediaries. The parallel is intriguing. Both frameworks converge on the same truth, showing how you can remove intermediaries but can’t remove risk mutualization. Whether by red tape or smart contract logic, something has to be done to resolve when volatility disrupt things. I’d rather it be through trustless code than intermediaries that we hope don’t try to break the rules.

Doug Colkitt

@0xdoug

10-11

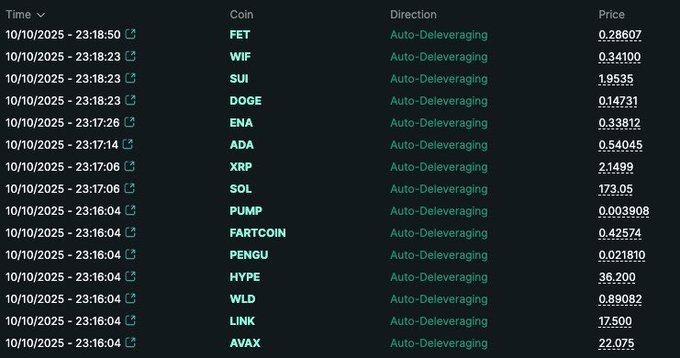

1/ Since a lot of people are waking up to see their perps positions closed and wondering what the hell “Auto-Deleveraging” means, here’s a quick and dirty primer.

What is ADL? How does it work? And why does it exist?

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share