The seizure of 127,271 Bitcoins from an international fraud ring could boost the US strategic crypto-asset stockpile to more than $36 billion.

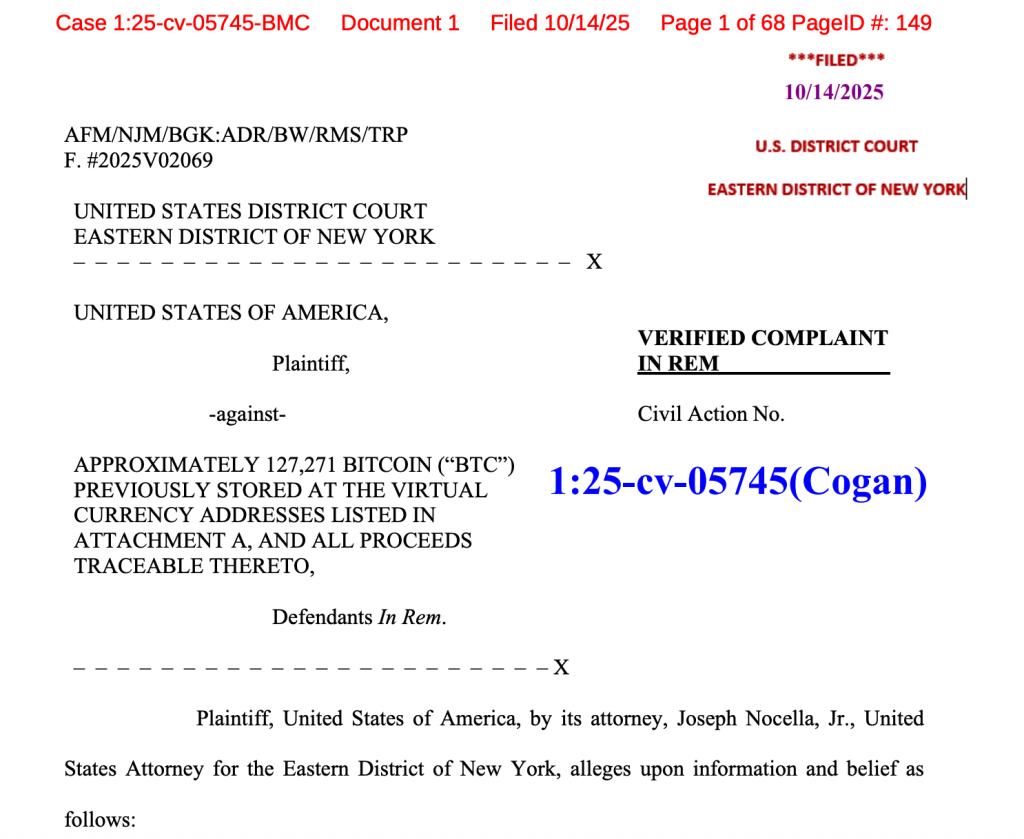

A newly unsealed criminal indictment could pave the way for the US government to make one of the largest digital asset additions in history, significantly expanding the size of the nation’s Bitcoin reserves. On October 15, the US Department of Justice (DOJ) announced a lawsuit seeking the seizure of 127,271 BTC – worth about $14.4 billion – related to a transnational fraud scheme.

The Bitcoins are tied to an indictment against Chen Zhi, the founder of a Cambodia-based group accused of running “pig butchering” cryptocurrency investment schemes.

According to the DOJ, all assets have been seized and will be formally forfeited if Chen Zhi is convicted of conspiracy to commit wire fraud and money laundering in the Eastern District of New York. On the same day, the Office of Foreign Asset Control (OFAC) also imposed sanctions on Prince Holding Group, a conglomerate founded by Zhi.

According to prosecutors, profits from the fraud scheme were used to fund a lavish lifestyle that included yachts, private planes and an art collection. Chen Zhi is currently on the run and could face a maximum sentence of 40 years in prison.

Criminal seizures of digital assets are becoming a significant addition to the US digital asset reserve. The government has accumulated about 198,000 BTC to date, worth more than $22 billion. If Chen Zhi’s seizure is completed, the total reserve could increase to about 325,000 BTC, or $36 billion at current prices.

But expanding the reserve isn’t just about law enforcement. Policymakers in Washington are XEM at other options to bolster America’s position in the crypto-asset space. Senator Cynthia Lummis has suggested the government could consider converting some of the nation’s 8,100 tons of gold reserves into Bitcoin.

However, there are legal issues surrounding whether the current executive order would allow the sale of other assets to purchase Bitcoin. Some advisers, including Treasury Secretary Scott Bessent, have suggested that the government could implement “budget-neutral” mechanisms to purchase Bitcoin, but such a move would almost certainly require congressional approval.